Introduction

Merger Arbitrage tackle the potential of mergers and acquisitions (M&A) to yield returns irrespective of market conditions. By examining the transaction dynamics, we illustrate how arbitrageurs capitalize on the ‘deal spread’ – the difference between the current market price and the proposed acquisition price. As we navigate through various approaches, the article sheds light on the potential and limitations of merger arbitrage. Through empirical data and analysis, we aim to get a deeper understanding of how this strategy performs in different market conditions, highlighting its viability as a component of a diversified investment portfolio. Moreover, we examine the expected outcomes of these transactions, illustrating how Machine Learning identify subtle patterns that may indicate the success or failure of a merger. Lastly, we apply the theory to the specific case of BHP’s attempt to acquire Anglo American trying to understand weather this deal actually represents ab opportunity for Merger Arbitrage or not.

All-cash vs All-stock deal

When an M&A deal is announced, since there is some risk of the transaction either being successful or not, after the offer price or exchange ratio are announced, the target company will typically trade at a discount to it. This discount, more commonly called deal spread, is the measurement of potential return for the Merger Arbitrage strategy.

The decomposed expected return of this strategy can be written as follow:

![]()

In an all-cash deal, after the price offer is announced, the target company will trade at a discount to it, allowing the risk arbitrageur to bet on the deal being successful, by buying shares at the discounted price. If the deal is completed, he would then resell those shares at the price offered realizing a profit equal to the deal spread.

Assuming that the target company pays no dividends and if the deal is unsuccessful, the share price of the risky asset will revert back to its pre-announced level, we can define the expected return for a cash-only deal as follows.

![]()

![]()

In an all-stock deal scenario, the process entails exchanging the shares of the target company for shares of the acquirer. Essentially, the acquirer would determine an exchange ratio, specifying how many shares of the acquirer’s stock each share of the target company will be converted into.

Before the merger announcement, the share prices of both companies were known. After the announcement, the market reacted, causing the share prices to adjust. Initially, the risk arbitrageur can make an unhedged bet by simply buying shares of the target company. The potential profit is calculated by subtracting the current market price of target company shares from the value of the shares they would receive in the merger. This assumes that the share price of the acquirer company remains stable until the deal is completed.

However, a more common and conservative strategy is to hedge the bet. In this case, the risk arbitrageur also takes a short position on shares of the acquirer company. For every share of the target company purchased, the risk arbitrageur sells short an amount equal to the exchange ratio of acquirer company shares. This way, they are protected against fluctuations in the market and the share price of the acquirer.

The goal of the hedged bet is to secure the spread between the target share price and the acquirer’s share price. As long as the deal is completed under the initial terms proposed, the risk arbitrageur stands to make a profit, regardless of market movements.

With the same assumptions we made for the all stock-deal we can define the expected return in case of success or failure of the deal as follows:

![]()

![]()

Where P is some price identified by the super- and subscript; the superscripts T and A refer to target and acquirer, respectively, the pre/post subscript refers to whether the price is before or after the deal announcement, and is the exchange ratio.

Risk Arbitrage Return Series for all-cash and all-stock deals

If we look at Risk Arbitrage Return Series, we can start taking into account the profits made with dividends and, for each M&A deal at time we calculate the return for all-cash deal as:

![]()

Where ![]() is the closing share price of the target company on day

is the closing share price of the target company on day ![]() ,

, ![]() is the dividend payment made by the target company on day

is the dividend payment made by the target company on day ![]() and

and ![]() is the closing share price of the target company on day

is the closing share price of the target company on day ![]() . Likewise, the return for an all-stock deal is calculated as follows:

. Likewise, the return for an all-stock deal is calculated as follows:

![]()

![]() remain the same as above, while

remain the same as above, while ![]() refer to the same values for the acquiring company,

refer to the same values for the acquiring company, ![]() is the exchange ratio of the deal, and

is the exchange ratio of the deal, and![]() is the daily risk-free rate on day t.

is the daily risk-free rate on day t.

