Introduction

The Consumer Healthcare sector has long been crucial for consumers to find quick solutions without heading to the doctors, covering over the counter (OTC) products such as supplements, medicines (painkillers), skincare, hygiene products, and more. With the rise of digital healthcare tools and prescription management, Consumer Healthcare providers play a vital role in expanding access and affordability to basic resources and education.

The largest players in this sector are Johnson & Johnson [NYSE: J&J] (Tylenol, Band-Aid, Listerine), Procter & Gamble [NYSE: PG] (Vicks, Pepto-Bismol), GSK [LSE: GSK] (Sensodyne), Bayer [DE: BAYN] (Aspirin) and Pfizer [NYSE: PFE] (Advil).

In January of 2005, P&G announced their acquisition to buy Gillette, a manufacturer of razor and shaving products, for $57bn. The merger created the largest consumer product company at the time and gave P&G more control over shelf space at retailers, grocers, and drug stores. The overall net earnings margin improved ~3% post-merger, largely benefiting from distribution, marketing, and other cost synergies in procurement and manufacturing.

Despite large acquisitions being a constant presence in the healthcare space, a recent trend has emerged for big pharma to separate out their consumer health arms. J&J, Pfizer, GSK, and Sanofi have all taken this step, looking to benefit from the significant sums generated in the divestment and focusing on their core biopharma and vaccine lines. The large pharmaceutical companies see their consumer sector as low growth, low margin, non-core, and off-patent. This does not mean the sector is fundamentally unprofitable—it has been suppressed from pursuing a more efficient business model and riding the wave of trends in digital therapeutics and home diagnostics. Pharmaceutical companies traditionally focused on R&D and regulatory engagement as its core, while consumer companies revolved around brands and marketing.

What is a spin-off?

Oftentimes corporations wish to own stock in other corporations, which could be done either through acquisitions or the creation of new entities by the parent. Separation from the parent corporation can happen for various reasons, most often due to the subsidiary operating in an unrelated business, and is done through spin-offs, split-offs and carve-outs.

In a spin-off, a new company is created from a subsidiary or a division of a parent company. Also referred to as a divestiture, this move allows the parent to issue new shares of the new entity to the parent’s existing shareholders. Importantly, shareholders do not give up or exchange any ownership in the parent; they instead receive shares of the spun-off company on a pro-rata basis. On the contrary, a corporate split-off supposes that shareholders of the parent exchange their shares for new shares of the created entity. While shareholders are not required to exchange their shares in a split-off event, they are eligible to do so or keep existing shares of the parent entity. However, it is important to note that a spin-off is not necessarily better for shareholders than a split-off because new shares are given to shareholders compared to exchanging. A spin-off is usually followed by a decline in the market value of the parent by the market value of the spun-off entity. Lastly, the parent may choose to do a carve-out, i.e. create a new corporation and offer its shares through an initial public offering (IPO). In a carve-out, existing shareholders are not eligible to exchange or given shares; the newly issued shares are available for anyone to purchase in an IPO event.

Looking into a spin-off in depth, this event is followed by distributing shares of the new entity to the parent’s existing shareholders on a pro-rata basis in the form of a special dividend. Parent usually receives no cash consideration, but the shareholders benefit from holding shares of two separate companies. Moreover, the parent may spin-off just a part of its subsidiary to its shareholders while retaining a minority interest in the new entity. Spin-offs have many advantages to key stakeholders of the action. First, spin-offs most often are tax-free events, meaning that both the parent and its shareholders can enjoy created value without tax deductions thanks to the pro-rata allocation. Second, spin-offs are comparatively simple for legal implications. As opposed to business unit sales or mergers, spin-offs do not require extensive negotiations with external buyers and aren’t met with antitrust scrutiny because the ownership is retained by an already existing shareholder base, leading to lower legal complexity. Third, a significant consequence of legal simplicity is the speed of execution. Due to the lack of negotiations, internal restructurings, legal filings and regulatory compliance steps in spin-offs, contrary to mergers and sales, the process is quicker and often has a predictable timeframe. Lastly, the separated entity can pursue a financing strategy independent of its parent. The parent often benefits from a reduction in its capital expenditure requirements, and the spun-off entity becomes valued on its own merits, frequently leading to better market valuations. Moreover, since a spin-off creates an opportunity for the parent to become more pure-play, and the new entity to be in its own specific sector, it can be a highly attractive way of unlocking sum-of-the-parts valuation (SOTP). For instance, a spun-off consumer healthcare division might be more attractive for investors looking for steady cash flow, while those looking for high-growth biotech opportunities might instead focus on the core parent pharmaceutical company. The created distinction between business lines through the separation of entities drives the market values up and unlocks shareholder value.

Johnson & Johnson x Kenvue

Johnson & Johnson (J&J), a leading multinational corporation specializing in pharmaceuticals, biotech, and medical technologies, was established in New Jersey in 1886. In 2023, J&J reported revenues of $85.2bn. The company maintains operations in two main sectors, Innovative Medicine and MedTech, and it spun off its consumer healthcare division, Kenvue [NYSE: KVUE], in 2023. Kenvue has become a key player in consumer healthcare, and offers a diverse range of products, including household names such as Band-Aid, Tylenol, Neutrogena, Listerine, Visine, and many others.

