Introduction

The second biggest cosmetics company by revenue in the world, Estée Lauder [NYSE: EL] has announced on November 15 that it has signed an agreement to buy the fashion house Tom Ford brand for $2.8bn making it the largest acquisition within the luxury world this year. The deal is an extension of a longstanding relationship between the two firms given Estée Lauder ’s licensing agreement for Tom Ford’s extended product line including fragrances, cosmetics and skin care products. The acquisition will further expand Estée Lauder’s products to apparel, whose focus was mainly on cosmetics owning brands such as Bobbi Brown, Clinique and La Mer. Moreover, Estée Lauder will gain important synergies from the deal as it will strengthen Tom Ford’s relationships with other luxury brands such as Ermenegildo Zegna [NYSE: ZGN], who will be licensed with the firm’s fashion department.

About Estée Lauder

The Estée Lauder Companies Inc. is an American multinational company founded in 1946 and now is a key player in the cosmetics industry owning more than 20 diverse brands within its portfolio, such as Clinique, Tom Ford Beauty, falling within the cosmetics market, Jo Malone and Bobbi Brown in the Fragrance market and Aveda in the Haircare products market. The largest shareholder is the Lauder Family, who owns a 38% share of the firm with 86% of the voting power, followed by the Vanguard Group Inc. with a 5% stake and Blackrock Inc. holding just less than 4%. Estée Lauder has an annual revenue of $17.3bn with a net income of $2.2bn.

The firm began its growth in the cosmetic world in the US and then expanding in 1961 to Hong Kong. The firm began with cosmetics focused skincare and soon began to expand into the fragrance market with the introduction of Aramis, its first line of fragrance along with grooming products for men in 1964. In the same year the firm opened one of its most established brands: Clinique, a fragrance-free cosmetic brand which has now reached over 20,000 employees worldwide today. Estee Lauder rapidly grew in the 1990s with licensing and brand acquisitions: its first licensing agreement was in 1993 with Tommy Hilfiger, followed by Kiton in 1995 and Donna Karan in 1997. The firm acquired MAC Cosmetics in 1994, followed by the acquisition of Bobby Brown Cosmetics in 1995 and its first hair care acquisition with Aveda in 1997, growing continuously both in terms of net sales and in terms of product development as it branched out from skincare cosmetics to fragrance, makeup and haircare. In 1995, the firm went public and today the firm operates in more than 150 countries with more than 60,000 employees worldwide. In 2005, Estée Lauder started to develop its first relationship with Tom Ford by obtaining a licensing agreement to develop and distribute fragrances and cosmetics under the Tom Ford Beauty brand and has since played a key role in the distribution operations for the Tom Ford brand developing a strong relationship between the two firms.

Estée Lauder has invested heavily in its digital commerce especially following the COVID pandemic, which displayed the risk in relying too much on physical retail stores. In terms of marketing, Estee Lauder has been a pioneer in the use of spokesmodels, often referred to as “faces.” Hiring “faces” such as Elizabeth Hurley, Carolyn Murphy, Joan Smalls and Constance Tabloski and more recently, in 2015, signing Kendall Jenner to promote the brand has gained them a lot of popularity. The firm’s popularity also grew enormously through the launch of the Breast Cancer Awareness Campaign (BCA), organized by Evelyn Lauder, Estée’s daughter in law, co-creating the “Pink Ribbon” with Self Magazine. Since its foundation the firm and its 20+ brands have contributed to the Breast Cancer Research Foundation, raising over $89m in medical services, research and education.

