Introduction:

The TMT sector focuses on Technology, Media and Telecommunications and is oftentimes the leading fee generating business unit for Investment Banks worldwide. From regional boutiques to large household names like Goldman Sachs, deals are fought over what is seemingly the sector we interface with the most in our daily life. Whether that be calling an Uber to go to work, scrolling social media or placing a phone call. The sector is extremely detailed with several deep pockets of expertise required to fully understand one sub vertical, thus, we have chosen to follow some recent developments in the Telecommunications space, focusing on Vodaphone [LON: VOD] and the European market with its differences to the North American one.

Major operators across Europe including the likes of Deutsche Telekom [FRA: DTE] and Orange [EPA: ORA] have seen the industry shift overtime, in order to adapt they have divested some assets and attracted foreign investors, ultimately culminating in a proposal on behalf of the European Commission to allow larger cross-border M&A in the sector with hopes of creating a more consolidated market similar to the one in the United States.

Telecommunications Update:

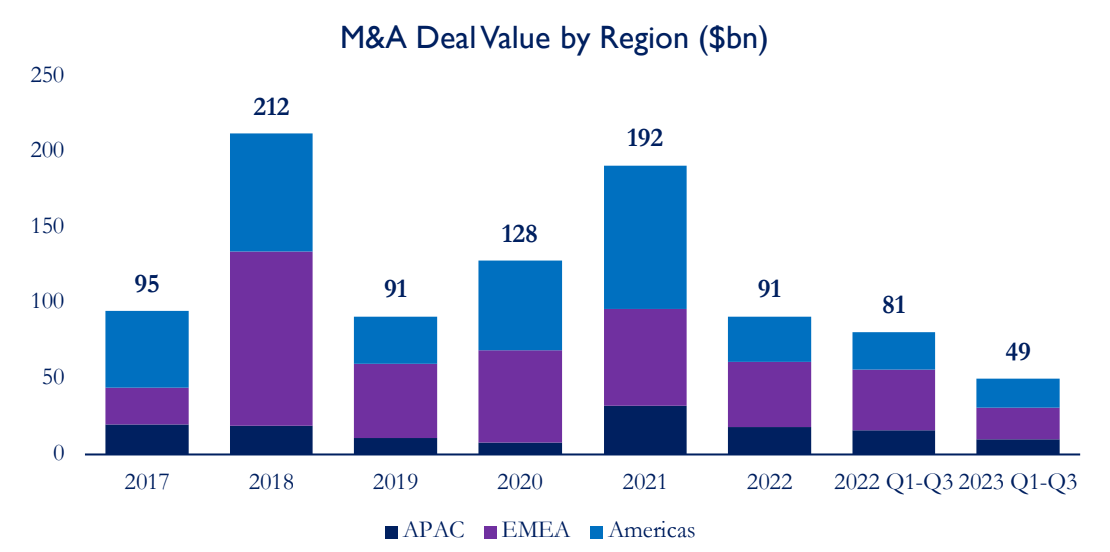

Throughout the last few years, many communication companies have turned to either divestures or consolidation through mergers and acquisitions to prepare themselves for the next era of telecommunications. However, along with most of the industries, global telecom M&A activity continued to slow down in 2023, reaching just $49bn in deal value for the first three quarters of the year, representing a 39% decrease over the same period in 2022. Last year’s decline in both deal value and deal activity can be attributed to the high interest rates, and credit availability constraints, during a time when telecom companies are in need of major network upgrades to adapt to 5G. Geography wise, most transactions came from Europe, the Middle East, and Africa, accounting for over 41% of the total reported deal value as of Q3 2023. Moreover, telecom infrastructure continued to be the main deal type by deal value.

