Introduction

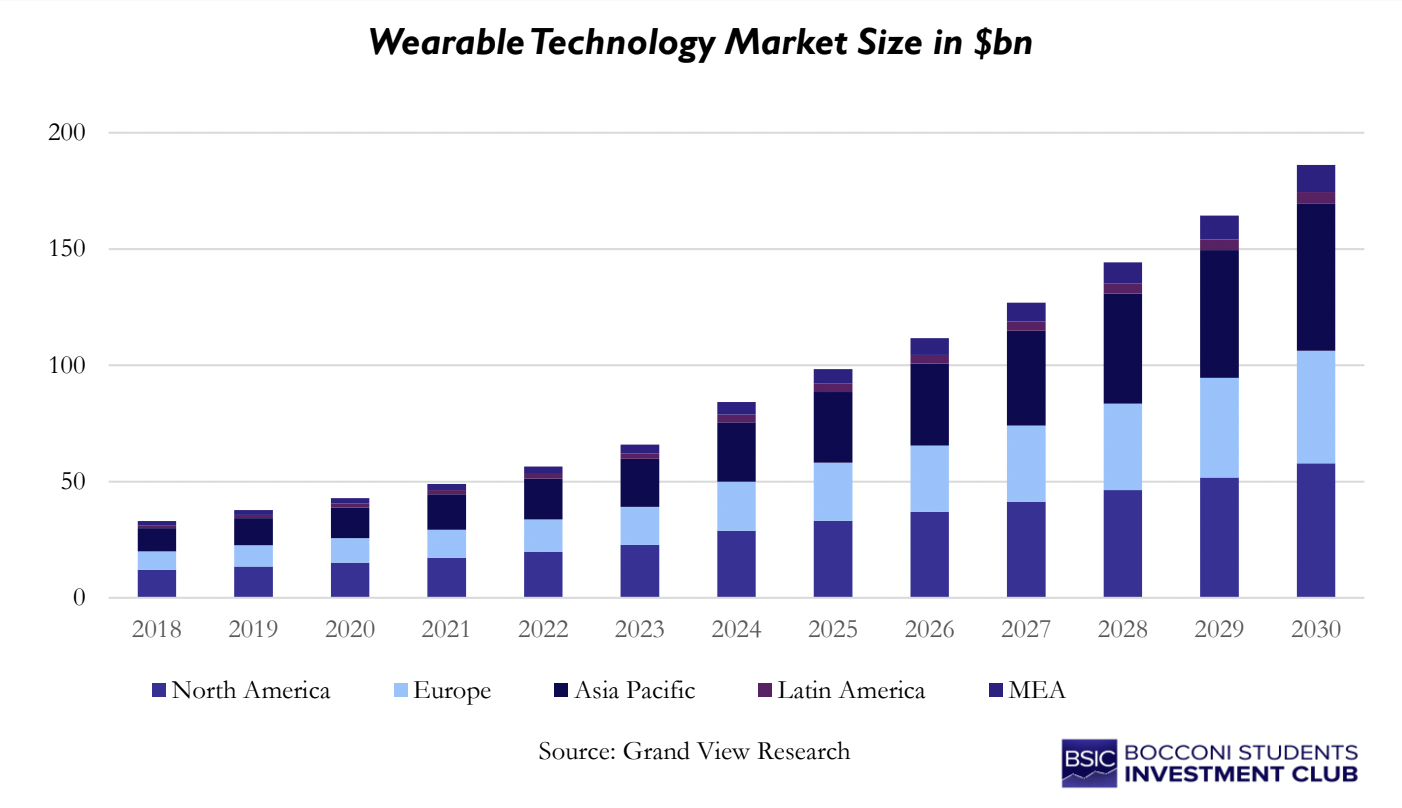

Over the past years wearable devices have moved from simple fitness trackers to essential tools to gain data related to health and lifestyle. Driven by an increasing trend in health consciousness, platforms like Garmin and Strava have reached tens of millions of monthly users, while new devices, such as Whoop and Oura rings, are gaining market share in the wellness tracking. Big tech companies are still dominating and investing within certain segments, despite showing divergent strategies between each other. With upcoming IPOs in 2026, the wearables sector is becoming increasingly active, expected to reach almost $200bn in 2026, according to Grand View Research.