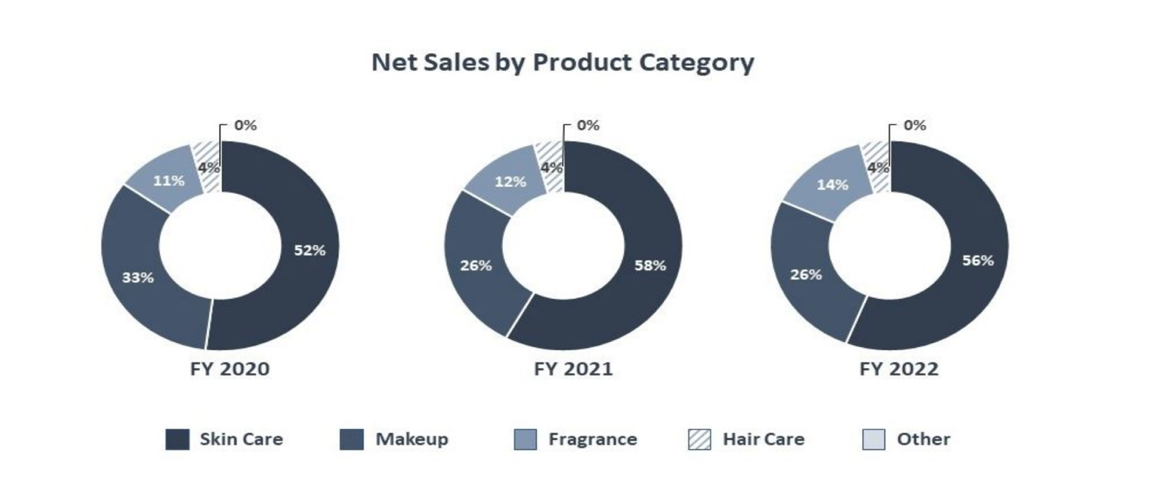

Estée Lauder has been growing its revenue for the past five years, growing from $12.2bn in 2017 to $17.3bn in 2022, with an average 2% growth revenue YoY. The firm’s operating activities lay within four different divisions: skincare, makeup, fragrance and haircare. The skincare division represents the biggest in terms of net sales accounting for 56%, followed by the makeup division with 26% of the net sales, fragrance accounting for 14% and hair care products accounting for 4% of net sales.

Source: Estée Lauder Annual Report

About Tom Ford

Founded in 2005 by the designer Tom Ford after leaving Gucci as creative director a year prior, the Tom Ford brand has become a very important fashion brand in the luxury industry generating over $650m in annual revenue. The firm was initially set up as a joint venture between Tom Ford and Domenico De Sole, a significant player in the luxury world working within Gucci, as CEO of Gucci America, and within Sotheby’s as chairman. In 2005 the firm pursued growth in the sunglass and optical frame market in particular and announced a partnership with Marcolin Group, an Italian eyewear production firm who still owns the license to the firm’s line of glasses today. The subsequent year the firm also launched its first product line in collaboration with Estée Lauder: the Tom Ford Estée Lauder Collection of cosmetics. The privately held firm is mainly held by Tom Ford, owning 64% of the firm, followed by the Italian luxury retailer Zegna holding around 15% of the company and De Sole holding 11% of the firm and the last 10% being owned by Grupo Americo Amorim, a Portuguese conglomerate.

Tom Ford has within its product line 4 different categories of products: fragrance, apparel, cosmetics and watches. Tom Ford’s first fragrance was released in 2006, originating from a newly developed rare black orchid, elaborated during Tom Ford’s time as creative director at Yves Saint Laurent: the Black Orchid. Following its release date, Tom Ford’s first fragrance brought an estimated revenue of $40m in its first year. The fragrance is considered one of the main attraction points of the Tom Ford beauty brand, being described by Estée Lauder ’s CEO himself as “the cornerstone of Mr. Ford’s vision to bring more luxury into the world of fragrance”. In addition, the Tom Ford brand is well known for its fashion line, producing and selling a diverse range of apparel to its customers both in menswear and in womenswear. Products such as Tom Ford’s famous underwear collection which has been displayed at many of the firm’s runways, along with a wide range on high quality jackets, cardigans, shirts and trousers which are sold worldwide both via Tom Ford official distribution channels such as their online platform and in retail stores around the world. Moreover, Tom Ford also produces a vast collection of watches and accessories which are very popular amongst the luxury fashion world.

