Carrefour S.A. (EPA:CA) – Market Cap as of 31th March 2021 €12.5bn

Atacadão (Carrefour Brasil) (BVMF: CRFB3) – Market Cap as of 31th March 2021 R$45.3bn

Grupo BIG – Private Company

Introduction

On March 24th, 2021, Carrefour SA announced that its Brazilian arm has entered into an agreement with Walmart Inc. and Advent International Corp. for the acquisition of Brazilian food retailer Grupo BIG Brasil SA in a deal that valued the company at roughly R$7.5bn (€1.1bn). The acquisition comes in two months after Couche-Tard, a Canadian convenience store chain, made a takeover bid worth €16.2bn for Carrefour that was rejected by the French government opposition.

Carrefour has been active in Brazil since 2007, when it bought discount superstore operator Atacadao for $1.1bn. The merger of Carrefour Brasil, which is currently the leader in the local food retail industry, and BIG, which stands at the 3rd place, would inevitably stipulate synergies and thus create an indisputable region champion and further strengthen Carrefour Brasil’s leading position. Together Carrefour and Grupo BIG operate 876 stores in Brazil and have about $18bn in annual revenue.

About Carrefour

Carrefour SA is a French-based retailer with a strong presence in Europe, South America (Brazil and Argentina) as well as in Asia. Its activities include operation and management of hypermarkets; supermarkets; convenience stores; cash and carry stores; and both food and non-food e-commerce websites. The company was founded on July 11, 1959 and is headquartered in Boulogne-Billancourt, France. Carrefour operates different store formats, as well as multiple online offerings to meet the growing needs of its diversified customer base. A pioneer in countries such as Brazil in 1975 and China in 1995, the Group now operates in three major markets: Europe, Latin America and Asia. With a presence in more than 30 countries, it generates more than 55% of its sales outside France. In 2020, Carrefour generated Net Sales of €70.7bn and EBITDA of €4.5bn. Carrefour focuses on strengthening its position in the core markets through efficiency improvement as well as acquisitions. Only in 2020 Carrefour executed 7 minor acquisitions with a total enterprise value of approximately €760m which should contribute more than 2% of additional sales on the annual basis.

In Brazil, Carrefour operates through its subsidiary Atacadao, also known as Grupo Carrefour Brasil, which it acquired in 2007 for $1.1bn. In 2017, the French retailer saw an opportunity to take its Brazilian subsidiary public in one of the largest Brazilian IPOs since 2013 raising approximately €1.5bn and resulting in a total valuation of the Brazilian business of €8.1bn. Today, Carrefour maintains 71.64% ownership of its Brazilian business. Brazil remains an important market for Carrefour with total net sales contribution of approx. €10-11bn or 16% on the annual basis.

About Grupo BIG

Present in Brazil since 1995, Grupo BIG, formerly Walmart Brail, operates a multi-format network of 387 stores under several brands and different formats. The Group comprises of 35 membership-only stores under the Sam’s Club banner, 107 hypermarket stores under the BIG and BIG Bompreço banners, 99 supermarket stores under the Bompreço and Nacional banners, 97 soft discount stores under the Todo Dia banner, 49 Cash & Carry stores under the Maxxi banner as well as 13 gas stations. Grupo BIG has a presence in 19 states, with a larger footprint in the southern and northeastern regions of Brazil. In 2020, Grupo BIG generated gross sales of R$24.9bn and adjusted EBITDA of R$928m.

The rapid expansion throughout the country started in 2004 when BIG acquired Bompreço, a leader in the Northeast and a reference in retail in the region. In the following year, the group completed the acquisition of Sonae Distribuidora in the South, with a strong presence in the three states of the region with the BIG, Nacional, Maxxi Grosso and Mercadorama flags.

In July 2018, the Advent Investment Fund acquired 81% of Walmart Brasil. From this acquisition, a new chapter in the company’s history began: the chain was rebranded to Grupo BIG and focused on the investment in the cash & carry and shopping club formats, in order to compete more effectively against rivals GPA and Carrefour Brasil. At the same time, the company pledged to invest more than R$1.2bn (€270.6m) into the modernisation and enlargement of stores. Finally, management was changed to 100% local in order to ensure more agility in decision making and enable the company to reach a new level of competitiveness.

