Introduction

The first newspaper – a printed, dated, frequently published sheet containing news – was published in 1605 in Germany. In the following years many European countries started publishing newspapers with the first one written in English published in 1620 in Amsterdam. In the United States the first newspaper was published in Boston in 1690 and the first weekly newsletter started in 1704. The first successful daily was “The Daily Courant” and was published in 1702 in England. In the beginning of the 19th century thanks to developments in technology newspapers became cheaper and accessible to more people. With the development of the internet many people stopped buying printed newspapers both because digital versions became abundant and because readers could benefit from websites dedicated to specific topics.

Nowadays the newspaper market, made up mostly by publishing giants but with an increasing interest from funds in recent years, is usually very concentrated within a country with the exception of some big players that are read worldwide such as the behemoth newspapers company News Corps, focused mainly on news and information services and with a market cap of about $8bn, the New York Times, a global media company operating in journalism with a market cap of $6.8bn and Daily Mail and General Trust plc, a British company that operates mainly in information, data analytics, insight and entertainment with a $1.8b market cap and Sinclair Broadcasting Co., focusing mainly on news and sports with a market cap of $1.4b. Most newspapers are divided in sections and nowadays the most read section of newspapers are local and global news read by most newspapers readers followed by sport with a 50% readership and then entertainment .

Over the last decade many newspapers have reduced print publishing. Between 2004 and 2018, more than 100 US newspapers and many more worldwide reduced publishing frequency from daily status, that is when a newspaper publishes at least three times a week, to weekly status, when it publishes at most twice in a week. Most printed newspapers are read by elder people while digital newspapers, a much cheaper and much more comfortable option, are becoming more popular among the young and middle-aged generations.

Since the creation of digital newspapers, publishers chose to have the majority of newspapers free of charge with revenues coming only from advertisements. The development of the web caused a big loss for printed newspapers as most customers can now find specific articles for free. Because of that, in the last decades newspapers have been losing increasingly more readers. The estimated total U.S. daily newspaper circulation (of print and digital newspapers combined) in 2018 was about 29m being 8% down from the previous year, while the circulation of printed press was down 12% from the previous year. While from the 50s the circulation of newspapers was constantly growing, in the 90’s it started decreasing with the development of the internet.

