European Integration

As an introduction, we provide a brief overview of the pan-European regulation on which Financial Services is largely based and which helps explain the convergence and the subsequent attractiveness of the industry towards consolidation. Its objective is the further integration of European countries by the creation of a single market for services, in particular Financial Services.

Banking Union – is the first pillar in the system and it is finalized and fully functional at present. It has been progressively implemented by means of a number of European directives. CRD IV outlines the main provisions regarding the capital requirements of financial institutions and was inspired by the Basel regulations. Single Resolution Mechanism and Single Supervisory Mechanism outline the procedures for the resolution of failing credit institutions and entrust their supervision to the ECB.

Capital Markets Union revolves around three main arguments. First, the provision of common cross-border products that would be legitimate in every member state. Second, giving companies across Europe a chance to draw on sources of funding different from bank loans. Last but not least, creating efficient supervision of investment activities, which would bolster investor confidence, given the multiplicity of jurisdictions across the continent. Within this pillar of the European regulation, significant progress has been made with most of the regulation agreed on by the Member States and transposed in national legal systems. However, it is not yet completely finalized.

The relevant directives implemented at this level are the MiFID II covering all firms involved in providing investment and financial services to the public. UCITS V has effectively introduced the cross-border legitimacy of investment funds registered in at least one of the states of the European Union, while the AIFM directive determines rules that govern other alternative investment managers.

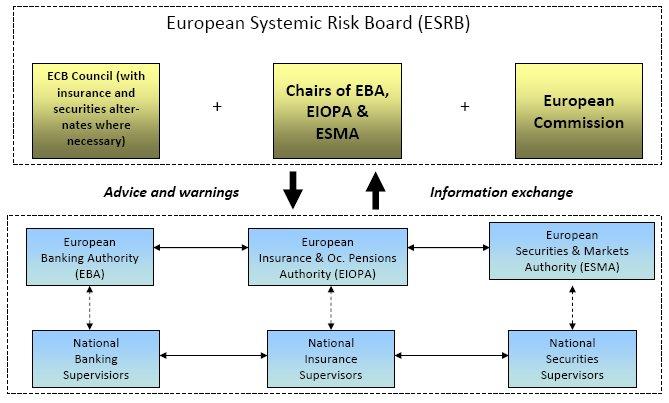

We cannot underestimate the role of European Supervisory Authorities in the financial stability of the Euro Area institutions. Together with the ECB and the European Commission they are part of the European Systemic Risk Board that takes crucial decisions and assesses on a continuous basis the state of affairs in the eurozone.

It is important to stress that these three ESAs (EBA, EIOPA and ESMA) are a so-called source of soft law, which is formulated by means of regularly published guidelines and Q&As. They are not binding per se (since ESAs are not strictly speaking European institutions), however non-compliance by European financial firms would require a formal justification. In addition, ESAs can be considered, to some extent, expert committees which provide technical inputs to the European Commission which later implements them as regulations at a supranational level.

Source: European System of Financial Supervision – ESMA

Historic Waves of Consolidation

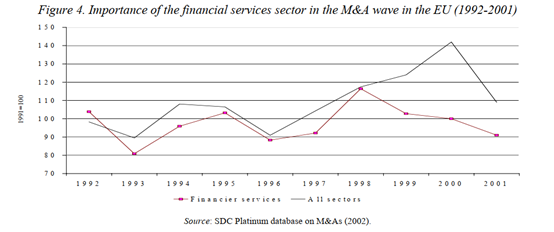

History often repeats itself. To have a better understanding of the driving forces behind the current wave of consolidation among Financial Services, historic waves of consolidation were studied to find similarities among rationales across the time. The three most recent rounds of consolidation in the financial sector in Europe happened between 1992 and 2000, 2003 and 2009, and from 2015 till now. From this pattern, it can be found that the M&A transaction activities rise and fall along with the recovery and downturn of the economy.

