Introduction

On November 9th, 2021 food delivery company DoorDash, Inc. announced they had reached an agreement to acquire Wolt Enterprises in an all stock transaction, valued at approximately € 7.0 bn. DoorDash equity issued as part of the transaction will be valued at $206.45 per share. The deal is one of the most expensive takeovers yet in Europe’s hyper-competitive delivery market and opens up for DoorDash a new (already crowded) market.

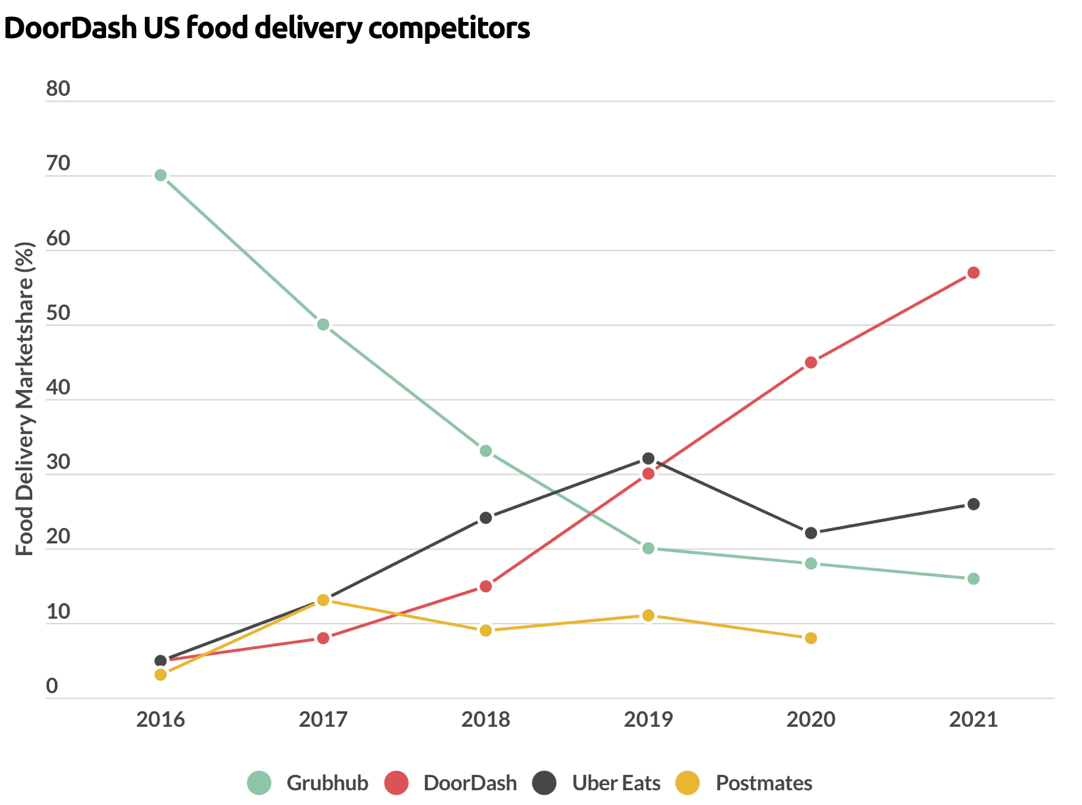

The food delivery industry has consolidated globally during 2020 thanks to the pandemic, which enormously increased the demand for food delivery. While the US market sees four big competitors – Doordash (56% market share in US), Uber Eats (24%), Postmates (acquired by Uber Eats in November 2020 with 3% market share) and GrubHub (15%). The European market is significantly more crowded and counts a lot more companies with less market share and a higher level of competition. The acquisition of Wolt by DoorDash, is an entryway for the company into this crowded European market with no clear industry leader yet, with the possibility for the company to exploit economies of scale by employing new technologies and consolidating their position before anyone else.

About DoorDash

DoorDash, Inc., based in San Francisco and is the largest food delivery company in the United States with a 56% market share. It also has a 60% market share in the convenience delivery category. It serves around 450,000 merchants, 20 million consumers, 1 million deliverers (“dashers”) and has over 6000 employees.

Founded in 2013 as “PaloAltoDelivery.com” by Stanford University students, which sought to apply technology to delivery, it became “DoorDash” in October 2014. In the same year it expanded within the US and, the following year, it began operating in Toronto. Since 2019 it has been operating outside North America, launching in Melbourne, Australia, and recently also in Sendai, Japan.

The company, which mainly offers food delivery, connecting restaurants to customers, expanded its service offerings in 2020, adding grocery delivery in August 2020. In 2021 it also launched DoubleDash, which allows for orders from multiple merchants, and alcohol delivery in 20 U.S. states, the District of Columbia, Canada, and Australia.