The Luxury Beauty and Fashion Industry

Estée Lauder ’s acquisition of the Tom Ford brand falls within the luxury beauty world, in particular within the luxury cosmetics industry. The deal will represent the largest acquisition within the luxury industry this year and it comes as high-end brands are looking for new avenues for growth as business in China — once the engine for luxury beauty businesses — has become more difficult following the pandemic. The luxury market is one which possesses a very volatile demand as the market driver is represented by specific individuals with increasing disposable income which are not always a certainty especially following the Covid crisis and the current energy crisis hitting the global economy.

The global luxury goods market was worth an estimate of $296.4bn in 2021 and is expected to grow to $355.5bn by 2027, with an estimated CAGR of 4.73% between 2023 and 2027. As mentioned, the industry is highly dependent on increasing disposable income and also on improving living standards. Based on its products the luxury industry is divided into perfumes, jewelry, watches, bags, clothing and cosmetics. These can be further subcategorized according to the distribution channels present within the industry: online, offline and omnichannel brands. In fact, Estée Lauder and Tom Ford, have a mixture of net sales deriving both from physical retail stores and from online sales. The luxury industry has recently taken a hit with the Covid pandemic causing severe restrictions in the industry’s most influential region in terms of market demand: Asia. With the pandemic, the global economy slowed down in terms of disposable income and global GDP per capita, drastically reducing consumers purchasing power and thus decreasing consumers’ willingness to purchase luxurious or non-necessary goods. In Asia, particularly in China, the population saw extremely strict restrictions amid the pandemic, hindering the possibility of economic growth and consumer spending. The poor global performance in 2020 following the pandemic made the luxury goods market drop significantly in size falling from $305.5bn in 2019 to $260bn in 2020. Following the drop in size due to the pandemic hitting the global economy, the luxury industry has picked itself up with an average 7% YoY market size growth reaching a $312bn market size in 2022.

Source: Statista

Luxury goods market size

Source: Statista

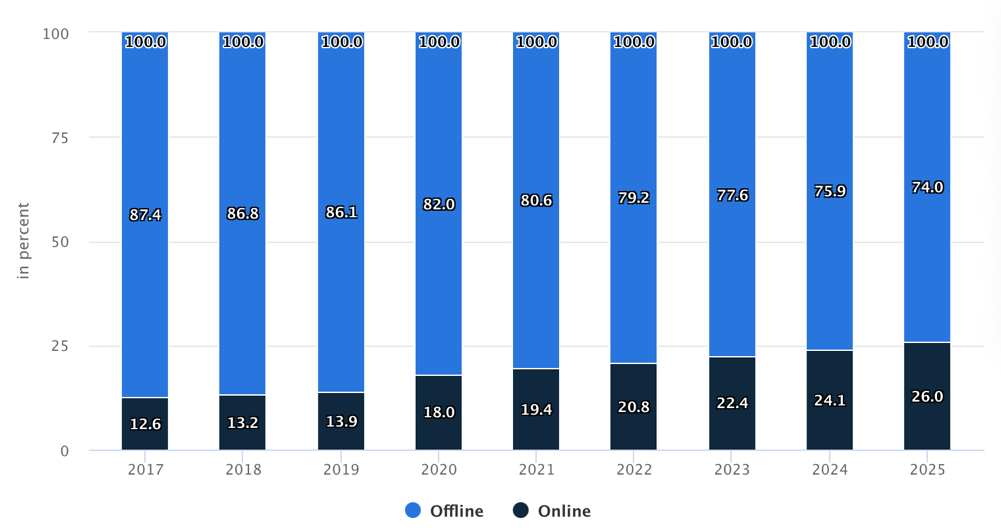

Although physical retail stores maintain their importance and share of net sales, a huge driver of growth for both the luxury industry as a whole and the luxury cosmetics division is represented by online sales. The online sales channeled through ecommerce platforms have been growing thanks to the rapid development of global digitalization allowing firms to easily advertise and reach more consumers while cutting costs and so making online sales far more profitable than sales from brick-and-mortar stores. Online sales have been growing as a percentage of total sales with ecommerce developing as a more convenient sales channel.

