Introduction

After the great years of 2020 and 2021, the cryptocurrency market has been recently going through what many industry analysts believe to be a “crypto winter”, with Bitcoin prices reaching a low of $15,000 in December 2022, falling from almost $60,000 in November 2021. The fall from glory was caused by the impending bursting of a speculative bubble, as well as several bankruptcies and illicit actions in the cryptocurrency market, the most famous of all being the FTX scandal back in November 2022. This scandal was triggered when CoinDesk managed to get his hands on a copy of Alameda Research’s balance sheet and found out that the financial position of SBF’s proprietary hedge fund was rather worrisome, with most of the fund’s assets being tied up in FTT. As readers may expect, the crypto mining business, in which Bitdeer operates, is linked to trading operations since miners benefit more if the produced output sells for a greater price. Furthermore, the mining process necessitates a high level of energy, the price of which skyrocketed last year because of the Ukraine conflict. After being scheduled to go public in a SPAC merger in 2021, Bitdeer is finally listed on Nasdaq, although at a fraction of the initial market valuation and with challenging times ahead.

Company Overview

Bitdeer, a major cloud mining platform that provides people all over the world access to cost-effective mining, was founded in 2018 in Singapore by a group of industry veterans such as Chinese Billionaire Jihan Wu. The company’s main business line is the lending of cryptocurrency miners to users in exchange for a plan subscription, which can vary from 30 days to 1800 days. In addition to its cloud mining vertical, Bitdeer provides management solutions that aid in the optimization of the mining process, firmware, and data centre architecture. Currently the company has datacentres in The United States and in Norway, totalling a capacity of 974MW, planning to add 762MW in the coming years. In the cryptocurrency market, Bitdeer is a leader in both revenue generation and in proprietary hash rates (a measure of computational power and efficiency). As of Q1 2021, Bitdeer had revenues of $215m, 40% higher than the second largest company in the industry, Core Scientific. In addition to its leading position in the market, Bitdeer is using carbon-free energy sources for its data centres, with the operations in Norway being 100% carbon-clean, while the ones in The United States only 60%.

Bitcoin mining industry overview

Bitcoin mining is the process of producing new bitcoins and confirming transactions on the Bitcoin network. To validate transactions and add them to the blockchain, miners use powerful computers to solve complex mathematical problems. In exchange for their work, miners are rewarded with current bitcoins as well as transaction fees paid by the end users. Bitcoin mining is a constantly developing and dynamic business. It entails miners, who compete to be the first to solve the problem and receive the bitcoin reward, hardware manufacturers, who design and manufacture specialized mining equipment, and mining pools, which are groups of miners who pool their processing resources to increase their chances of solving the mathematical puzzle. This industry has gone through a volatile period in recent years, defined by extraordinarily high profitability in 2021 followed by a significant fall in 2022. The most consequential event in bitcoin mining was China’s ban in the summer of 2021. This caused a dramatic shift in the market as most Chinese mining companies relocated, primarily to North America. This led to investments in the mining business in North America at a time when interest rates were low, and the price of Bitcoin was constantly rising. Furthermore, because the ban removed roughly half of all Bitcoin miners from the network, the remaining miners faced less competition, resulting in higher profitability margins.

However, from the beginning of 2022, the situation started getting worst. Electricity costs rose due to the war in Ukraine and margins were significantly compressed. Furthermore, as the amount of competition grew, the difficulty of mining bitcoin increased, making it less profitable for smaller miners to maintain their operations. Additionally in May 2022, China announced a crackdown on illegal Bitcoin mining and trading, which had a significant impact on the Bitcoin market, leading to a sharp drop in Bitcoin prices. The dramatic FTX crash in November 2022 made the problem worse by undermining investor confidence in cryptocurrency exchanges and causing a major drop in market confidence. In the wake of the FTX crash, Bitcoin’s value, which had been trading at over $60,000 in early 2022, fell to under $15,000, a reduction in value of more than 50%. The significant bitcoin value drop contributed to even worse bitcoin mining profitability, with analysts estimating that bitcoin mining profitability dropped 70% in 2022. Core Scientific, one of the largest publicly traded crypto mining companies in the U.S, filed for bankruptcy in December 2022. The crypto market has begun to recover in 2023, as confidence in the technology increased, and the bitcoin price rose significantly. This is causing an upturn in bitcoin mining profitability, indicating a better moment for the industry’s enterprises.

