About Boaz Weinstein

Boaz Weinstein is a seasoned hedge fund manager specializing in credit derivatives, structured products, and event-driven strategies. He began his career at Deutsche Bank [BIT:1DBK] in the late 1990s, where he founded Saba Principal Strategies, a proprietary trading group focused on relative value opportunities in credit markets. Known for his deep quantitative expertise and aggressive trading style, he quickly built a reputation as a top-tier credit trader before spinning out Saba Capital as an independent hedge fund in 2009.

Weinstein’s name became widely known after his role in the 2012 “London Whale” incident, where he successfully bet against JPMorgan’s oversized credit derivatives position, leading to billions in losses for the bank. Over the years, he has evolved Saba’s focus from pure credit trading into a multi-strategy approach, with an increasing emphasis on closed-end fund arbitrage and shareholder activism. His ability to exploit market inefficiencies and navigate complex financial structures has solidified his reputation as one of the industry’s most sophisticated hedge fund managers.

Saba Capital Management, L.P. is a credit-relative value-focused hedge fund spun out of Deutsche Bank in early 2009. Weinstein exited his proprietary trading group at Deutsche Bank’s New York office, taking with him a strong track record in structured credit trading. As of October 2024, Saba manages approximately U$5.3bn in AUM.

The firm traces its origins back to 1998 when Weinstein established Saba Principal Strategies within Deutsche Bank. The group became one of the bank’s most successful trading desks but suffered a USD 1.8bn loss in late 2008 amid the global financial crisis. Despite the challenging market conditions, Weinstein proceeded with a previously planned 2006 agreement to spin out Saba as an independent firm.

Saba Capital is headquartered in the Chrysler Building in New York and remains 100% self-owned, with a team of approximately 55 professionals. The name “Saba” comes from the Hebrew word for “grandfather”, inspired by Weinstein’s grandfather, who saved his mother’s and others’ lives during the Holocaust. The lift-out structure allowed Weinstein to retain most of his team, trading infrastructure, and intellectual property, avoiding rebuilding operations from scratch—a significant advantage in an otherwise turbulent financial environment.

The firm currently employs four primary investment strategies:

- Credit Relative Value – Saba’s flagship strategy, leveraging its deep expertise in credit dislocations across the capital structure.

- Tail Hedge – A strategy utilizing credit default swaps (CDSs) to hedge portfolios against major market downturns.

- SPAC Arbitrage – A structured approach to capturing mispricings in special purpose acquisition companies (SPACs).

- Closed-End Fund (CEF) Activism – A structural arbitrage strategy that seeks to unlock value in CEFs trading at a discount to NAV, often through activist engagements, board challenges, and fund restructuring.

Saba’s increasing focus on closed-end fund activism has set it apart from traditional credit hedge funds. Weinstein has expanded his strategy beyond the U.S., taking activist positions in UK-listed investment trusts, where structural NAV discounts and corporate governance frameworks present challenges and opportunities.

Closed-End Funds & Arbitrage Strategy

Closed-end funds are investment vehicles with a fixed number of shares that trade on exchanges like regular stocks. Unlike open-ended funds, which continuously issue and redeem shares at NAV, CEFs trade based on market supply and demand, often leading to persistent discounts or premiums relative to NAV.

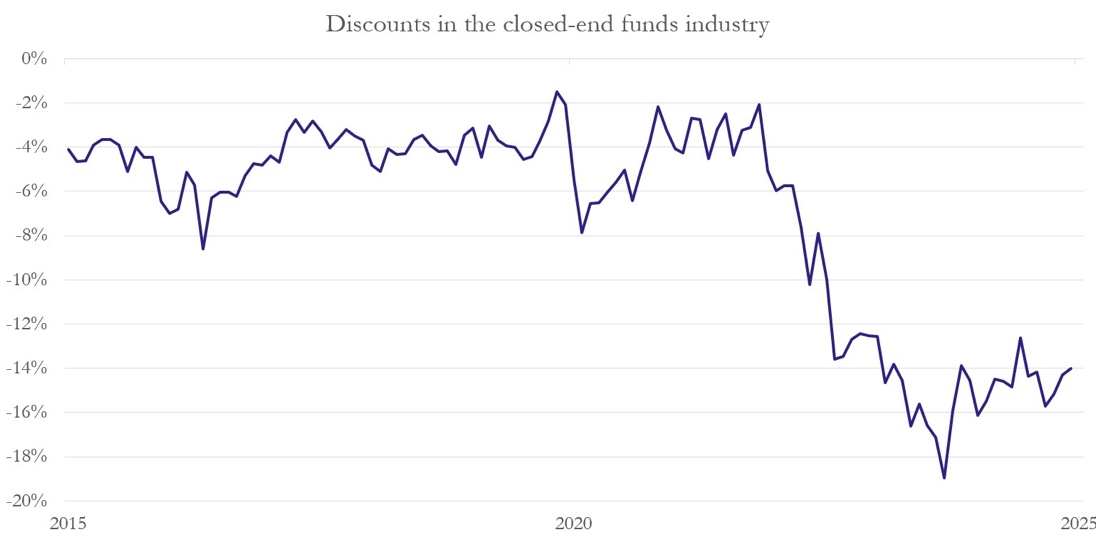

Difference between share price and total assets, industry average, weekly (%)

Source: Financial Times, BSIC

Saba Capital’s CEF strategy revolves around structural arbitrage, targeting funds that consistently trade at a significant discount to NAV, typically due to poor governance, inefficient capital allocation, or lack of liquidity. Weinstein’s approach follows a multi-step activist playbook:

- Identifying Underperforming CEFs – Screening for funds with double-digit NAV discounts, underwhelming historical performance, and governance structures that enable prolonged inefficiencies.

