With the equity markets being arguably reluctant to consider the potential threats to global growth stemming from the Corona virus outbreak (COVID-19), the commodities market experienced quite large price movements over the past month. While we clearly acknowledge that commodity prices are more directly affected by an interim – expecting a recovery in the near term – fall on the demand side than company profits, which have the potential to recover in subsequent quarters, it seems like equity markets are not reflecting the potential non-linear effects stemming from the bottlenecks in the global supply chain. We thus wanted to give a broad overview about how the uncertainties around COVID-19 did have an effect on various commodities, by providing insights on the price action from agricultural to base metal commodities and then cover in more detail the price dynamics in Gold and Oil.

The impact of COVID-19 on commodities

With the epicentre of COVID-19 being in the world’s most dominant consumer of raw materials, the heavy strong price impact among various commodities is not surprising. Figure 1 shows the price performance of major commodities, with those most dependent on Chinese demand most affected. The only commodities with a positive performance since the COVID-19 outbreak are safe-haven assets, with gold covered in more detail further down this article, driven by risk-off dynamics and those affected by tight supply chains such as palladium and cocoa, which both will be covered below.

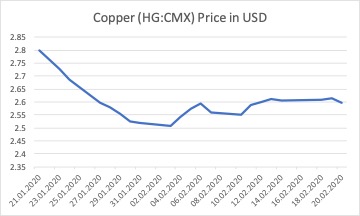

Copper is among the commodities that suffered the heaviest price declines. Since the outbreak of COVID-19, hedge funds opened large short positions in Copper. The short positions were not only driven by the weakened demand of the largest commodity buyer of the world, but also used by some as a hedge for long positions in risky asset classes, such as equities, to avoid missing out the seemingly never-ending bull market. The price recoveries in the middle of the month were thus also driven by short-covering as markets responded positively to China’s pledge to support the economy. However, this uptrend seemed to be short-lived, with copper prices slightly declining over the past days and moving horizontally due to the continued demand shock.

Source: Nasdaq. Data as of 21/02/2020

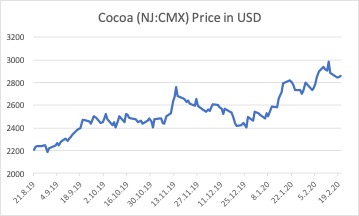

Cocoa has enjoyed a enjoyed a strong rally so far this year with lack of rain in key production areas of West Africa, the worlds top producer, raising concerns over yields. Combined with continued efforts of top producers Ivory Coast and Ghana to boost grower’s income, hedge funds now have a net-long positions in cocoa that are on a 6-year high. One week ago, there was also a 10% spike in Arabica coffee prices due to supply concerns in Brazil, the world’s biggest grower.

Source: Nasdaq. Date as of 21/02/2020

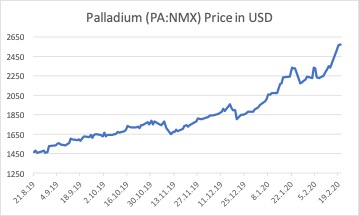

A precious metal which price movement is driven to a far lesser extent by macroeconomic uncertainties is Palladium. The price of Palladium surpassed Gold this past summer and is one of the most precious metals. Growing demand by car makers which need to use more palladium in catalysts to meet tighter emissions standards leads to a demand overhang. The premium paid for physical palladium and futures maturing in March rose to the highest level in 20 years past month. With the fall of the soviet union in the late 1990’s, restrictions on Russian exports lead to a similar demand overhang (driven by the supply side), however as shipments from Russia rose back to normal levels, the market normalized as well. This time the market shows a fundamental deficit and the shortage of palladium is growing, which urged the chairman of the London Platinum and Palladium Market, Mr. Metcalf to express his concerns over the proper functioning of the market.

Source: Nasdaq. Date as of 21/02/2020

Lastly, it may seem like US steel manufactures could benefit from the disruptions in the global supply chain. The US Philly Fed Survey released on Thursday surprised strongly to the upside, with the highest reading in 8 months. Steel prices reacted strongly positive, as shown in the price chart below.

In what follows we want to cover the price dynamics behind Gold and Oil a bit more detailed. The former, considered as a safe haven experiences high demand from investors in the prevailing times of uncertainty, while the price of the latter not only experienced shocks to the demand side lately, but is also affected from the supply side.

Overview of the Gold Market

Gold had a magnificent start to 2020, rallying over 8.5% and nearly tapping $1650 per troy ounce, the highest traded price level in 7 years. The shift of capital towards the, increasingly more, precious metal is the investors’ response to economic uncertainty.