With the acquisitions of Caviar in October 2019, Scotty Labs in August 2019 and Chowbotics in February 2021, the delivery company has been able to enter new markets and implement new technologies, increasing its competitive advantage in a crowded market. DoorDash utilises technology, such as machine learning tools to give personalised suggestions and assist in predicting delivery time and has also researched utilising autonomous robots for food and delivery (with the acquisitions of Chowbotics and Scotty Labs. The integration of technology, together with the ability to exploit niches in the market of food delivery, has been the strategy that helped DoorDash gain such a huge advantage, over time, against its closest competitors, GrubHub and UberEats. Also, its handling of the global pandemic, where they offered lower fees to attract restaurants and consumers, while paying attention to sanitary concerns, has been pivotal in its expansion, during a period where the only way to eat “outside” was to order food. The company’s record IPO on December 9th, 2020, raised $3.37bn and closed up 86%, from its original valuation of $102 per share, trading at $182 and closing at $189.51 per share, making it one of the most successful IPOs among tech companies. The first-day jump gave DoorDash a market capitalization of $60bn and a fully-diluted value of $71.3bn. The company, despite the doubts of a decrease in its value due to the post-pandemic rebound, which happened during Q2 2021, now has a share price of around `$225 and a market cap of around $75bn, higher than its rival Uber, demonstrating that it has been able to hold onto its advantage and positioning in the market.

About Wolt

Wolt is a Finnish technology company known for its delivery platform for food and merchandise, where customers can order food and other items and either pick up their order or have it delivered by the platform’s courier partners.The company was founded in 2014 by 6 founders, including Miki Kuusi, the former the CEO of Slush.

In 2015 Wolt first launched in Helsinki as pick-up only, but in 2016 it added delivery to the platform and expanded to Sweden and Estonia. From 2017 on, the company concentrated in expanding abroad, launching in many European countries, as well as in Middle East and Japan. Wolt now operates in 23 countries and over 180 cities. It has over 4,000 employees, more than 45,000 merchant partners, 90,000 courier partners and 12 million registered customers.

It has grown in the last few years by raising $856m in funding from investors, including ICONIQ Capital which led its latest round of financing in January and raised $530m.

Wolt, whose revenues tripled to $345m last year and recorded a net loss of $45m, was ranked second in the 2020 edition of the FT:1000 Europe’s Fastest Growing Companies 2020 published by the Financial Times. According to an investor presentation, its app also has more than 2.5m active users and its gross order volume is more than $2.5bn on an annualised basis.

Industry Analysis

While people sheltered in their homes during the coronavirus pandemic, food delivery reached new heights. In October 2021, sales for meal delivery companies rose by 15% YOY, collectively leading the global market to be worth more than $150bn. The number of customers using meal delivery services has increased, but the average sales per consumer have risen too. The companies that experienced considerable growth in average sales are DoorDash and Uber Eats. In the third quarter of 2021, DoorDash counted a 114% increase compared to the third quarter of 2019, while Uber Eats has seen a rise of 92%.

However, as the world begins to recover from the Covid-19 pandemic and people are starting to return to their normal lives, stores and restaurants are regaining customers quickly. DoorDash CEO Tony Xu said, although “we are seeing a normalisation of growth rates”, it’s important to acknowledge that “delivery is here to stay”. This is because people are unlikely to abandon the eating habits they formed during the pandemic.

Despite the overall industry growth, the rivalry between food delivery services is still fierce. One of the biggest challenges these companies face is, in fact, the battle for customers as brand loyalty is very low and unreliable. With similar business models and services, meal delivery firms only have two possibilities: attempting to differentiate from their competitors or consolidation. Competition is one of the factors that prevent these firms from making profits. Despite the ferocious rivalry with Grubhub and UberEats, Doordash is currently dominating the U.S. market. As of March 2021, DoorDash occupied 55% of the meal delivery market, while Uber Eats had a market share of 22%. In 2019 Uber Eats offered a merger deal to Doordash, but the two competitors did not reach an agreement.

DoorDash food delivery competitors – Source: Business of Apps

In the second quarter of 2020, the average cost of a DoorDash order was $36, out of which the firm made $0.90 in profit. According to DoorDash COO Christopher Payne, this value is acceptable because “this is a cost-intensive business that is low-margin and scale driven”. Meal delivery firms earn money by charging a percentage of the order to restaurants and a service fee to consumers. They then use the revenues to pay drivers, their biggest expense. After advertising costs, refunds to customers, and operational expenses, these companies are left with a very low or inexistent profit, which is why the company has not reached break-even yet.

To become profitable, DoorDash and its competitors like Uber Eats and Grubhub are consolidating with other firms. This search for consolidation has led to an increase in M&A activity over the past year. For example, Uber Eats acquired the American delivery company Postmates for $2.4bn and Cornershop, a Chile-based grocery delivery start-up. Grubhub was acquired by the Dutch company Just Eat for $7.1bn. This growing M&A activity is starting to raise doubts regarding antitrust concerns.