Benefits of Merger Arbitrage Strategies

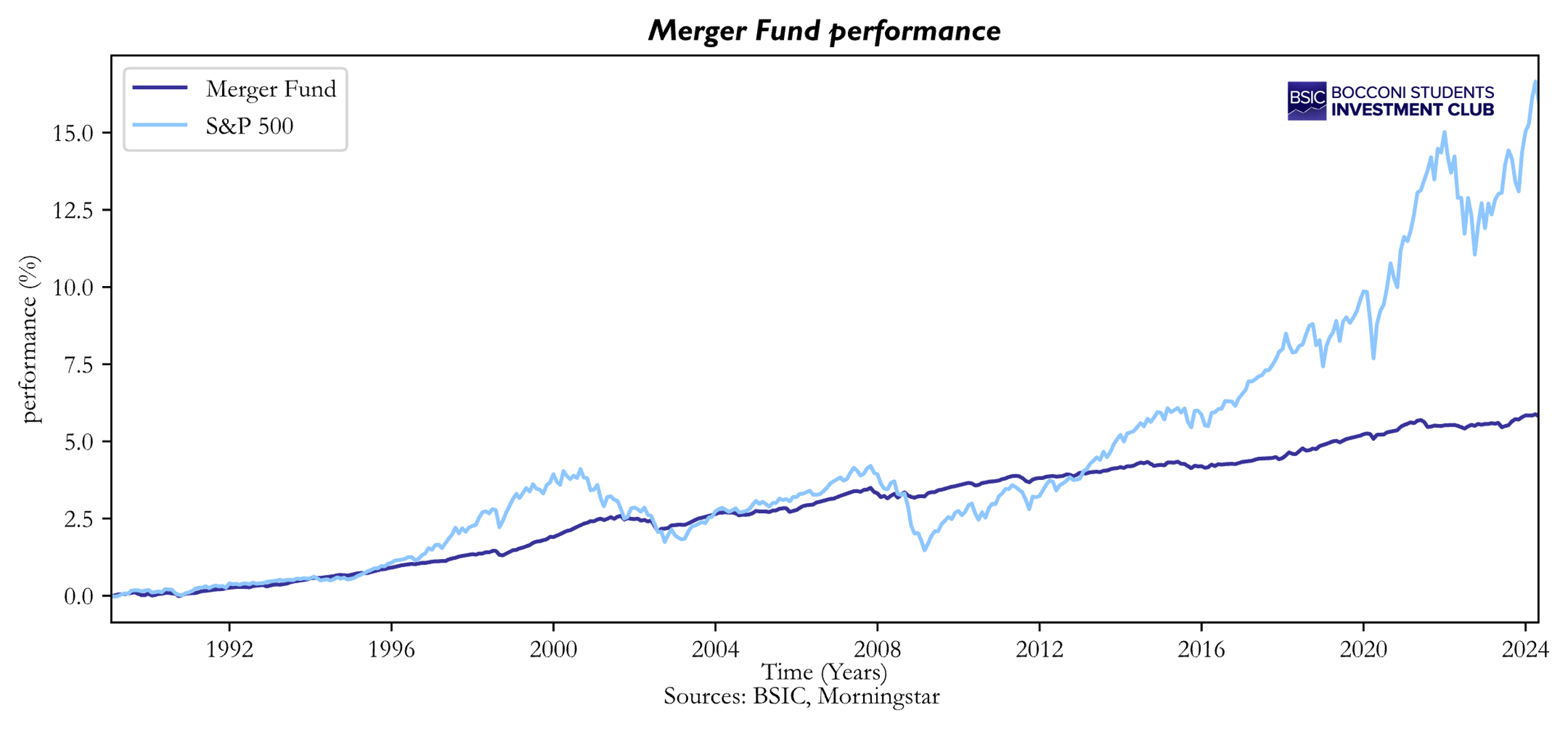

Historically, Merger Arbitrage Strategy have been able to generate positive returns in most market environments, providing significantly less downside in Bear Markets. To explore deeper this behaviour, we present to you the performance over the past 25 years of the Merger Fund compared with the S&P 500. The Merger Fund is the biggest mutual fund that specializes in Merger Arbitrage strategies. The fund is managed by Westchester Capital Management, a leader in global event driven investing for over 30 years. Since the launch of the fund in 1989 their team has evaluated more than 10,000 potential transactions, and invested in over 5,000 corporate reorganizations, over 98% of which were completed.