Source: Bain & Company, BSIC

Even though historically they had been government driven or induced, now telecommunications companies are pursuing separation, which involves splitting the existing integrated company into two businesses: one that operates the network (the NetCo) and one that has a customer facing role (the ServCo). Moreover, these divestments also include operations in non-core geographies and non-core business units. On one hand, these transactions allow businesses to have narrower business models, and they may even perform better because of more specialized management. On the other hand, they free up cash to pay outstanding debts, reduce capital expenditures, and/or de-leverage the companies’ finances, three much needed remedies in times of relatively high inflation and continuous high borrowing costs. Also, it is a mechanism for addressing the current market and financial pressures that are the result of the increased infrastructure funding needed because of the ongoing investment-heavy transition towards 5G and Fibre-To-The-Home (FTTH) networks. Furthermore, the diminished organizations have smaller market structures, making them less prompt to regulatory intervention and antitrust.

Companies that go through separation procedures can choose among different methods. There is the accounting separation, the functional separation, where the wholesale (NetCo) and retail (ServCo) areas are set apart as independent businesses with different owners, and the legal separation, where new legal corporations are created but ownership remains in the same hands. As stated earlier, functional separation used to be primarily government mandated as a mechanism to break up monopolies. Nonetheless, it is now more common for telecom companies to consider breakups voluntarily, resulting in significant benefits.

Separation is positive for a telecommunications company for a wide variety of reasons. For starters, it creates some sort of regulatory relief as a divesture alters the existing market structure. In the case of the EU, companies can gain greater pricing and contracting flexibility, allowing them to operate more freely and even improve their margins. Secondly, a carrier neutral NetCo, meaning that it is not directly affiliated with a specific operator, can expand its customer base as it now can offer its services to various operators while potentially keeping the same infrastructure, resulting in a greater addressable market and possibly larger revenues. Thirdly, by operating independently, NetCo’s companies have more financing options. As they invest mostly in infrastructure, an alternative asset that has gained increased traction because of its ability to act as a hedge against inflation as well as its “safe” returns, pure NetCo’s companies are able to attract investors with more ease. On the contrary, ServCo’s are able to attract investors who aim for higher risk-adjusted returns. Hence, having the different services separated offers better fundraising capacities for each type of firm.

Additionally, the separation between a NetCo and a ServCo allows the companies to have more focused management teams. As the investment horizon differs between the wholesale and retail business, with NetCo’s planning in 10-to 15-year time frames for infrastructure investments that last for decades, while ServCo’s work with short-term investment cycles mostly centered around commercial activities, having differentiated companies can lead to better investment decisions. The management team can then direct the strategy and budget solely to the specific requirements of each company, improving its efficiency. Lastly, the current transition towards 5G benefits NetCo’s companies more, than integrated carriers, as they can benefit more from the network sharing that is likely to occur. 5G will increase the cost of network ownership because of the higher requirements on the capillarity of fibre networks in highly densified urban areas. A survey conducted by McKinsey showed that 93% of CTO’s (Chief Technology Officers) expect an increase in network sharing as a result of the growth of 5G.

Nonetheless, even though separation has the capacity to lead to value creation, it may also have the opposite effect and result in value destruction. By divesting their network ownership, telecommunication companies may face higher costs in their day-to-day operations because of the contracts they may sign with NetCo’s, as well as lose substantial advantages that they used to have when being vertically integrated. For example, ServCo’s may lose the preferential treatment they used to have regarding operational integration. Moreover, they will no longer have the power to influence NetCo’s investments into specific geographies that end up benefiting the retail business. Consequently, while there are benefits to separating a telecom company into two different businesses, there are associated risks that might offset all of the positive aspects of the divesture.

On the other hand, as a result of greater competitive threats and industry transformation, telecommunications companies have also turned to M&A to add new capabilities and geographies, allowing them to evolve their businesses for the future. The telecom industry is constituted by mostly big players because of the economies of scale related to running the business. Then, firms with smaller operations may find it complicated to compete against the larger companies. Consequently, those firms resort to M&A to help grow their smaller companies, gain scale, and be able to make the necessary investments to compete with the larger, market-dominant firms. Moreover, the softening of the regulators in some countries has strengthened the M&A activity, with firms aiming to realize both CapEx and OpEx synergies both on their networks and retail businesses. Furthermore, the ongoing technology shifts, from 4G to 5G, from copper to fibre, the growth of data storage units, will further encourage firms to continue growing through M&A activity.