The running boom: Garmin and Strava

As noted by Stock Sharks, Gen Z is swapping dating apps for running clubs and fitness communities in the search for alcohol-free ways to socialize and build meaningful connections. Downloads have jumped 80% year-over-year, and marathon registrations are breaking records globally (1.1 million applications in the 2026 London Marathon). Two main companies benefited from this trend: Garmin and Strava.

Garmin: from GPS Navigation to leader in sports wearables

Garmin Ltd. [NYSE: GRMN] is an American multinational technology company founded in Kansas in 1989, originally under the name ProNav. Later renamed Garmin, a portmanteau of its two founders Gary Burrell and Min H. Kao, the company initially built its reputation in GPS navigation for the U.S. Army before expanding into marine, aviation and automotive sectors. Over the last three decades the company has repositioned itself as a leader in connected health technologies and wearables, with record full-year revenue of $6.3bn in 2024 and operates across five business segments: fitness (28%), outdoor (31%), aviation (14%), marine (17%) and automotive OEM (original equipment manufacturer) (10%). On December 8, 2000, Garmin began public trading on NASDAQ at a price of $14 per share, but twenty-one years later the company transferred its listing to the New York Stock Exchange, in one of the biggest stock listing transfers in recent history. The move reflected the company’s evolution into a diversified technology group operating across multiple business segments, as explained by the group CEO Cliff Pemble.

Garmin’s core business remains hardware driven (Forerunner, Fenix, Venu, Vivomove Hybrid, Lily, Vivofit Jr. and Descent smartwatches), with an extremely diversified portfolio of devices across multiple price segment ensuring sensor accuracy, battery longevity and multi-sport specialization. The watches are not classified as medical instruments but are designed to capture a broad range of biometric and performance data (heart rate, VO₂ max, sleep quality, stress levels, incident detection), positioning Garmin within the ecosystem of preventive and digital wellness. These same features now underpin its move toward remote patient monitoring (RPM) and clinical-trial applications. Remarkably, Garmin has partnered with ActiGraph to integrate its wearables into the CentrePoint platform for long-term monitoring in clinical trials and recently collaborated with both Harvard University and the University of Oxford on the “Health and Happiness” study, showing a strong association between physical activity, rest and emotional wellbeing.

Garmin continues to leverage its technical roots to sustain a competitive advantage in both performance and precision. In 2024 it invested $994m in R&D across 39 facilities worldwide. Its focus on satellite connectivity through inReach devices (the first personal satellite communicator on the market), combined with solar charging and adaptive training algorithms, reinforces Garmin’s positioning as a provider of integrated performance and safety technology, rather than merely a smartwatch manufacturer. At the same time, the company is expanding its software and subscription-based services, primarily through the Garmin Connect ecosystem that enables users to sync, visualize, and analyze their health and performance data. With more than 300 million products shipped since its foundation (18 million in 2024), and 89 locations across 35 countries, Garmin’s evolution from a GPS manufacturer to a data-driven health technology company reflects the broader industry tendency of convergence between wearables, analytics, and medical research.

Strava upcoming IPO underscores the fitness revolution

Strava was launched in 2009 as a GPS-based activity tracker, initially focusing on running and cycling and later expanding to a broad range of sports. Users can record their workouts using either smartphones or wearable GPS devices, upload the data and share it with the Strava network. The app emphasizes a strong social component: the athletes can follow each other, give recognition (the so-called “kudos”), join clubs, and compare performance against peers. Its business model follows a freemium approach, with basic tracking and sharing being free, while premium features, including detailed analytics, advanced challenges, and training plans, requiring a subscription. The subscriptions segment (Strava Premium) accounted for more than $180m by September 2025, costing $11.99 a month or $79.99 per year, but it’s not the only stream of revenue. On one hand, the San Francisco-based app runs sponsored segments, branded challenges, and partnerships with sportswear brands and events, turning the platform into a valuable marketing and engagement channel. On the other hand, the company is expanding into corporate wellness, athlete tracking services, and licensing parts of its data or platform for third-party programmes, positioning itself as a B2B partner in the health-tech industry.