Industry overview

The food and grocery retail market involves retail selling of food products, packaged and unpackaged, as well as beverages, tobacco, and household goods. Looking at numbers, in terms of global reach the market remains dominated by Europe and the US, but local growth in Asia-Pacific, especially China, is very strong. Actually, the APAC region registered the most considerable market share in 2020, reaching 46.4%, with China being the primary market in this area. The US was also a key market with a 22.5% share in the global food & grocery market during the same year. As to South America, instead, it accounts for less than 5% of the global market share, signaling a market with potentially high growth opportunities to be exploited.

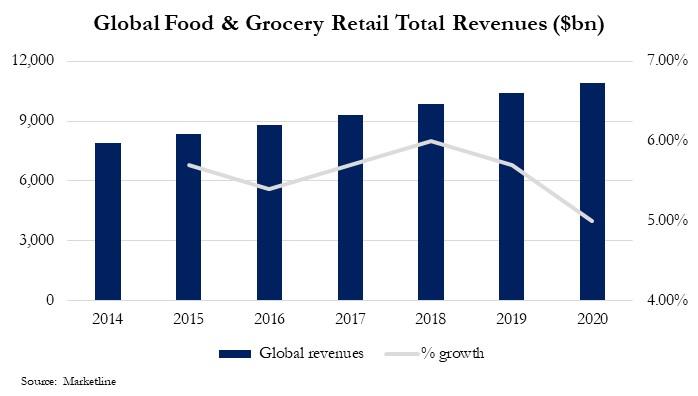

The global food and grocery market value has increased at a stable and robust pace in recent years. Despite the spread of COVID-19, the market is expected to continue its current growth trajectory. Indeed, the sector is undergoing strong growth and transformation, with many new markets opening up, especially in emerging economies, due to an improved standard of life of middle classes in developing markets paired with an increased demand for environmentally friendly and fresh products worldwide, along with rapid urbanization. Most growth in the food & grocery market originates from developing countries in Asia and South America, with economic development forging consumer confidence and creating markets with more significant amounts of disposable income. In other regions, markets are mature and facing saturation, particularly in Western Europe. Mild growth in this region is driven mainly by wage increases, low-level inflation and population increases. The global food and grocery retail market recorded total revenues of around $9.9 trillion in 2018 and $10.4 trillion in 2019, signifying a compound annual growth rate of 5.7% between 2014 and 2019. As to the future outlook, the market size shall reach a market value of about $17.3 trillion by 2027, progressing at a CAGR of 5.0% over the forecast interval. What is fueling growth in the developed markets is that consumers are becoming increasingly health-conscious and are expanding measures to protect animal welfare and the environment. As a result, the organic and health food retail market is becoming a key growth factor across the global marketplace.

Source: Marketline

The massive COVID-19 spread drastically affected the sector forcing global retailers to speed up transformation towards digitalization of services. In terms of financial performance and growth retailers were not negatively affected due to the necessity of the distributed products. However, as the global pandemic strengthened, grocers instead had to battle with supply chain issues, panic buying and safety measures as a bewildered public stocked up quintessential items.