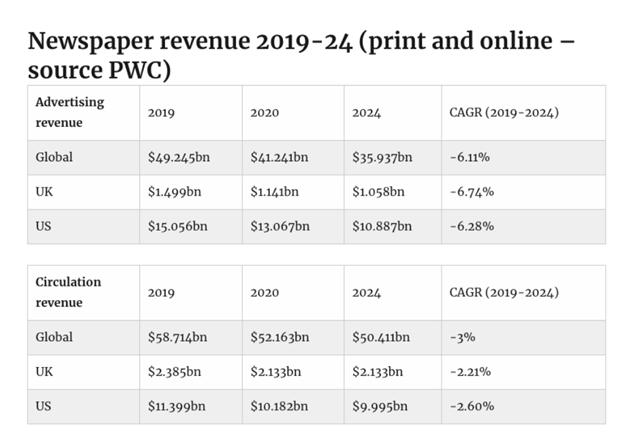

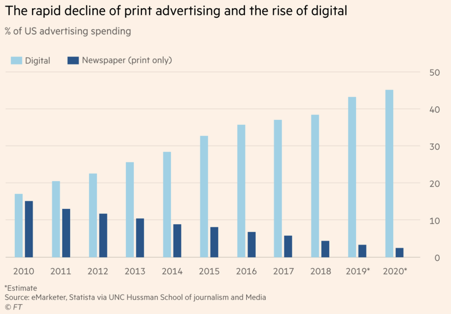

Most of the industry revenues come from advertisement, but due to the growth of other platforms and the customers shifting from printed press to websites, companies nowadays prefer to be advertised on other more popular platforms, among their target audience. At the beginning of the digital era, newspapers and magazines hosted half of all advertising spending worldwide. In two decades their share of the $530b market has fallen to less than 10 per cent, with platforms such as Google and Facebook being the biggest local advertisers. Because of that, publishers are looking for new sources of revenue, such as subscriptions. The majority of the newspapers nowadays allow to only read a part of or a limited number of articles with the rest requiring payment or subscribing. A PWC report forecasts that global newspaper advertising (print and digital) will fall from more than $49b in 2019 to $36b in 2024, a 27% decrease over five years and with it also global circulation and subscriber revenues are expected to fall from $58.7b in 2019 to $50.4b in 2024.

Source: PwC

After years of complaints for not being compensated fairly, and despite Google’s threats of leaving the country and the “experiment” to keep Australian’s sites out of their web, Australia has finally come to an agreement where platforms like Google will pay for the news they display on their engine. In addition, to address bargaining power imbalances there is also going to be a code of conduct that allows publishers to bargain individually or collectively with digital platforms. The code of conduct will only be applied to Facebook and Google but more digital platforms could be added in the foreseeable future. Many countries see this as a possible solution to the newspaper crisis but powerful countries as the U.S. are far from agreeing to something similar.

During the pandemic the audience for online news jumped to new highs even though most sites still converted less than 1% of website visitors into paying readers. Among the biggest beneficiaries of the pandemic are local news sites, with huge jumps in subscriptions as people try to learn how the pandemic is affecting their hometowns. Despite the increase in subscriptions for some local newspapers, for example the Tribune Publishing had a 293% increase in digital subscriptions sales only during March 2020, most publishers suffered a loss from the pandemic with more than 40,000 news media workers losing their jobs in the US and many more around the globe in Q1 of 2021.

In Italy

In the 1990s and early 2000s, the majority of publishers and newspapers adopted the same business model as commercial television: the published content would be available to all, free of charge and it was decided that revenues would derive only from online advertising. Furthermore, apart from some international exceptions, the relationship between the use of paper and digital services has been handled with difficulty by all newspapers. Among the future developments of the sector emerges the possibility of restricting the audience, abandoning the ” popularization” started in the nineties and developing a commercial logic that takes into account the rebalancing that has occurred between the reader and advertising market.

As reported in the Audipress report, revenues in the Italian newspaper industry are dropping dramatically: the number of regular newspaper readers decreased by 15%, from 18.7m in 2015 to 15.8m in 2019. In 2020 the drastic profit reduction derived from the advertising market, the main source of revenue in the newspaper industry, with the newspaper advertising market in March 2020 recording a decline of 29% YoY corresponding to a loss of 243m euros.

Journalism as it is, has not changed much from the industrial era when it was conceived, while in the meantime the world has entered a new information age based on different rules. The basic product of journalism, the news, has become a commodity that no longer has sufficient value to support the organization of publishing companies still structured as if it was the beginning of the twentieth century. The system held up until, in the 21st century, began a decline in earnings from online advertising, which has largely moved to web giants like Google and Facebook. The straw that broke the camel’s back of an already unstable and declining situation was the advent of the CoronaVirus. As in the other sectors, the virus has exacerbated already existing problems, with the increase of 17% enjoyed by digital copies unable to counterbalance the decline in sales at newsstands during the lockdown period. With the stop and also the decrease in sports activities the pandemic had a great impact especially on sports journalism: not being able to document live sports events or interview athletes, the articles were based solely on gossip about players or on online interviews that hardly aroused any interest in readers, resulting in a net decrease in copies sold and active readers.