In April 2025, Strava announced it would acquire Runna, a UK-based running-training app founded in 2021 offering personalized coaching plans. The rationale is to complement Strava’s core community-tracking strengths by adding a deeper training-plan feature and personalisation capability, thus enhancing the value for users and strengthening the monetization path via premium services. The deal can be seen as part of a whole strategy of acquiring rivals to add features to its app, with the final aim of building a “verticalized fitness ecosystem”.

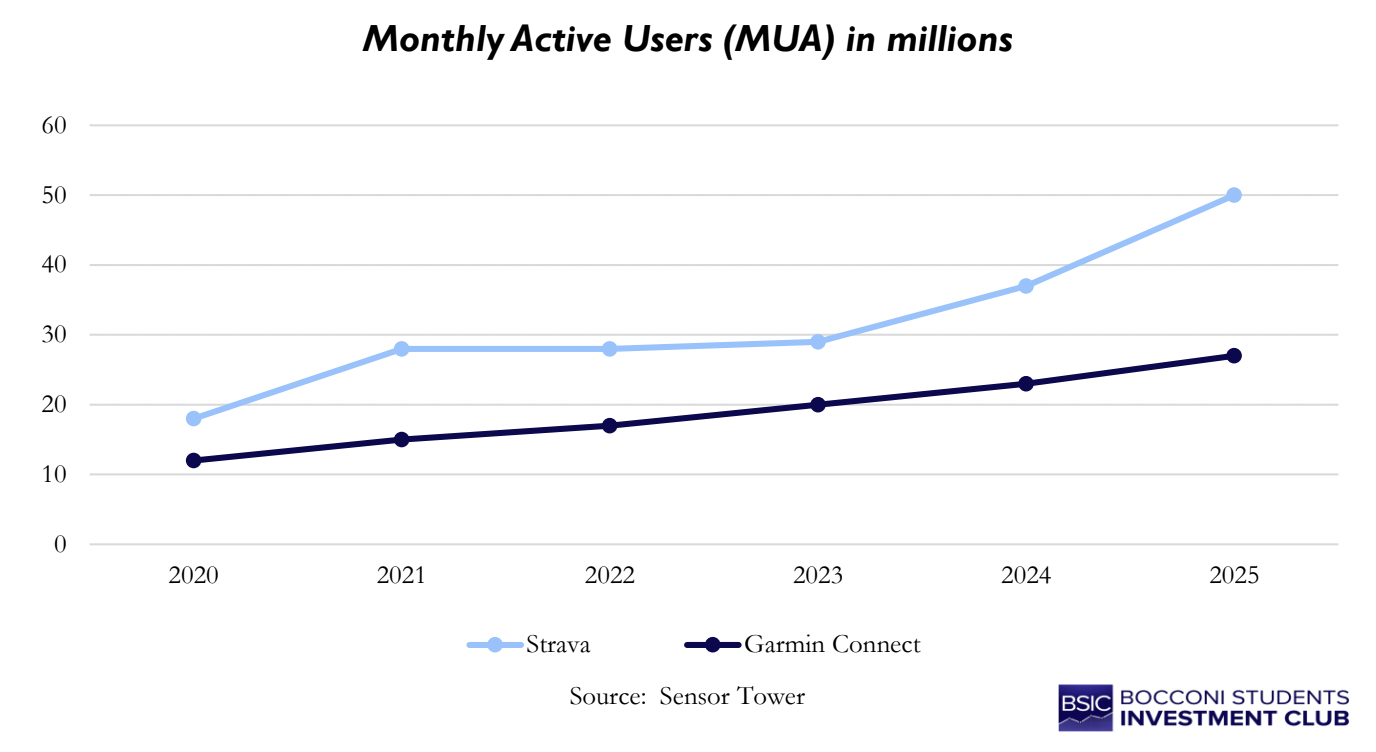

Strava chief executive Michael Martin believes that a listing provides easy access to capital in case they want to do more and bigger acquisitions, with the company reportedly preparing for a US IPO as early as 2026. Its last valuation hit $2.2bn in May 2025 and the numbers tell a remarkable growth story. Strava’s user base has exploded to 50 million monthly active users in 2025, according to Sensor Tower data, nearly double its closest competitor. As of 2025, Strava counts more than 150 million registered users across 185 countries, with nearly 1 billion runs recorded in 2024, underscoring its dominance as the world’s largest fitness-tracking community. Downloads surged 80% year-over-year, positioning the app at the center of what industry analysts are calling the “fitness social revolution” (particularly in Gen Z customers), as people increasingly pursue healthier lifestyles.

Wellness tracking – Whoop, Oura rings and Samsung rings

As the general population has become more health-conscious following the Covid-19 pandemic, the demand for devices that accurately measure key physiological data and turn it into actionable insights has grown dramatically. This has led to a rise in health-focused wearables and accompanying wellness apps from the likes of Whoop, Oura, and Samsung [KRX: 005930].

Whoop

Whoop is a personalized 24/7 digital fitness and health coach, providing key health metrics and insights that help people better understand their bodies and make meaningful lifestyle changes. The Whoop membership includes free hardware, and a platform designed to optimize behaviour. The strap captures over 100MB of biometric data every day, analysing key metrics like heart rate variability, resting heart rate, skin temperature, and blood oxygen saturation. These inputs then feed into three main pillars – Recovery, Strain, and Sleep – which help determine how well the body is reacting. The accompanying Whoop app helps provide an in-depth breakdown of this data and gives you actionable ways to improve your performance through suggestions like optimal sleep need calculations based on how much fatigue you’ve accumulated.

