China’s current economic downturn

Over the past decades, China’s economic trajectory has signaled its resilience and strategic prowess. It went from farming to manufacturing and became a leader in technology and infrastructure. Symbols of modern progress were quickly incorporated into the cityscapes’ once-grand historical settings. However, the recent economic indicators hint at a potential shift in this narrative. China was expected to lead the world’s economic recovery after the pandemic. But the unfolding reality has been a mix of unexpected challenges and introspection.

Both the global financial crisis of 2008–2009 and a potential capital outflow scare in 2015 raised concerns about the state of the economy. China restored confidence at that time, among other things, by giving infrastructure investment a startling rise and promoting housing market speculation. However, the property bubble has burst and the infrastructure improvements have generated too much debt, creating hazards to the current state of the economy. China only has one other source of demand to experiment with: household spending, as debt-fueled investment in infrastructure and real estate has reached its peak and exports are falling in pace with the global economy. Since the pandemic, Chinese economic GDP growth has been driven by the housing market, which the lending activity operated by banks has supported. However, after the collapse of Chinese Housing market, there are widespread signs of slowdown emphasized by many economic indicators.

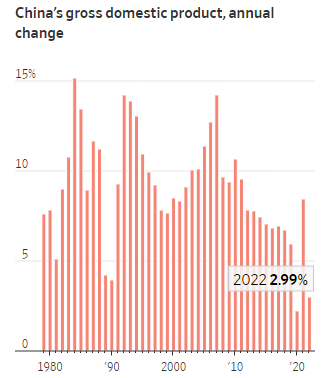

The industrial sector, the backbone of China’s economic might, showed signs of slowing momentum. Many people expected China’s industrial production to grow by 4.4%, but it only grew by 2.99% over the last year. This isn’t merely a statistical deviation; it reflects economic challenges even a powerful country such as China is not immune to. The International Monetary Fund (IMF) forecasts Chinese GPD to grow below 4% over the following years, while Capital Economics provided way more conservative expectations, expecting a 2% growth by 2030.

Figure 1. Source: World Bank

China’s younger generation most acutely feels the ripple effects of these challenges. The unsettling spike in youth unemployment, reaching a concerning 21.3% in June, is not just an immediate economic concern but also a reflection of potential long-term socio-economic shifts. This generation, which matured witnessing China’s meteoric rise on the global stage, now faces a landscape of evolving challenges and uncertainties. In response, the People’s Bank of China took a proactive step, significantly reducing the interest rates on one-year loans, passing from 3.55% to 3:45%. While this move underscores the government’s intent to stabilize the economy, it has been met with cautious scrutiny from both domestic and international observers. Most people think it’s better to be careful and that current policies might not be enough to solve the complex challenges China is currently facing. Data highlighting a 14-year low in bank loan value, coupled with emerging concerns of deflation and a contraction in exports, further amplifies these concerns.

The only certainty, at the moment, is that China’s choices and plans will affect its future and the world’s economy.