Looking back, the motives for M&As of financial institutions in the European countries can be divided into two categories: 1) firm-level reasons and 2) external reasons. Institutions were driven by optimizing service offerings and generating positive managerial and operational synergies to achieve a competitive edge and become a leader in the warmed-up market. Comparing the cut and dried intrinsic factors, external factors that include regional and national policies often played a more crucial role in stimulating the previous waves of consolidation. Let’s take the consolidation process in the 90s as an example. The period resulted in a decrease of 23% in the number of financial institutions in Europe. The phenomena can be greatly attributed to the financial liberalization and deregulation in the region, and the launch of the monetary union and the euro.

The first peak during this process was resulted by the implementation of the Second Banking Directive announced in 1989 which led to the completion of the Single Market in 1992 allowing institutions to increase their scale by engaging in cross-country and cross-industry operation. This act encouraged institutions to conduct inorganic expansion and adopt the universal banking model with both investment and commercial banking activities to gain a seat in the pan-European market.

The second peak followed the agreement of the Stability and Growth Pact in 1997 confirming the fiscal discipline of Euro and signaling its coming application. The M&A activity in the Financial Services in Europe rose by more than 47% between 2007 and 2000 as the single currency scheme in the region prompted financial systems across European countries to be integrated. However, the M&A activities in the Financial Services sector declined after the slowdown in economic growth in 2000, and another round of consolidation started in 2003 following the gradual recovery of the economy.

Source: SDC Platinum Database on M&As (2002)

Learning from the past, it can be seen pan-European regulations and policies cast a great influence on the M&A transactions within the financial sector.

Local Policy and Events

In addition to the supranational regulations affecting the whole of Europe and causing a series of consolidation across European countries, we also see the effect of regional policies on the regional concentration of M&A deals and capital markets movements in the financial sector.

One of our previous articles (Report on the Italian Banking System: NPL, Bad Bank, and M&A Wave) discussed how the Italian government’s reacted to the country’s NPL conundrum in 2015 by approving a bill to transform Italy’s midsized popolari banks into joint stock companies to strengthen capital.

Similar situations can be found in other European countries such as Germany and the UK. The issue of over-banking in Germany has been long argued. Within the single market, there are approximately 2400 banks with more than 45000 branches. The competitiveness within the German market can be seen from another set of data that 40% of the private client business is controlled by more than 300 saving banks. Overbanking carries a lot of risks that are detrimental to the practices within the industry. First of all, due to the fierce competition, underperforming banks will have more incentive to price aggressively and take greater risks on underwriting corporate and personal loans leading to potential subprime lending issues. Secondly, The over-saturation of banks leads to structural inefficiencies increasing operational expenses in the sector and resulting in high cost-to-income ratio and high leverage of banks. Last but the least, the low and negative interest rate environment worsens the scenario and adds more pressure on the profitability of banks. All of these reasons urge the government to encourage industry consolidation within the country. Thus, we were able to see the German government backing the collapsed potential merger between Deutsche Bank and Commerzbank in April 2019.

In 2019, the unknown Brexit impact influenced every aspect of the market including the equity capital markets in the financial sector. On account of the uncertainty of Brexit and its possible effect on the western European economy, the value of the European assets has plunged. For example, both sterling and UK equities traded at a big discount since the referendum in 2016. The cheap assets attracted value investors and activist shareholders. In the year 2019, the number of activist shareholders arose where investors took the chance to demand more equity shares to influence corporate behavior. For instance, Edward Bramson wielded a 5.05% equity stake in Barclays via his Sherborne Investors to demand board clearout.

Business Needs

As anticipated, the European financial industry is considerably fragmented. Research suggests a 0.36 correlation rate between the average cost to income ratio of financial institutions in certain countries and their degree of consolidation in the financial industry. In fact, the cost to income ratio is put under strain from increasingly lower interest rates and higher compliance costs in part characterising the industry’s M&A trends in the Euro Area that have been declining since the 2008 financial crisis. To foster our understanding of this issue it is essential to look at business needs, a main driver of consolidation.

