Introduction

With IPO window open again, markets start to see more deals coming in, however, the pace is different across regions. While in the US alone 10 large IPOs were priced the week of 8 – 14 September with more companies in pipeline, the European market is only starting a revival with a Swiss network of online marketplaces SMG having raised $1.1bn in secondary proceeds this month – Europe’s largest listing since the IPO of Polish retailer Zabka Polska in October 2024. Although European pipeline is very strong, investors remain highly selective, worried about elevated valuation ranges and low-quality listings. Such cautiousness can be explained by poor aftermarket performance of some recent IPOs, with companies repeatedly missing earnings expectations. And while highly liquid US stock markets enable investors to exit positions quickly when problems arise, many European investors found themselves trapped in underperforming IPOs for years after listing, particularly following the 2021 boom. This brings additional investor caution and shapes the way they assess new listings in today’s market environment. Overall, we anticipate a recovery ahead, and if offerings are priced attractively for investors and market volatility stays subdued, more deals are likely to come through, though without reaching the same level of enthusiasm seen in the US.

Cautious Optimism in Europe: Key Themes

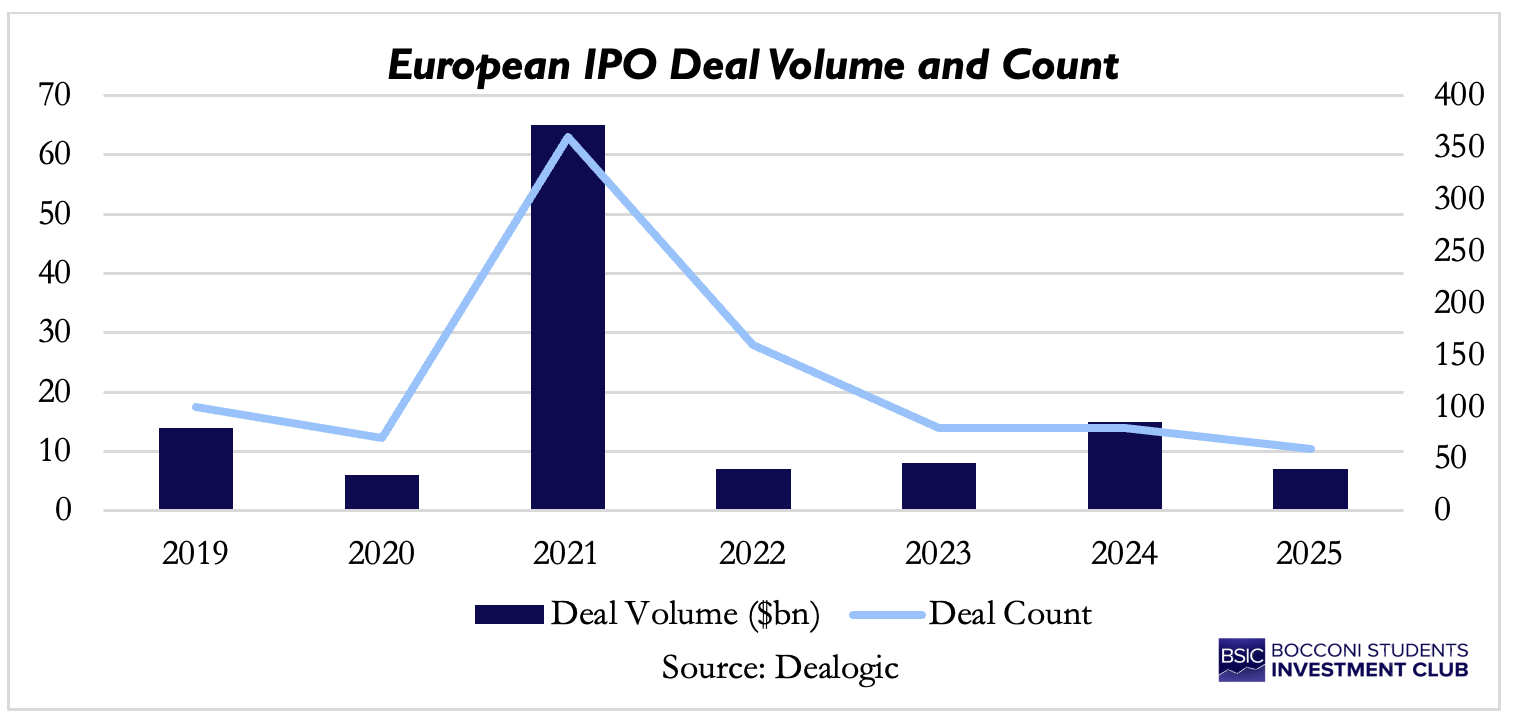

European IPO activity in 2025 has been notably subdued, with YTD deal value and volume near 10-year lows. Persistent market volatility (following US President Donald Trump’s “Liberation Day” tariffs) and lack of investor demand have led to postponement or even cancelation of some potential offerings. While volatility has eased with VIX standing at near 15 level (a level often cited as favourable for ECM issuance), fluctuations in US stock markets and concerns about the rate policy still add uncertainty. Moreover, rising popularity of dual-track process with many companies considering M&A exit alternatives further challenges IPO market.

However, companies are actively filling the IPO pipeline despite the challenges, hoping for favourable macroeconomic environment and robust investor demand. SMG’s debut on Zurich Stock exchange [SWX: SMG] and recent IPO of NOBA bank in Stockholm [STO: NOBA] tested investor appetite and readiness of European exchanges to accommodate future potential offerings. Moreover, a private equity-backed security company Verisure is expected to raise $3.7bn in its Stockholm IPO, the largest listing since Porsche in 2022. A successful debut would demonstrate that the market is open again and could encourage more European companies to pursue offerings shortly. In addition, The Beauty Tech Group and German prosthetics maker Ottobock are preparing to list in Q4 2025 in London and Frankfurt respectively, alongside other mid-cap and sponsor-backed expected offerings. Such a strong pipeline is anticipated to drive a rebound in the European market, provided the deals are completed and deliver solid performance after listing.