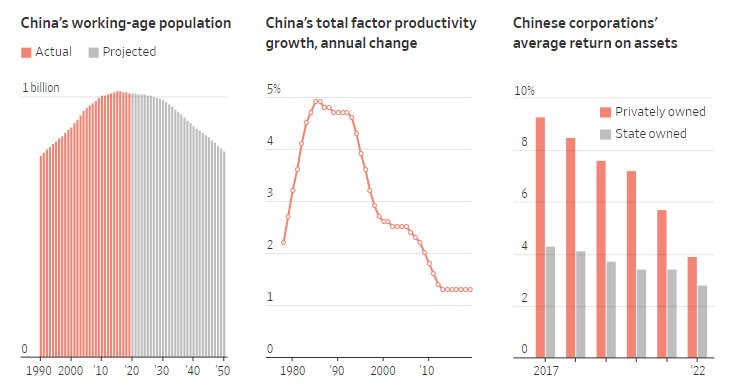

Figure 2. Source: The Lowy Institute based on UN population Division Data

The property crisis and the Three Red Lines policy

For decades, the blooming real estate sector fueled China’s economy, initially creating jobs and being used as a wealth storage for the Chinese middle class. A 2010 report from the Chinese government itself stated that home ownership rates in the country are nearly 90%, much higher than the world average of 63% and the U.S. average of 65%. Additionally, the report highlighted that 15% of Chinese people own more than one housing unit. Moreover, the real estate market largely benefitted local governments, which can generate revenue through two channels: land usage rights and property-related taxes. By selling land usage rights, the government still retains ownership of the land which is almost “rented out” to the buyers who benefit from its usage. Thus, with a surge of land prices all over the country and, consequently, great growth in the property sector, local governments were able to sustain their public spending. Property-related taxes created revenue which accounted for about 19% of the total local General Public Budget Revenue in 2021, while land sale revenue relative to total government revenue increased from 20% in 2021 (CN¥2.7tn) to 30% in 2021 (CN¥8.7tn). The two revenue streams combined accounted for 37% of total fiscal revenue for all local governments in China in 2021.

However, the property sector, which heavily contributed to China’s growth targets, expanded through massive amounts of debt, which quickly surpassed the value of the related projects. Thus, all parties relied on the implicit agreement that that property prices would continue to rise long term, allowing them to exploit leverage. As long as population was growing, and, with it, urbanization and business productivity, real estate prices would be rising as expected. Due to the assumption of ever-rising property prices, businesses would buy more land that they operationally required, effectively speculating on future prices with foresight. Over time real estate purchasing slowly switched from largely driven by fundamentals to partly or even largely speculative.