SPAC deal structure and valuation

Bitdeer and Blue Safari deal involves a traditional SPAC merger in which Bitdeer becomes a subsidiary of Blue Safari, and the newly combined entity is renamed Bitdeer Group.

Bitdeer was valued at $4bn in the first attempt of going public in 2021. This high valuation was due to many factors. Firstly, Bitdeer had experienced a steady increase in revenue since its founding in 2018. The company’s revenue had increased by 250% in 2020 and 300% in 2021, demonstrating its ability to scale and adapt to changing market conditions. Furthermore, Bitdeer’s profitability was also a key factor in its valuation. The company had implemented a cost-effective mining strategy, utilised renewable energy sources and optimised its hardware and software solutions. This allowed Bitdeer to maintain a high level of profitability, with a net profit margin of 25% in 2021. However due to the worse market conditions which led to a significant drop in revenues and in profitability, the total value of Bitdeer decreased. In 2022 the firm reported revenue of $330.3m and a loss of $62.4m, compared to $394.7m in revenue and a profit of $82.6m the year before. According to Blue Safari announcement, Bitdeer implied enterprise value was around $2.1bn, and the implied market cap was $1.18bn.

Blue Safari issued 200 million shares of common stock to Bitdeer’s shareholders, which represented approximately 83% ownership of the combined company. The remaining 17% was held by Blue Safari’s existing shareholders. However, the issued shares under the ticker BTDR, lost nearly 30% of their value after the SPAC merger and were trading at around $6.90 at the time of publication. The deal also included a PIPE (private investment in public equity) transaction, in which institutional investors agreed to purchase $200m worth of Blue Safari’s common stock at $10 per share, providing additional capital for the combined company.

Deal Rationale

Over the past two years, several companies in the digital asset industry chose the blank-check route to accelerate the listing process. Instead of undertaking Initial Public Offerings (IPOs), the firms merged with pre-existing blank-check companies (SPAC) that were established with the aim of raising capital. According to company officials, the deal will allow the company to continue growing and to further establish itself as a leading harsh rate supplier, and further contribute to the crypto economy. Nonetheless, while being publicly listed will allow the company to raise funds more easily by issuing new shares, it will also make them subject to further disclosure requirements that may be time-consuming. Furthermore, the market appetite for new shares of a crypto-related company comes into doubt due to the ongoing market condition. As of April 28, the price of the stock has barely fluctuated over the two weeks of trading.

Expected to hit a $4bn valuation, the deal underwent adjustments to its valuation, leading to a final value of $1.18bn. The reduction in valuation reflects the ongoing market conditions, and the prolonged crypto winter. With its Nasdaq listing, Bitdeer will join competitors Riot and Marathon, who have also listed their shares for public trading. As of April 2023, Marathon [MARA] trades at around $10, a ~180% YTD increase, while Riot [RIOT] trades around $12, a ~250% YTD increase.

The merger plan was originally agreed upon in 2021, soon after Blue Safari completed its IPO and subsequent private placement of shares, producing around $58m in profits. At that time, as digital currencies were on a bull period hitting all-time highs, digital asset companies were potential merger targets for such SPACs. However, the slowdown in the cryptocurrency industry, the surge in energy prices and the increased difficulty of minting virtual coins, among others, resulted in Blue Safari’s shareholders delaying the SPAC merger three times. Last December the SPAC changed its articles of association to allow it to delay a merger up to four times, and up to 30 months since its June 2021 IPO to successfully merge with another company. Else, if it fails to achieve the latter, it would have been automatically dissolved. This led to many of Blue Safari’s shareholders redeeming around $42m of the SPAC’s stock, significantly decreasing the cash Bitdeer would receive when the transaction went through. Eventually, Blue Safari shareholders agreed to the merger.