Whoop markets itself as a health and wellness-focused brand, intentionally distancing itself from smartwatches produced by big tech. The Whoop band has no screen, notifications, or entertainment apps, instead focusing exclusively on providing the most accurate health data possible.

The company initially charged customers a $500 fixed fee for their Whoop strap but pivoted in 2018 to a subscription-based model after noticing very low churn among early users. The hardware is included as part of the membership fee and customers are given complementary device upgrades and software improvements as the technology improves. The subscription-based pricing model is centred around three membership tiers – One, Peak, and Life – with Life offering the most advanced health analytics and access to a unique MG titanium band.

In addition to consumer memberships, Whoop operates Whoop Unite, a B2B arm serving the needs of professional sports teams, corporations, healthcare institutions, and government bodies. This platform provides dashboards that combine group recovery and strain data, enabling organizations to visualize in real time the performance of their teams.

Whoop has raised a total of over $400 million across nine funding rounds. In Whoop’s latest Series F funding round led by SoftBank Vision Fund 2, the company raised $200 million at a valuation of $3.6 billion. Notable backers of the company include IVP, Cavu Ventures and numerous high profile athletes including Kevin Durant, Patrick Mahomes, and Roy McIlroy. Recently, Whoop’s founder and CEO, Will Ahmed, has also floated the idea of a potential IPO within the next two years, stating that the company’s broadened portfolio of proprietary technology, hardware, software, and analytics make it well-positioned for an IPO.

Oura

Another key player in the wellness tracking space is the Finnish company Oura, most well-known for its Oura Ring. The minimalistic ring contains a number of key health-tracking sensors, tracking many of the same metrics as Whoop, including heart rate variability, resting heart rate, body temperature, and sleep performance. The accompanying Oura app helps translate this key data into personalized insights, identifying patterns in sleep, recovery, and circadian rhythm and providing a daily readiness score every morning.

Oura’s business model contains both a fixed upfront cost and a subscription-based fee. Consumers initially purchase the ring for between $329 and $549 depending on the finish and then pay a monthly Oura membership fee of $5.99. The subscription unlocks access to the full analytics suite, personalized recommendations, and historical trend data, while non-members only receive access to very limited daily scores. This helps reinforce the centrality of the recurring software revenue to Oura’s business model.

