Introduction

CVS Health has agreed to buy Oak Street Health in a $10.6bn deal, to further integrate primary care into the healthcare conglomerate, through the acquisition of the Medicare-focused company.

According to CVS management statements, the deal is expected to close by the end of this year and will be fully financed by internal resources. Oak Street’s CEO Mike Pykosz will continue to lead the company following the closing of the deal. This acquisition could mark a key shift toward a healthcare model based on “Value-based Care,” which could lead CVS to modify and/or integrate its current business model. “Combining Oak Street Health’s platform with CVS Health’s unmatched reach will create the premier value-based primary care solution”, as said to CVS Health CEO Karen Lynch.

About CVS Health Corporation

CVS Health (NYSE: CVS) is an American company based in Woonsocket, Rhode Island, operating in the healthcare industry. The company operates in 4 segments: (1) Health Care Benefits, (2) Pharmacy Services, (3) Retail/LTC, and (4) Corporate/Other. More precisely, it owns CVS Pharmacy, a retail pharmacy chain, CVS Caremark, a pharmacy benefits manager; and Aetna, a health insurer, among other several brands.

The company has more than 9,000 retail locations, about 1,100 walk-in medical clinics, a leading pharmacy benefits manager with over 110 million plan members (including specialty pharmacy solutions), and a senior pharmacy care business, serving about one million patients per year. The company additionally serves around 35 million people through traditional, voluntary, and consumer-directed health insurance products.

As of December 31, 2022, it reported revenues of about $323bn, with a gross profit of about $54bn. The gross margin is about 16.7%, while the net profit margin is around 1.2%. This suggests moderate operating profitability, further confirmed by a ROA of 4.2% and ROE of 5.7%, which nevertheless tends to be typical for the industry. Therefore, according to Damodaran, the average unadjusted ROE for the healthcare industry (gross of R&D expenses) is around 7%, as of January 2023.

The company has recorded in 2023 approximately 300,000 employees, divided among the different business lines of the company. According to the 10-K for the year 2022, about 63.3% of total revenues are derived from pharmaceutical services, an incidence that remained stable in the previous two periods (2021 and 2020) as well. The remaining part is split among Prescription Drug Sales (30.8%) and OTC drugs and general merchandise sales (5.9%).

Among CVS’s main strengths are its stable relationships with its suppliers, which allow it to avoid supply problems and bottlenecks. Another significant element is the company’s size and extremely widespread territorial expansion: among the 50 states in the U.S., CVS accounts for about 27 percent of total prescription drug revenues in the country. Such size has also allowed the brand to gain notoriety and make it distinguishable throughout the territory, becoming an icon for the country itself.

The great ability to generate cash flow has also enabled the company to carry out several M&A transactions over the years. Therefore, the company has recorded $16.18bn operating cash flow in 2022 and about $12bn of Levered Free-Cash-Flow in the same year. The inorganic growth strategy has enabled it to strengthen its position in the industry: acquisitions include IlliniCare Health, Omnicare, Aetna, and Caremark.

Finally, it has a customer loyalty score of 75% and is ranked #1 among its top competitors, according to several sectorial surveys.

About Oak Street Health

Founded in 2012, Oak Street Health (NYSE: OSH) is a Chicago-based company that specializes in Value-Based Care. According to the latest available data (Q3 2022), the company owns 169 centers, located across 21 states, through which it serves senior Medicare beneficiaries in traditionally underserved communities, where care quality is poor and unnecessary spending is high. More than half of the patients identify as African American, Hispanic or Latino, or Indigenous. By the end of the year, Oak Street Health (OSH) expects to serve almost 160,000 patients; although its focus is on primary care, the company also provides patients with specialty care when needed.

Oak Street Health is one of the leaders in the Value-Based Care (VBC) segment. VBC is a rather new healthcare model, in which providers (hospitals, physicians) are not paid based on the quantity of services they provide, but rather on the patient health outcomes. This model promotes quality over quantity of care, and rewards providers that contribute to improve their patients’ health. This way of providing healthcare has numerous advantages when compared to its predecessors, the fee-for-service model, which rewards providers for the quantity of services they supply, and is being increasingly supported by policymakers.

Within Value-Based-Care, Accountable Care Organizations (ACOs) are one of the three prominent models, and the one in which Oak Street dominates: ACOs group doctors, hospitals, and other healthcare providers, that work together to give the patient the best possible treatment at the lowest possible cost. Since the teams share both risks and rewards, collaboration and efficiency are incentivized, the opposite of what happens in a fee-for-service model, where each individual provider wants to run as many tests as possible in order to increase its revenue, regardless of the patient’s health outcome.

Being a first mover in Value-Based Care gave Oak Street plenty of time to improve its efficiency and reduce costs, getting ahead of competitors. In 2021, OSH achieved $14.6m in net shared savings, the highest figure across all companies in the VBC segment in absolute terms, and second only to United PA in percentage terms.

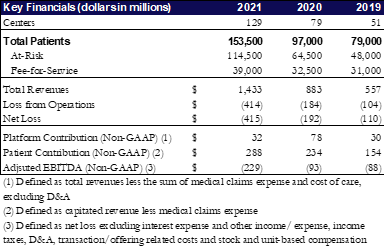

When it comes to financial performance, although having grown exponentially in recent years, Oak Street has not yet reached profitability, showing a net loss of $415m in 2021. In 2021, the company served a total of 153,500 patients, compared to 79,000 in 2019. Approximately 75% of those (114,500) was under capitation (At-Risk), while the remaining 25% (39,000) was under Fee-For-Service (FFS). It has to be noted, however, that FFS accounted for less than 1% of revenues during 2021. Capitation agreements are contract in which a fixed amount of money per patient, per unit of time, is paid in advance for the delivery of healthcare services (regardless of the volume of services that will be delivered). These multi-year agreements, which are on a per patient, per month (PPPM) basis, create a recurring revenue stream and allow the company to forecast revenues rather accurately, in addition to increasing customer retention.

