Introduction

Historically, large institutional investors pursued purely financial strategies and kept a low profile in governance. This may no longer be the case. In a manner vaguely reminiscent of the corporate raiders of the 1980s, a new generation of activist shareholders is on the rise. The number of companies targeted by shareholder activists hit an all-time high in 2018. This spike in activity coincided with the return of billionaire Carl Icahn to the activist scene after a sojourn in Washington as a special adviser to President Donald Trump.

Trends in Shareholder Activism

Publicly traded companies have been experiencing increasing levels of activist involvement. A record 226 companies faced activist campaigns in 2018, up from 188 in 2017, and the amount of capital invested in the targets was up to a high of $65bn. Additionally, board seats awarded to activists increased from 100 in 2017 to 160 in 2018, breaking the peak of previous board seats allocation of 145 in 2016. M&A Activism has played an important role in the uptick of the practice: since 2013, 13 of the 41 US Companies facing activist opposition to all-cash bids saw an increased offer price representing an average jump of 7%. U.S. activists are now also targeting Europe. During 2018, the number of activist campaigns focused on Europe has increased from 7 in 2013, to 53 in 2018. This trend towards European activism is mainly driven by better valuations and the fact that more vulnerable conglomerates still exist in Europe. Elliott has been the most aggressive so far, launching a campaign to gain control of two-thirds of the board seats at Telecom Italia Spa and taking stakes in iconic European companies like Bayer and Pernod Ricard.

While it was said that activism would have given way to passive investment, apparently activist investors identify in the pursuit of the more sophisticated campaign, targeting large companies all over the world as a profitable way to generate higher returns for their fees. Their agenda typically involves issues related to corporate governance, such as replacing management, dividend payouts, new director appointments and executive compensation. Furthermore, increasing numbers of activist campaigns seek influence within the strategy domain, which was traditionally the prerogative of executives. If consensus about these points is not reached, they may make their demands public through open letters, white paper reports, shareholder proposals and proxy contests. Bill Ackman, for example, has openly discussed his Pershing Square Capital Management’s investments in United Technologies and Starbucks Corp. Moreover, activists are also more frequently running so-called wolf pack campaigns: an instance where several firms group together to create a block that owns a substantial chunk of a company’s shares. A good example of this practice is showed by a campaign conducted by the New York-based hedge fund Paulson & Co, replacing the majority of the board at Canada’s Detour Gold. Corporation. Another key trend affecting shareholder activism is the ESG movement. No longer viewed as “soft” or “moral” issues, ESG practices are now defined in terms of financial risk and long-term sustainable performance. ESG stands for Environmental, Social and Governance. Even though investors have long seen ‘G’ as a source of Alpha, there is growing attention for ‘E’ and ‘S’. In 2019 Institutional Investor Survey conducted by Morrow Sodali, 85% of respondents indicated that climate change will be the most prioritized sustainability topic of their corporate engagements in 2019, with this being up 31 percentage points from last year. 54% of investors equally agreed that human capital management will be the other key engagement topic in 2019.

In addition, ESG ratings released by international agencies are becoming, for Institutional Investors, more prevalent and commonly used in assessing the ESG performance of their portfolio companies. These are complementary to traditional investment processes and existing strategies. In the coming months, several current trends will continue. From an environmental and social perspective, climate change is likely to be the leading concern for investors. Within governance, there is going to be an increased call for diversity at the board level and the employee population. As a result, companies will be constantly challenged in demonstrating to investors leading ESG performance

Existing Conditions for Shareholder Activism

Recent empirical studies on shareholder activism show that the engagement process follows a precise structure. According to an academic paper titled Returns to Hedge Fund Activism: An International Study, by M. Becht, J. Franks, J. Grant and H. Wagner, activists tend to hold, on average, a stake of 11% across the analyzed target companies across different countries. This is not a significant number when the main goal is to obtain voting power, hence the tendency to seek support from other shareholders, and, in particular, from other activists, creating a so-called “wolf pack” when starting an engagement.