The main factor playing a role in the large, sustained value increase of gold is undoubtedly the need for strategic portfolio hedging at a time in the business cycle when investors fear that an economic downturn may just be around the corner. Gold, as a physical commodity, has historically proven to be a successful store of value. The reason why gold has always been a safe haven asset, along with the rest of precious metals, is its ability to serve as an “insurance policy” for investment portfolios. The fact that the price of gold is only impacted by the powers of supply and demand has made it an asset, which is supposed to provide some diversification in a portfolio. This is exactly what makes gold appealing in 2020. Particularly, the continuous fiscal and monetary expansion in the EU and US along with important indicators like US manufacturing portray a picture illustrating that markets are reaching their peaks.

Aside from rising need for portfolio hedging, there are two other reasons that have impacted the price of gold fundamentally and have been aforementioned in the discussion of the other commodities: The coronavirus and geopolitical tensions, factors that feed into a rise in economic uncertainty.

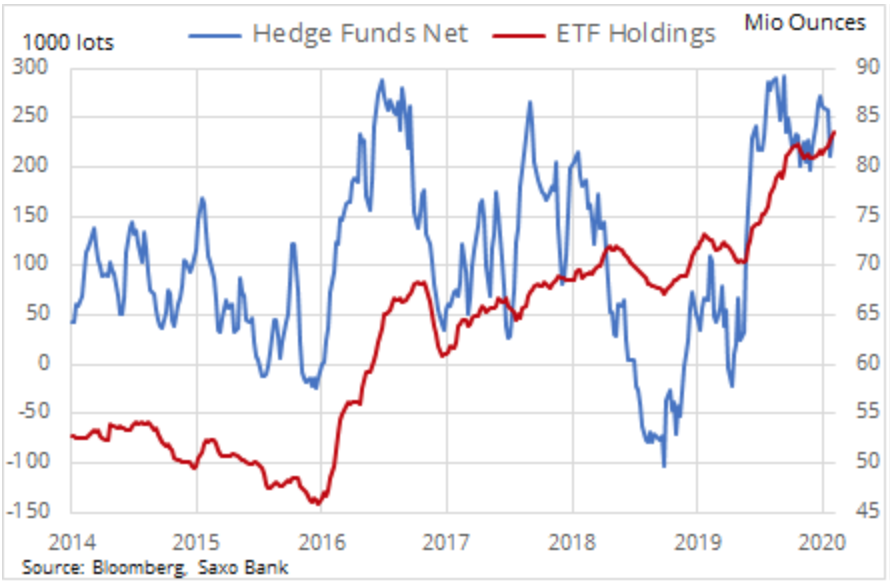

It should also be mentioned at this point that fear of missing out (FOMO) should also be considered as a valid factor of gold’s bullish momentum. After such parabolic moves retail investors are quick to jump in in order not to miss out on potential gains. Retail investors, however, are not the only ones who are still heavily investing at the highs. ETF holdings and many hedge funds keep adding to their long positions on gold futures. Hedge funds, in fact have been net long between 200,000 and 300,000 lots since October, 2019.

At this point, what should investors expect from this asset? This is always a difficult question to answer but specifically for gold, at this point in time, it is hard to imagine what could halt this rally. What contributes to the unpredictability regarding the future value of this asset is the fact that its parabolic move in 2020 happens at a time where the stock market is hitting all time highs and the dollar remains relatively strong.

Overview of the Oil Market

In recent months, the Middle-East has been the theatre of political tensions that heightened attention for oil prices from investors. On June 2019, two oil tankers were attacked in the Gulf of Oman, escalating frictions between the USA, Iran, Japan and European superpowers. Later, on January 3, Iranian military commander Qassem Soleimani was killed by a US air raid at Baghdad’s international airport. As a response, Iran attacked two military bases with US troops based in Iraq. These events increased the volatility in the market, that does not disappear in January. As a consequence of the coronavirus outbreak, future prices dropped by 16.17% and 12.42% for WTI and Brent respectively, driven by expectations of lower demand by China. The oversupply led the oil price structure to configure a contango, that is a situation where spot prices are lower than future prices. At the same time, fees for oil-carrying super tanker dropped by 75% to $23.000 a day. This led commodity trading houses to set up a simple arbitrage: buy oil spot and sell forward at a higher price while storing it in super tankers, bearing a cost of carry that was low enough to make a profit.

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

To reduce price pressures, OPEC+, the consortium composed by OPEC countries, Russia and other producers, committed to reducing oil production by 1.7m bpd in January, leading to the lowest OPEC output since 2009. In February, oil price performance has been benefitting from the cuts. Brent futures surged by 5.59%, while WTI by 1.53%. Nevertheless, the International Energy Agency expects demand to grow by 825,000 bpd in 2020, a quantity that corresponds to the slowest annual growth rate since 2011.