As it appears clear from the graph above, the Merger Arbitrage strategy allowed the Fund to get lower, but still more consistent returns in respect to the ones shown by the S&P 500. If we focus only on Bear Market periods, then we can see that the Merger Fund had indeed much smaller downsides, confirming our previous statement about the capability of Merger Arbitrage to be less vulnerable to sudden falls in the markets. This makes the historical relative performance in both up and down markets relative to traditional portfolios as a key differentiator for Merger Arbitrage strategies.

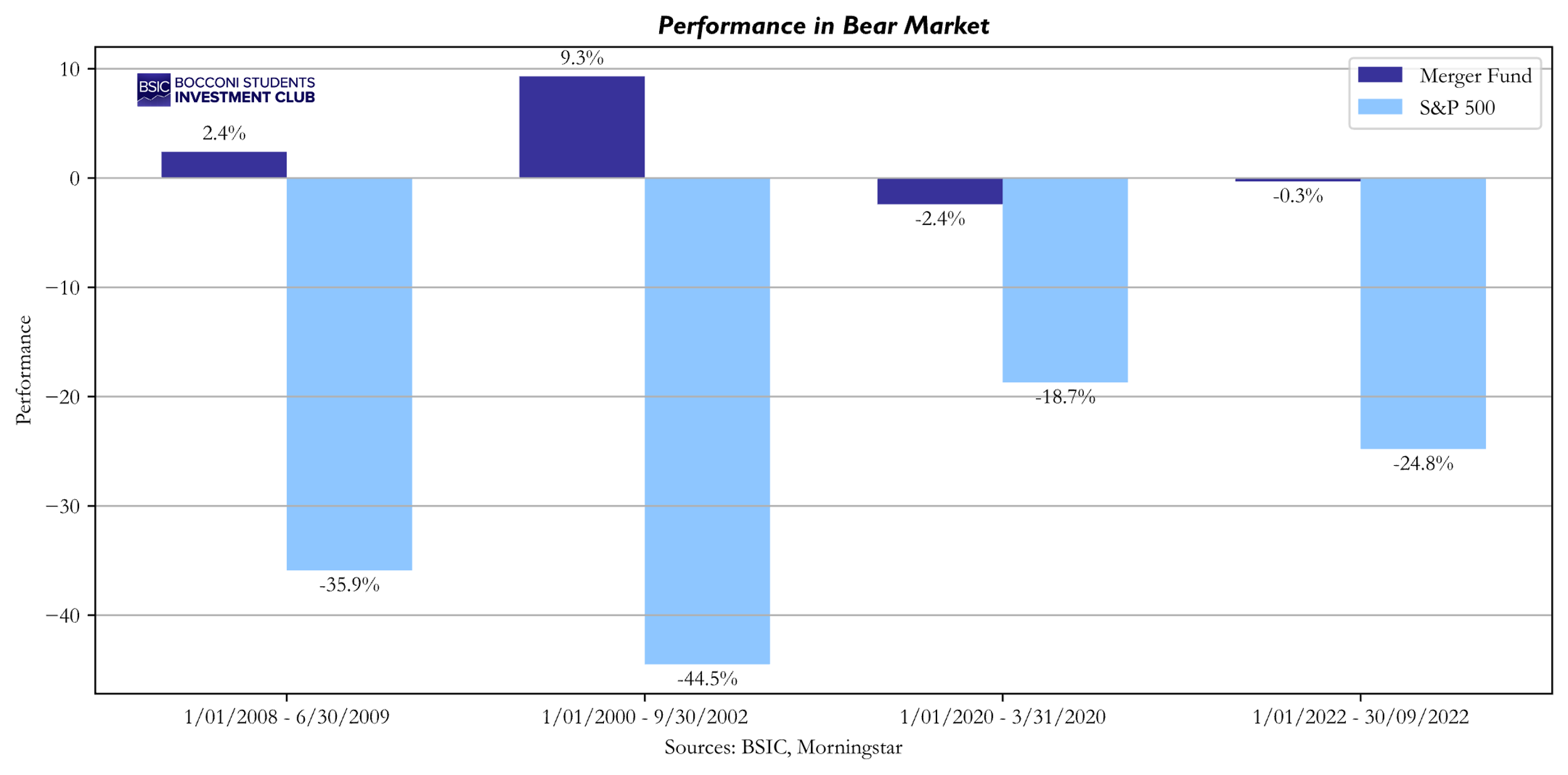

To give a better understanding we plot a graph showing the performance of the Merger Arbitrage Fund during largest S&P 500 Index drawdowns.

From this it appears much clearer the robustness of Merger Arbitrage strategy during Bear Markets allowing the Fund not only to be resilient but also in some cases to even generate returns.