Before analysing individual deals, we will first examine the key themes shaping European equity capital markets in the current environment. Firstly, in IPOs and follow-on offerings focus shifts to pricing, while investors remain highly selective, turning their attention to companies with strong financials and well-establish strategies. Pricing at a predefined fixed value rather than marketing an IPO price range has become increasingly common in current volatile environment as it reduces the risk of having to cut the range if there is not enough demand and brings more certainty to investors and issuers. For example, earlier this year the IPOs of Cirsa, Hacksaw, and Asker were all priced at fixed values, while NOBA Bank’s offering on the Stockholm exchange was likewise set at a predetermined price of SEK 70 on September 26. Moreover, investors remain concerned about aftermarket performance, as many newly listed companies in recent years have shown weak trading on such benchmarks as 3 days, 1 week, 1 month after the offer. That is why, to secure sufficient investor demand and supportive aftermarket trading companies might need to price their offers at significant discounts to listed peers to indicate clear upside potential.

Secondly, dual track process is becoming increasingly common as private equity firms try to keep their options open till last to choose the most favourable one in current fast-changing environment. For instance, Bain Capital and Cinven have eventually opted for a sale of their stake in the German drugmaker Stada for as a less risky and quicker exit route, while considering IPO for a long time. Furthermore, the Dutch government is also shifting towards selling German utility operator TenneT to a consortium of private investors, instead of pursuing a public listing. The move reflects ongoing market volatility and differing views on valuation in a more challenging market environment.

Finally, shift in PE firms’ strategy is shaping equity capital markets: sponsors are actively increasing sales of their listed holdings to return some capital to LPs before completing full exits. This has led to 38 private equity sell-downs through follow-on deals in 2025 YTD, worth $16bn – the highest deal value since 2017. Although the number of sponsor-led sell-downs has declined from 2024, the transactions have been larger in scale, reflecting investors’ willingness to dispose of bigger stakes. The champion in sell-downs is for sure EQT – the Swedish sponsor has completed 5 sell-downs this year worth $3.9bn. The most prominent example is its ~$2.8bn accelerated equity offering in Galderma completed in July 2025. The shares were sold at 8% discount to last close, leaving money on the table to ensure strong aftermarket trading for future disposals. Indeed, the stock closed on 26 September 10% up vs offer price of the last deal. This strategy has consistently proven effective with EQT able to sell its Galderma stake at a higher price each time it has come to market, leading to more and more sponsors starting to implement this strategy, which drives follow-on issuance.

