Franklin Templeton Investments [BEN] – Mkt Cap as of February 25th, 2020: $11.79bn

Legg Mason [LM] – Mkt Cap as of February 25th, 2020: $4.35bn

Introduction

As Invesco’s chief executive Marty Flanagan correctly pointed out some months ago, the Asset Management industry is going through dramatic changes right now; in his words: “Winners and losers are being created today like never before. The strong are getting stronger and the big are going to get bigger.”

Exactly on these grounds, on February 18th, 2020, US asset manager Franklin Templeton disclosed its plans to acquire rival Legg Mason for $6.5bn, in an all-cash transaction.

The deal points at scale, as activist hedge fund Trian Partners’ founder Nelson Peltz (who joined Mason’s Board last year) declared when interviewed. Indeed, according to him, scale will be increasingly vital for the success of players within the industry at issue.

The discussions for this acquisition started back in June 2019 and came to an end only in the latest few days, due to some uncertainties about the moves from Legg Mason’s affiliates, as explained in the next paragraphs.

Even though Franklin Templeton’s CEO Jennifer Johnson defined the transaction as an “offence, not a defense”, the deal hides a purely defensive nature. As a matter of fact, the move comes after several other similar moves from peers worldwide, seeking economies of scale to survive the current industry turmoil and investors’ redemptions, which made Templeton’s results some of the industry’s worst last year.

About Franklin Resources Inc.

Currently headquartered in San Mateo (California), Franklin Resources Inc. is a global investment management organization operating as “Franklin Templeton” under the motto “Gain from our perspectives”.

The corporation was founded in 1947 in New York by Rupert Johnson as “Franklin Distributors”. The name is linked to the character of Benjamin Franklin, since Mr. Johnson admired his frugality and prudence in terms of investments and savings; for this reason, the organization is listed on NYSE under the symbol “BEN”. As a matter of fact, one of the main distinguishing features of the company at issue is exactly its conservative approach in terms of asset allocation, making Templeton’s funds suitable for pension funds and prudent mandates.

Headquarters have moved from New York to San Mateo in 1973, when Franklin Distributors acquired Winfield & Company, an investment management firm based there. In 1992 Franklin Distributors bought Templeton, Galbraith & Hansberger Ltd., and turned its name into “Franklin Templeton Investments” (which embraces Franklin Resources Inc., alongside all its subsidiaries).

In February 2009 Barron’s Magazine defined Franklin Templeton the “King of the Decade”, on the basis of its higher-than-average stock return and operational results. However, six years later the company was forced to step into the passive funds industry, launching its first ETF funds, so to survive the pressure on fees. Unfortunately, this move did not solve all the issues the company was going through, and in 2019 the company was ranked among the worst performers in operational terms; indeed, last year Franklin Templeton saw a dramatic surge in net redemptions from clients, with a significant outflow registered by the “Templeton Global Bond Fund”, which lost $6.3bn.

As of January 31st, 2020, Franklin Templeton Investments registered AUM for $688bn.

About Legg Mason

Founded in 1970 through the acquisition of Mason & Co. by Legg & Co. and headquartered in Baltimore (Maryland), Legg Mason is currently ranked among the major asset managers in the world, operating under the motto “Investing to improve lives”.

It has been listed on the NYSE since 1983 (LM) and encompasses a diverse range of affiliates, each operating with investment independence and having specialized expertise across asset classes and markets around the world; among those mentioned affiliates, we find: Brandywine Global, Clarion Partners, ClearBridge Investments, Martin Currie, QS Investors, Royce Investment Partners, Western Assets.

This organization could be defined as a pure asset management company only after it exchanged its Private Client and Capital Markets businesses for Citigroup’s asset management division in 2005.

As of January 31st, 2020, Legg Mason could count on $806bn AUM.

Industry analysis

The past ten years certainly did not spoil asset managers and, as we are entering the new decade, the question “what do the next years hold for asset managers?” starts bothering the industry. Unfortunately, according to current predictions, revenues will most likely shrink, costs will raise, margins will be squeezed, and the biggest players will get even bigger. According to Morgan Stanley’s analysts, revenues in the sector will only raise by 1% per year for the next few years.

The biggest struggle awaits active asset managers, who will see their fees shrink by around 36% by 2023. Moreover, many of them, such as Legg Mason and Franklin Resources, have faced issues in recent years as low-cost, passive index funds and ETFs have been drawing investors away from their classical investment model based on high management fees and savvy stock picking, especially immediately after 2008.