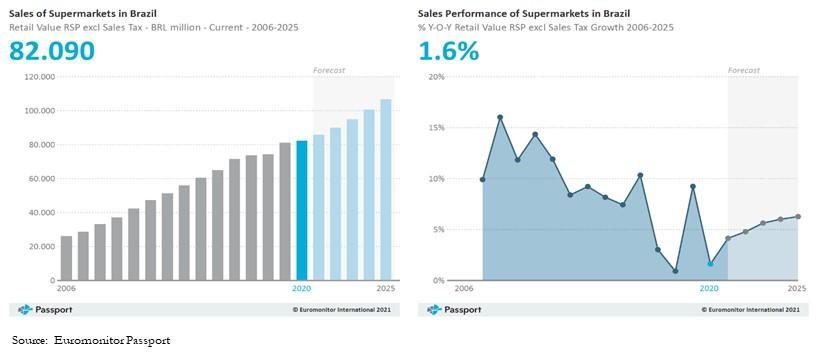

The grocery sector in Brazil, as no exclusion, managed to maintain a stable level of financial performance during 2020. The result was a consequence of supermarkets’ necessary status, which ensured that they were permitted to remain open throughout the year, even during the quarantine lockdown period. Furthermore, with on-trade service banned across Brazil’s as well as the entire hospitality industry during the quarantine lockdown, food and drink consumption shifted to the off-trade, further benefiting supermarkets and other grocery retailers. In detail, one of the main factors pushing sales in supermarkets throughout 2020 was the surge seen in sales during the quarantine lockdown’s initial phase. It was due to the widespread stockpiling observed among consumers living in central urban districts. Among the products most commonly sought out by consumers interested in stocking up were products generally regarded as reasonably essential. With some consumers hoarding vast volumes of such products, the shelves of many supermarkets were left empty. Besides, mild positive growth in grocery retail was supported by the availability of the Brazilian government’s emergency financial aid. Access to federal income subsidies enabled many consumers to continue spending money on groceries despite the spike in unemployment and the pressure on household incomes during the year. However, this beneficial situation is unlikely to remain in effect during the following years due to the emergency financial aid programme’s end falling due in early 2021. This may result in restored stress on the salary levels of many users. Moreover, supermarkets are expected to generate lower margins as the rising cost of merchandise is accelerating due to the rising production cost. This is within the context of rapidly rising inflation, which impacts the price of specific packaged food items such as rice, which forms a vital part of the essential Brazilian diet.

Source: Euromonitor Passport

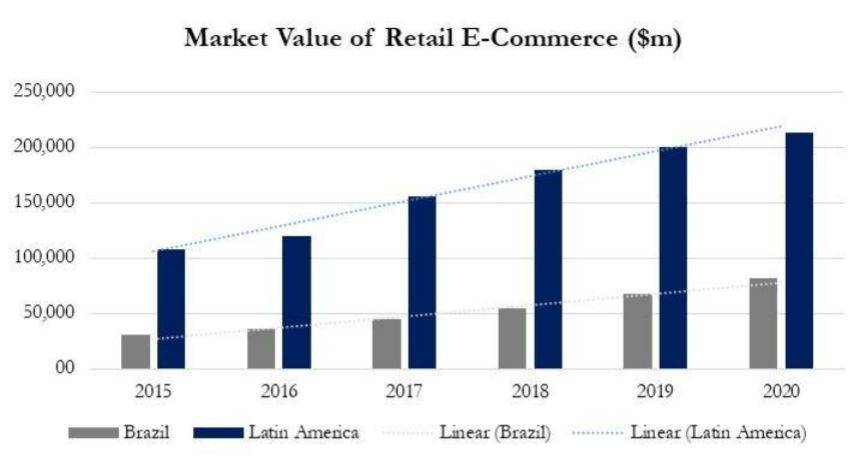

Nevertheless, the COVID-19 pandemic embodies a watershed moment for online grocery. The global retailing industry has seen significant transformations in recent years, as the inexorable advance of e-commerce has revolutionized the fashion consumers shop for products of all genera. Nothing in the modern metamorphosis of the business matches the global disturbance caused by the COVID-19 pandemic. Governments trying to hinder the enlargement of the virus have centred on controlling public gatherings, encouraging “social distancing”. Even if most physical grocery stores remained open, many consumers – dreading for their health and safety – have endeavoured to halt all but the essential visits to stores. As a result, people who would never have considered buying groceries over the internet shifted most of purchasing online to minimize the risk of COVID-19 infection significantly. The concluding consequence of this drastic shift in consumer practice has been a colossal surge in online grocery sales worldwide, accelerating a process which in many countries was too slow-paced. As a result, one of the most critical trends that surfaced in the Brazilian retailing business during 2020 was the notable alteration towards purchasing groceries online. Indeed, food and drink e-commerce were big winners during the year as vast numbers of consumers grew accustomed to grocery shopping online. However, even after the pandemic situation has been resolved to the extent that people feel safe shopping in supermarkets once more, it is likely that the convenience of online grocery shopping will continue to support growth in food and drink e-commerce.