Recent European IPOs with Further Listings Ahead

The online marketplaces leader SMG Swiss Marketplace Group [SWX: SMG] made its debut on September 19, with a total of ~19.6m existing registered shares offered at a price of CHF 46.00 per share, top of the marketed price range, leading to a company valuation of ~$5.68bn. The offering was structured as a secondary sale by existing shareholders (mainly Ringier and La Mobilière) with no primary proceeds to the company itself. The deal value equals ~CHF 903m (~$1.14bn), however, with an over-allotment option for an additional ~2.9m shares it could increase up to ~$1.3bn. The free float amounts to 20% before any exercise of the over-allotment option and 23% if the over-allotment option is exercised in full. Pictet and BlackRock acted as cornerstone investors and have subscribed each for CHF 150m worth of shares at the offer price. Strong demand from both Swiss and international investors led to books being at least 10x oversubscribed, according to bookrunners. The shares opened at CHF 48.25, a promising 4.9% premium over the issue price, and closed the first day at CHF 49.00 (+6.5% vs offer price). However, by the third day they partially drifted and closed at CHF 46.50 (+1.1% vs offer price) and the stock continued to weaken over the following sessions, closing its first week at CHF 45.00 (–2.2% vs offer price). This aftermarket performance can be explained by the fact that the offering was priced only at marginal discount to listed peers, thus limiting the potential upside in aftermarket trading. Overall, SMG’s IPO provides financial flexibility, greater brand visibility, and liquidity for existing shareholders, creating room for acquisitions, technology upgrades, and entry into adjacent markets. This will allow the company to accelerate innovation and broaden its platforms, reinforcing its position as a leading Swiss digital platform.

Another important deal was priced this week in Europe. The digital banking group NOBA Bank [STO: NOBA] went public on Friday September 26 on the Stockholm stock exchange at a fixed price of SEK 70 per share. The deal was structured entirely as a secondary sale by existing shareholders – the private equity firm Nordic Capital and the Finnish insurer Sampo, with 108.7m shares offered (~21.7 % of outstanding shares), plus a 15 % secondary greenshoe (16.3m shares) that, if exercised fully, would lift the free float to 25 % and deal proceeds to ~SEK 8.75bn (~$0.9bn). Strong demand from Swedish and international institutional investors as well as the general public in Sweden and Denmark resulted in the book being multiple times oversubscribed. Moreover, the offer was supported by cornerstone commitments from OP Cooperative, DNB Asset Management, and Handelsbanken Fonder, who together subscribed for almost SEK 3.2bn worth of shares (~36 % of the base offering). The stock opened with strong momentum at SEK 84.90 on its first day of trading, 21% higher than the offer price. Shares continued to rise and ended the first day at SEK 90.99, 30% up from the offer price, resulting in implied valuation of SEK ~45.6bn (~$4.83bn). The first trading day surge can be largely attributed to strong cornerstone support, heavy oversubscription, and broader investor appetite for high-quality companies after a slow year for European issuance. However, a fuller judgment on the deal’s success will depend on its longer-term aftermarket performance. What is clear already is that Stockholm has emerged as Europe’s busiest exchange this year, accounting for three of the five largest listings.

