BP P.L.C. (BP:LSE) – market cap as of 05/05/2017: £88.41bn ($114.33bn)

China Petroleum & Chemical Corp (0386:SEHK) – market cap as of 05/05/2017: HK$762.30bn ($97.93bn)

Introduction

On April 27, 2017, it was announced that BP had agreed to sell its 50% stake in the Chinese SECCO Petrochemical Company Limited (SECCO) to Gaoqiao Petrochemical Co Ltd, a fully-owned subsidiary of China Petroleum & Chemical Corporation (Sinopec), for a total transaction value of $1.68bn.

Shanghai SECCO Petrochemical Company Limited was founded by China Petroleum and Chemical Corporation (Sinopec Corp.), Shanghai Petrochemical Company Limited (SPC) and BP East China Investment Company Limited with an investment of about $2.7bn in a 30%, 20%, and 50% proportion respectively (810m, 540m, 1.35bn). The SECCO plant started operations in 2005 by manufacturing products such as ethylene, which is an essential building block for plastics. It is by far one of the largest petrochemical projects in China.

About BP P.L.C.

BP P.L.C. is one of the so-called “supermajors”, the nickname given to the seven largest oil and gas producers worldwide. As a vertically integrated company it operates in virtually all the segments of the oil and gas industry, including the initial stages of exploration and production, the later refinement and distribution as well as power generation and trading.

BP has operations in more than 70 countries, producing around 3.3 million barrels per day. The company has more than 17,000 service stations worldwide. Its largest division is BP America in the United States, whereas in Russia it owns a 19.75% stake in Rosneft, the world’s largest publicly traded oil and gas company. BP has a primary listing on the London Stock Exchange and has secondary listings on the Frankfurt Stock Exchange and the New York Stock Exchange.

The firm was founded as the Anglo-Persian Oil Company in 1908. In 1954, it was renamed to British Petroleum. Formerly state-owned, the British government completed the privatization of the company by 1987. British Petroleum merged with Amoco in 1998, becoming BP Amoco P.L.C., and acquired ARCO and Burmah Castrol in 2000, and was renamed to BP P.L.C. in 2001.

The performance of BP’s stock price is strongly correlated with developments in the oil price, and has fallen throughout the past three years. The 2010 Deepwater Horizon oil spill caused the firms stock price to halve within three months. Its TTM P/E multiple of 51.3x, below industry average of 54.0x, can be partially explained by its negative 3-year average net income growth of -83% and operating margins of only 0.5%, while at the same time having a Debt/Equity ratio of 0.6x (double the industry average of 0.3x). The higher leverage emphasises the risk of the company and could to a certain extent explain why the company is trading at a slight discount. BP, however, outperforms its peers as far as TTM ROE is concerned, with a return to shareholders of 2.2% vs. the 1.8% industry average.

About Sinopec

The China Petroleum & Chemical Corporation, which is also known as Sinopec Ltd., is a Chinese oil and gas company based in Beijing, China. It is listed on the Stock Exchange of Hong Kong (SEHK) with secondary listings in both Shanghai and New York. The company is fully owned by Sinopec Group, a state-owned Chinese petroleum and chemicals behemoth.

Similarly to BP, Sinopec’s vertically integrated businesses includes oil and gas exploration, refining, marketing and distribution while also engaging in the production and sale of chemical fibers, fertilizers and petrochemicals both in China and abroad. Sinopec produces around 1.6 million barrels per day and is China’s largest refiner by annual volume processed.

The company has expanded rapidly throughout the past years through a string of strategic acquisitions. In December 2006, Sinopec acquired the assets of Shengli Petroleum to stabilize its crude inputs and raise the utilization rate of its existing refineries. In 2013 the company made the following investments: it bought Sinopec Group’s overseas oil and gas-producing assets for $1.5bn, it acquired a 33% stake in Apache Corporation’s oil and gas business in Egypt for $3.1bn, and bought Marathon Oil Corp’s Angolan offshore oil and gas field for $1.52bn.

Sinopec has a very low trailing P/E multiple of 11.4x, compared to the industry average of 54.0x. Despite its revenue growth and net income growth being -12.5% and -11.0% respectively over the past years, Sinopec has performed significantly better than peers, while offering a solid 8.1% TTM ROE and a low Debt/Equity ratio, equal to 0.2x. Sinopec’s relatively low multiple could be explained by investors’ concern over possible Chinese currency devaluations as well as uncertainty arising from Sinopec’s ties to the Chinese government (risk perception makes a company trade at a lower multiple) or by potential growth opportunities (higher growth reflects lower multiple values according to Gordon’s Growth Model).