The analysis includes the study of a sample of 1,740 interventions in publicly traded firms, initiated between January 2000 and December 2010. These occurred in 23 countries with extremely skewed distributions as 1,125 interventions are concentrated in the United States, 184 in Japan and 165 in the United Kingdom. These numbers are even smaller in the rest of the countries surveyed in Europe and Asia. This gives us an initial interesting fact of the popularity of the business in the US compared to the rest of the world, as the absolute numbers show, but the numbers must be adjusted to create a comparable measure of activism frequency across countries. This is done by taking the number of engagements for every 1000 listed firms in each surveyed country. The United States retain the first place with 19.6% of engaged listed firms for every 1000 listed firms, followed by Italy (13.3%), Luxembourg (12.4%), the Netherlands (11.6%) and Germany (7.3%), in contrast to what the absolute numbers show, putting Japan and the UK after the US.

The previous fact is also stressed by the fact that usually a significant percentage of interventions is based on the creation of a Wolf Packs of activists, with the maximum reached in Germany, with a percentage of 32%. Also, most of the engagements that do not occur in the United States are carried out by foreign activists, usually American activists as the table shows. Indeed, all the surveyed countries show fractions of foreign activists well above 50%, with even 100% in some of them and 1% in the US. Particularly interesting is the “Fraction US Foreign Activists” column which shows how US activists have significant proportions of participation in interventions in foreign countries. For example, 56% of the interventions in France include one or more US activists, while the UK has appeared to be an intermediate case with 38%, the lowest share of foreign engagements in Europe, with most of the activists being domestically located.

Wolf Packs

In general terms, a wolf pack is defined as a group of multiple activists involved in the same engagement with a disclosed stake in the target. Going into more details, coordination must be needed to really consider the group a wolf pack instead of single activists that happen to have equity stakes in the same company. However, detecting the degree of coordination between activists, in accordance to Section 13(d)(3) SEC Act of 1934 has become increasingly difficult, favoring activists who are subject, in this way, to less regulatory limits imposed, on the other hand, on wolf packs.

Based on the sample used for the research, 21.75 of engagements involved the presence of a wolf pack. The percentage is still less than stand-alone activism cases (78.3%) but is still a significant number. Moreover, 23.3% of the wolf pack engagements involve the presence of three or more hedge fund activists involved.

Lastly, one main benefit that arises from the creation of wolf packs involves the increase in the percentage of ownership of the target. According to data gathered by multiple research studies, wolf packs tend to hold an aggregate 13.4%, compared to an average of 8.3% by individual activists.

Despite the importance of having the opportunity to increase equity stakes, which, in general, gives the holder more voting power, the other 2 important factors that must be considered when assessing overall power in the Board of Directors. A Shareholder must consider whether support from other major shareholders can be obtained within the overall legal and regulatory framework of the country in which the target operates.

Shareholder support becomes a key element to consider since, by common legal frameworks across countries, stakes of activists are usually limited to 11% in the US, 13% in Europe and Asia. This aspect does not allow activists to immediately hold a majority stake, hence support from other shareholders is fundamental for the ultimate success of the investment. The last few years large US institutional investors increased their equity stakes abroad in foreign companies and these same institutional investors appeared to be the best supporters for activists. According to the historical trend of successes of activism, many cases involved the activist or wolf pack being supported by institutional investors, while employees, domestic investors and the management team with substantial equity stake supported the incumbent group of executives.

Another interesting fact pointed out by multiple pieces of research that appear to corroborate Returns to Hedge Fund Activism: An International Study shows statistical relevance of some key indicators that can be used to assess the likelihood of becoming a target for activists.

Using multiple linear regressions including different right-hand side variables, researchers have found out how activists tend to behave more like value investors when choosing a target. Lower Market-To-Book ratios, higher cash balances and lower investments increase the likelihood of becoming a target and all the coefficient, respectively -0.006, 0.014, -0.037 are statistically significant at 5% and 1% significance levels.

Furthermore, Market capitalization has little effect on the likelihood of becoming an activist target as the statistical coefficient obtained is 0.000 with a standard error of 0.000, which means this result is statistically significant too. There seems to be a positive relationship between likelihood and presence of US institutional investors with a coefficient of 0.063 and statistically significant at 1% significance level. This happens because activists know how likely it is to get voting support from this kind of investors.

Engagement Performance: Returns on the different phases

Return analysis for shareholder activism starts with focusing on abnormal returns generating on the date of disclosure of the equity stake with an event window that goes from 10 to 20 days, as the movement of returns tends to have a positive drift.

