Introduction

With so much information to store, almost every one of us currently uses the “invisible” space of the cloud. But it’s not that invisible. There is a physical place where all this data is processed, called a data center. When you buy space in iCloud, for example, you are paying for a fraction of an Apple data center somewhere in the world. With the growing demand for data storage, the search for properties and cheaper opportunities to use these data centers has skyrocketed. This article will explore the reasons for the booming demand, its impact on real estate and the environment and investment opportunities in the sector.

Data Centers Overview

Netflix [NASDAQ: NFLX], ChatGPT, and Google [NASDAQ: GOOGL] are examples of ever-growing companies. Millions of people and devices are connected online, streaming and downloading their services, and there is increasing demand for them. For this reason, companies need to have a place to store all the data necessary to run these services.

A data center is a facility that centralizes an organization’s informational technology operations to store and process data. Because they contain vital data supporting a company’s operations (especially software-based companies, e.g. SAAS), they are essential to modern-day companies, making their security and reliability imperative. Data centers act like traditional computers, but instead of a hard drive, they have servers that store, process, and host vast quantities of data. Similarly, they also use energy and heat up; vast arrays of servers are stored in rows of energy-intensive racks that produce a lot of heat. This requires special cooling systems to regulate and maintain, making the facility incredibly energy and water-intensive.

Data centers are the heart behind services such as data storage and management, productivity applications (Excel, Email), High-volume e-commerce transactions (trading and e-commerce), big data and AI databases, etc. This means virtually every business counts on these facilities, but ownership structures vary. Organizers can build and operate data centers for their own needs (Google recently announced a further $2bn investment for data center campuses in Fort Watne and an incremental $1bn investment on their existing Virginia campuses). In-house data centers can be useful for companies that want to safeguard information and prevent leaks, like security-sensitive government or military operations, or software companies like Google or Microsoft, which can profit and improve off developing these centers. On the other hand, server space can be rented from “cloud providers” such as Amazon Web Services (AWS) or Google Cloud.

There are different types of data centers, but each has four main components: the facility itself, industrial equipment, IT hardware, and software. The differences lie in how the structures are operated and utilized; for example, Enterprise data centres are constructed, owned, and used in-house, as in the case of Apple [NASDAQ: AAPL]. Managed services data centers are deployed and managed by third parties, and companies opt for a leasing model; for instance, IBM [NYSE: IBM] and AT&T [NYSE: T] are providers of these services. Colocation data centers allow businesses to rent space within an off-premises physical facility, and renting companies provide computing hardware and servers, like Equinix [NASDAQ: EQIX]. Cloud data centers, such as AWS, support companies in allowing their customers to access resources via the Internet managed by a third-party service provider.

Rising Demand

Nowadays, every text message sent, every BSIC article uploaded, and every trade in the stock markets can only be executed and stored due to our reliance on data centres; this dependence will only become more entrenched as years pass. The latest trend to add fuel to the fire is AI; the way artificial intelligence algorithms work is they need to be trained on and refer to a massive amount of data, making data centers vital to the existence of AI. These algorithms are so data-intensive that they have run out of the ideal type of data to train on, with companies like Google or Microsoft going as far as considering creating synthetic data to train AI on.

Last year, nearly 100tn gigabytes (100 zettabytes) of data were created and consumed; this figure will nearly double again by 2025. With growing demands for AI, data storage capacity for AI alone is expected to grow from 10 zettabytes to 21 zettabytes in 2027. This will not only increase the storage necessary in data centers, meaning they will need more and more efficient ones, but also the energy and water requirements for these centres increase.

Big companies will try to cash in or jump ahead in this race. For example, Nvidia [NASDAQ: NVDA] expects to spend $250bn on data centers annually; Amazon [NASDAQ: AMZN] plans to spend $150bn in the next 15 years to upgrade its data capacity; Google has about 30 data centers operating and developing worldwide; Microsoft also operates over 200 physical data centers; Meta owns and operates 21. These data centers are critical to supporting the company’s social media platforms and cloud computing services, which completely rely on data centers. Data centers are the “cloud”; this service is a huge cash cow to many FAANG companies; AWS delivered 54% of Amazon’s operating income in Q4 2023.