Stokholm’s exchange is also expected to host Europe’s largest listing since Porsche IPO in 2022. The private equity-backed security company Verisure has announced plans to raise €3.1bn ($3.7bn) in primary proceeds in an initial public offering, with an enterprise value potentially exceeding €20bn, a large increase in valuation after US private equity firm Hellman & Friedman first invested at a €2.3bn valuation in 2011. The offering is expected to consist of the issuance of new shares by the company to raise gross proceeds of ~€3.1bn of which ~€235m is expected to be raised from two existing investors, Alba Investments and Securholds Spain, who both want to increase their economic exposure to Verisure. Sales of existing shares are expected to be primarily limited to the overallotment option. The Swiss company plans to use those proceeds mainly to reduce debt and strengthen the balance sheet, as well as to support growth initiatives and new acquisitions. If successful, this deal, together with NOBA IPO, is poised to establish Sweden as one of Europe’s leading hubs for equity capital raising in 2025. However, to secure robust aftermarket performance sponsor Hellman & Friedman might need to give a greater discount on the Verisure IPO pricing to avoid lower than expected surge of share price on the first day of trading, which was the case for SMG. Given the scale of potential IPO of Verisure, opportunities for additional secondary sales are limited. This means that majority shareholder H&F is expected to gradually monetize its stake through future block trades for which strong trading after the IPO is crucial. While SMG shares still traded up, the discount to listed peers was not large enough to give shares a desirable buffer in the market. So, H&F might take this into consideration when deciding on pricing and follow the EQT strategy at Galderma’s IPO. By setting Galderma’s IPO valuation at a comparatively attractive level relative to its listed peers, EQT effectively positioned the stock for a strong aftermarket trading, resulting in a 20.7% first-day gain, much higher than 6.5% uptick in case of SMG.