As the telecom industry is very capital intensive, many companies built and expanded their networks through debt during the years when interest rates were low. However, facing pressure to earn returns from past investments as well as the burden that the high interest payments currently represent, many telecom companies are selling their assets to private equities (PE). Over the past years, PE firms have taken a serious interest in towers and fibre broadband networks due to their passive nature and continuous ability to generate long-term cash flows.

TMT Divestures in Europe:

The Media and Telecommunications sector in Europe has been a driving force in both the EU and UK economies for many years and the proposed wave of consolidation may bring an easier path for the otherwise extremely competitive market.

Some very significant changes and trends have come to Europe including an increase in asset divestitures and an inflow of foreign investment. Firms have struggled due to the high levels of competition which has led to suppressed financial health and several billions of debts on their large balance sheets. Unlike the United States, the European telecommunication market does not only have AT&T [NYSE: T], Verizon [NYSE: VZ] and a few other players, the complex regulation, and the natural challenges that 27 EU member states must navigate leads to an increase in the number of market participants – which has resulted in slower growth. One of the main trends we have seen is the liquidation of non-core assets, an example of this is mobile towers which are considered non-core due to the technical definition of “infrastructure assets that are not Fibre Network Assets, including but not limited to networks consisting of electrical coaxial cable, fixed wireless, or satellite assets.” One of the largest telecom deals recently is the mega deal by KKR [NYSE: KKR] and TIM [BIT: TIT] at well over $20bn for the Italian telecommunication giant’s network grid, this has highlighted the increase in divestitures across Europe.

The rise of foreign investors & foreign firms buying stakes has also been relevant in the EU telecommunications market. A key example is the consortium of private investors including Xavier Niel that jointly took the Vodaphone competitor Iliad private for $3.7bn in 2021. This was at a time when other ultra-high net worth individuals were attempting to take stakes in telecom firms such as Patrick Drahi who also privatized France’s second biggest telecoms group SFR – “Société française du radiotelephone”. Not only has Middle Eastern money flowed into the European continent in the form of our favourite sport franchises including Newcastle United and Paris Saint Germain but the allure of the telecommunications market and individual companies with weakened financial health has enabled Middle Eastern giants to expand their reach. In the last few years, we have seen an increase in deal flow with 4 major transactions valued at well over €5bn conducted by the Saudi Telecom Company which owns nearly 10% of Spanish giant Telefonica as its largest shareholder and e& the UAE based technology group with its ever-growing stake in Vodaphone which it plans to grow to 20%.

The European Union’s high concern for antitrust issues and fair competition has enabled a highly fragmented market to emerge across the EU with several companies operating in each country. This has led to increasingly thin margins and companies that are full of debt, unlike in the United States where the market is much more united. A new wave of EU sentiment has shown sympathy towards the idea of more relaxed antitrust policy in the space which gives shareholders hope for increased performance and a bright future for Europe’s largest companies.

Recent Transactions in the European TMT Industry:

The following aims to provide a summary and analysis of the most relevant TMT transactions that occurred in 2022 and 2023, highlighting the key features of each.

Orange & MasMovil: Beginning in Central Europe, the merger between the French’s mobile operator Orange, and the Spain’s MasMovil [BME: MASM] was announced in July 2022, with an overall enterprise value of approximately $20.1bn ($8.5bn for the former and $11.8bn for the latter). The terms of this transaction were approved by the European Commission in February 2023. After this merger, which is expected to be completed by the end of Q1 2024, the two firms will combine their operations in Spain, in the form of a 50-50 joint venture. The two companies will share co-control over this newly formed company, with equal rights to governance. The gain of competitive power through the combination of the two companies’ assets and internal knowledge is the primary rationale for this agreement, with the merged company becoming the largest player in the Spanish telecommunications market. This scale will allow the joint venture to invest in 5G and fibre and generate cost savings. Revenue for 2024 is expected to be $8bn, with expected synergies of more than $490m.