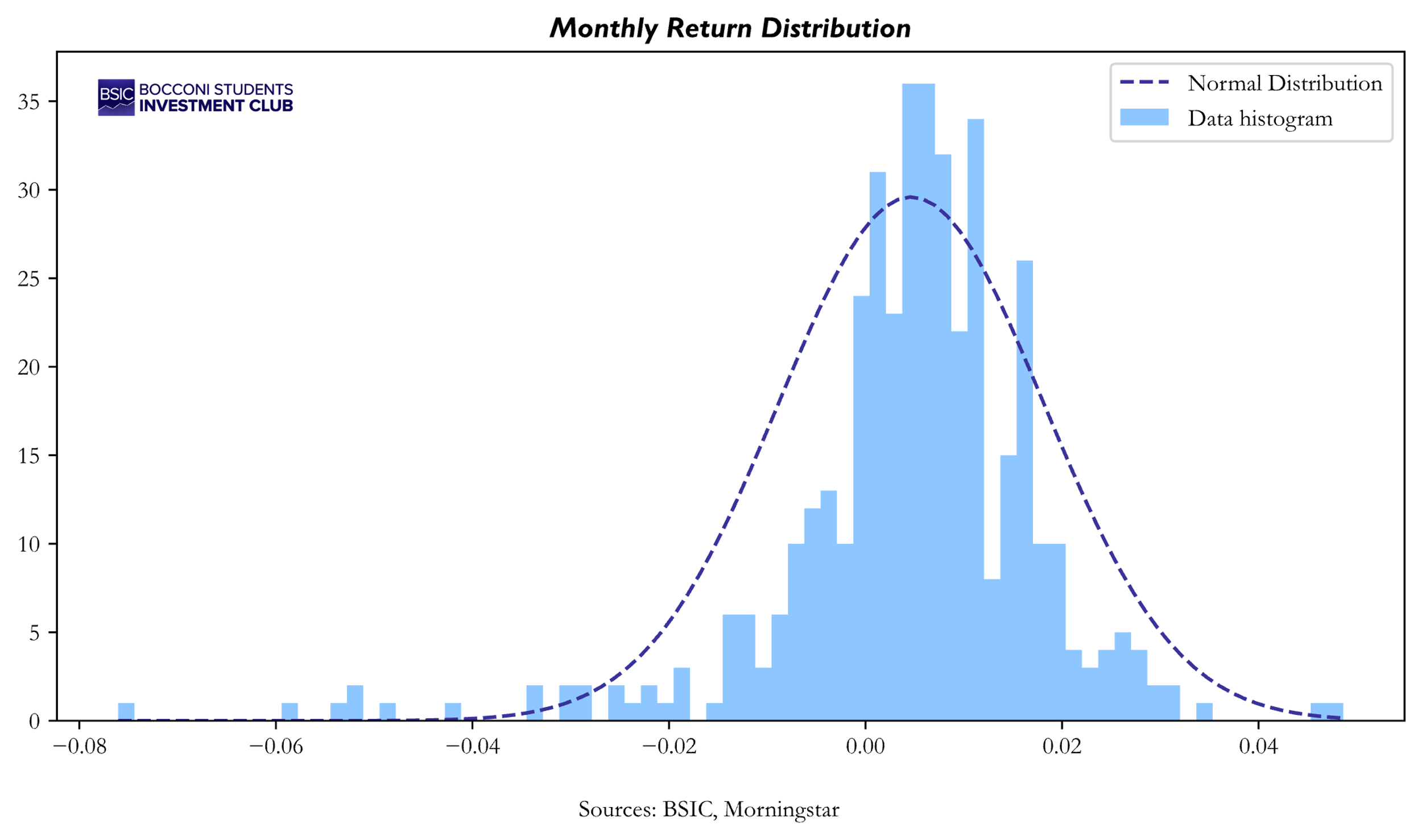

For an even deeper analysis, we show the distribution of monthly returns on the Merger Fund based on 423 observations from January 1989 to April 2024, and compare it to a normal distribution with the same mean and standard deviation.

The distribution shows a non-normal behaviour and a notable kurtosis. This appears to be coherent with the strategy that indeed does make on average consistent and small profits. Although the Merger Arbitrage Strategy is still dependent on a large number of different variables that expose the investment to the risk of deal failure.

Historical of Merger Arbitrage Strategy

To provide a comprehensive overview of the historical performance of the Merger Arbitrage Strategy, we then analysed a dataset containing 4,828 transactions from 1984 to 2020. This data is sourced from Kristoffer Halskov’s paper, “Improving Merger Arbitrage Returns with Machine Learning.” It encompasses exclusively all-cash or all-stock transactions involving 100% mergers or acquisitions of public U.S. firms. The dataset has been filtered to only include transactions with detailed initial terms, a valid CRSP/Compustat link, necessary pricing data, and situations where the target’s share price was below the offer price.