On average, abnormal returns seem to reach levels of 6.14% for a 10-day event window and 6.4% for a 20-day event window. At this point investors are pricing the possible outcomes and their respective probability of success, moving share prices up. During this phase, wolf packs appear to be better placed than stand-alone engagements, as they reach abnormal returns of around 14% against an approximate 6% for individual activists. The question that arises at this point is whether this advantage is given by the fact that wolf packs have more stakeholding that inevitably increases returns or if that is due to increase the probability of success thanks to higher voting power and influence in decision making. According to empirical results obtained through different papers studying the case, the higher returns associated to wolf packs are statistically independent from the higher aggregate stake held, suggesting that probabilities of success for wolf packs must be higher.

Besides abnormal returns calculated on the disclosure date, returns must also be calculated on the disclosure of the outcomes achieved by activists during the entire holding period. Outcomes are defined as general Corporate decisions that will include (i) Board replacements of CEOs, CFOs, Chairmen and Non-executive directors, (ii) Payout decisions entailing buybacks and increased or diminished dividends, (iii) restructurings and takeovers of the target.

At this point, successful outcomes will inevitably drive share prices up as in the disclosure phase, investors attach some probability to all the possible outcomes and a successful realization of them involves higher returns.

On average, abnormal returns on disclosure of all the possible outcomes in the sampled engagements reach 6.33% and 6.42% in the 10 and 20 event windows, respectively, statistically significant at a significance level of 1%. The most profitable strategy for activists seems to be a final takeover of the target which follows a sequence of successful outcomes such as board restructuring. This event involves abnormal returns of approximately 18% followed by the achievement of multiple outcomes without a takeover, which yields between 7.46% and 9.04%.

Returning to the advantages of wolf packs, whose higher returns do not depend on their higher equity stake, empirical analysis of the sampled engagements shows the advantages of them lay on the fact that they achieve more voting power and the possibility of getting support from other shareholders. Overall, abnormal returns during the disclosure of successful outcomes, between wolf packs and individual activists are not significantly different, but probabilities of achieving any outcome for a wolf pack stand at 78% against 46% for stand-alone action. Moreover, the most profitable strategy of multiple outcomes achieved, plus a final takeover seems to be easily achieved by wolf packs, relative to stand-alone engagements. Probabilities stand at 40% against 30%.

Lastly, a good measure of returns is needed for the entire investing period during the engagement. In this last phase, researchers tend to use different single or multifactor models to compute returns and possible excess returns achieved. On average, based on a Market factor model, abnormal returns achieved through the achievement of successful outcomes leads to 8.399%, against -5.513% in the case of no outcome achieved. The same trend is obtained by switching towards a four-factor model (Carhart model) that starts from a Fama-French three-factor model and includes a high versus low momentum factor.

The results convey an important intuition: activism is capable of creating value by generating alphas and this aspect is deeply linked to the capacity of achieving a certain set of outcomes.

Cases of Shareholder Activism: Elliott Management

Several shareholder activists have attained cult-like recognition in recent years. For instance, Paul Singer’s $35bn hedge fund Elliott Managed has continued to dominate the activist landscape. The fund launched 22 new campaigns in 2018, more than twice that of the next-biggest mover, ValueAct with nine fresh targets, and targeted companies in more countries than any other activist investor. Elliott also topped the list with the largest market value of its current activist positions at $14.7bn in 2018. They were followed by ValueAct with $12.6bn deployed, Cevian with $11.2bn and Trian with $10.1bn.

No activist can compare to Elliott Management’s breadth of activity. The omnipresent activist has gone from targeting 7 companies in 2013 to 24 in 2018 across Asia, Europe, Australasia, and North America with an average target market cap of $17.9bn.

While 2017 saw the first major deal for Elliott’s private equity subsidiary Evergreen Coast Capital, 2018 saw it strike even bigger deals with more established partners Siris Capital and Veritas Capital for Travelport Worldwide and Athenahealth, respectively. Already in 2019, it has bid for Mitek Systems and energy company QEP Resources. Elliott has also gained attention for its development of a team focused on corporate governance, including nominating a four-person board slate with an even gender split at Commvault, which had appointed its only female director just weeks prior, and winning plaudits for its slate at Telecom Italia, where it likely faces another tussle with Vivendi in 2019. “We have a formal strategy tailored to each situation for improving governance at companies we invest in, and we have a team dedicated to it,” stated Jesse Cohn, head of equity activism, although the framework is private for now. “Every company and every board are a little bit different.”