In addition, much like Whoop, Oura offers a B2B product called Oura for Business, which targets corporations, athletic teams, and healthcare partners. Some of the company’s clients include the U.S. Navy, U.S. Army, UFC, and Nascar.

Oura has raised a total of over $1.32 billion across twelve funding rounds. In the latest Series E funding round, Oura raised $875 million, valuing the company at $10.9 billion and more than doubling the valuation from the Series D funding round a year earlier.

Samsung

Another competitor in the wearables market is Samsung, with its Galaxy ring. Similar to Oura, the ring is a titanium smart ring that measures key biometric data, including heart rate, heart rate variability, blood oxygen, sleep levels, and skin temperature.

However, Samsung differentiates itself from competitors because it is able to leverage the strength and size of its existing tech ecosystem. Unlike the Oura Ring, which emphasizes detailed physiological insights within its proprietary app, the Galaxy Ring functions as an extension of Samsung’s existing health platform, Samsung Health, where wellness data across all Samsung devices is collected.

Moreover, the ring benefits from Samsung’s Galaxy AI platform, which helps provide personalized health summaries and habit coaching based on data collected from all Samsung devices. For example, the AI tool can cross-analyse sleep quality from the ring with activity patterns from a smartwatch or nutrition logs from Samsung Health. This enables the AI system to contextualize data rather than only presenting raw numbers and provide consumers with the most accurate health recommendations like when to sleep, hydrate, or adjust training intensity.

Samsung also differentiates itself from competitors with regards to pricing. Unlike Whoop and Oura, Samsung’s Galaxy Ring is not based on a subscription model. The device is bought outright for $399, which then gives access to all health-tracking features in the Samsung Health app at no additional cost. The device is merely another addition to Samsung’s wide portfolio of products.

Where the Big Tech players are positioning themselves

In the race for the Digital Health Integration, Big Tech players are rapidly shaping the industry by establishing themselves at the core of digital medicine. Companies such as Apple [NASDAQ: AAPL], Google [NASDAQ: GOOGL], and Meta [NASDAQ: META] are redefining the landscape of connected healthcare through wearable devices leveraging on artificial intelligence and interconnected ecosystems, while following distinct strategies though.

Apple’s Healthcare Ecosystem

Apple [NASDAQ: AAPL] entered the market in 2015, and since the launch of its first Apple Watch, it has reshaped the watches industry, influencing the entire segment – including the luxury players – and outselling the entire Swiss watch industry. Over the past decade, the company has sold around $127 billion worth of devices, establishing itself as a global leader in wearable technology. Its success is largely based on its ability to seamlessly integrate each product within the Apple ecosystem; the brand’s focus on advanced technology, design quality and interconnectivity has enabled it to command a premium pricing compared to competitors. At the same time, the expansion into health services has become an equally critical driver of growth.

The newly released Apple Watch Series 11 introduces several features that highlight this direction and the importance of AI in personalized health. The device now includes a Sleep Score, Hypertension Notifications and Vitals App, constantly monitoring the customers’ health. A further key application of Apple Watches technology is in the cardiology diagnostics: enabling the use of single-led ECG screening to check structural heart diseases, potentially marking a breakthrough in the industry and facilitating prevention on a larger scale.

Moreover, Apple is expected to launch its AI-powered Health+ service in 2026, integrating AI to deliver personalized coaching, nutrition tracking and health insights. Apple is among the first major tech companies to gain traction in the AI health chatbot space and this subscription-based health platform could provide users with tailored recommendations by merging Fitness+ and the Health app. However, Health+ could also cause a possible backlash for the company. In fact, consumers can be sceptical about premium paid services on previously free products and if they feel as if they were being forced into committing to the subscription, this could undermine customer loyalty. If Health+ erodes the current content to the point where they must switch to a new provider or purchase the service, the brand perception could be penalized in the long term. Nevertheless, Apple’s integration of medical functionality, privacy, and seamless interoperability across devices continues to set the standard for the sector.