- Accumulating a Strategic Position – Building a substantial stake (often above 5%) to gain influence over board decisions and initiate shareholder-driven changes.

- Engaging with Fund Management – Advocating for measures such as share buybacks, tender offers, or full open-ending to eliminate the NAV discount and unlock shareholder value.

- Proxy Battles & Board Takeovers –Saba launches proxy contests to replace board members and push for shareholder-friendly policies if engagement fails.

- Exit Strategy – Monetizing the convergence of price and NAV by selling shares at a premium or forcing fund liquidation.

This strategy has proven effective in the U.S. market, where Weinstein has pressured asset managers like BlackRock and Nuveen to implement discount-reducing measures. However, his recent expansion into the UK investment trust sector has introduced new challenges. Unlike in the U.S., UK-listed investment trusts operate under a stricter governance framework, making direct board takeovers more difficult. Saba has increasingly focused on coalition-building with other institutional investors to collectively pressure fund managers to unlock NAV discounts to counter this.

Open-Ended Funds

Unlike closed-end funds, open-ended funds continuously issue and redeem shares at NAV, ensuring that share prices align with the underlying asset value. This liquidity mechanism prevents the persistent trading discounts that CEFs experience, eliminating the structural arbitrage opportunities that drive Saba’s activist strategy.

Despite this fundamental difference, Weinstein has occasionally advocated converting certain closed-end funds into open-ended structures as a permanent solution to NAV discounts. However, such conversions face significant resistance. Fund managers prefer the stability of closed-end structures, allowing them to manage capital without sudden redemptions. Many institutional investors also favour CEFs for their ability to invest in illiquid assets and employ leverage, features that are often unavailable in open-ended vehicles. Additionally, regulatory barriers make conversions difficult, as they typically require a supermajority shareholder vote, a threshold that is rarely met.

Given these constraints, Saba’s activism in CEFs remains focused on creating liquidity events—such as share buybacks and managed distribution policies—rather than pushing for full-scale fund conversions. The recent pressure exerted by activist investors has already led several fund managers to take proactive steps to narrow NAV discounts preemptively, demonstrating the broader impact of Weinstein’s strategy on the sector.

Strategy

As mentioned before, Saba offers four main strategies, which all have their distinctive periods of high returns.

First, the Credit Relative Value Strategy mainly uses CDSs to profit from mispricing in the credit market. In particular, Weinstein managed to create exceptional returns during the Covid crisis, although not being able to predict it in the first place. The fund discovered “the most notable mispricing” [Boaz Weinstein in an interview with Institutional Investor in May 2020] he had ever seen in prices for high-yield CDSs on companies such as United Airlines Holdings [NASDAQ:UAL], which were priced equally to investment-grade companies such as Verizon [NYSE:VZ]. The strategy was that the spread between junk and investment-grade bonds would revert to historical means as soon as the next economic downturn hit. Luckily, not only did an economic downturn happen, but Covid catalysed the increase of the spreads and the Saba Capital Master Fund spiked by 33% in the first two weeks of March 2020, whereas a second offering, the so-called Saba Capital Tail Fund was up by an exceptional 99%.

In 2010, Weinstein set up a tail-risk strategy, which was completed with a “carry neutral” version in 2020. The strategy serves as a downside protector.

Additionally, Saba employs a SPAC strategy, which has led to notable gains. In 2021, Saba became the fourth biggest SPAC hedge fund investor and was invested in the SPAC that took Donald Trump’s social media platform, Trump Media & Technology Group Corp [NASDAQ:DJT], public in 2022. Saba sold its shares as soon as it learned about the acquisition target, potentially not to be associated with the merger. Possible gains were not published, but the stock rose by more than 300% upon publishment of the news.

Furthermore, Weinstein has employed a closed-end fund strategy, which focuses on “freeing” locked-in capital in CEFs that trade beneath their net asset value. Employing this strategy in the US initially, he has since moved to the UK, where he specifically targets British investment trusts. With a broad history of over 150 years, these funds usually trade at a discount to their assets, and Weinstein aims to change that. He is applying the same scheme as before in the US: Oust the board, replace it with his nominees, and change the strategy. Furthermore, he has since changed his approach, not focusing on the board anymore but relying on backing from other funds to push through an agenda that would lead to these CEFs’ transformation into open-ended funds. Saba estimates the total trapped money in UK trusts to be more than £19bn, of which almost £13bn is in equity trusts. The rise of low-fee ETFs and the poor performance of UK trusts is fuelling his agenda.