Food delivery revenues are expected to reach $220bn by 2023, accounting for 40% of the total restaurant sales. Because of the constant competition, companies have to keep on top of the future trends the foodservice industry is moving towards. Big Data is becoming essential to delivery companies as it improves the firms’ reliability and allows quick responses to customers’ needs. Through the data analysis, delivery firms can make accurate estimations regarding, for instance, delivery time, personalised offers, and inventory management. Technology and innovation will also be employed to develop more modern and efficient delivery options. Companies are, in fact, starting to embrace robots, drones and even parachutes aiming at speeding up delivery and lowering operational costs. Finally, some delivery firms are targeting niche markets hoping to overcome entry barriers and fierce competition. For example, there are start-ups focusing on the fight against food waste, pet food, healthy meals, and even crypto food orders.

Deal Structure

The US-based company DoorDash announced the Wolt acquisition alongside its third-quarter 2021 results. DoorDash will acquire Wolt through an all-stock deal which values the firm at $8.1bn. DoorDash equity that will be issued as part of the transaction is valued at $206.45 per share, based on DoorDash’s 30-day VWAP as of November 3rd, 2021.

Upon conclusion of the deal, Wolt Co-founder and CEO Miki Kuusi will run DoorDash International, a new division for the company’s operations outside the U.S. Kuusi will report to DoorDash co-founder and CEO Tony Xu. However, it has not been announced yet where his role will be located. Additionally, DoorDash announced that other key executives from Wolt will be joining the firm, and a new retention pool of $500m will be reserved for Wolt management and employees.

The deal would mark the exit of EQT Ventures and EQT Growth as shareholders of Wolt. The transaction is expected to close in the first half of 2022, subject to regulatory approvals mainly linked to antitrust concerns.

Deal Rationale

Both Doordash and Wolt share a mission to build a global platform for local commerce that connects consumers with the best of their community, drives incremental revenue for merchants, and provides meaningful earning opportunities for millions of Dashers and couriers around the world. This partnership is expected to accelerate their progress towards their common goals.

With more than 2.5 million active users, Wolt has an annual total value of all transactions of more than $2.5bn. Wolt operates in 23 European markets including Germany, where DoorDash has been eager to gain a foothold shuttling food and groceries to customers. Wolt was the second among the fast-growing companies in Europe last year, according to a tally published by the Financial Times. As DoorDash has always wanted to expand internationally outside of its home market in the U.S, this deal provides the company an exciting opportunity to accelerate launch in European markets and compete with UberEats in Europe. Tony Xu, the Chief Executive Officer of DoorDash told the Financial Times, “This is a business that was designed to be international, so we couldn’t be more thrilled. ” With access to 22 new countries representing a potential customer pool of 700 million, DoorDash will establish an advantage in international expansion against its peers in the food delivery industry.

Although Wolt isn’t a market leader in Europe, Mr. Xu found the merger attractive because the startup has grown in what he considered a more cost-effective way compared with its peers. Wolt will continue operating under its brand in the countries where it currently does business, leveraging the established brand name. This gives DoorDash a foothold to expand in a market that could have otherwise taken substantial time, effort, and money for the company to penetrate on its own.

For Wolt, as the food delivery industry has become increasingly competitive and logistical undertaking has become more expensive, this merger allows the company to stay competitive in the market with access to more capital and cost reductions. Coming from a small native market Finland, it is very difficult for Wolt to compete with other companies globally, especially following the trend of big players swallowing up smaller rivals. This merger provides Wolt access to DoorDash’s capital, operational effectiveness, and management expertise.

From a financial point of view, the deal is expected to be accretive to GOV growth in 2022 with an expected pro forma combined adjusted EBITDA of $0 to $500m. Together with the news of the acquisition comes with DoorDash Q3 earnings. Although it beat analysts’ expectations on revenue, gross order volume and adjusted EBITDA, it reported a net loss of $101m, more than double of the same period last year. While the company says it was because of the costs of last year’s IPO and stock-based remuneration, it leaves uncertainties around its future operations and profitability, especially when Covid-19 is becoming a new norm. Thus, this merger comes at the right time, giving investors more positivity around the company’s ability to make profits. DoorDash said the Wolt merger next year could lead it to post a full-year profit by this measure of up to $500m.

Market Reactions

After the deal was announced last Tuesday, DoorDash shares surged more than 20% in after-hours trading on the news. It reached its all-time high at $245.97 last Friday, up 28% from $192.01 this past Tuesday. It is currently trading at $230.20, up 19% from before the deal announcement.

However, some analysts hold the opinion that the stock is currently overvalued. Its trading multiples are on par with software companies, while the growth rate is limited. At the same time, with the evolving situation around Covid-19 and return-to-office trends, it is uncertain if people will keep ordering from food delivery Apps, which could make a big impact on DoorDash’s revenue. Lastly, it has become increasingly hard to recruit delivery drivers, which could add to the cost of delivery and drag down profits.

Deal Advisors

Goldman Sachs & Co. LLC is acting as exclusive financial advisor to DoorDash, and Wilson Sonsini Goodrich & Rosati, Allen & Overy LLP and Avance Attorneys Ltd are acting as its legal advisors with regard to the transaction.

Qatalyst Partners is acting as exclusive financial advisor to Wolt, and Skadden, Arps, Slate, Meagher & Flom LLP and Roschier, Attorneys Ltd. are acting as its legal advisor.

0 Comments