KKR & TIM: Approved in November 2023, the $20bn acquisition of the TIM fixed-line network is one of the most significant TMT deals in the Italian context for that year. This sale involves an asset which is strategically important for Italy as the country aims to close its technological gap compared to other EU nations. Consequently, the Italian government has permitted the Treasury to allocate up to €2.2bn euros for acquiring a 20% stake in the network, alongside the US private equity firm. The transaction is part of TIM CEO Pietro Labriola’s plan to reduce the debt of the phone company, that led to a junk rating and consequent struggles in financing investment. The transaction is expected to reduce the company financial debt by approximately $15bn. (Read out past article on the deal)

Telekom Austria Spinoff: In August 2023, shareholders of Telekom Austria Group [WBAG: TAG], the Austrian largest telecommunication provider, approved in the extraordinary General Assembly their decision to spinoff the cell tower business, which includes around 12,900 towers in Austria, Bulgaria, Croatia, Serbia, Slovenia and North Macedonia, as a separate company, EuroTeleSites [WBAG: ETS]. The newly formed company was then listed in the Vienna Stock Exchange. Shareholders of Telekom Austria AG received one additional EuroTeleSites share for every four Telekom Austria shares held.

Stonepeak & Cellnex Telecom: Moving to North Europe, the Stonepeak acquisition of a 49% stake in Cellnex Telecom Sweden and Danish subsidiaries for $793m (equivalent to a multiple of 24x 2024E EBITDAaL) is one of the most relevant transactions of the TMT sector in 2023. Stonepeak is a leading American alternative investment firm focused on infrastructures and real estate, while Cellnex [BME: CLNX] is a Spanish wireless telecommunications infrastructure and services company. By selling a stake in its Nordic business, the management of the company aims to attain investment grade ratings. Stonepeak managers, on the other hand, are confident that Cellnex Nordics, as a regional leader, is strategically well positioned to capture outsized organic and inorganic growth in the future years.

KKR & Telenor: Announced in October 2022 and completed in February 2023, KKR acquisition of 30% of the shares of Norwegian telecommunications company Telenor [OSE: TEL] at a $3bn valuation, is another North European relevant transaction. A new company called Telenor Fiber AS was established, whose fibre assets include more than 130,000 km of cables, connecting approx. 560,000 homes. The deal is consistent with Telenor’s plan to secure a fast-paced rollout of fibre in Norway in the upcoming years and to solidify the infrastructure business’s value. Telenor intends to gain a significant portion of Norway’s remaining fibre market. To that end, the company will keep expanding fibre coverage throughout the country and giving customers more access to high-speed fixed, mobile, and TV services. KKR shares a long-term outlook for the Nordic telecom sector and have substantial experience in digital infrastructure.

Saudi Arabia & Telefonica: Over the summer of 2023, Saudi Arabia’s STC Group [Tawadul: 7010]—a prominent provider of telecommunication services in the country of Saudi Arabia— accumulated a 9.9% interest in Telefónica [BME: TEF], a Spanish telecommunications corporation, for a total estimated worth of $2.3bn, becoming the majoritarian shareholder. The acquisition of a major ownership interest in Telefónica is Riyadh’s second recent venture into European communications fits into the country’s long-term strategy to diversify its primarily oil-focused economy. In April 2023, STC made another investment in European telecoms infrastructure when it decided to purchase tower infrastructure from the United Group, a southeast European operator, for $1.4bn.

Emirates Telecommunications & PPF Group: Another major deal involving an Arabian entity is the purchase of Czech PPF Group’s telecommunications holdings in Bulgaria, Hungary, Serbia, and Slovakia by Emirates Telecommunications Group Company e&, announced in August 2023. The parties involved in the transaction have established that e& will pay a sum of $2.4bn initially at the time of acquisition for a 50% plus one share stake in PPF Telecom. In addition, there will be extra earn-out payments that could reach up to $380m over the next three years if PPF Telecom surpasses specific financial objectives. However, there is a provision for a claw-back of as much as $90m if these financial goals are not met. The deal lays the groundwork for a collaboration between PPF and e& aimed at developing a significant telecommunications enterprise in Central and Eastern Europe. Both parties, PPF and e&, are focused on achieving substantial synergies across different domains, such as enhancing procurement processes and improving wholesale and roaming agreements. The collaboration enables PPF Telecom to get into e&’s market knowledge to introduce superior digital, IoT, and B2B services, thereby enriching customer services and experiences.

