BSIC Quant Library: Streamlined Financial Data Retrieval

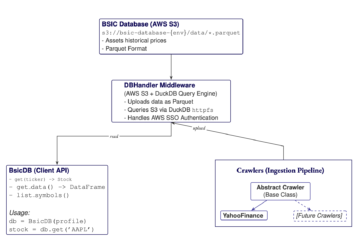

Download PDF Abstract This technical report details the architecture and implementation of the BSIC Quant Library, a Python-based infrastructure designed to centralize and optimize financial data retrieval for the BSIC members. The system is designed to facilitate access to financial data from the association’s members by providing a robust pipeline Read more…