Therefore, the preponderance of retailers awaits an endured increase in request for digital commitments through 2021. So, even though some of the effects of COVID-19 will be evanescent, it is already manifest that the pandemic will have a permanent and transformative impact on the grocery market, with a permanent alteration towards e-commerce. However, this will undoubtedly require further industry consolidation. As the COVID-19 pandemic loosens, inevitably, many grocery businesses without the appropriate scale or the technological prowess to persist in the e-commerce age will be driven out of business or acquired by giant competitors. This will certainly increase the number of transactions, already at its uptick, as many players are trying to acquire clean and sustainable brands.

Deal Structure

The acquisition of Grupo Big is set to be 70% in cash, and 30% in shares, based on a R$7.5bn ( around €1.1) Equity Value. The R$5.25bn to be paid in cash will be split into R$900m of upfront payment and R$4.35bn at closing and will be financed through available cash and a minimal portion of debt, which shall not significantly affect the company’s rating. Instead, as to the R$2.25bn in shares, there will be the issuance of about 117m new shares. The shares will be issued at a price per share equal to R$19.26 with a 6-month lock-up.

The transaction value of R$7.5bn in equity, results in Implied EV/ LTM EBITDA of 15.0x and Implied P/E (LTM) of 2.4x. Upon completion, Carrefour Brazil will retain 67.7% of the new group (versus 71.6% today), while Sellers of Grupo GIB (Advent and Walmart) will become minority shareholders in the merged entity with the stake of 5.6%. The deal is expected to be executed at the beginning of 2022 and is subject to CADE’s approval.

Source: Carrefour Transaction Presentation

Depending on regulatory approval by the competition authorities, the acquisition of Grupo BIG by Carrefour Brasil would create a clear regional champion. The resulting company, combining Brazil’s largest and third largest food retailer, would have sales of R$100bn (€15.3bn) and would employ 137,000 employees at 876 stores.

According to the structure of the deal, Advent International and Walmart will together hold 5.6% in Carrefour Brasil for at least 6 months from closing. This shows the confidence which all parties have in the future of the merged entity. Especially for a private equity fund, this is noteworthy, as they typically prefer a full exit.

The two business groups complement each other perfectly in terms of geography. While Carrefour Brasil is mostly present in the Southeast of the country, Grupo BIG is focused on the Northeast and South.

Source: Carrefour Transaction Presentation

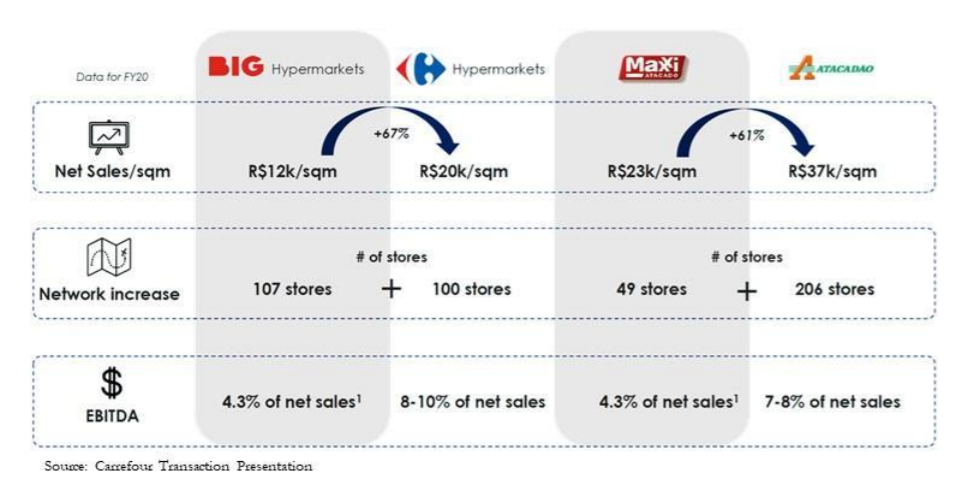

The integration plan foresees that Grupo BIG’s brands for the hypermarket, supermarket and cash & carry format will be replaced by the Carrefour brands. The common brand will lead to more effective marketing and customer loyalty programs and simplifies the production of own-brand products. Furthermore, the company expects significant upside potential as a result of the transformation, as Carrefour’s brands have significantly higher net sales per square meter and EBITDA margin. The Sam’s Club and Todo Dia brand will be continued, as they represent two new formats (Club and Soft Discount) which complement the group’s offering.