SPAC Industry Overview

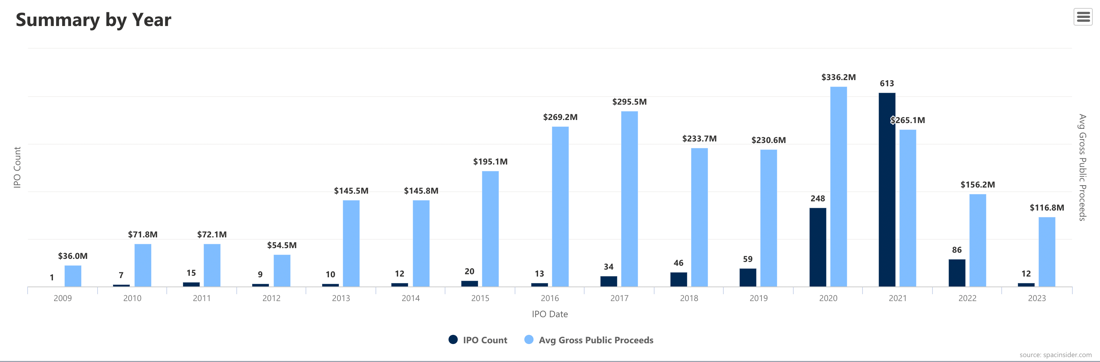

SPACs emerged in the 1990s as an alternative to blank check companies regulated under the Securities Act of 1993. Its usage used to be very stable, with an average number of 22 SPAC IPOs between 2010 and 2019. However, during 2020 and 2021 they had a surge, primarily fuelled by stimulus from the Federal Reserve, which helped boost the stock market after an initial pull-back caused by Covid. Furthermore, this surge even led them in 2021 to raise 1.5x the average annual IPO market. Following record-level years in 2020 and 2021 in which more than $245bn were raised through SPACs, the industry began experiencing a slowdown in 2022 which has carried over into 2023. Not only did the deal count fall from 613 in 2021 to 86 in 2022, to only over 10 in the first quarter of 2023, but the average gross public proceedings fell from record levels of $336.2m in 2020, to $116.8m in 2023.

Source: Spacinsider.com

The slowdown in the SPAC has been fuelled primarily by the disappointing performance of plenty of companies that went public through this vehicle, several going bankrupt after a short period of being public, disillusioned retail investors, and a tougher regulatory environment. Hindenburg Research has issued scornful reports about several companies that went public through SPACs, claiming that the reported information is misleading or false. Firms that go public via SPACs do not go through the same rigorous procedure of review by Investment Bankers nor by the Securities and Exchange Commission (SEC) as firms that go public via IPO. Furthermore, they claim that firms that have solid financials, and believe have good prospects, typically go public through the traditional route. Else, SPACs tend to be highly speculative, and they put into doubt the actual value of the company. The fact that many of the companies that either have gone public through blank check mergers, or are looking to, are start-ups in industries where actual sales, and therefore earnings, are still away from materializing, don’t help the argument that valuations are somehow accurate. Furthermore, the Securities and Exchange Commission also issued stricter guidelines on accounting principles for SPACs, which limited the use of financial forecast and improved complex and ambiguous reporting requirements, more specifically, related to warrants.

Additionally, the increase in redemption rates has posed increasing challenges to SPACs aiming to complete business, as less cash remains in the trusts accounts to satisfy any possible minimum cash conditions that the deals require. Furthermore, they are also a challenge as the decrease in cash means the company has less to use for its future operations, as well as a reduced liquidity in the stock of the company post-transaction. Between January and July 2021, the average monthly redemption rate for SPACs ranged from 7% to 43%. Then, between July and November 2021, the average monthly redemption rate grew to a range of 43% to 67%, and further rose significantly in 2022, with an average redemption rate above 81%.

0 Comments