Introduction

Polestar, the Swedish premium electric car maker, has announced it will go public. It will do so by merging with a blank-check company backed by private equity investor Alec Gores and investment bank Guggenheim Partners. The implied enterprise value will amount to $20bn. The transaction will mark Polestar as one of the most valuable electric-vehicle companies to go public via a SPAC; with a valuation of three times its current projected revenues for 2023. As a result of the deal with Gores Guggenheim, Polestar will receive cash proceeds of over $1bn, including $800m from the SPAC company and private investment in public equity (PIPE) of $250m. This deal also comes at a time where the SPAC market has significantly soured following a frenzy at the beginning of the year.

Polestar

Polestar was founded in 2017 by Volvo Cars and Geely, its Chinese parent company. Prior to the SPAC, the company had raised $550m from Chinese investors.

The premium electric vehicle maker’s current offering includes two models: the Polestar 1, a hybrid car, alongside the Polestar 2 which is fully electric. However, the company is planning a very aggressive growth strategy for the near future – aiming to expand its line-up by three new models within the next three years. One of these upcoming models, the SUV Polestar 3, has already been announced, will begin production next year at Volvo’s South Carolina facility. Polestar produces both of its current models at a plant in Chengdu, China but faces stiff tariffs when exporting these vehicles to the US. The strategic decision to shift its manufacturing will allow the firm to avoid these import tariffs but may also be balanced out by the higher manufacturing costs faced in the US.

Polestar sold its first vehicle in 2019 and has projected $1.6bn revenue for 2021. This figure is predicted to double next year, following the introduction of the Polestar 3 which is aimed at the luxury end of the market. The company delivered around 10,000 vehicles last year but has recently set out an ambitious plan where it expects to sell about 290,000 per year by 2025 this is in comparison to Tesla having recently delivered 240,000 vehicles in the third quarter of 2021.

Polestar now joins a hoard of other electric-vehicle companies that have gone public via SPAC including Lucid Motors and Nikola. Yet, Polestar differentiates itself from such EV manufactures by highlighting its low-capital requirements. Its production lines being backed by Volvo and Geely provides the company with a significant competitive advantage – the firm does not have to invest in capital to build a plant, instead focusing on investing in research and development of new technologies.

SPACs

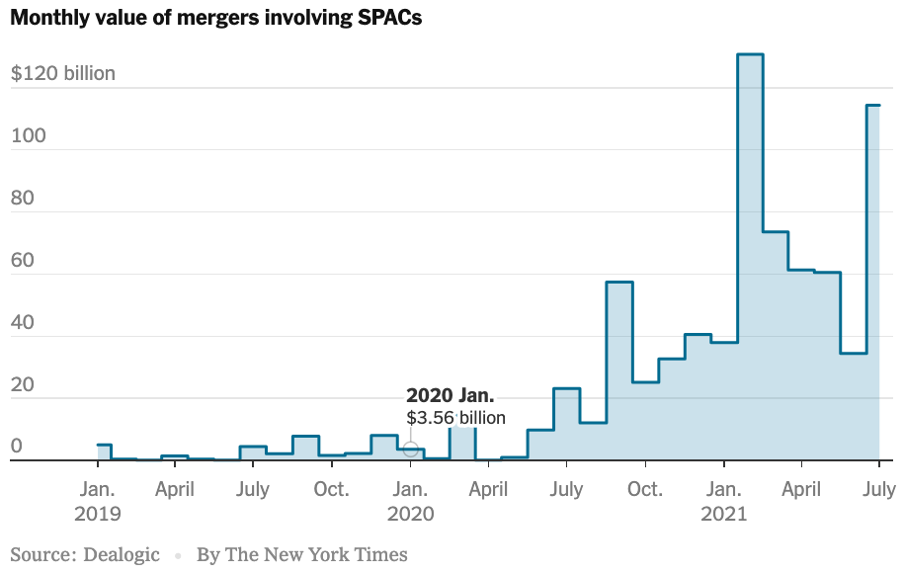

In terms of SPACs. The frenzy in SPAC deals seen in the first quarter of the year has slowed down significantly over the summer after investors were turned away by the poor financial performance of many SPACs as well as the increasing regulatory scrutiny by the SEC over their disclosures. Furthermore, in January, SPAC shares had rallied 28% on average on the first day of trading – such stock price bumps have also disappeared. SPACs are becoming increasingly unattractive amongst retail investors as returns are badly underperforming as well as the significant asymmetry of information present between early SPAC investors and said retail investors.

EV Industry

The global Electric Vehicle (EV) market size is projected to grow from 4,093 thousand units in 2021 to 34,756 thousand units by 2030, at a CAGR of 26.8%. Factors such as growing demand for low emission commuting and governments supporting long-range, zero-emission vehicles through subsidies and tax rebates have compelled the manufacturers to provide electric vehicles around the world. This has led to a growing demand for EVs in the market.

Increasing number and value of investments by governments across the globe aimed at developing EV charging stations and hydrogen fueling stations. In addition, there are also incentives offered to buyers that will create opportunities for OEMs (original equipment manufacturer, an organization that makes devices from parts bought from other organizations) to expand their revenue stream and geographical presence. The market in the Asia Pacific is projected to experience steady growth owing to the high demand for more cost-efficient and low-emission vehicles, while the North American and European markets are growing fast due to the government. However, the low presence of EV charging points and hydrogen fuel stations, higher costs involved in initial investments, and performance constraints could hamper the growth of the global electric vehicle market.

