Part 1 – A booming equity market

The successful IPOs of Airbnb and DoorDash at the end of 2020 were in stark contrast with the high-profile debuts of big privately held companies, such as Uber and Lyft, which were not met with investor excitement in 2019. Not to talk about the float of WeWork which was pitched and then aborted due to intense public scrutiny about multibillion-dollar valuations for loss-making businesses. Overall, companies tapped the public markets to raise a record $149bn through IPOs in 2020 in the US. That resulted in an unprecedented seven consecutive months of $10bn-plus flotations. Even when excluding a boom in blank-cheque companies (or Spacs), the IPO spree is running at its fastest pace since 2014 despite new listings slowed to a standstill in March when the pandemic started.

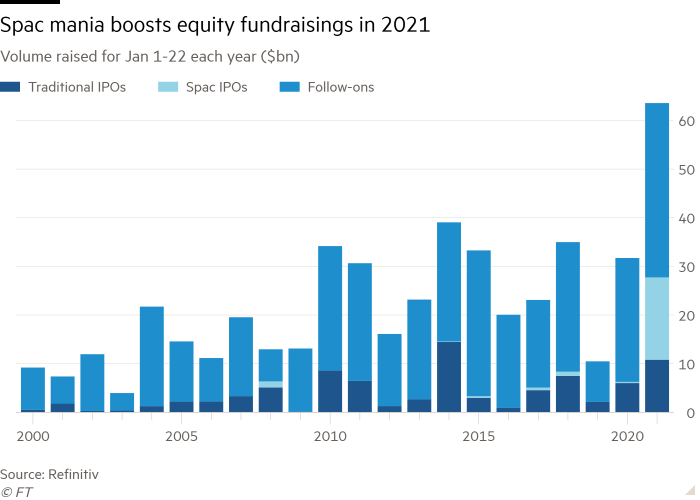

The booming primary market showed no sign of slowing down in the first months of 2021. Companies raised $64bn in the first three weeks of January in the US alone, compared to just over $30bn the year before. The fundraising spree continued despite the economic blow from coronavirus and the uncertainty that follows. Equity markets remained undaunted while much of the world is grappling with a deadly winter wave of Covid-19. The forecasts of a V-shaped recovery and the low interest rate environment contributed to the current bull market. It is widely recognized that the trillions of dollars injected by the FED and other central banks into the financial system have contributed to the rising stock market valuations. This situation has enticed companies to pivot from private to public markets much sooner in order to take advantage of public valuations and raise capital.

Source: Refinitiv, FT

Source: SPACInsider, Statista

Source: SPACInsider, Statista

The pace of fundraising in equity capital markets is more than double the amount raised in the same period last year, and this is also partly due to the boom in Spacs. The frenzied listing of Spacs of 2020 also continued in 2021, despite some warning that their surging popularity may be unsustainable. As of January 12th 2021, 34 blank cheque companies raised $8.4bn, in perspective, Spacs raised slightly more than one tenth of the entire proceeds in 2020 over just 12 days.

Israeli mobile games company Playtika holds the crown for this year’s biggest listing so far, raising $2.2bn, while Warren Buffett-backed Chinese electric vehicle company BYD’s $3.9bn share sale last week made it January’s biggest equity market transaction. Some more interesting potential IPOs are planned for later this year. As always, the technology sector is the master, in particular the niches relating to the development of software and platforms for social interactions. UiPath (est. valuation ~$15-20bn) is dedicated to the development of a platform for robotic process automation, while Roblox ($8bn) offers an online gaming service through which users can program new video games and use those already developed by others. Bumble ($8bn) and Nextdoor ($5bn) offer spaces to facilitate social interactions, which have become a significant issue due to the pandemic that has forced millions of people to isolate themselves for long periods. The last two are Coinbase ($8-25bn), a digital goods trading company, and Petco ($6bn), focused on the sale of products and services for animals.

Part 2- A blockbuster year for Tech IPOs

Tech IPOs, in particular, have seen a large surge in recent months as the global pandemic has highlighted the economy’s dependence on technology as well as signaling the unlimited opportunities of the sector for the future. Tech companies have also benefited from the shift to remote working and investors are betting that trends such as food delivery and online shopping will outlast the crisis.

But as tech IPOs approach record highs, and share prices and profits become increasingly detached analysts are drawing unsettling parallels to the dotcom boom and bust two decades ago. Only three companies raising at least $1bn in the US have climbed more on their first day than Airbnb (listed in December of last year), and the trio did so between March and June 2000, at the height of the dotcom boom.

Sky-high valuations have challenged traditional assumptions about how to best value a business. Alternative metrics such as revenue growth, price/sales and even operating expenses have been sighted as better indicators of a company’s prospects. Larry Fink, the CEO of the world’s largest asset manager Black Rock, recently warned that stock offerings are soaring to “unsustainable” levels. These listings have been accompanied by ultra-low interest rates which give a higher value to future cash flows and so support current high valuations. The yield earned from a treasury bond is a key factor of stock valuation models and in an era of near-negative real interest rates, riskier assets such as equities look more attractive.

Some investors argue there are key differences between the pandemic tech-frenzy and the one in the late 1990s. While the valuations of tech companies in the past year have been elevated, they are now supported by stronger revenue streams. The technological shifts in areas such as healthcare, retail and transportation that have been further accelerated by the pandemic have also been used to justify the valuations.