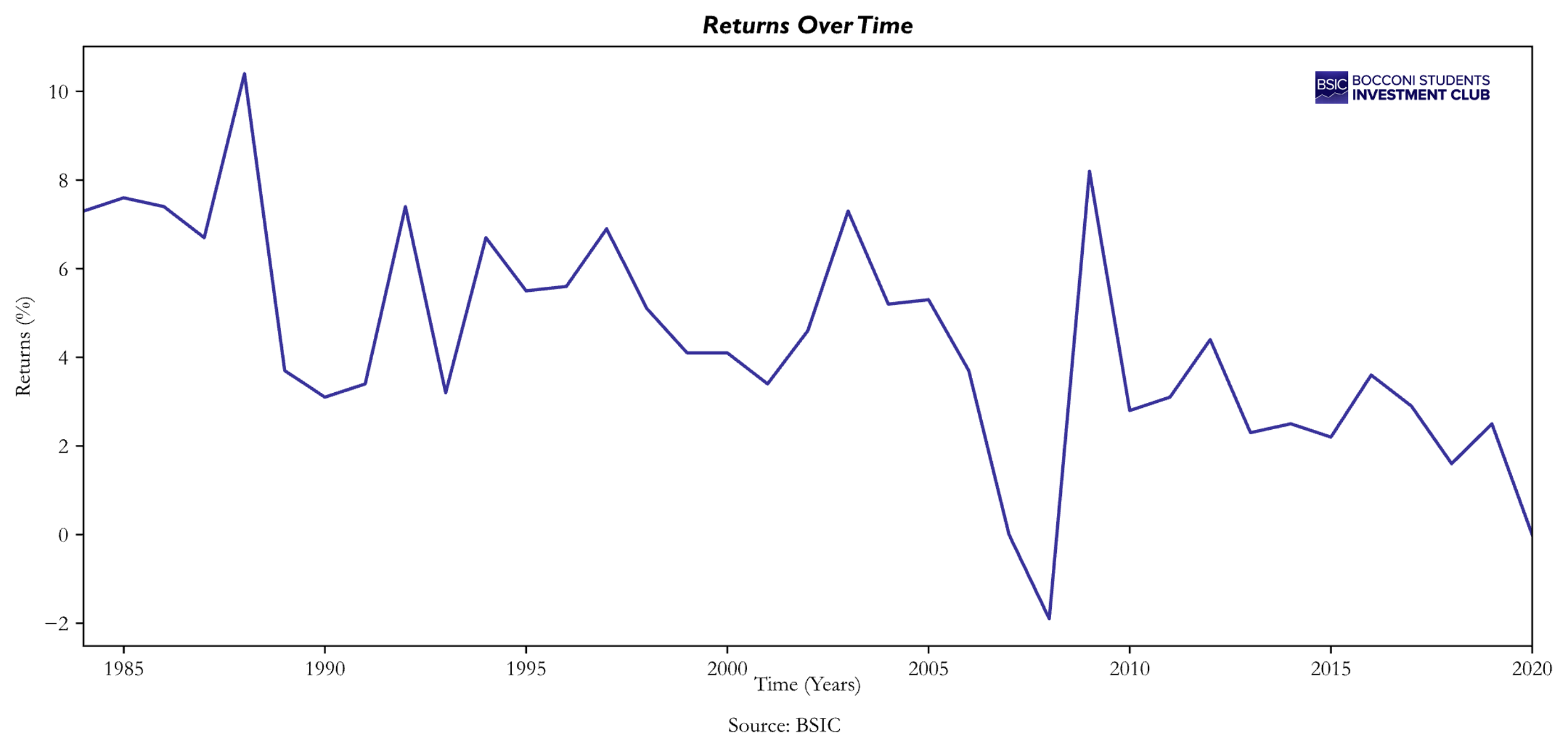

The accompanying graph illustrates the return profile of Merger Arbitrage by plotting the annual average returns from participating in risk arbitrage trades for announced deals.

It is evident that since the financial crisis of 2008-2009, there has been a noticeable downward trend in returns. Data from the adjacent table indicates that returns from Merger Arbitrage typically decline during market downturns. This trend seems to correlate with a decrease in the number of M&A deals announced during and following recessions. Notably, only about 19% of the trading months classified as being in a recession occurred in the first half of the dataset. This disparity may help explain why risk arbitrage has shown poorer performance in the latter half, as the economy experienced more recessionary periods during this time.

Empirical results and variable importance: measuring the variable importance

Machine learning models are often criticized for being less transparent and harder to interpret than more traditional statistical models. The Merger Arb ML paper mainly used three different ML models (logistic regression, tree based model and neural network) for the classification task of identifying the successful and unsuccessful deal. One problem the researchers faced when dealing with variable selection and importance identification was due to the different models they used, as logistic regression has p-values as well as the absolute size of coefficients while decision tree methods have impurity based measures like the Gini coefficient. Consequently, the measure used to rank the importance of the features across all models was based on randomly permuting the out-of-sample data 5 times for each variable j and recording the average increase in brier score that results from that, but normalized so the sum of all p variable importance measures sum to one. For clarity, the Brier score is given by the formula:

![]()

where ![]() is the predicted probability for observation,

is the predicted probability for observation, ![]() is the actual outcome and N is the total number of observations. Using this universal significance ranking, the researchers managed to rank the importance of the following 15 M&A deal-specific variables:

is the actual outcome and N is the total number of observations. Using this universal significance ranking, the researchers managed to rank the importance of the following 15 M&A deal-specific variables:

- Cash: Indicates if the deal is an all-cash transaction (value is 1 for yes, 0 for no).

- AExp: Represents whether the acquirer has successfully completed another acquisition in the past two years (1 for yes, 0 for no).

- Friendly: Shows if the target company’s board supports the merger or acquisition (1 for yes, 0 for no).

- US: Indicates whether the acquirer is a U.S.-based entity (1 for yes, 0 for no).

- Compete: Identifies if the offer is a competing bid (1 for yes, 0 for no).

- LBO: Points to whether the deal is a leveraged buyout (1 for yes, 0 for no).