Source: Carrefour Transaction Presentation

Grupo BIG’S consumer finance services are currently outsourced and will be internalized within Banco CSF (belonging to Carrefour Brasil). The offering consists of credit cards and complementary financial products. Moreover, Carrefour will use the strong position of Grupo BIG’s online platforms to increase its e-commerce penetration.

The aforementioned expected revenue synergies will be supplemented by cost synergies. The combination will read to a reduction of overhead and indirect costs by combining the companies’ administrative structures. Furthermore, it will lead to improved sourcing conditions which increases profitability. Additionally, cost synergies are also expected along with the logistics operations through increased transportation efficiencies. As a result, the transaction is expected to be very beneficial for the company’s shareholders. Following the integration, significant annual synergies of R$1.7bn (€260m) are expected by the third year after the acquisition.

Brazil is currently Carrefour’s second largest market. Matthieu Malige, CEO of Carrefour, underlined in an interview that the transaction is therefore in line with the overall strategy to focus on Carrefour’s main countries and in-store formats that have good potential synergies..

Overall, the deal is in line with European retailers trying to improve their positions in their core markets with a focus on the shift towards digital services to prepare for the market entry of global e-commerce giants as Amazon. However, while most European retailers are focusing on strengthening their position in Europe or the US, Carrefour seems to bet on improving its position in Brazil as a potential hedge against increasing competition in Europe.

Market Reaction

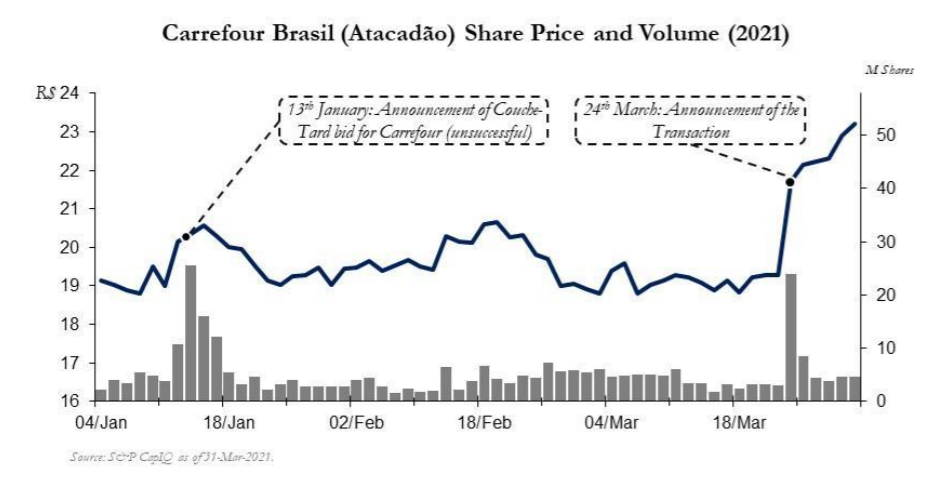

Source: S&P CapitalIQ

The transaction was positively perceived by the investors. On the 24th of March, the day of the announcement, Carrefour’s share price gained 2.3%. During the following days, it further increased and stabilized at a level of around 4% compared to the pre-announcement level. Also, first analyst reactions were positive and the target price experienced a slightly positive trend. The trading volumes were moderate especially compared with January. This seems reasonable as the transaction is in line with the company’s communication strategy and the transaction volume is proportionally moderate with R$7.5bn (€1.1bn). However, it restores growth prospects for investors after the failed combination with Couche-Tard in January this year. The Canadian convenience store group approached Carrefour in a friendly manner with a €16.2bn takeover bid which was announced on the 13th of January. Even though the approach was appreciated by Carrefour’s management and its investors, the French government blocked the takeover offer only two days after the announcement due to concerns about France’s “food sovereignty”.

Source: S&P CapitalIQ

The positive perception can also be seen in the share price development of Atacadão, Carrefour Brasil’s subsidiary. On the day of the announcement, its share price jumped up by 12.8% and the trading volume soared. Furthermore, first analyst reactions were positive increasing the consensus target price to R$26.40. In contrast, the announcement of the Courche-Tard bid in January had a similar effect on the trading volume, but the share price was only slightly affected.

Financial Advisors

The financial advisors of the parties have not been disclosed.

0 Comments