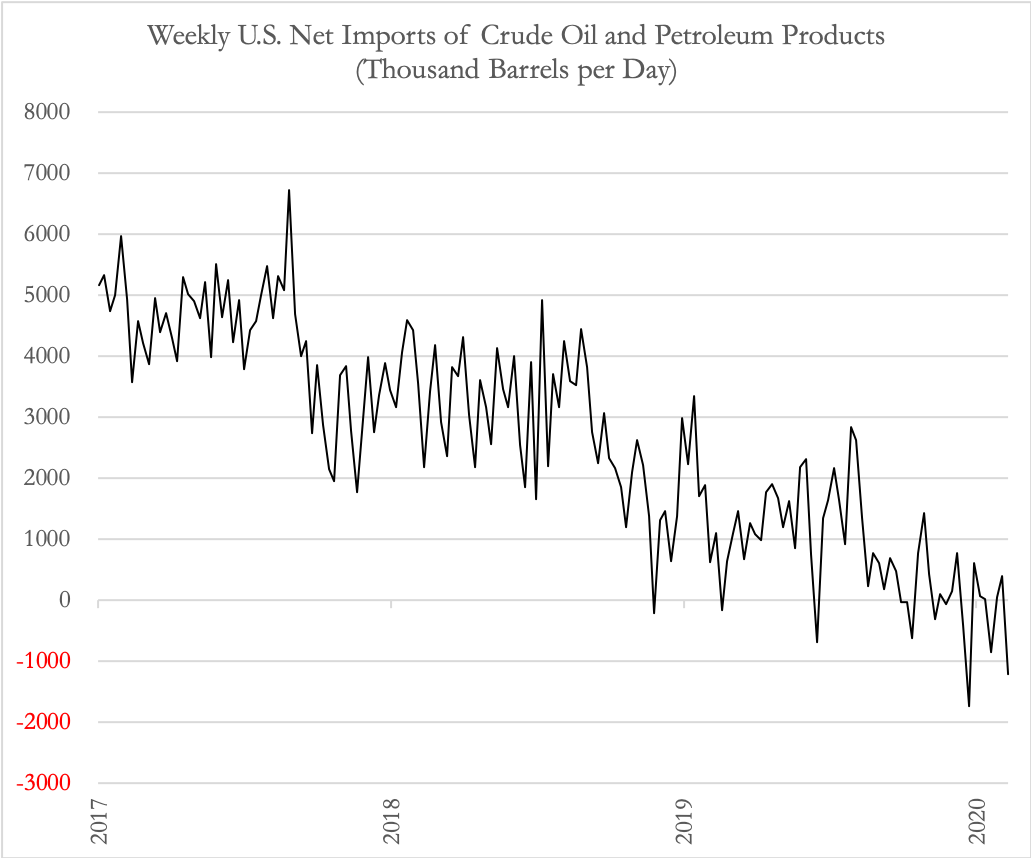

Even if the market is still influenced by the historical producers, OPEC, and the geopolitical forces that find in the middle east their nest, we should account for a new crucial factor that put downward pressure on prices: the U.S. energy renaissance.

Since 2012, U.S. oil production has been roaring, going from 6m bpd to almost 13m bpd. The U.S. thus became the leader in the market, obscuring the output of historical producer: Russia (11,596m bpd), Saudi Arabia (9,762m bpd), Iraq (4,565m bpd), Iran (4.4m bpd), UAE (3,062m bpd) (December 2019 data). At the same time, America became a net exporter of petroleum products for the first time in history (petroleum products include oil and oil derivatives), while importing the majority of crude oil (60%), from Canada and Mexico (and not from OPEC countries).

It is clear that the influence of traditional producers on the oil market decreased, but we should expect that the trend will continue on the future. In fact, the Permian Basin, the region responsible for the increase in U.S. oil output, is still waiting to deploy its entire potential. The oil field, based in Texas and New Mexico, saw its capacity soaring from 0.9m bpd in 2010 to 4.7m bpd in December 2019. Nevertheless, experts forecast production to climb to 8m bpd by 2023, as new investment in road and pipeline will reduce the current infrastructure bottleneck.

Where do we go from here?

Even as markets began to shrug off the fears around COVID-19 with equities indices reaching record highs, Gold continued to rise, despite a continued Dollar strength. Additional rate cuts and global uncertainties will continue to drive strategic diversification and safe haven demand, arguably making further price increases in Gold possible despite the relative sharp appreciation of Gold, especially of this past week.

Oil could face a continued volatile market environment with adding signs that COVID-19 might not be only a Q1 event. With extended lockdowns and the peak of infections now projected to be reached in the next month (originally analysts were expecting to reach the peak of infections more than a week ago) the uncertainties about the effects on global growth and especially demand in the APAC region will persist for a longer time than initially expected.

0 Comments