IPO boom in the US

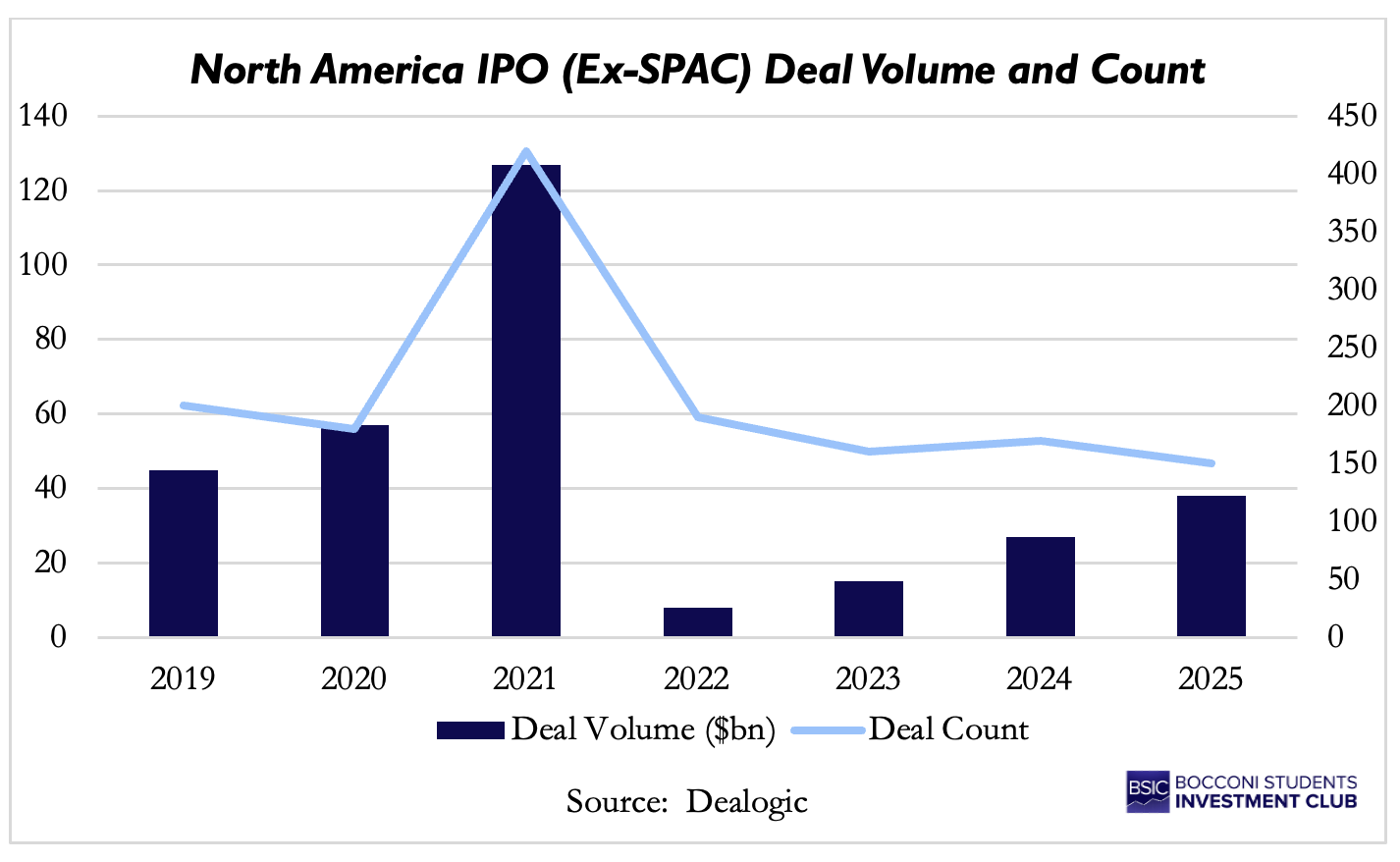

During August there was a total of 28 ECM transactions with a total deal value of $31.6bn. Half of transaction were follow-ons, while one third were convertible bonds. IPOs contributed to just 16% of the total deal value, however, it is a large amount for a month like August. To understand the rationale behind rushing IPOs is to utilize the high demand of investors when the competition is still low before autumn, which is expected to bring even higher deal volume. The VIX index, which measures the volatility of the market by assesing the price swings of options of the S&P 500 companies, closed at 16.18, a way lower figure compared to the peak achieved on the 8th of April equal to 52.33. Generally, for IPOs, a VIX threshold under 20 is considered favourable. This paired with the Fear and Greed index, which measures investors’ appetite and whether emotions are pushing higher or lower valuations. The index is in the range between greed or extreme greed showing investors’ appetite for higher returns and new opportunities. Most of the industries are experiencing an IPO revival, but the common focus of companies is to implement AI in their business operations. If the current trend continues with strong aftermarket performance, healthy pipeline and high investor demand, Q4 of 2025 is set to bring another wave of IPOs, even though the concerns regarding tariffs, inflation and US policy remain. The main goal for companies is to show scalability and competitive advantages. There has been a drastic change in terms of characteristics shown by companies going public compared to 2021, when early-stage companies used the favourable market conditions to rush their listings. Today’s companies display profitability, larger size, and discipline. In 2025 YTD there were 175 IPOs in North America amounting to $30.5bn, excluding SPACs. It is estimated that there will be 20-25 more deals in Q4 2025, mostly from fintech, crypto, defence, insurance, and consumer companies. If the momentum continues, the IPO market is on track to beat the previous year. One of the most important large cap deals are Klarna [NYSE: KLAR], Gemini, Legence [NASDAQ: LGN], Black Rock Coffee Bar [NASDAQ: BRCB], and Figure Technology Solutions [NASDAQ: FIGR].

The fintech Buy Now Pay Later company Klarna [NYSE: KLAR] has achieved a $15bn valuation in its IPO. The company priced its shares at a fixed price of $40 per share, above the initial price range of $35-$37. Nevertheless, the shares skyrocketed 15% and achieved as high as $57.20. Afterwards, Klarna’s share price closed at $45.82. The IPO is structured as a mix of primary and secondary issuance. From the raised $1.37bn Klarna will receive $191.5m, while the selling shareholders will get $1.12bn. The IPO was 20x oversubscribed, indicating strong investor demand. However, this valuation is only a shadow of the highest point reached by the company. In 2021, Klarna’s backer Softbank lead an investment round and achieved a valuation of $46bn. The interest rate hike of 2022 caused a crash in valuations, especially in losses incurring start-ups. Klarna was one of them since 2019, when they pursued an expansion in the US, knowing it would incur losses. This particularly affected the value of the company and dropped it to $6.7bn. The company main revenues come from fees from retailers, but 13.6% of the income comes from “snooze fees” and “remainder fees”. The current goal of the management is to diversify from the Buy Now Pay Later model and become a real digital bank. Most notably, the company started issuing debit cards and entered the high interest-bearing loans market. Although the deal finally came through, a fuller judgment on its success will depend on its longer-term aftermarket performance.