Google’s revival of Fitbit through Artificial Intelligence

Google [NASDAQ: GOOGL] entered the market of consumer health hardware in 2021, with the acquisition of Fitbit for approximately $2.1 billion. The operation was aimed at combining the best hardware, software and AI capabilities in order to bring medical-grade insights to wearable devices, evolving from basic fitness trackers to advanced platforms for continuous health monitoring.

The latest product launches have positioned closer to its main competitor in the market, Apple. In fact, the new Google Pixel Watch 4 integrates certified medical technology, introducing comparable features, such as advanced ECG capabilities, skin temperature and pulse sensing. However, the main innovation is the ongoing Fitbit Hypertension Study, a clinical trial designed to validate the use of wearable sensors for continuous blood pressure detection, further strengthening Google’s push into preventive digital health.

Moreover, similar services to Apple’s Health+ are offered by the new Personal Health Coach available on the Fitbit app, built using Google’s Gemini AI. It acts like a fitness and sleep trainer, providing personal routines with weekly progression tailored to the user’s lifestyle and goals. This subscription is aimed at offering Premium users a specific solution, moving beyond generic health advice widely available online.

Furthermore, the company has recently announced a new pipeline of Fitbit devices coming out in 2026. These devices represent a slender and lightweight option, providing a cheaper and more convenient alternative to the do-it-all Google Pixel Watch 4. Their compact design makes them particularly suitable for continuous wear, including during sleep, reinforcing Fitbit’s focus on comfort and long-term health tracking.

Aside from hardware innovation, Google’s main concern remains on privacy: following scrutiny from EU authorities, the firm agreed to a ten-year moratorium on using Fitbit data for advertising. This decision shows the importance of users’ trust in healthcare adoption. However, profitability remains a challenge: Fitbit Premium subscriptions are growing, but Google must balance monetization with user accessibility to prevent erosion of its long-standing reputation for open access.

Meta: Pioneering the Next Interface with Smart Glasses

While Apple and Google compete for dominance on the smartwatch segment, Meta [NASDAQ: META] is focusing on a different frontier: eyewear. In 2021 the company established a partnership with EssilorLuxottica [BIT: ESLX], a key player in the sector, aimed at developing AI-enabled glasses combining fashion with advanced technological functionality.

Meta currently holds approximately 66% of the global smart glasses market, aggressively pursuing a long-term strategy aimed at creating tools that could replace smartphones. In fact, since the launch of the first Ray-Ban AI glasses, the capabilities of such devices have advanced exponentially. The latest model released in 2023 features real time translation and voice assistance, navigation cues and integrated sports metrics.

However, these devices do not only have consumer applications, but also growing potential in healthcare, serving as discreet hearing aids or providing forms of visual impairment correction. Such technologies could potentially become complementary tools to existing medical wearables, enhancing real-time patient monitoring and accessibility.

Meta is currently the winner of the smart glasses race, with its proprietary software and exclusive partnerships being the main sources of its competitive advantage. At the same time, the company has increasingly emphasized health-related innovations within its broader hardware strategy, signalling a stronger commitment to integrating medical functionality into future devices.

The company will have to gain users confidence while continuing the innovation trajectory, quickly adding new features that could allow it to differentiate it from an increasingly competitive landscape, but also to lay the foundations to become independent from major opponents, such as Apple or Google, to distribute its own apps. If successful, Meta could emerge as a pioneer in merging consumer wearables with professional healthcare environments.

Conclusions

The wearable device sector is growing strongly, and the mix of data, AI capabilities and technology has the potential to transform how people approach health and fitness. However, the sector faces headwinds coming from regulatory oversight, data manageability, and privacy concerns, all representing significant barriers to scalability. Moreover, long innovation cycles and high R&D intensity also weigh on the industry. Leading players will need to demonstrate tangible clinical impact to justify valuations and sustain long-term growth.

0 Comments