Saba Capital vs Blackrock

One of the most prominent activist campaigns of Saba Capital is their recent settlement with BlackRock [NYSE: BLK]. During the spring, the Hedge Fund pushed new candidates in 10 of Blackrock’s closed-ended funds with a total market value of $10bn and asked to terminate the management’s contracts in 6 of them. The rationale behind the activist battle was that the fund was trading at a discount to its Net Asset Value and failed to deliver appropriate long-term returns to its shareholders. BlackRock won the proxy battle by utilizing a fund bylaw that states that to approve a new nominee or terminate a manager, the vote must be supported by a majority of all the shareholders and not only by the ones who voted. In the votes, only 11% of the CEF’s shareholders voted in favour of Saba Capital’s proposals, which made the raid unsuccessful. In the settlement with Saba Capital, BlackRock agreed to purchase back 50% and 40% of the outstanding shares of the BlackRock Innovation and Growth Term Trust and Health Sciences Term Trust, respectively. The price agreed was 99.5% of each Fund’s NAV, a total of $1.6bn. On the other hand, Saba Capital committed to stop pursuing activist campaigns against BlackRock’s funds.

Saba Capital’s Activism in the UK

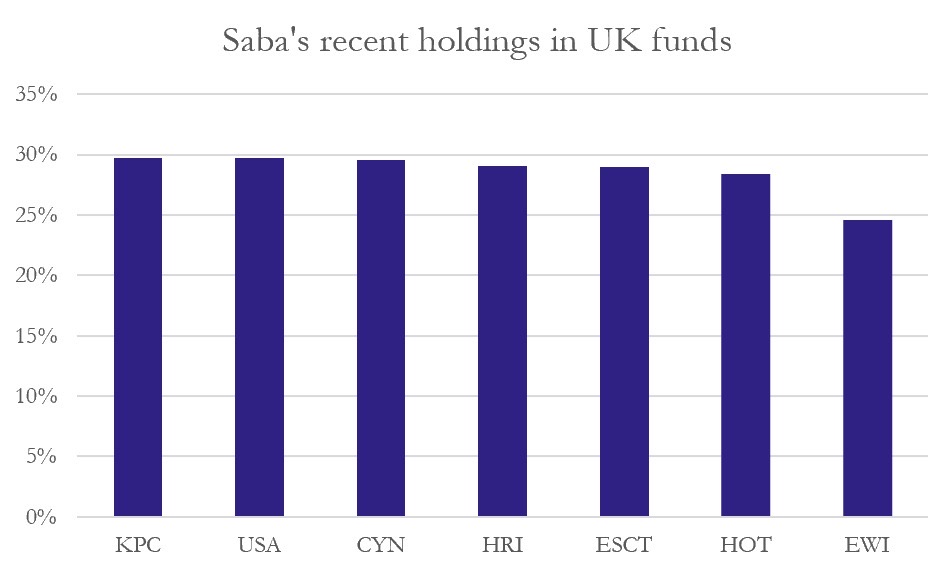

On December 18th, 2024, Saba Capital announced its latest campaign and expanded its activism in UK closed-end funds, targeting seven underperforming funds that, according to Boaz Weinstein, suffered from weak management and persistent NAV discounts. The activist hedge fund sought to replace the board of directors in these funds through a proxy vote, aiming to implement governance changes that would unlock shareholder value. The table below illustrates Saba’s substantial stakes in its targeted UK funds.

Saba Capital’s holdings in selected UK closed-end funds (% ownership)

Source: Financial Times, BSIC

Despite holding significant stakes in these funds, Saba’s proposals faced strong resistance. Less than 1.5% of the remaining shareholders supported the hedge fund’s efforts, reflecting the structural and cultural challenges of implementing aggressive activism in the UK market.

Unlike in the U.S., where shareholders are more assertive in launching proxy fights to drive boardroom changes, the UK’s corporate governance framework presents obstacles to this approach. The UK system places a strong emphasis on board independence, as highlighted by the AIC’s best practice guidelines, which recommend that most board members be independent of fund managers. Additionally, the 2006 Companies Act enforces the principle that directors must represent the interests of all shareholders equally, making it harder for activists to drive unilateral changes.

As of 2024, the UK closed-end fund market comprises 294 trusts with £265 billion in assets under management. In response to the increasing threat of activist interventions, many UK-listed investment trusts have proactively taken steps to reduce their NAV discounts. A recent example is the merger between Henderson International Income and JPMorgan Global Growth & Income, a move intended to deter activist pressure by improving fund liquidity and governance.

Despite these challenges, Saba Capital’s presence has already forced many UK trusts to reconsider their discount policies, demonstrating the growing influence of activist hedge funds in this traditionally conservative market. However, once an activist enters a trust’s shareholder base, it becomes difficult for fund managers to remove them, reinforcing the long-term pressure for structural change.

0 Comments