Industry Overview

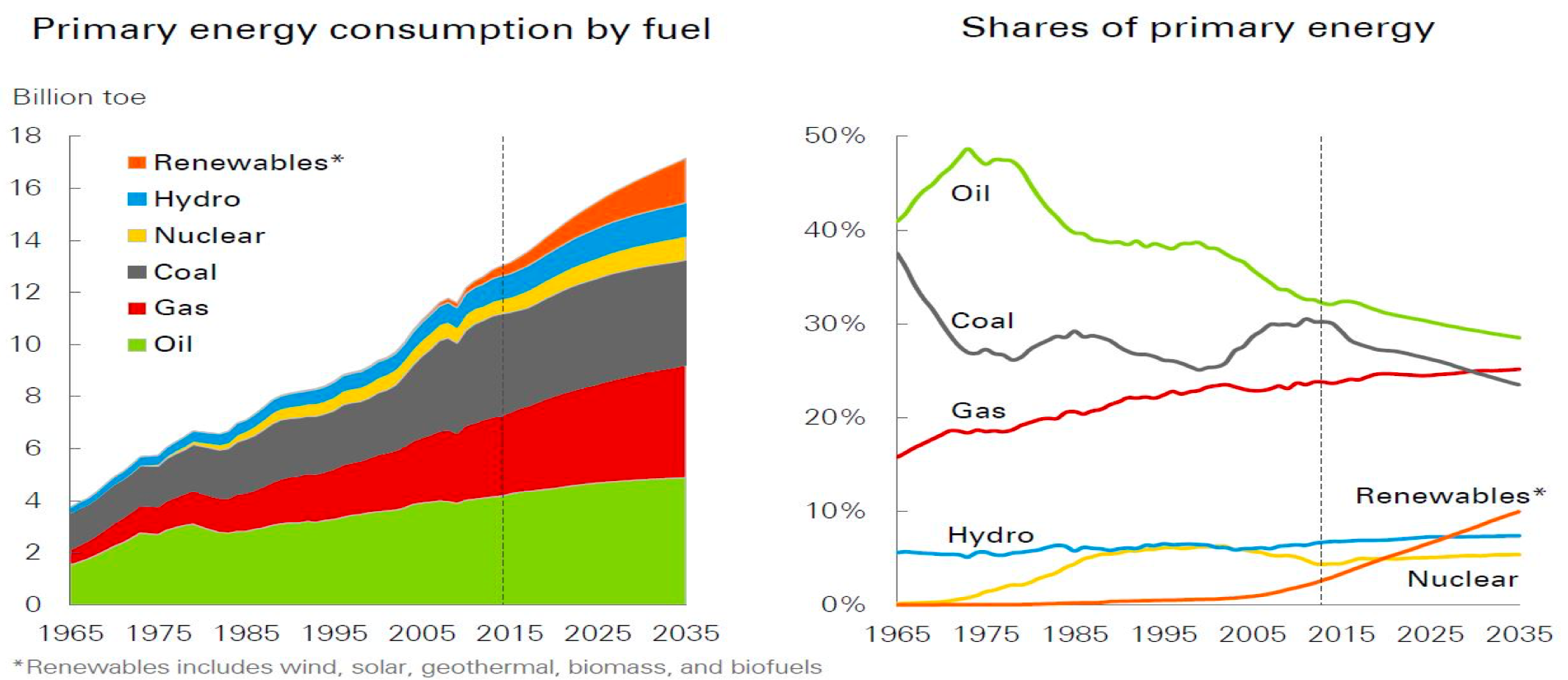

According to the BP’s Energy Outlook report, the global energy landscape is changing as sources of demand are being affected by fast-growing emerging markets. Furthermore, the energy mix is shifting, driven by technology improvements and environmental constraints. The main features of energy transition are illustrated by the gradual decarbonisation of fuel and the increase in competitiveness of renewable energy sources, which together with nuclear and hydro energy are predicted to provide around half of the increase in global energy by 2035. Natural gas is expected to grow faster than oil or coal thanks to the increasing accessibility of LNG (liquefied natural gas) across the world. Oil demand is expected to rise in the future, but at a slower rate due to more efficient technological improvements such as electric vehicles etc.

Source: Zhang, Lixin & Tao, Ye & Jiang, Yan & Ma, Ju. (2018). Research on the Direction of China’s Energy Development and Coping Strategies Based on the Trend of World Energy Development.