While Europe proved a particularly bright spot for Elliott in 2018, with breakups of ThyssenKrupp and Whitbread, Asian markets look harder to crack. It took concessions rather than continuing to oppose the merger of Alps Electric and Alpine Electronics in Japan, and campaigns at South Korea’s Hyundai and Samsung are proving a long slog.

Recent Deals

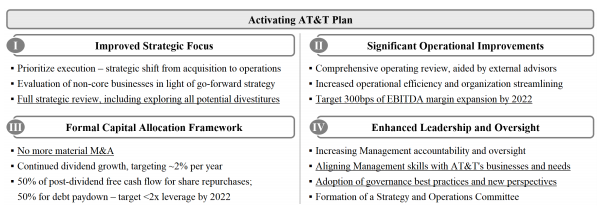

Recent deals by Elliott Management include an assault on telecom giant AT&T. In early September the activist investor took a $3.2bn stake in the company, while also releasing a highly publicized letter criticizing recent transactions—such as the $80bn takeover of Time Warner—and other poor strategic choices. Elliott laid out to relevant stakeholders “The Activating AT&T Plan”, which represents their strategy to unlock shareholder value through focusing the asset portfolio, improving operational performance, instituting clear capital priorities, and enhancing leadership and oversight. By honing the strategic focus of AT&T onto core activities, through the use of necessary divestitures and operational streamlining, Elliott feels as though they could achieve nearly 300bps of EBITDA margin expansion by 2022 and dividend growth of 2% per year.

Source: Elliott Management

Their justification in taking an aggressive stance in AT&T was driven by several factors: failed transactions, poor strategy, and continued financial disappointment. In 2011, AT&T failed to purchase telecom competitor T-Mobile in a $39bn deal, which resulted in the largest break-up fee ever paid. A subsequent takeover of DirectTv in 2014 was deemed by many analysts as poorly timed, coming at the peak of the pay-TV market and adding little to AT&T’s clear telecom portfolio. Finally, a string of unsuccessful acquisitions ended in the botched integration of the Time Warner deal in 2016, which resulted in many prominent Time Warner executives leaving the firm and little to no manifestation of strategic benefits. AT&T’s focus on trying to expand its portfolio outside of Telecom ultimately came to drag down its financial performance and value to shareholders. Following Elliott’s announcement of its involvement in AT&T, the share price jumped 4% to $38.14, reflecting investor’s excitement of a potential activist resurgence.

Other recent deals include the assault launched on energy conglomerate Marathon Petroleum. Since then, one other large investor, hedge fund D.E. Shaw, has joined the effort. Marathon Petroleum has a trailing twelve months P/E ratio of 10.53. If we focus on the long-term P/E trend, Marathon Petroleum’s current P/E level puts it below its midpoint over the past five years. In addition, the stock’s P/E compares favorably with the Zacks Oil – Energy sector’s trailing twelve months P/E ratio, which stands at 12.97. At the very least, this indicates that the stock is relatively undervalued right now, compared to its peers. Marathon shares are already higher by 42% from mid-August, when Elliott apparently took a position. That’s a stark contrast to Elliott’s ill-fated foray into Telecom Italia (TIT, TIIAY). The firm faced a formidable opponent in that battle in French media giant Vivendi SA (VVU, VIVHY), which owns 23.94%. But rather than reach a deal and move on with a profit, Elliott launched a full-on war for control starting on March 2018. That effort was ultimately a success. The investment, however, has been a different story as Telecom Italia shares have cratered roughly 35%. Last month, Elliott’s handpicked CEO Fulvio Conti resigned. Meanwhile, the firm is reportedly attempting to settle with Vivendi, possibly as an exit strategy. At the time this article was written Telecom Italia generates gross margins for $22.77 bn. with a negative Net Income of -$1.67bn. But while Elliott Management may experience lows in its activist campaigns, it seems unlikely that the firm will ever change its aggressive approach to strategic change and operational efficiency.

0 Comments