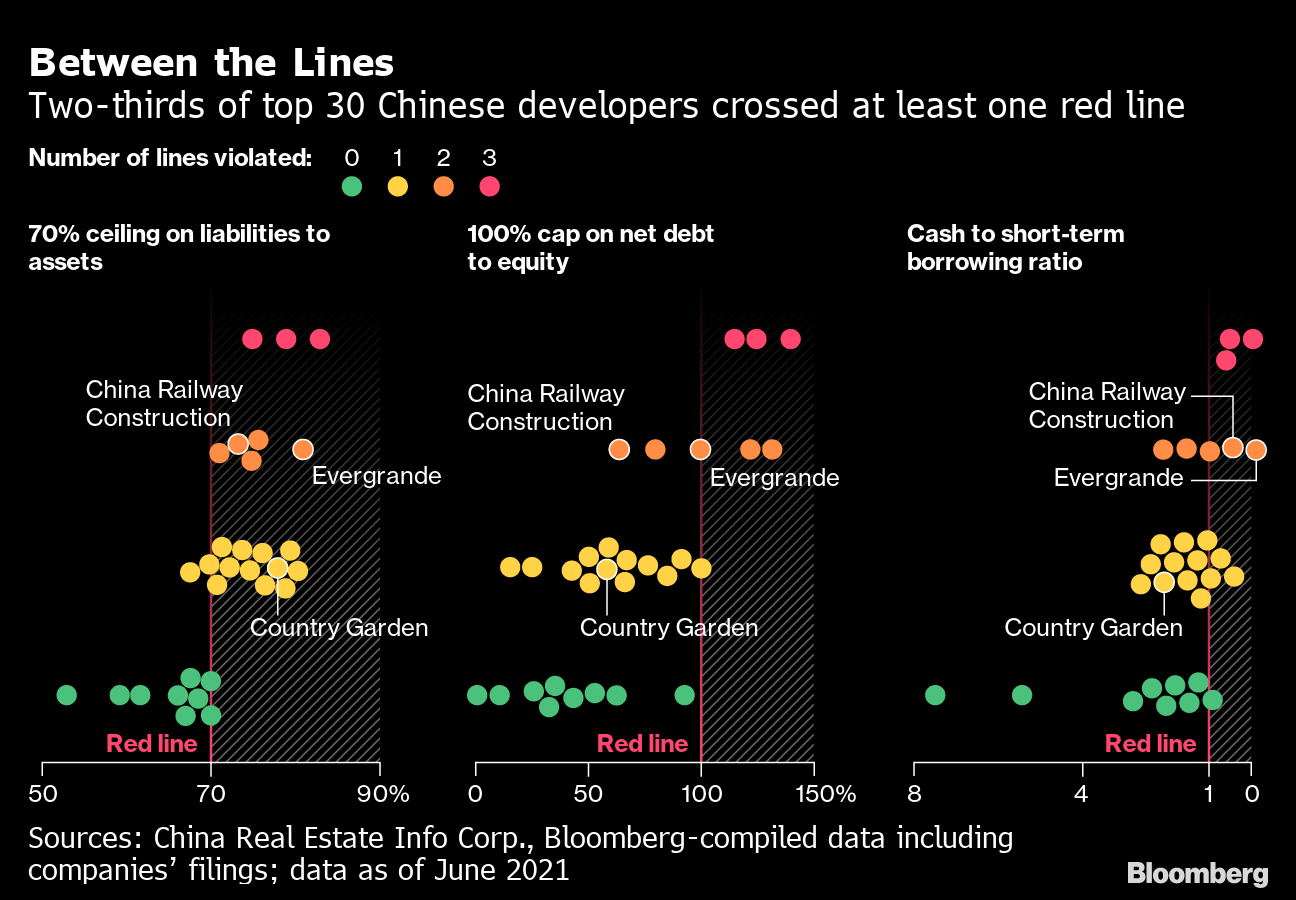

To avoid the formation of a housing bubble, the government actively implemented a policy aimed at limiting the growth of the sector by targeting risky practices in the industry. The Three Red Lines Policy was introduced in August of 2020, and it specifically aims at reducing the leverage of developers, improving debt coverage and increasing liquidity. To achieve specific objectives, large developers are assessed against three specific criteria. The first is a liability to asset ratio of less than 70%, to assess the risk of taking on potentially more debt; then, a net gearing ratio of less than 100%, calculated dividing total debt over total shareholders’ equity; finally, a cash to short-term debt ratio of at least one. If a company satisfies all the criteria, they can increase their debt up to 15%. In breach of one, two or all three, the percentage for debt growth can be 10%, 5% or 0% respectively. On the one hand, the policy proved to be successful, as 90% of the companies registered an improvement in their liability to asset ratio, 81% in their net gearing ratio, and 86% in their cash to short-term debt ratio. Developers had until mid 2023 to meet all criteria and they started by reducing the amounts of borrowings, scaling back on their land acquisition and disposing assets not related to their core development business.

Since then, China has introduced other measures to regulate the real estate market, such as the issuance of regulation to cap property loans so that housing price speculations could be controlled. Banks are divided into five categories and, with a grace period of 4 years to meet the requirements, they are subject to different caps on their loans depending on which one of the categories they fall into. Moreover, in July 2021, eight government departments announced another guideline for improving the order in the real estate market, specifically to eradicate irregularities in the sector, as they expected it would grow in the near future.