Revenue Share: Online vs Offline Channels

The importance of emerging markets within the luxury industry has become one of the most important drivers of the industry with luxury brands shifting their attention towards developing countries. China, India, Malaysia, Brazil and South Africa are some of the most important developing countries generating new large markets from which luxury firms can expand their market share and increase sales. In many of these emerging countries social status has become a very important aspect of consumers who have begun to seek for luxurious products to stand out of economically struggling areas or developing countries and the luxury goods market will no doubt benefit from this particular consumer segment.

Although the pandemic rapidly decreased the luxury market value, M&A operations within the industry did not decrease. The year 2020, in fact, represents a benchmark in the history of the luxury industry as the year with the most M&A transactions ever, seeing over 270 deals being completed throughout the year. The industry saw both before and after the pandemic a period of consolidation with large firms acquiring smaller firms to strengthen their omnichannel strategies of reaching consumers through both online and offline channels. The acquisition of smaller firms will also enable bigger brands to diversify their portfolio of products, enriching their product line with a greater range of collections. At the same time the latter acquisitions will be key for smaller brands, such as Tom Ford, as this will enable them to grow and take advantage of the existing presence of the large brands in emerging markets such as Asia. The future of M&A within the industry is very dependent however on current interest rates which have hindered the prospect of transactions in recent times.

Deal structure

Estée Lauder, will pay $2.8bn and will finance the deal through a combination of cash, debt and $300m in deferred payments that are due from July 2025 onwards. Ahead of Estée Lauder, Gucci owner Kering was in early talks to acquire Tom Ford for roughly $3bn. However, the negotiations with Tom Ford failed due to difficulties in coming to an understanding on a number of fronts, as well as the fact that Estée Lauder already has an established licensing agreement for Tom Ford’s cosmetics and fragrances, which might have made a deal with Kering more difficult.

According to the business, Tom Ford and Tom Ford Chairman, Domenico De Sole, will continue to work with the brand until the end of 2023.

Estée Lauder has decided to renew the prior production licenses to Zegna for clothing lines and Marcolin for eyeglasses since Tom Ford Company not only creates cosmetics and fragrances but also clothing and accessories. The Zegna Group, which has had a license to produce and market Tom Ford men’s clothing since 2006, is arranged to be Estée Lauder’s sole licensee for Tom Ford men’s and women’s clothing, accessories, jewelry, children’s clothing, and home goods. Marcolin, the Italian organization that holds the license for Tom Ford eyewear, will pay Estée Lauder $250m when the deal closes and will maintain the license to produce and market Tom Ford’s eyewear.

Deal rationale

The acquisition highlights the strength of a luxury fashion and cosmetics market that has continued to be resilient in the face of rising inflation and supply chain disruptions.

Not only does it coincide with the high-end companies’ search for new business opportunities in China, but it also represents an effort to get into the fashion industry and, if successful, maybe start to compete with Kering and LVMH. Tom Ford offers the 360º luxury experience, with make-up, fragrance, accessories and lifestyle/interior design items. The purchase of Tom Ford is therefore crucial because it will help Estée Lauder break into the broader luxury fashion sector, which goes beyond merely garments and beauty. Fashion luxury brands today offer not just conventional luxury goods, but also luxurification of even the most common daily objects, such as gym equipment (done by Dior x Techno Gym) or a bread toaster (Dolce and Gabbana x SMEG) – these brands can be considered therefore 360º luxury groups covering many market segments. This deal can therefore grant access for Estée Lauder to a wide range of more niche luxury markets that are necessary for a luxury brand today to offer to its consumer a truly all-round luxury experience.