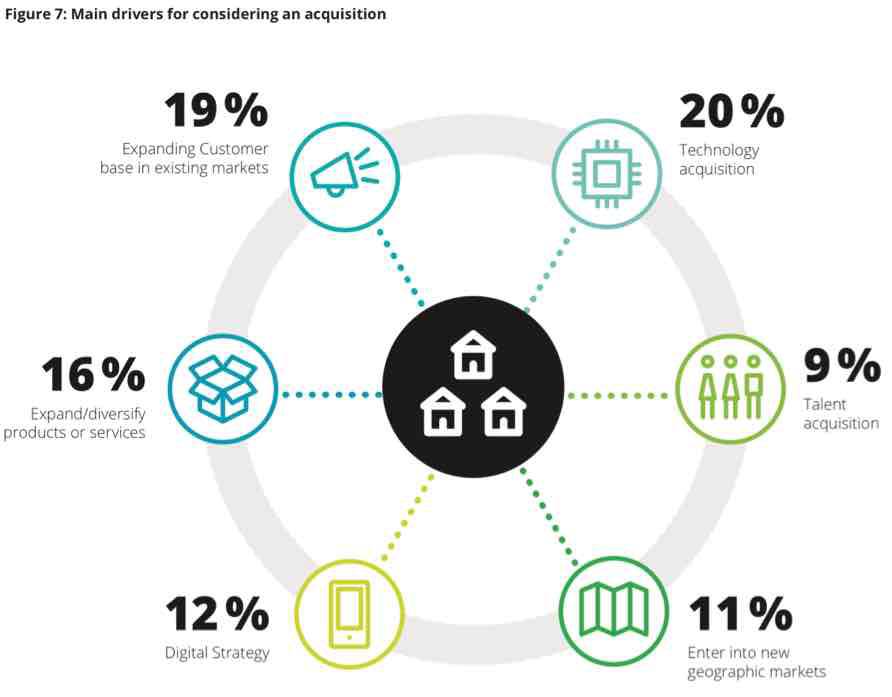

Below, the chart illustrates what is meant by “Business Needs” and the weight that each element takes. The most influential reasons for M&A transactions, which are all inter-connected, tend to be Technology, Expanding Customer base, and diversification of products.

Source: Deloitte

Technology

As the financial industry expands, the biggest cost-cutting instrument is technology, making it the most relevant M&A driver in this industry. Technologies take different forms, for example, from product distribution channels to investment algorithms. In addition, technology also contributes to expanding customer base and diversification of products as discussed later in the article.