VEON Russia: Veon, a global digital operator that provides converged connectivity and online services, announced in October 2023 the completion of its exit from its Russian operations, which were sold to a group of senior members of the PJSC VimpelCom management team, led by VimpelCom CEO Alexander Torbakhov. This sale allowed Veon to focus on the other six emerging markets in which it operates with a lower leverage and ample liquidity, delivering higher growth.

The Vodafone Case:

Vodafone Group is a British multinational corporation with a direct presence in over 21 countries and partner networks in other 48. Founded in 1991 after being demerged from Racal Electronics, the firm began operating in the UK and continued to grow to become one of the world’s most important telecommunications companies. At the beginning of 2022, Cevian Capital, Europe’s largest activist investor, took a position on the company and began lobbying in favor of a divesture of some of the company’s international assets, as well as further strengthening the key markets. Consequently, over the past couple years, the group began to decrease the size of their European operations in an attempt to strengthen its financial health and consolidate in the markets where they hold a significant market share, as well as to seek strategical acquisitions.

On August 2022, Vodafone agreed to sell 100% of its operations in Hungary for $1.8bn to both 4iG, a local company with significant interests in the telecommunications and IT markets, and with close relationships to the country’s government, and Corvinus Zrt, a Hungarian state holding company. The price represented an EV/EBITDA multiple of over 9.1x, showcasing a significant premium over the 6.0x multiple telecom companies in Europe were trading at the time. The cash from the sale allowed Vodafone to pay part of its large debt, which amounted to over €41.6bn in March 2022. Moreover, the sale created Hungary’s second largest mobile and fixed operator, making it now a direct competitor to Deutsche Telekom’s local business, Magyar Telekom. Nonetheless, Vodafone retained ownership of its Vodafone Investment Solutions (VOIS) operations, a call centre, and the telecom towers through Vantage Towers.

On November 2022, Vodafone entered into an agreement with KKR and Global Infrastructure Partners (GIP) to sell a portion of Vantage Towers to the two infrastructure investors, creating a joint venture (JV). Vantage Tower is one of Europe’s leading tower operators, with over 83,000 sites in 10 countries. The JV initially controlled an 81.7% stake in the company, which later grew to 89.3% of the shares after launching a voluntary takeover (VTO) for the shares held by the minority investors at a valuation of €32 per share, which represented a 19% premium to the average of the previous three-month price. The deal, which valued Vantage Towers at $16bn, allows Vodafone to remove the company, with its debts, from their balance sheet while retaining partial ownership, as well as to get the necessary financial backing to bankroll the expansion of the 5G network. Vodafone received at least €3.2bn of proceeds from the transaction, which at the moment could allow the company to reduce its leverage by 0.2x, and proceeds at the moment had the potential to further increase to €5.8-€7.1bn. Moreover, Vodafone recorded a €8.6bn gain on disposal on its 2023 financial statements because of the Vantage Tower transaction.

On June 2023, Vodafone and CK Hutchison Group Telecom, owner of Three UK and a subsidiary of Hong Kong based CK Hutchison [SEHK: 1], agreed to merge their operations in the UK. Vodafone will own 51% of the combined unit, while CK will retain 49%. It was a non-cash transaction in which each company would contribute equitably to the debt amounts according to their ownership levels. Additionally, Vodafone has an option to buy-out CK’s 49% stake three years after completion. The merger will create the UK’s largest mobile virtual network operator (MVNO) with over 30% of the market share, overtaking both EE and 02, and creating a fairer playing field in an already ultracompetitive industry. The transaction is expected to bring substantial synergies, which are expected to account to over £700m in annual total cost and CapEx by the end of the 5th year post-completion. Moreover, the new business is expected to invest over £11bn over the next 10 years to create one of Europe’s most advanced 5G networks. Nonetheless, on January 2024, the Competition & Markets Authority (CMA), the UK’s competition regulator, began a formal probe into the ongoing merger, citing that it might impact competition. The CMA has 40 days to assess the planned merger and decide whether to continue with a more in-depth probe. While the outcome of the decision can go either way, it is important to take into account that seven years ago, the CMA blocked Hutchinson’s attempt to merge with 02. Furthermore, as Hutchison is a Hong Kong based firm, the deal also needs to receive approval because of the UK National Security and Investment Act, which allows the government to intervene in any deal when they deem there is a substantial risk to national security.