Figure 1. Source: Bloomberg

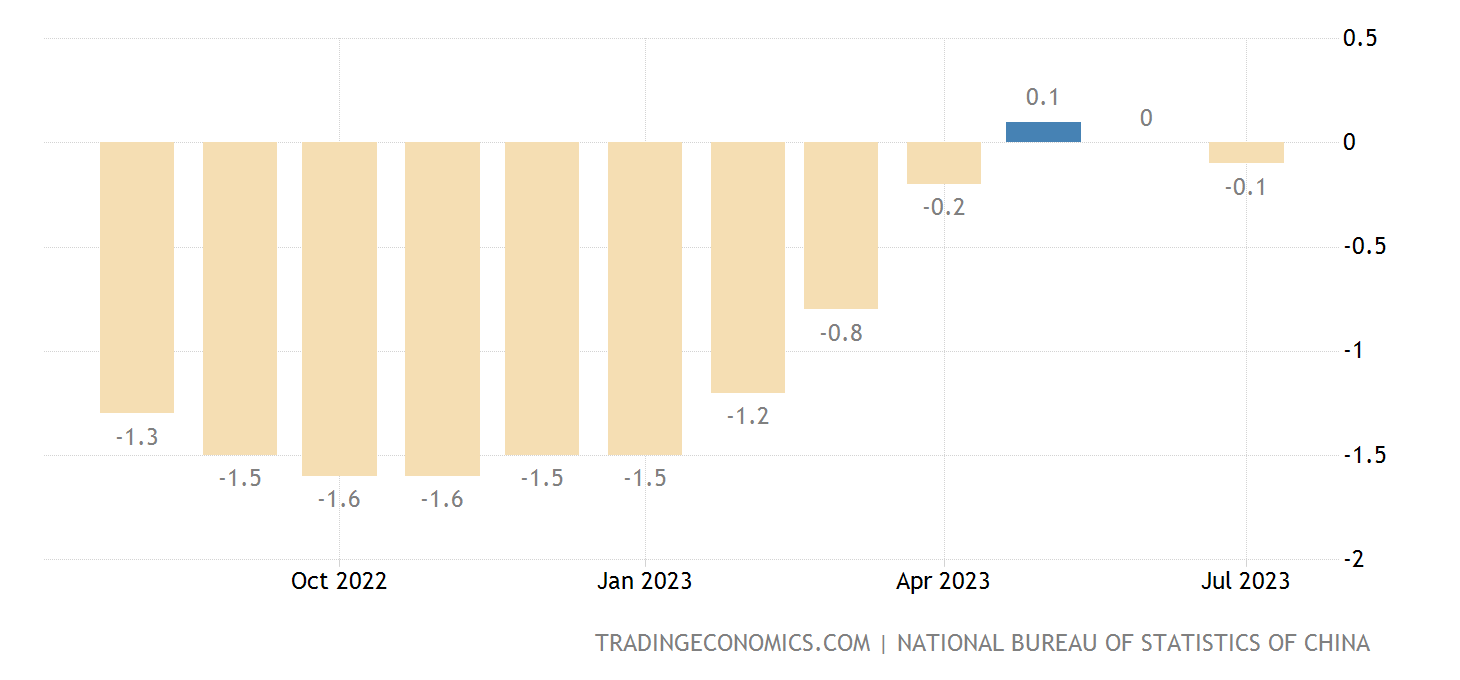

However, as the regulations were put in place and developers started complying, Covid 19 fully hit China and the slowdown that had started in 2019 continued all the way through the following years to the current situation. Average new home prices in China’s 70 major cities fell 0.1% year-on-year in July 2023, while on a monthly basis, new home prices dropped 0.2%.

China Newly Built House Prices YoY Change

Figure 2. Source: TRADINGECONOMICS.COM through the National Bureau of Statistics of China.

Despite all efforts, the Three Red Lines Policy resulted in a wave of defaults, as well as possible slump in the market.

Country Garden & Evergrande

One of the biggest defaults of this real estate crisis came when Evergrande [HKG: 3333], once China’s top developer, failed to meet a deadline for a $1.2bn interest payment to international investors in December of 2021. Evergrande [HKG: 3333], founded in 1996 in Guangzhou by businessman Hui Ka Yan, owns 1,300 pending projects in more than 280 cities across the country. Moreover, its business ranges from food and drink manufacturing to wealth management, to making electric cars. The company pursued an aggressive expansion to become the biggest company in China, collecting $328bn in debt.

As the Three Red Lines Policy was introduced, Evergrande [HKG: 3333] started to offer its properties at great discounts in order to keep business afloat but, months later, the company stated it could not guarantee “to perform its financial obligations”, thus leading rating agency Fitch to declare it in default. In the past two years, Evergrande [HKG: 3333] has been working with creditors to renegotiate its agreements, releasing a restructuring plan in March 2023. The plan proposes that bond investors in Evergrande [HKG: 3333] receive new notes with a 10 to 12 years maturity or a combination of new debt and instruments tied to either its shares, its EV division shares or its property service unit’s. However, the developer revealed a loss of $80bn over the last two years, as well as an additional $4.5bn in H1 2023, and eventually filed for Chapter 15 bankruptcy protection in a New York court mid-August 2023. By doing so, it will be able to protect its U.S. assets during the negotiations with its creditors. Moreover, a Hong Kong court approved the request to hold votes on the offshore debt restructuring plan in late August 2023, but the meetings were delayed until late September, as the company wanted creditors to evaluate the terms of the proposal as well as the resumption of trading of its stock on August 28. As a matter of facts, uncertainty about its future had caused Evergrande’s [HKG: 3333]stock price to plummet about 90% in 2021 and stock stopped trading in March 2022. On their first day back on the Honk Kong exchange, shares plummeted 80% and shrank the company’s market value to just about $600mn from a peak of more than $50bn in 2017, marking a 99% loss in market value. Activity in Evergrande’s [HKG: 3333] construction sites seems to be returning to normal, but the firm’s “severe cash shortage” might jeopardize the completion of its presold homes, worth about $83bn.