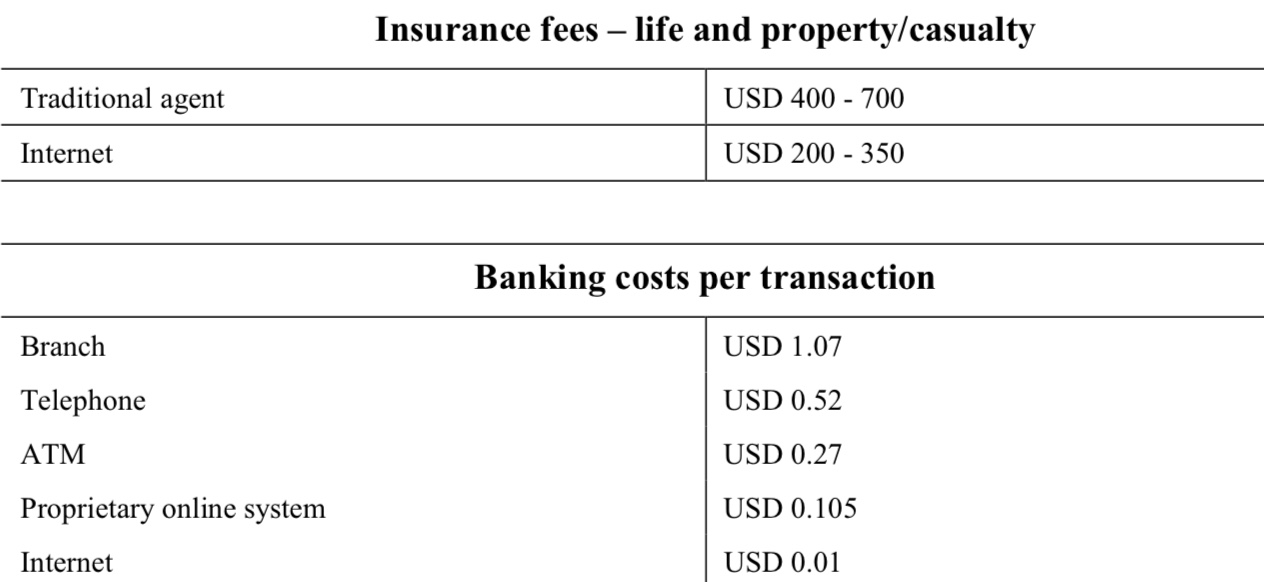

Source: Bank of International Settlements

The table above gives a sense of the weight of technology by displaying the costs faced by a typical bank for different products and through different channels. For example, the transaction cost for a typical bank is less than 1% through the internet than what it would be through a branch. The latter highlights the issue of over-concentration of branches, in particular in Italy and other countries where the industry is the most fragmented. Branches incur great costs which could be cut through technology and consolidation. In fact, technology is not only useful to the financial institution to cut costs, but it is also an attractive characteristic to acquirers.

Another important form of technology adopted also by other financial institutions such as Asset Management firms is the algorithms used to evaluate investments. These are highly used nowadays to reduce research costs and also to attract, for example, new investors.

The survey by Deloitte encouraged the view that during an acquisition, the lack of appropriate IT facilities is the main showstopper as this would create high costs for the acquirer. The importance of technology cannot be overstated. The same survey reports that a third of financial firms in Europe are expecting to acquire a Fintech firm in the next two years, and a half are willing to make a joint-venture with a Fintech firm over the same period. Hence, financial firm’s investment in technology is increasingly beneficial as it allows firms to become more efficient, and the industry to be more consolidated. However, technology development is a costly and lengthy process which firms with few resources are not willing to risk.

Expanding Customer Base

As technology helps cutting costs, expanding customer base could potentially create economies of scale, reducing costs further and potentially increasing income through increased monopoly power, helping to move towards the lower desired cost to income ratio.

The ECB has recently stated multiple times that a consolidated financial system would help the economy to grow, but most countries’ financial industries are made of small-medium size popolari banks or small asset management firms, with only a few big market players. Economies of scale can be created for example by sharing the distribution costs among more clients, however, studies by the Bank of International Settlements have shown that it is relevant mainly in small to medium-size financial institutions which are characterised by little market capitalisation and high inefficiencies. While for large banks or asset management firms, economies of scale is a small if not an insignificant incentive to consolidation.

Despite economies of scale, there are more motives to expand customer base. One is to allow the firm to increase the riskiness of its portfolio as it has more backup resources. While a second and increasingly more important one is data mining. Through technological advance, data is used more and more to create information useful to companies to become more efficient. For example, in tailored product offering, a bank retains data on habits of its clients to understand which investment, loan, or other product, might be the best according to the client’s degree of risk aversion, credit history, or expectations on return and at the same time be profitable for the bank. This data can be used in many other ways to increase profitability, but to generate more and more accurate raw data the company needs a larger consumer base and higher investment in technology. A recent example of transaction after data processing and technology was PayPal’s acquisition of Honey Technologies.

There are also reasons for a firm to avoid expanding its customer base too quickly. One of the most important is that when a rival big firm is acquired, the target’s clients may be from multiple jurisdictions, implying regulatory obstacles and stringent compliance rules.

Diversification of Products

As anticipated, only small to medium-size firms are motivated to consolidate by economies of scale, while bigger firms can be motivated by empire-building ambitions. To achieve this, firms aim to enter new markets by offering new products or offering their product to new geographical regions. A quick way to do this is to acquire a company which already has existing products or is already present in other geographical areas.

European financial institutions do not highly focus on this objective, but a very recent example of a transaction in the US with the objective to scale up is the acquisition of Legg Mason by rival Franklin Templeton for $6.5bn.

0 Comments