While the company is famed for its sought-after men’s tailoring, the acquisition was also motivated by the success of Tom Ford’s beauty business, which encompasses fragrance, cosmetics, and skin care and for which Estée Lauder has had a long-standing licensing deal. The luxurious fragrances from Tom Ford, such as Black Orchid and Tuscan Leather, regularly top best-seller lists and sell for more than $100. Estée Lauder has begun to concentrate on perfumes, especially since the luxury fragrance market had an unexpected uptick during the pandemic as consumers sought for inexpensive indulgences. The recent purchases of Estée Lauder within the fragrance market include Frédéric Malle, Kilian, and Le Labo. Despite the fact that hundreds of perfumes are launched each year, a successful scent like Chanel No. 5 or Mugler’s Angel might be the main source of revenue for a company since scent has strong profit margins and year-round appeal. Customers were more inclined to purchase fragrance online during Covid, and this increase in sales has persisted even as things have started to get back to more-or-less normal in North America and Western Europe. By building a solid reputation and a devoted following over the years, Tom Ford has truly been able to establish itself in the market for luxury fragrances. As a result, many people now consider some of the Tom Ford fragrances to be iconic signature fragrances and true staples in their perfume cabinet.

Announcing the acquisition, Estée Lauder said Tom Brand Beauty in particular has delivered impressive success, achieving strong double-digit growth from fiscal years 2012 through 2022. Through this tactical acquisition, Estée Lauder’s growth goals for Tom Ford Beauty will be strengthened and new doors will open up. The cosmetics giant claimed that the agreement will provide it more creative control over the Tom Ford Beauty division, more speed and agility, and potential for expanding its online presence. Other advantages include safeguarding the Tom Ford Beauty brand’s long-term financial flow after the current license expires in 2030. According to the corporation, it will also make royalty payments unnecessary and create new revenue opportunities from licensing.

Some factors concerning the acquisition still remain uncertain: first, how the brand, especially the clothing line, will continue to incarnate the same luxurious allure and provocativeness after the visionary behind it, Mr. Ford, will leave at the end of next year; and second, if and how current inflation will impact customer demand. Clothing lines which retail for much more exclusive prices should remain relatively unaffected by inflation, as they are sold to luxury customers, that are more likely to be able to pay a higher premium for goods. However, while clothing lines could be less impacted, the beauty, fragrances and eyewear industries could be affected a lot more by rising prices. This is because as these goods typically retail for a much lower prices, without going much over $1000 for an item and with an average of $300 per item, they appeal to a much bigger slice of customers, which has however less deeper pockets. This makes the demand for beauty, fragrances and eyewear much more elastic, as the customers would be quicker to switch their preferences and substitute with less expensive brands in case of a rise in prices. Therefore, it is still uncertain whether the current economic environment will pose a threat to Estée Lauder’s highly ambitious expansion plans. Furthermore, it remains to be seen if Tom Ford’s decision to sell to a beauty giant rather than to a major fashion group will become a trend among other firms.

Market Reaction

Shares of Estée Lauder rose about 4% in afternoon trading the day of the deal announcement. However, Estée Lauder’s stock has fallen 17% since the deal talks with Tom Ford were reported by the media in August. This may be due to the fact that, while Estée Lauder already sells Tom Ford beauty products and fragrances, the deal has raised some eyebrows on Wall Street due to the new expansion into the fashion business by the group, given it previously only had beauty companies in its large portfolio. This may leave room for questions by investors on the future handling by the Group of this side of the Tom Ford’s business.

Deal Advisors

Perella Weinberg Partners LP served as financial advisor to Estée Lauder, while Goldman Sachs & Co. LLC acted as Tom Ford’s financial advisor.

0 Comments