Rising demand has become an environmental concern because data centers can’t be recycled. Existing infrastructure doesn’t support expansions and is abandoned when outdated, wasting energy and other resources. Electricity consumption from data centres alone is poised to triple from 2022 levels by the decade’s end. With the net zero carbon goals, these companies will have to find a way to accommodate demand growth somehow and decarbonise simultaneously.

Geographical trends and sustainability

Ireland is famous not only for being a European base for big techs due to its slim 12.5% corporate tax but also for being a leading world data center hub alongside Amsterdam, Zurich, and Virginia. These geographical clusters for data centers are formed mainly due to their climate, electricity grids, and access to a skilled workforce. Most active hubs also have important optic fiber links that span continents and connect data networks—Amsterdam and Dublin are especially strong in this.

Data centers are big energy consumers, and a hyperscaler (a company with a particularly huge data center, such as Amazon or Google) can consume up to 80,000x what a normal household does. To feed this elevated demand, they still resort mostly to fossil fuels; data centers and transmission networks account for 1.5% of carbon dioxide emissions worldwide, more than Brazil annually. Roughly 1% of the world’s total energy usage is spent on data centers, yet the expenditure isn’t equally distributed in its geography. 82 data centers operate in the Republic of Ireland; another 52 have either planned approval or are under construction. These centers consumed 19% of Ireland’s total energy use in 2022, with the share expected to increase to almost 30% in 10 years, raising serious grid capacity issues in the Dublin area. In a patch of northern Virginia called “data center alley”, the boom in AI has increased its use so much that power companies servicing the area had to pause operations at certain points in 2022. Other cities also suffered from these issues. In response, Germany, Singapore, China, the Netherlands, and the U.S. have introduced restrictions on new data centers to restrict energy expenditure by these infrastructures.

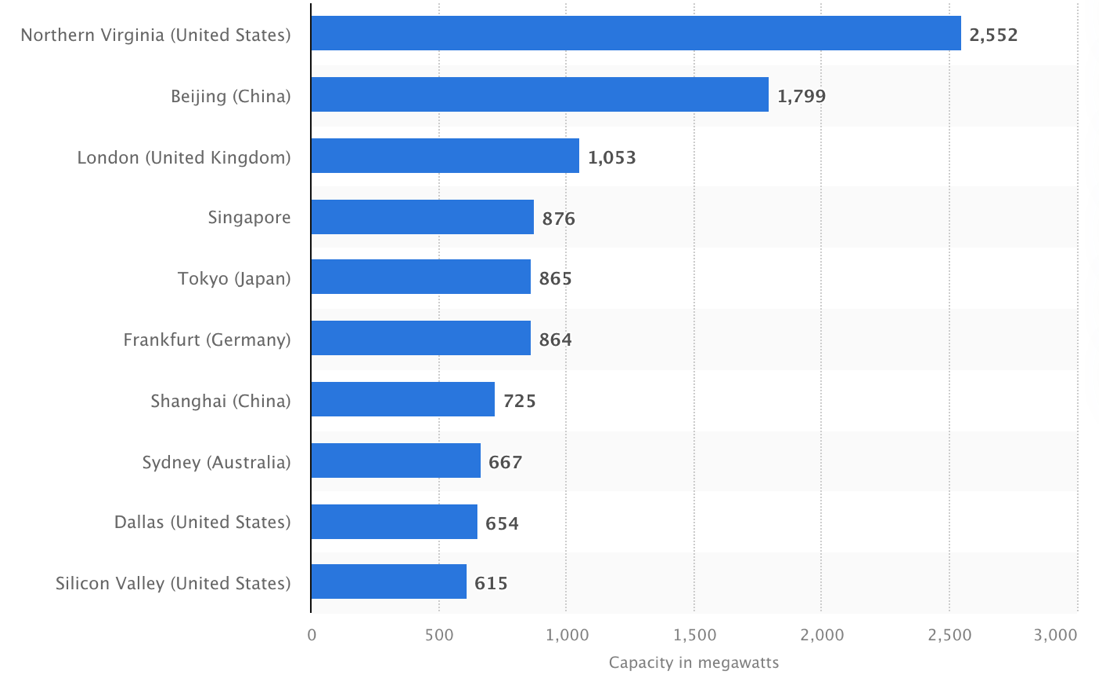

Biggest Data center markets by electricity consumption in 2023

Source: Statista

Technology firms seek ways to mitigate this environmental risk and invest in cloud services more sustainably. Google in 2020 announced a commitment to operate on a 24/7 carbon-free energy system in all its data centers by 2030. These goals were going according to plan for the most part, but in the last few years, two obstacles have stood in FAANG companies’ way of sustainable practices. Firstly, the AI boom has made it harder to reduce energy consumption due to how data-intensive it is, meaning it is energy- and water-intensive. Secondly, their efficiency; over the last years, data centers’ efficiency has been improving dramatically, but similarly to Moore’s law, there is a plateau in efficiency, making developers think their data centres can’t run much better with current technology on an energy consumption basis.