Source: Bocconi Students Investment Club

Deal Structure

CVS Health is set to buy all outstanding shares for $39 per share, paying a total of around $9.5bn. The drugstore chain will finance the acquisition through available resources and existing financial capacity, for an all-cash transaction that represents an enterprise value of $10.6bn. CVS will pay a 16% control premium to the closing price for February 7, the day before the deal was announced, and a premium of 73% to Oak Street’s last closing price before talks of an acquisition were first reported in January of 2023.

After closing 2022 at a loss, Oak Street Health has a book value of $56m which, compared with its market value the day before the deal was officially announced (almost $8.3bn), is about 148 times lower. The company barely covers the direct costs of delivering its services and has, as a matter of fact, negative EBITDA and, consequently, negative net income. For this reason, it has been registering negative retained earnings for years, resulting in low total equity, especially compared to its market capitalization. Thus, traditional transaction multiples, such as EV/EBITDA or P/E might not be considered meaningful for valuation as they are both negative. However, this situation is very common in the healthcare industry, as is the case for other new medical practices recently part of acquisitions.

Deal Rationale

This acquisition would have significant implications for the whole industry, and, as such, it will be under great scrutiny by regulators. If it were to go through, there are several reasons why it may turn out to be a winning move for CVS in the coming years.

As a starter, acquiring Oak Street would allow CVS to enter the Value-Based Care segment and capture more customers in the Medicare Advantage area. Medicare Advantage (MA) is a very profitable product for insurers. Among the three private health insurance markets, MA is by far the most lucrative, with Average Gross Margins (AGM, a key metric for insurers financial performance) of $1,608 per enrollee per year. The other 2 markets, group and individual, had AGM of $855 and $779, respectively.

Furthermore, Value-Based Care is gaining traction and is being pushed by policymakers as the new, better alternative to the Fee-For-Service model, because of the better incentives that it provides. Although VBC can be very lucrative, succeeding is far from an easy task and calls for a completely different approach than in Fee-For-Service model. In Value-Based-Care, healthcare providers get paid a fixed amount per beneficiary, no matter the volume of services they give; this shifts the focus from quantity to quality, pushing companies to provide the best service possible and to improve the long-term health condition of the patients (so that they do not have to get treated again). Scale is also important to reach profitability and stable cashflows, otherwise, a few patients with major issues can significantly skew results. Among all the players in VBC, Oak Street is one of the most established, with a decade of experience and the one of the highest net savings margins.

Secondly, the merger of the two companies could offer significant cost synergies and boost growth. On one hand, Oak Street Health’s model has proved to be scalable: the company has a very specific target customer and has mastered the use of technology to select new markets and recruit staff. Even though the target demographic is rather specific, the Total Addressable Market, according to Oak Street Health, amounts to 27m patients, which translates to a $356.5bn annual revenue opportunity, given an average annual revenue of $13,200 per member. By taking advantage of CVS’s capital and real estate footprint, Oak Street could significantly boost its growth; according to CVS, by 2026, the company will have over 300 centers, each of which could contribute up to $7m in adjusted earnings at maturity, for a total of $2bn.

Moreover, CVS estimates that the two companies could achieve synergies for $500m, which will improve operating margins. We have to consider, however, that OSH is not profitable yet, and could be a burden on CVS’ financials at least for a few more years.

Lastly, Oak Street Health is part of the broader M&A Strategy that CVS has been implementing for the past few years, with the main goal of vertically integrating the healthcare sector. Oak Street Health fits perfectly in this strategy and could integrate very well with some other companies that are joining CVS’s portfolio. For instance, if the $8bn acquisition of Signify Health were to go through, OSH could start providing primary care to Medicare beneficiaries at their own homes. As far as the whole industry is concerned, this acquisition would threaten Humana’s health services arm, CenterWell, and value-based clinical network Conviva Care Center, and would be a defensive move against players like Walmart, which is also looking to expand in the healthcare space.

Market reaction

The deal is CVS’s third largest in the last decade and it seems to echo the moves made by its competitors, as the focus on primary and urgent care services has increased with the Covid-19 pandemic. As a matter of fact, patient care has emerged as a bright spot for Wall Street investors as companies jostle to take advantage of a shift in how medical care is paid for in the US. Walgreens Boots Alliance acquired CareCentrix in a two-phase transaction expected to close in March, while Amazon, looking to improve its presence in the healthcare industry, closed a $3.9bn deal to acquire One Medical on February 22, 2023, after the FTC started investigating the transaction in September of 2022.

The market reacted to the announcement of the acquisition with a rise of 4.8% in CVS shares and a rise of 4.9% for Oak Street Health, whose price had risen 33% since talks of CVS exploring a deal were first reported in January. However, since the acquisition has been official, CVS’s share price has slightly decreased, while Oak Street‘s has been overall constant, indicating that investors are being cautious as this is currently CVS’s second deal under review after the company has entered an agreement to acquire Signify Health for $8bn in September of 2022. Moreover, Oak Street Health has reported net losses for the past three years, which is another possible reason why the market might be more cautious in this phase of the deal.

Advisors

Credit Suisse Securities and Lazard are the buy-side co-financial advisors of the deal. CVS Health has been legally advised by Shearman & Sterling, Dechert, and McDermott Will & Emery. Centerview Partners has operated as a financial advisor for the sell-side, advising Oak Street Health, while Kirkland & Ellis has been nominated the Oak Street Health’s legal advisor.

0 Comments