On October 2023, Vodafone agreed to sell its Spain operations to UK-based Zegona Communications [LON: ZEG] for €5bn. This divesture makes sense for both parties, as for one party it is a deal that won’t face any regulatory hurdles, while for the other it allows them to exit from a very competitive market where they haven’t been able to grow, or generate the same average revenue per user (ARPU) as in their other geographies. Moreover, Vodafone will continue providing services to Vodafone Spain, now under Zegona ownership, for around €110m a year, as well as both companies agreed to a brand license deal, allowing Zegona to benefit from the brand name Vodafone has in Spain. Furthermore, the acquirers have expressed their interest into merging in the future with any of the other operators in Spain to continue expanding their business. Overall, the disposal is Vodafone’s biggest step in reducing the size of its European business, especially in a geography where they didn’t have market power nor produced the most attractive returns.

More recently, on December 2023, Iliad [Euronext: ILD], the French telecommunications company, proposed a merger of its Italian operations with those of Vodafone Italy, a proposal that had already been made and rejected two years ago by the UK-based company. On January 2024, Vodafone once again rejected Iliad’s proposal. The deal, which aimed to create a 50-50 JV, would have raised new debt to pay €6.6bn in cash to Vodafone and €0.4bn to Illiad, and would have had an enterprise value of €14.9bn. However, valuation wise, the deal was less than ideal for Vodafone as they would have been valued at ~8.0x its forecast EBITDA after lease payments, while Iliad was at 17.0x. Moreover, the transaction would have generated cost saving synergies of over €600m, as well as created a stronger business that would have been better suited to excel in the extremely competitive telecom market of Italy. Nonetheless, the M&A market for Vodafone Italy is all but done, as there are rumors of a potential merger with Fastweb [SIX: SCMN]. This deal, unlike the one with Iliad, would mean less regulatory scrutiny, but also less cost synergies as Fastweb is mostly a fixed-line operator with a small presence in the mobile area.

Overall, Vodafone’s recent transactions have allowed them to exit markets where the company was trailing behind its competitors, as well as to form strategic alliances in its core markets. Moreover, transactions as the ones shown before, along with others that might happen in the future, will continue helping the company reduce its large debt balance, which as of FY 23’ it felt close to 2019 levels. Furthermore, both the divestures and strategic M&A is expected to contribute to reverse the ongoing long period of share underperformance, which led the stock to its 25-year low.

Conclusion:

Despite a lack of dealmaking activity, the European TMT sector saw several divestitures or consolidations through M&A in 2023, with Vodafone being a prominent participant as a result of its strategy to reduce the scale of its European operations.

Three main drivers of the TMT industry in 2024 are interest rates, government restrictions, and overall growth predictions. These factors provide a large amount of uncertainty for projections. Rate reductions in 2024 may force TMT companies to postpone dealmaking until 2025 in order to wait for more favorable financing terms and better valuations. Moreover, TMT companies are also awaiting new regulations that would facilitate consolidation. Consolidation and the reappearance of the NetCo model, in which businesses own, run, and lease network equipment to telcos and service providers, are reshaping telecom market structures in an effort to realize synergies, mutualize costs, and draw in outside investment. Such trends are expected in both the fixed and mobile sectors, particularly in Europe, highlighting significant investment prospects.

In conclusion, there are two possible outcomes in this uncertain context. According to Bain, the least optimistic view, which holds a 30% consensus predicts fewer deals in 2024 than in 2023, mostly because of the cost of financing and the gap in buyer-seller valuation. However, on a more positive note, certain economists anticipate a reduction in inflation and dealmaking growth in 2024 that could surpass expectations, overall benefiting the TMT M&A activity.

0 Comments