With this in mind, not only private companies will have to invest, but there will also have to be some government regulation to make it easier for companies to use green energy. In Europe, due to their 40-year-old data center system, investments of €584bn will be required by 2030 to meet the EU green goals. In the U.S., the switch to green energy will require around $2tn to upgrade their grid, according to estimates.

However, throwing money at the problem might not be the only way forward; a software technique pioneered by Google is gaining traction in its optimization for clean energy sources. Their software finds locations with excess sun and wind and ramps their data operations there. This strategy is called load shifting; it lowers emissions by changing how data centers function. Overall, the strategy has been successful in its tests, guaranteeing over 90% of the power from renewable energies. Other hyper scalers could promptly follow Google’s footsteps and make this change, too, but this won’t be the end; getting to net zero carbon will be difficult for these huge companies.

Recent Deals

Infrastructure investments are not only fuelled by private equity deals; large corporations are also investing to create infrastructure for their own businesses and expansion plans. Google invested about $1bn into a Kansas City Data Center, and Microsoft [NASDAQ: MSFT] promised €3.5bn in investments into data center capacity expansion in Germany. Apart from these corporate deals, many enormous private equity buyouts are covered in the following.

There have been $43bn worth of data center deals between 2021 and 2023 in the US alone and approximately $48bn of aggregate deal value worldwide in 2021. Investments range from real estate to full data center and power provision, which answer different needs. Blackstone Inc [NYSE: BX], Brookfield Infrastructure Partners LP [NYSE: BIP], KKR & Co. [NYSE: KKR], Silver Lake Technology Management, and PGIM Real Estate (a subsidiary of Prudential Financial [NYSE: PRU]) were prominent investors among recent large deals.

Quality Technology Services (QTS), a Blackstone portfolio company acquired in 2021, provides a combination of real estate and infrastructure investment scopes, which could result in its best investment ever. The company was a US data center Real Estate Income Trust (REIT) that performed poorly trading publicly and was taken private for $10bn in 2021. In less than three years, its lease capacity has grown six-fold, and it is now the largest data center company in North America.

QTS was founded in 2003 and is a provider of carrier-neutral data centers and colocation services within Northern America and the Northern Netherlands, with one project planned in the United Kingdom. The company has $15bn of properties under development (up from $1bn at acquisition) and rents them out to companies such as IBM, Microsoft, and other big tech players.

Blackstone has over $1tn of assets under management, making it the largest and most diversified investor in the alternatives area. In their Q1 earnings call, they mentioned data centers specifically, illustrating parallels between their warehouse investments 15 years ago when e-commerce was rising and today’s AI boom and rise in content creation, cloud adoption, and more. The company holds more than $50bn in data centers globally and has an additional $50bn in prospective future developments. Their strategy is well diversified, with investments in different companies that range from designing, building, and servicing data centers.

The deal rationale illustrates how general infrastructure investments, specifically data centers, can be a great strategy for alternative investments and offer stable but significant returns.

Investment Opportunities

The main investment vehicle used by Blackrock for the acquisition is their Blackstone Real Estate Income Trust (BREIT). This commonly used entity pools investors’ capital to acquire or provide financing for all forms of income-producing real estate. QTS had also been a publicly traded REIT before being taken private by Blackstone. However, apart from other notable REITs, Blackstone’s vehicle is not public, sparking whether private non-institutional or non-high-net-worth individuals can participate in the data center infrastructure boom. Indeed, there are specialised REITs for such purposes in this sector.

A REIT is a company that owns, operates, or finances income-generating real estate. It must invest at least 75% of total assets in real estate, cash, or U.S. Treasuries and pay a minimum of 90% of taxable income as shareholder dividends each year. In addition to the US, 35 other countries have such frameworks, of which the majority mirror the US approach.