- TO: Specifies if it’s a tender offer (1 for yes, 0 for no).

- Private: Shows if the acquirer is a private entity (1 for yes, 0 for no).

- Sought: Represents the percentage stake that the acquirer seeks in the target company (ranges from 0 to 100).

- mve/dv: Ratio of market value (one week before deal announcement) to deal value (as if 100% of the company is being acquired).

- atf/dv: Ratio of acquirer termination fee to deal value.

- ttf/dv: Ratio of target termination fee to deal value.

- tpremium: Measures the percent increase in the target’s share price post-deal announcement compared to one week before.

- rpremium: The ratio of the offer price to the post-announcement target share price minus one.

- isp: Implied Success Probability, a risk-neutral probability of deal success based on assumptions from specific studies (Samuelson and Rosenthal (1986), Brown and Raymond (1986).

The main 4 insights found are the following:

- Firstly, all models agree on the top 6 most important variables for determining deal success, with the “Friendly” indicator (indicating board backing of the target company) being the most significant and the “ttf/dv” (target termination fee to deal value ratio) ranking second in importance.

- The findings also suggest that for successful mergers and acquisitions, having the board of directors of the target company support the deal and including a target termination fee in the merger agreement is very important.

- Although the “Friendly” indicator is the most critical variable, models with the best performance in terms of Brier score, namely Random Forest and Gradient Boosted Trees, tend to place higher importance on other variables, indicating that these also contain valuable information, though it may be challenging to extract.

- Lastly, at least half of the top 10 most important variables for each model are deal-specific variables, despite these constituting only 13.5% of the total explanatory variables. This finding underscores that improvements in conditional probability estimates are likely to come from incorporating more deal-specific information rather than relying solely on traditional variables associated with individual stock risk premiums.

Anglo American Merger Arbitrage Analysis

On April 25th 2024, the mining giant BHP Group [LSE, ASX: BHP] announced its planned takeover of Anglo American PLC [LSE: AAL], valuing the company at £31bn. The takeover would be an all-stock transaction, offering 0.7097 BHP shares for each Anglo American share, giving the stock a valuation of £25.08 a share and paying a relatively low premium of 13%. The combined entity would be the biggest copper producer in the world with an output of 2m tonnes of copper per year or around 10% of the global amount. The proposal further shows the impacts of the transition towards renewable energy as demand for copper increases due to its applications in electric vehicles and renewable energy projects. Quoting BHP, it would increase the “exposure to future facing commodities through Anglo American’s world class copper assets”. The deal comes after Anglo American has struggled with its performance since December after facing downgrades in its production forecasts combined with low prices of the De Beers division and the platinum metals unit which caused the London-listed shares to fall by 47% since April 2022. BHP with this deal can also diversify its heavily concentrated portfolio around Iron Ore (46.1% of total revenue). The deal, although it has a very big strategic potential, may prove to be hard to realise as it is considered to be highly opportunistic in the eyes of Anglo American shareholders.

About BHP Group

BHP Group [LSE, ASX: BHP] is a multinational mining company founded in 1885 with its headquarters in Melbourne, Australia and a strong presence around the globe with operations extending to Chile, the United States, Brazil, Canada, and Peru. The main products the group sells are copper, iron ore, nickel, metallurgical coal and potash. BHP’s strategy is based on managing a long-term portfolio of assets consistent with highly valuable commodities. The company aims to create value through its operations, discovery and development of resources, acquisition of the right assets and options, and capital allocation. In 2022 BHP dropped its primary listing in London which has simplified its corporate structure, allowing for simpler consolidation processes following the divestiture in its Oil and Gas business. In the following year, BHP acquired the Australian competitor Oz Minerals in a deal valued at A$9.6bn which increased its exposure to copper.

BHP is also committed towards sustainability and is a leader in the production of copper, a metal that plays a crucial part in the energy transition due to its vast applications. In the FY2023 BHP has produced 1716.5 kt of copper and has forecasted that the demand for copper will double over the next 30 years. The company has also heavily invested in developing extensive copper infrastructure and has extended the life of the Spence mine in Chile for another 50 years.