J&J’s decision to spin-off Kenvue was originally aimed at refocusing its business and streamlining its core operations by removing the consumer division. The medical arm of J&J displayed weak performance after competitors’ Covid-19 vaccinations were more successful, and the company decided to put more into developing medicines and medical devices by separating the lower-growth consumer unit. The company’s C-suite reflected that the “consumer division was getting lost within J&J”, which also limited the value of the parent’s pharmaceutical and medical device business lines. Kenvue offered just below 10% of the total stake in the company at $22 per share on May 4th, 2023, giving it an initial equity valuation of $41bn. The carve-out marked the biggest US IPO since 2021 at the time, with shares rising 22.3% to $26.90 on the day.

But J&J’s history is not spotless. In 2023, J&J faced litigation related to its talc-based baby power products, initially offered to pay $2bn in settlement fees. However, the healthcare corporation attempted a “Texas two-step” bankruptcy manoeuvre, thereby trying to create a subsidiary to offload the costs associated with its talc scandal and consequently filing for Chapter 11 bankruptcy. In this move, liabilities are absorbed by the new entity, and the parent company is isolated from direct litigation risks. However, in July 2024, federal appeals court dismissed J&J’s attempt, stating that it cannot use bankruptcy to resolve these claims without demonstrating financial distress. Critics argued that the Kenvue carve-out was another manoeuvre by J&J to shield valuable assets from talc litigation claims. By going public with Kenvue, J&J potentially limited the resources available to satisfy the talc-related fees. A new class-action suit was filed against J&J in May 2024, alleging that Kenvue was used to create an “additional, unlawful shield” against litigation.

Interestingly, J&J reduced its ownership of Kenvue not just through the IPO, but through multiple subsequent selloffs. Owning about 90% of Kenvue post-IPO, J&J initiated a further split-off in July 2023, offering its shareholders to exchange some of their holdings for Kenvue shares. As a result of this offer, J&J kept about a 9.5% stake in the consumer health entity. Fast-forward a year, and J&J announced that it will sell its remaining stake in the company, worth about $3.8bn. In this move, J&J used its equity in Kenvue as a form of payment to reduce its debt obligations with Goldman Sachs [NYSE: GS] and J.P. Morgan Securities [NYSE: JPM], transferring ownership to the banks. As of today, November 14th, 2024, Kenvue’s stock is down 12.68% since IPO, trading at $23.14 per share.

Looking at the value created through the separation of businesses, it is worth to look at the combined enterprise value (EV) pre-selloffs and the sum-of-the-parts value after the completion of J&J’s ownership reduction. According to FactSet, J&J was worth $485.6bn as a combined entity in December 2022. After completing the spin-off and retaining a minority stake, J&J’s enterprise value decreased to $388.3bn in December 2023. Kenvue’s enterprise value as of the same date was just $48.3bn, bringing the sum-of-the-parts EV to $436.6bn. While in theory J&J likely expected the spin-off to create value for shareholders, the realized value has decreased despite best efforts. This situation is peculiar with other items at play; most significant of which is the litigation process J&J has been facing for the past 2 years. While spin-offs do create value, J&J is still in damage control mode, which has likely led to an uncommon outcome for the valuation.

GSK / Pfizer x Haleon

In 2019, GSK and Pfizer agreed to create a joint venture to merge and strengthen their consumer healthcare divisions. GSK held a majority of 68% and Pfizer held minority of 32%. The new structure allowed combination of popular brands such as Sensodyne, Voltaren, Advil, and Centrum. This initiative lasted until 2022, where GSK officially spun off the joint venture into a standalone company, Haleon, which exclusive focused in consumer healthcare.

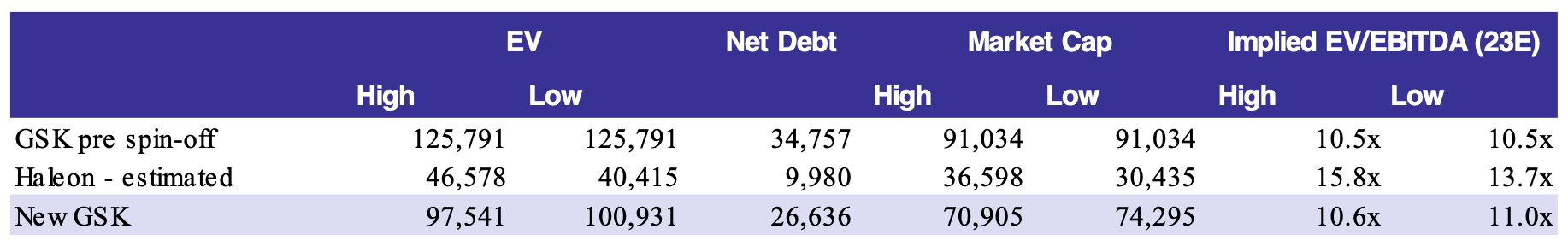

The Consumer Healthcare segment of GSK reported £9.6bn of turnover in 2021, a 4% decrease in revenue vs. forecasted growth of 4-6%. The spin-off was an effort from activist investors, questioning their ability to deliver a more productive drug pipeline. Through a spin-off, GSK was able to spend their proceeds in £7bn of dividend on R&D and potential acquisitions. Analysts also believed that by Haleon was able to unlock higher multiple valuation as a separate entity, seen through a SOTP analysis done by BNP Paribas in 2022.