However, Evergrande [HKG: 3333] is not the only developer facing major issues with finding money. Chinese property giant Country Garden [HKG: 2007] warned that it might default on its debt after reporting a $7.6bn loss for H1 2023. The company was founded in 1992 by Yang Guoqiang and was China’s largest developer by contracted sales from 2017 to 2022. It focuses its operations on smaller cities, whose fast expansion came with the price of higher exposure to economic downturn and the housing slump. While Evergrande’s [HKG: 3333] debt surpasses $300bn, liabilities on Country Garden’s [HKG: 2007] balance sheet amount to $187bn. However, the latter currently has over 3000 pending projects, which is the reason why experts worry that its collapse might have a greater impact than Evergreen’s [HKG: 3333] default in 2021. By far, Country Garden [HKG: 2007] has managed to avoid default by extending some bond payments due in August and obtaining support from creditors.

Starting from the pandemic, China has pursued a firm “zero-covid” policy to fight the spread of the pandemic. However, this approach had many spillovers on the Chinese and global economy. Lower production capacity led to more melancholic industrial productions with the disruption of supply chains worldwide. More precisely, Europe has been widely affected by the change in productivity since the old continent imports approximately 44% of its needed raw materials from China. The increasing uncertainty in the Chinese country could lead to increasing uncertainty over companies’ supplies and production ability, especially for European companies dependent on Chinese furniture. This could thus indirectly affect dealmaking activity: if the Chinese economy slows down, also affecting European firms, it could make companies more cautious about pursuing M&A activities.

Also, the banking sector is experiencing a peculiar situation. The Commercial Bank of China (ICBC), the Bank of China (BOC), the Chinese Construction Bank (CCB), and the Agricultural Bank of China (ABC) recorded $164.8 bn in the first six months of 2023, recording an increase of 7.6% compared to the end of last year. The housing crisis is the primary driver of this phenomenon, and Construction sector related NPLs skyrocketed. Also, the Net Interest Margin (NIM) fell by an average of 1.7% over the past quarter for the leading banks in the country. During the year’s first half, ICBC, ABC, and CCB said their net interest income fell 3.89%, 3.3%, and 1.73% to 337 billion, 290.4 billion and 312.2 billion yuan, respectively.

This trend could damage the banking sector’s ability to fuel the company, and the tech sector – one of the most fast-growing, with great potential worldwide – may be heavily damaged and would require additional sources of funding at (1) a higher rate or (2) through alternative paths.

The concerns for western companies

Problems in China’s property market add to concerns about the world’s second largest economy. U.S. Deputy Treasury Secretary Wally Adeyemo expressed his worries about the structural economic issues, such as demographics and high debts, and on the impact the headwinds might have on neighboring countries or countries that have borrowed from China. U.S. Secretary of Treasury Janet Yellen said Washington was monitoring the situation in China, while President Joe Biden defined China as a “ticking time bomb”, referring to how internal economic and social tensions might affect the relationships between Beijing and the rest of the world. However, American tech giants can benefit from China’s current economic state. Indeed, with credit losses between 37% and 42% of GDP China will face its biggest clean-up operations and the tech industry is most at risk. This raises worries around its tech ambitious and questions the ability of Chinese tech giants to compete against US technology.

Meanwhile, President of EU Commission Ursula von der Leyen addressed the need to establish a coherent security, economic and trade policy toward China as she recognizes the dangers of dependency on Beijing. The risk is especially on raw materials such as lithium or cobalt, as Europe rushes to find sources to further develop its renewable energy market.

Tags: China, Real Estate, Property Crisis, Restructuring, Evergrande, Country Garden

0 Comments