Gemini Space Station [NASDAQ: GEMI] was founded in 2014 by Cameron and Tyler Winklevoss and is one of the main players in the crypto space. The company offers a variety of services such as spot trading for crypto assets, the ActiveTrader platform, and derivatives exchange. For large-scale block trades investors can choose OTC transactions. Gemini also issued the Gemini Dollar (GUSD), a stable coin backed by the US dollar and Ethereum. There is also an ongoing partnership with WebBank to issue credit cards, which gives users crypto rewards, and has generated $1.3bn in lifetime spend and $93m in receivables. Lastly, the platform offers users an NFT marketplace for creators and brands. The IPO of the company occurred on the 11th of September 2025. The issuance price per share was fixed at $28 per share. The transaction is mainly structured as a primary listing, with around 15m shares issued to the public. Some stockholders though decided to participate in the selling of their shares to the public through an over-allotment option, which, if exercised, would increase the number of shares by around 458k. The net proceeds of the IPO amount to $437.2m ($445.1m if the greenshoe option is exercised). In separation of the public bookbuilding NASDAQ is also acquiring 1.9m shares through a concurrent private placement, at a price of $26.25 per share. The implied valuation of the company from this deal amounts to $3.3bn. Similarly to Klarna, the IPO was heavily oversubscribed, with orders significantly exceeding the available shares, which forced bankers to cap IPO proceeds at $425m. The high demand allowed company to sell its shares at $28 per share instead of the $24-$26 price range. In the first few minutes, the stock surged as much as 45% and closed with a 15% gain. However, 2 weeks later, the stock closed at $25.14 per share, which is a 10% loss from the IPO price.

The resale platform StubHub [NYSE: STUB] made its debut after two delays on September 27, selling 34m Class A shares at $23.50, raising a total of roughly $800m at an implied valuation of ~$8.6bn. The secondary-heavy deal had a choppy aftermarket. The stock opened with an 8% increase from the initial price but quickly lost steam, closing day one at $22.20 (-6% vs offer) and continued to weaken over the following sessions. The decline can be explained by a combination of factors: valuation skepticism, profitability concerns, regulatory risk in ticket resale markets and market volatility.

Design software maker Figma [NYSE: FIG] and crypto exchange Bullish both completed landmark summer IPOs, raising over $1bn each. Figma debuted above its $30–32 range, pricing at $33 per share, to raise roughly $1.22bn at a valuation near $19bn and ended its first day on the NYSE with an eye-popping gain of 250% in July. Its shares are now trading about 37% lower than where they opened, and 61% higher than the IPO price. Bullish, backed by Peter Thiel and supported by anchor orders from BlackRock and ARK, upsized its offering to nearly $1bn, valuing the exchange at about $4.8bn. The crypto exchange platform offered 30m shares at a price of $37 (above the marketing range of $32-$33) and doubled that at the opening (~$90), facing a trading halt in the following sessions due to extreme volatility, ranging between $50 and $70 in the following month.

Throughout industries, the landscape expanded. At the start of the year, fintech and space companies contributed to the revival of IPO activity, but by August, offerings expanded to include industrials, consumer goods, healthcare, financial sectors, and more. At the same time, cross-border listings stayed robust: despite geopolitical challenges, foreign firms still see US markets as leading platforms for their launches. The deals all lean on a supportive market backdrop of record-high equity indices and subdued volatility, with the important add-on of the strong investor risk appetite. Eye-popping first-day performances by high-profile names are also encouraging many would-be issuers to test investor appetite. At the same time, aftermarket performance highlighted a clear pattern: investors are discriminating on fundamentals and valuation. Due to increased profitability and SaaS scarcity Klarna and Figma held double-digit gains; Gemini and Bullish saw volatile swings linked to crypto sentiment; StubHub fell as concerns about regulation and cyclicality outweighed demand. Yet, the outlook is still favourable for late 2025: issuers are lining up, sentiment is high, and the pipeline is large. Investors are, however, expected to remain selective: quality growth names with clear profitability paths will likely continue to attract strong support, while consumer-cyclical and more speculative offerings may face a more difficult time if volatility or macro risks reappear.

0 Comments