Theoretical SOTP: (At time of spin-off, by BNP Paribas)

The market wasn’t fond of the spin-off initially. Haleon’s shares dropped 6.6% on its first day in 2022 with a market valuation of £30bn. There was also concerns over inflation as prices rises in consumer products and analysts were pessimistic about earnings growth. Others defended the stock, claiming the industry is “defensive at a time where volatility is upsetting markets”. The company also offered less exposure to commodity-related costs and environmental challenges.

Pfizer and GSK slowly sold off their stake. GSK disposed its entire stake in May 2024, helping it raise just under £4bn. Pfizer recently sold off $3.3bn in October 2024, reducing its stake from 22% to 15%. Haleon’s shares have outperformed GSK since the spin-off, up 15% while GSK has dropped 21% since the spin-off.

The company was able to reduce its net debt/EBITDA from 4x to 3x in the span of 2 years. As the only pure play consumer healthcare company, Haleon was positioned to outperform the sector given its streamlined focus on capital allocation, business structure & systems, and investments. By focusing its attention on marketing and gaining consumer trust, Haleon’s core portfolio brands such as Sensodyne was able to obtain 10% in global market share in oral care.

Sanofi x Opella

Despite a traditionally US focused view on Big Pharma, Europe is no stranger to these gigantic companies. With the advent of GLP-1 molecule drugs we have seen an increase in the market cap of companies like Novo Nordisk [NYSE: NVO] to join the $100bn+ valuation of European peers like Roche [SWX: ROG] and Novartis [SWX: NOVN]. Sanofi [EN: SAN] is a French pharmaceutical company headquartered in Paris with a market cap around €119bn, they operate across several sub verticals including prescription products, vaccines, generics and for now consumer health products. Halfway through the year, Sanofi started contemplating following in the footsteps of its US peers and distancing itself from its consumer health unit for several of the aforementioned reasons. At the time, in June, they weighed several options including a public listing valued at c. €20bn. The consumer health vertical of Sanofi accounted for ~10% of Revenue in the previous year through marquee products Doliprane (paracetamol) & Allegra (antihistamine) and would make this one of the largest European healthcare deals of the year.

In October, the situation evolved, and more information came to light on the “non-traditional” approach that Sanofi was taking relative to J&J and Pfizer – a partial sale to private equity instead of a full public listing. After collecting bids, the two main parties left standing were PAI Partners and Clayton, Dubilier & Rice (CD&R), the latter ultimately winning exclusive negotiation rights. This decision came as a bit of a surprise due to the extremely sensitive nature of the business with the French government as a key stakeholder that expressed concern regarding the future of the Parisian headquartered business. Thus, PAI investors had to swallow their pride and pony up a bid that was €200m more than their previous ones for Opella hoping that the social concerns that had arisen would help tip the scales. Despite this valiant effort, Sanofi denied PAI for the second time, leaving the French Government as the only obstacle for the US investor CD&R to finally get their hands on the asset. Industry minister Marc Ferraci even went as far as stating “Legally, we can oppose it” with reference to the deal, citing concerns for French interests including the domestic production of Doliprane.

The rumoured terms of the deal include a 50% stake being taken by CD&R in Opella with the remaining portion kept by CD&R with likely views of selling the position later. To align interests and mitigate some of the key concerns, Bpifrance is expected to take a small minority stake valued in the realm of 2%. The final deal value of Opella is expected to be a ~€16bn EV, approximately ~14x 2024E EBITDA and as the financing has been committed on the CD&R side, the deal is expected to close by Q2 2025.

Conclusion

Spin-offs like those by J&J, GSK, and Sanofi reflect the broader trend of separating low-growth, consumer-focused divisions from higher-growth, innovation-driven pharmaceutical and MedTech segments. Despite a track record of spin-off IPOs, Sanofi’s consideration of a private equity sale for its Opella division indicates an alternative route gaining traction. By partnering with firms like CD&R, companies can secure funding and operational expertise without the complexities of public listings. This trend, driven by unique market conditions and stakeholder pressures, shows private equity-backed partnerships becoming more appealing for unlocking value and addressing sensitive concerns. Despite several concerns being present when dealing with a big pharma giant that is central to a country’s economy, spin-off IPOs have been able to create shareholder value, and we believe that big pharma will continue to pursue these blockbuster transactions.

0 Comments