In the US market, three of the biggest tech IPOs in history occurred in 2020: Snowflake, Airbnb and DoorDash. Together these companies raised about $11billion with their market debuts. Airbnb raised $3.7 billion in December, it priced its IPO at $68 a share, and the stock price soared to $144 on the first trading day. However, unlike many tech companies, as a result of travel restrictions, Airbnb has been significantly bruised by the pandemic. Its revenue declined 32% year over year to $2.5 billion in the first nine months of 2020. Investors are betting on a rebound in the travel industry next year. Airbnb is now valued at $116.65bn which is higher than peer Booking Holdings which is valued at $85 billion despite the fact that Booking Holdings generated $15 billion in revenues last year compared to Airbnb’s $4.7 billion. Some have called into question Airbnb’s high valuation in comparison to Booking Holdings.

US meal delivery company DoorDash raised $3.4 billion in its public debut on December 9th. The delivery company’s shares closed at $190 each, 86% above its initial public offering price of $103. DoorDash has thrived in the midst of the pandemic and in the first nine months of the year its revenue more than tripled from the same period last year, to $1.92 billion. However, DoorDash’s growth was primarily sparked by stay-at-home orders and restaurant closures. It is expected that the company’s growth is likely to flatten after the crisis as it also faces new regulations aimed at the gig economy which could destroy its slim margins.

Stock listings of Chinese firms dominated global rankings last year and are set to continue this trend in 2021. Among the top 10 listings globally, Chinese firms made up half of the list while also taking the top three spots, these included: Chinese chipmaker SMIC and e-commerce giant JD.com. Similarly to the US, it is the tech companies in China that are leading the fundraising frenzy. In fact, the US was actually behind China in this respect as China recovered from Covid earlier. One important exception among the Chinese firms is the financial technology giant Ant Group, which was set to be the world’s biggest IPO before it was abruptly halted after it ran afoul of Chinese regulators. At the end of January, Chinese short video company Kuaishou, raised $5.32 billion in its IPO as its shares rose nearly 200% on the first day of trading. This marked the biggest IPO in the tech industry since Uber raised more than $8bn in 2019. Kuaishou’s main business is a short video app and it makes money from users who buy virtual gifts. The company’s debut may pave the way for its larger rival ByteDance to move to its own listing. However, this also comes as Beijing increases scrutiny of the sector in areas from data security to anti-monopoly.

The US and China both attracted record IPO proceeds last year. In contrast, European IPOs have raised just $19 billion, the lowest in at least a decade. Since August, SPAC listings have outnumbered traditional IPOs in the US, investors are watching if the SPAC phenomenon will migrate beyond the US into Europe. However, European tech firms are seeking to imitate the US IPO fever. At the end of January, the Polish parcel operator InPost raised $3.4 billion in Europe’s biggest IPO since 2018. This is the latest sign of investor appetite for ecommerce stocks amid an online shopping boom. One of the main challenges for InPost now is to diversify its business as it seeks to expand into the UK, France, Spain and Italy. In the first nine months of 2020, 99.4% of InPost’s revenues came from Poland. Furthermore, German online luxury fashion retailer Mytheresa jumped more than 37% in its stock market debut in late January, giving the retailer a market value of $3.08 billion. This presents a strong start to the year for tech IPOs in Europe and emphasises continued excitement among investors for technology orientated consumer facing companies.

Part 3 – The battle for Europe

Even if these first months of 2021 have been great for european tech IPOs, London’s financial services are still operating under a no-deal Brexit after the UK and EU failed to reach a deal on mutual recognition on standards and regulation. In fact, only 5 out of 1200 pages of the EU-UK Trade and Cooperation Agreement (TCA) were focused on financial services. Even if this outcome was expected by financial institutions on both sides (hence it did not generate a large amount of turmoil), it has caused a remarkably swift shift in liquidity from London to EU overnight (nearly €6bn of EU share dealing). This could be one of catalysts of the transition as main listing hub from London to European Exchages, for example Cboe Europe said 90% of its EU flows, more than €3.3bn worth of deals, were now in Amsterdam.

On the other hand, hopes for an economic revival following the U.K.’s turbo-charged Covid-19 vaccination campaign seem to be reversing the downward trend in IPO proceeds started after the 2016 referendum. A new wave of listings is indeed coming to London (as the iconic bootmaker Dr. Martens), many of which are driven by the prospective gains that could be made. Especially after several successful companies completed their IPOs on

LSE, such as THG Holdings, which listed on London’s standard segment in a $2.4 billion offering in September. Furthermore, the online greetings card company Moonpig has gone public on the LSE valuing the company at £1.2bn, whose share price surged by 25% to £4.40 less than an hour after listing.

Nonetheless, european exchanges are trying to take advantage of some companies’ uncertainty in listing on the London Stock Exchange. In the last year Euronext Amsterdam has showed to be one of the main rivals to LSE, after coffee conglomerate JDE Peet’s €2.3bn listing, which was the biggest European IPO since 2018. Euronext Amsterdam, also thanks to Euronext extensive network of exchanges across the continent (which is continuously expanding thanks to the newly acquired Borsa Italiana), has in fact shown much flexibility and an international reach, proving its ability to manage large listings.

Centres like Amsterdam, Paris and Frankfurt already are benefitting from these past months’ structural changes in the financial system, in fact it is argued by some that Amsterdam is to become the main listing hub for Central and Eastern european countries. Undoubtedly, these centres will continue to profit from this slow transition but London’s longstanding dominance of European Capital Markets is far from over.

0 Comments