The Electric Vehicle Market is dominated by established players such as Tesla (14.55%), VW group (12.52%), GM (8.55%), Stellantis (6.45%), BMW group (5.79%) and BYD (5.75%). The market ranking has been derived by considering a certain percentage of the segmental revenue for each of the companies mentioned above. These companies also offer extensive products and solutions for the automotive industry. They have strong distribution networks at the global level and invest heavily in R&D.

More than ten of the largest OEMs worldwide have declared electrification targets for 2030 and beyond. Some OEMs plan to reconfigure their product lines to produce only electric vehicles. Volvo and Ford (in Europe) will only sell electric cars from 2030 while General Motors plans to offer only electric LDVs by 2035. Volkswagen aims by 2030 for 70% electric car sales in Europe, and 50% in China and the United States similar to Stellantis that aims for 70% electric cars sales in Europe and 35% in the United States.

Deal Rationale

As mentioned, by merging with a company backed by billionaire Alec Gores and investment bank Guggenheim Partners, Polestar says it will have an enterprise value of $20bn. The deal will also net Polestar $800m from the SPAC and $250m in cash from private investment in public equity (PIPE) financing anchored by top-tier institutional investors, the company says.

Those other investors include Volvo Car Group and affiliates of Geely Chairman Eric Li, and actor Leonardo DiCaprio, among others. It is the biggest blank-check merger in the EV sector since Lucid Motors struck a $24bn deal in February.

The company was spun out of Volvo in 2016 as its performance sub-brand but has since recast itself as an EV-only marque. Polestar is jointly owned by Volvo and the automaker’s Chinese parent company, Geely. The reason behind the deal was not the usual aim to raise capital, but that Polestar has very ambitious short-term plans. Polestar intends to boost its lineup by three new models in the next two years, one of which will be an SUV, and expand into a large number of countries. These plans, including expected sales of just under 300,000 units by the middle of the decade, will still require some money even with extensive platform sharing among Geely-backed brands, as will rolling out a store network that is still just in its infancy. That’s because Polestar intends to sell and service its models in standalone locations, rather than being tucked away in existing Volvo showrooms. Polestar’s SPAC move also points to the brand’s growing needs in the coming years, aimed to support that growing lineup, plans that will also involve a network of Spaces, similar to Tesla stores and other EV makers’ standalone locations for sales and service.

Deal Structure

The deal will generate more than $1bn in cash proceeds for Polestar, including $800m from the special purpose vehicle (SPAC) and $250m of PIPE, or private equity investment, from institutional investors. Polestar’s current shareholders, who will distribute their entire stake in the combined company, will retain approximately 94% of the shares, it said. Once the deal is completed, Polestar will trade on the Nasdaq under the ticker symbol PSNY.

Gores Guggenheim is backed by Gores Group and Guggenheim Capital affiliates and is directed by Chairman Alec Gores and Mark Stone as CEO. It raised $800m in an IPO in March and intends to complete the Polestar acquisition in the first half of next year. As of September 27th, shares of the Gores Guggenheim SPAC had risen as high as 5.7 % to $10.5. However, the deal with Polestar is not the first time Gores entered into a SPAC agreement – in 2020 the company was involved with automotive lidar producer Luminar Technologies Inc.

Through the transaction, Polestar will join other EV producers like Tesla (TSLA.O) and Lucid Motors (LCID.O), already present on the public market. Polestar’s proposal to go public comes as manufacturers turn their attention to environmentally friendly automobiles in response to mounting pressure from politicians and investors worried about climate change. The Swedish carmaker has functioning vehicles on the market and access to a well-established carmaker’s production network, unlike other auto startups that have launched via SPAC deals (e.g., Lucid Motors).

Future of SPACs

Turning to SPACs, which have grown so popular that celebrities including music singer Jennifer Lopez and basketball icon Shaquille O’Neal have marketed them outside of Wall Street. However, they appear to have lost their taint in the last year or two. According to market tracker SPACInsider, more than 600 SPACs have gone public since last July, when the SPAC public-offering market exploded, raising more than $200bn.

The big names, celebrity power, and seemingly easy money that made SPACs so popular last year only gave the agreements a false sense of longevity. SPAC demand has recently resurfaced, prompting concerns about their long-term viability. And because an IPO is just the first stage in the life of a SPAC, hundreds of blank check firms are still pursuing merger targets.

In July alone, SPAC mergers worth more than $100bn were announced making it the second-largest month on record in US dollars. According to SPACInsider, 439 SPAC are still pursuing merger targets, with more than $130bn in the bank and the ability to add external investments at the time of a transaction.

Source: Dealogic, The New York Times

Two-thirds of the SPACs that went public in 2021, most of which have yet to identify a merger target, are trading below their offering price, according to research by Renaissance Capital. This increases the risk that early-stage investors will redeem their shares at the IPO price and withdraw their money (with interest) after the merger is announced but before the merger is complete.

Rising redemptions leave a SPAC’s merger partner with less cash than planned. To make up for the shortfall, SPAC sponsors may try to raise additional outside money or lower the price of transactions to make them more appealing to investors. Despite this, SPAC dealmakers are convinced that the market will sort out its current problems.

However, the most recent set of SPAC sponsors may soon discover that there are more of them than there are compelling firms to combine with. Given the two-year time limit for closing a deal, by late 2022, many sponsors may be returning the money they raised to their investors.

0 Comments