The main geographies of popularity for such trusts are the US and Singapore, with Equinix being the largest one with $8.2bn in revenue in 2023. The company was founded in 1998 and operates 260 data center facilities worldwide after opening 5 new centers in January 2024. A competitor is Digital Realty Trust, Inc. [NYSE: DLR], which has a global portfolio of 309 data centers. Investors can choose many other REITs depending on personal preferences.

Other publicly traded companies not classified as REITs but also own and operate data centers can be understood as non-REITs. Most of these have their physical assets located outside of the US. Examples would be NEXTDC [ASX: NXT] in Australia, operating 13 data centers, or DigitalBridge Group [NYSE: DBRG], which holds minority interests in companies that add up to 78 data centers. However, many of these are investment companies which invest in (digital) infrastructure as a whole and lack a specific focus on data centers.

Lastly, certain exchange-traded funds (ETFs) focus on data center infrastructure where one can invest. These ETFs mainly invest in public REITs with larger diversification.

An example of such an ETF would be the Global x Data Center REITs & Digital Infrastructure UCITS ETF Accum USD [NASDAQ: VPN]. Issued by Mirae Asset Global Investment Co. (a subsidiary of Mirae Asset Securities CO Ltd [KRX: 006800]), the ETF is fully replicating the underlying index, Solactive Data Center REITs & Digital Infrastructure Index, and has around €3m assets under management, making it one of the smaller ETFs. Its main holdings are Equinix (mentioned before), Crown Castle [NYSE: CCI], and American Tower [BIT: 1AMT], making up about one-third of all holdings. Over two-thirds of all holdings are in the US. As seen from its biggest holdings, not all investments are solely focused on data centers but also digital infrastructure.

Similar ETFs also have comparable sizes and focus on the same index or industry, so it becomes clear that ETFs exist but are not a very precise investment choice for the target sector or companies. Due to their low AuM and niche index, they bring risks.

Challenges and Future Outlook

Data centers are not returning money as easily as often pictured, and investors face some difficulties. One might be the high-interest environment and uncertainty about future central bank decisions. However, such a cost increase is mostly offset by increased rents and, thus, stronger returns. Certain challenges data centers face, in general, are opening up future investment opportunities.

An important point of consideration is energy. Should QTS complete all its planned projects, the electricity consumption of those will be equal to the needs of roughly 5 million homes. This raises concern not only about the carbon emissions connected with electricity but also about the supply of electricity itself, which is an important topic for investors to focus on. Recently, Sam Altman, Andreessen Horowitz, and others have invested $20m into Exowatt, a clean-energy company focused on AI data centers. The company has developed container-like modules which convert energy from the sun into heat via lenses, which then heat up basic materials to store energy for up to a day. Altman has also invested in nuclear power to support the push away from fossil energy sources to power such data centers. These alternative sources of electricity and power can provide strong returns, given legislative frameworks for emissions and possible electricity shortages in the future.

Furthermore, cooling is an important aspect of data centers. The temperature of such equipment often determines its output and how closely servers can be stacked, thus, how high the productivity per square meter can be. This leads to cooling, accommodating 40% of the energy consumption. Modern cooling systems, such as in-row or rotodynamic cooling designs, have replaced old systems in the past years. Still, heatwaves in Europe have led to downturns in some data centers. Additionally, new chip designs lead to changes in demand for power density, and data centers use power more effectively. These changes create investment possibilities into new cooling technologies, especially for R&D and deployment at scale. These technologies might be across the value chain, as some cooling systems require changes in chip manufacturing, building layout, and more.

In conclusion, as the backbone of our digital world, data centers are indispensable in supporting the ever-expanding landscape of online services, from cloud storage to artificial intelligence. As we’ve explored, the demand for data storage is not only increasing but becoming a critical consideration in real estate, technology investment, and environmental sustainability. While data centers are essential for the growth and development of modern technology, they also pose significant environmental challenges due to their substantial energy and water use. Moving forward, the industry must balance this growth with sustainability, innovating in green technology and energy efficiency to meet future demands responsibly. As the sector evolves, it will continue to offer significant investment opportunities and challenges, making it a dynamic and crucial field for stakeholders across various industries. This balance of innovation, investment, and sustainability will dictate the future trajectory of data centers, ensuring they can support our digital needs without compromising our environmental goals.

0 Comments