Since the 1990s, the newspaper industry in Italy has been supported by public funding. In fact, the Government makes a contribution to support the publishing activity of newspapers and periodicals and thus ensure the pluralism of information. The goal was to provide funding mostly to smaller newspapers with the aim of helping “the voices rooted in local realities and with a vision aimed at the evolution of the publishing market towards digital”, as stated by the executive branch of the government. The future of these government funding is not very promising, in fact a decrease in such grants is already under way and is poised to end with completely erasing the funding by 2024. With the budget law of 2020, in order to ensure a better allocation of funds, direct contributions in the coming years will gradually decrease, until they are completely zeroed in 2024, the cuts will lead to a reduction of 25% in 2021, 50% in 2022, 75% in 2023 and 100% in 2024.

In the US

As pioneers started moving to the West coast in the 19th century, one of the first orders of business was establishing a local newspaper, this is how crucial circulation of information was for American society from the very beginning. Naturally, the majority of papers were in the hands of the wealthy families which overlooked their operations. Today, the situation is much different with about half of US daily newspapers controlled by private equity, hedge funds and other investment groups, according to FT calculations, as a result of endless rounds of consolidation that followed the 2008 global financial crisis. What is more, one in every four US newspapers have disappeared in the past 15 years, according to a University of North Carolina School of Journalism and Media report. Out of the ones that survived, many have become “ghost newspapers” which are commonly understood as papers stuffed with adverts or published by a wire service. This can be illustrated with the graph below showing the change in the percentage of the US advertising spending gradually shifting towards digital only over time.

Source: Financial Times

Between technological changes such as the growth of television over the past couple of decades, the rise of the internet is seen as the biggest factor that destroyed the for-profit business model that sustained US journalism. In effect, the survivors usually make only very thin profit margins. In particular, advertising revenues for US newspapers decreased from $49bn in 2006 to $14bn in 2018, according to Pew Research. As a result, the financial crisis turned many highly indebted newspaper empires into distressed assets which automatically became perfect targets for Wall Street buyers. In line with the trend, Alden Global Capital had approached Tribune about buying out the entire company in an offer valuing the publisher at $520m according to the public filing. The idea of this transaction brings up numerous issues related to this kind of deals that many people started pointing out to.

Alden’s modus operandi is clearly inspired by the “zero-based budgeting” practice that gained popularity on Wall Street for its success accompanied by the brutality. In the case of the newspaper industry, it usually involves getting rid of the newsrooms and sale of the real estates that help with recouping the purchase price of the paper, followed by cutting as many line items as possible in the paper’s expense sheet and massive lay-offs. The fear of such practices forced many Tribune employees to start looking for new jobs as soon as Alden bought its initial 32% stake in the company.

Besides Alden, there are two other groups that focus on buying US local newspapers: Fortress Investment Group, which is controlled by Japanese SoftBank and Chatham Asset Management that is run by former Goldman Sachs and Morgan Stanley banker Anthony Melchiorre. Alden Global already owns about 60 daily newspapers through a subsidiary, Digital First Media, and if it successfully takes over Tribune, it will control nearly 18% of daily US newspaper circulation according to the estimates. New Media Investment Group, which is managed and controlled by Fortress, owns almost 150 newspapers in smaller US towns. Finally, Chatham Asset Management LLC is one of the largest shareholders and bondholders in McClatchy Co., publisher of the Charlotte Observer and Miami Herald.

On the other side, Alden strongly stands by its practices as it sees them as the only way to save many newspapers from extinction by putting them on a path to sustainability. Moreover, the cost cutting is working for each of the investment groups: MediaNews Group achieved about 20-25% operating margins in 2019, more than double that of peers such as The New York Times while Alden, with its methods, has made $159m in operating income in 2017 on revenues of $939m achieving operating margin of 17%.

The matter in question boils down to two opposing principles: a company’s fiduciary duty to act in the best interest of its shareholders, against a newspaper’s public duty to operate in the interest of a broader constituency, which includes a community’s access to local media. Indeed, studies have shown that people without access to news are less likely to vote. What is more, the loss of newspapers overwhelmingly hits poor, less educated rural communities. Consequently, it leads to general reduction in civic engagement and polarized communities.

0 Comments