In general, overall energy demand is expanding and is expected to keep the same pace, due to increasing income levels and population growth (mainly driven by improved net-worth levels) in fast-growing emerging markets. World GDP over the reported time period is forecasted to double in size due to rising prosperity in developing countries, which will see more than 2bn people escape the so called “poverty zone” and a total world population of 8.8bn by 2035. GDP is positively correlated to the increase in energy demand, however, advances in energy will offset this increase in demand. In fact, energy demand is assumed to increase by only 30%. China and India account for half of the increase in GDP, this fact emphasizes the potential market growth arising solely from these two markets. At present, China represents the largest growth market for energy, although it is likely to be overtaken by India by 2035.

In terms of fuel mix, nuclear and hydroelectric powers are expected to account for half of the growth in energy supply over the next 20 years. Among the different types of fuels, gas, as previously stated, is the fastest growing fuel and is expected to overtake coal to become the second largest fuel by utilization by 2035. On the other hand, renewable energy is the fastest growing type of energy as it will constitute 10% of total energy consumption by 2035, in contrast to 3% in 2015.

LNG will lead to increasing integration across gas markets: unlike pipeline gas, liquefied natural gas can be redirected to different parts of the globe in response to regional fluctuations in demand and supply. This will grant LNG suppliers power to move gas prices.

As far as China is concerned, its demand for energy is projected to grow by less than 2% in the upcoming years in contrast to its 6% over the last 20 years. This reduction is caused by sharp declines in energy intensity (as China is moving away from energy-intensive industries), combined with an easing in economic growth.

Deal Structure

BP has agreed to sell its 50% stake in Shanghai SECCO Petrochemical Company Limited (SECCO) to Gaoqiao Petrochemical Co Ltd, a fully-owned subsidiary of China Petroleum & Chemical Corporation (Sinopec), BP’s joint venture partner. BP will cash in a total consideration of $1.68bn less any possible dividends, which would be paid by SECCO to BP from the date of the acquisition agreement to the closing date. In 2016, BP reported after-tax profits from its SECCO stake for a total amount of $301m. This leads to an implied Price-Earnings multiple of about 5.6x (below industry average according to Morningstar). Moreover, as of FY2016, the value of gross assets subject of the transaction was $993m.

The transaction is subject to regulatory approvals and other conditions. The companies announced that they would probably complete the transaction before the end of 2017 with the consideration payable in instalments. Upon completion of the deal, Gaoqiao Petrochemical will own 50% of SECCO’s shares. As for the remaining 50% stake, Sinopec and Shanghai Petrochemical will continue to own 30% and 20% respectively.

Deal Rationale

SECCO is currently a supplier of feedstocks for Gaoqiao Petrochemical, which in turn is the main naphtha supplier for SECCO. Through this acquisition, Sinopec will be able to exploit additional synergies from the integration of SECCO and Gaoqiao Petrochemical’s refinery projects. Additionally, the deal will facilitate the construction of one of Sinopec’s big four refining-chemical bases in Shanghai. Overall, SECCO has reported strong business performance and, after the deal, it is expected to maintain, and possibly improve, these positive results.

From BP’s perspective, the move marks the company’s withdrawal from what used to be the largest chunk of its petrochemicals business. Furthermore, the deal can be interpreted as part of the London-based company’s planned sale of $4.5 to $5.5bn worth of assets aimed at financing a fine related to the Deepwater Horizon oil spill. BP has indeed been held responsible for the most devastating offshore oil spill in the US history and, as a consequence, will have to pay a fine of $62.6bn to make up for the damages. To this aim, the firm has already raised more than $50bn from assets sales.

Rita Griffin, COO at BP Global Petrochemicals, pointed out that the rationale of this sale was to align their Chinese business with BP’s current global strategy: at present, the company indeed prefers to focus on areas where it has leading proprietary technologies and competitive advantage. Despite a decreasing growth in China’s demand for energy, BP still considers the country as a key region for its chemical business segment and SECCO’s divestment paves the way to new opportunities aimed to exploit the firm’s competitive position worldwide.

Market Reaction

As of April 27, 2017, BP’s share price decreased by 6.82p (approximately -1.5%) to 446.83p following the announcement of the transaction. Given the small price fluctuation, the stock reaction may have been triggered by secondary market activity or by investors’ scepticism regarding the withdrawal from what is today the fastest growing market in the energy industry, which could impair the company’s ability to exploit future growth opportunities. Sinopec’s stock price remained unchanged in the range of $0.82-$0.83.

Advisors

BP was advised by Morgan Stanley, while China United Assets Appraisal Group Co., Ltd served as financial advisor to SECCO.

0 Comments