About Anglo American PLC

Anglo American PLC [LSE: AAL] founded in 1917 by Ernest Oppenheimer with headquarters in London, is a global mining company which through the utilization of innovative practises and technologies aims at delivering shareholder returns. Through its operations, Anglo American is involved in the finding, mining, processing, and sales of copper, nickel, platinum group metals and diamonds, as well as iron ore, steelmaking coal, manganese and polyhalite. The company is also the owner of the world’s leading diamond company De Beers.

The strategy of Anglo American has been focused on operational excellence and portfolio improvement, which together would contribute towards the company’s growth. The firm has registered an operating income of $32.5bn, a 13% decrease compared to 2022 with the main source of revenue being Iron Ore with a revenue of $8bn.

Through the FutureSmart Mining project, Anglo American has brought together technology, digitalisation and sustainability with the aim of revolutionizing the mining industry. Thanks to FutureSmart Mining Anglo American was able to reduce its environmental footprint through precision mining technologies and data analytics while contributing to the development of the regions in which the company operates.

Future Outlook and Implications of the Potential Merger

The stock price of Anglo American saw a significant increase following the announcement of the takeover bid, moving from £22.05 per share on April 24th to a peak of £27.05 per share on April 29th. This represents a gain of approximately 22.68%, reflecting investor optimism about the premium offered and the future prospects of the combined entity.

BHP’s proposed acquisition of Anglo American is centered around Anglo’s lucrative copper assets, particularly in Chile and Peru. The global demand for copper, which is essential for renewable energy technologies, is rising sharply, and securing these assets could significantly boost BHP’s market position. However, the regulatory challenges in South Africa, where Anglo’s substantial assets are not included in the bid, pose a significant hurdle. South Africa’s antitrust authorities will have considerable influence over the deal’s approval, focusing on competition and public interest impacts such as employment and local economic development.

The exclusion of South African assets from the deal has sparked notable political backlash, which could influence both public and regulatory reception of the merger. BHP’s efforts to reassure stakeholders about its commitment to South Africa suggest a recognition of these challenges but may not fully mitigate the concerns of local authorities and the public. The timing is sensitive, given the proximity to national elections, which adds another layer of complexity to securing approval.

The path to a successful merger is likely to be challenging, given the initial rejection by Anglo American and the subsequent political and regulatory concerns articulated in South Africa. The process is likely extended, taking several years to navigate the regulatory landscape and achieve closure. There’s also the possibility of increased offers either from BHP or other potential suitors, reflecting the high strategic value of Anglo’s assets.

To address regulatory and public interest concerns, BHP might need to make significant concessions, similar to past large-scale mergers in South Africa. These could involve guarantees about job preservation, local investment, and possibly maintaining certain operations within South African jurisdiction.

The complexity and scale of the BHP and Anglo American deal, combined with the geopolitical and economic stakes involved, suggest a cautious outlook. Success depends on BHP’s ability to navigate a challenging regulatory environment and potentially adjust its strategic approach to address stakeholder concerns effectively. The ultimate approval and successful closure of the deal will likely hinge on a delicate balance of economic, political, and social factors that are in a state of change.

Conclusions

We think the acquisition of Anglo American by BHP can have potential to generate returns from the Merger Arbitrage Strategy if the deal goes through. If Anglo American accepts a future offer from BHP, then by acquiring shares of the target company there would be the possibility of making profits on the deal spread. Furthermore, with a more risk-averse approach, it is to be considered also a hedge position by shorting BHP’s shares. This would protect from the market volatility caused by the transaction, which has shown already after the first offer that investors aren’t keen towards the deal. The possibility of the deal happening though is heavily influenced by uncertainty as a bidding war is expected for Anglo American. Moreover, the deal must be approved by the regulators, which can be heavily affected by the South African government.

References

[1] Halskov, Kristoffer, “Improving Merger Arbitrage Returns with Machine Learning”, 2024

[2] Westchester Capital Management, “An Introduction to Merger Arbitrage”, 2024

0 Comments