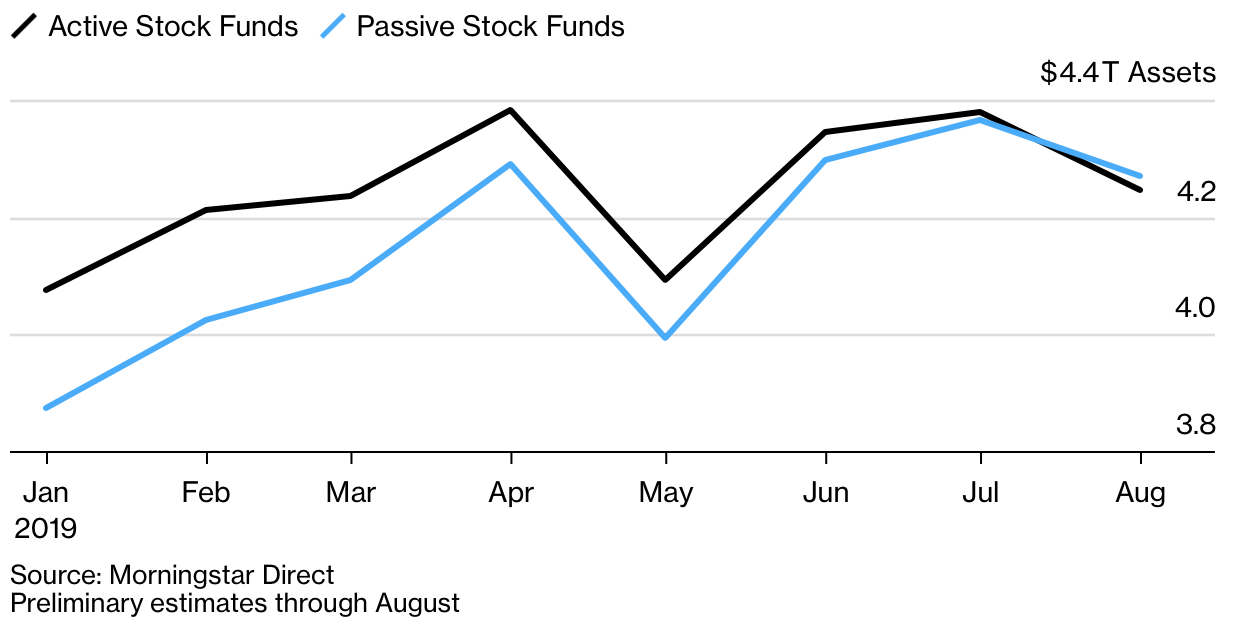

After having reached 33% in the US in 2018, assets in passive US equity funds overtook those in active equity funds for the first time in August 2019, as the graph here below shows:

It is worth pointing out that the idea about active investing being overrated is not new. Indeed, Princeton University’s economist and author of “A Random Walk Down Wall Street” Burton Malkiel compared the stock picking strategies of money managers to a blindfolded monkey throwing darts. Likewise, Jack Bogle, founder of Vanguard Group Inc. who popularized index funds, suggested that most active managers were not worth the fees they charged.

But most of the investors did not seem to care until they evaluated the damage to their portfolios after the 2008 financial crisis. Even when markets bounced back, many managers could not recover.

Today, the biggest threat for asset managers is the combination of fee competition and rising costs. Indeed, according to Casey Quirk’s principal and investment management chief strategist Ben Phillips, these factors are creating never-before-seen pressures within the industry.

However, some of the players may see themselves as the beneficiaries of this new environment. World’s largest asset managers are gaining more and more influence, attracting a larger share of investors’ money. Their size advantage allowed them to keep overall expenses under control, by exploiting economies of scale and make up for lower fees. On these grounds, they are also the most likely to be offering both passive investments and actively managed funds. Their success can be represented by the two largest U.S. indexing titans – BlackRock Inc. and Vanguard – which oversaw combined assets of around $13tn in 2019 (up from less than $8tn just five years before).

Fee wars resulting from intensified competition have pushed fund charges closer to zero for exposure to broad indexes. When in 2018 Fidelity, one of the US giants, unveiled four indexed mutual funds with no annual fees, their move gained a lot of attention. This measure came as a result of pressures from other titans such as the aforementioned Vanguard and BlackRock. Indeed, the former was offering some of the cheapest indexed products of the market, whereas the latter, being the world’s largest issuer of ETF funds, could afford offering products that charged less than $1 for every $1,000 invested. As a result of several moves of this sort from different investment managers around the globe, investors are paying today roughly half as much as they were nearly two decades ago and about a quarter less than five years ago.

The changing environment also did not spare the employees. Hundreds of jobs were slashed in 2019, with many being replaced with machines to help automate functions and cut costs. Legg Mason cut 12% of its staff, while BlackRock cut 500 jobs, which represented the biggest reduction since 2016. When it comes to top executives, the biggest changes took place in Europe; in fact, during the last year alone, more than 10 new CEOs have been appointed within the continent. Broadly speaking, more than half of the CEOs at large asset managers globally took their positions in 2014 or later.

When it comes to M&A activity, after 2009 BlackRock’s acquisition of Barclays Global Investors, consolidation has brought mixed results for investment firms. In 2018 deals in the asset management industry hit a record, with 253 transactions announced and deal value rising 29% from 2017 to $27.1bn, according to some researches compiled by Sandler O’Neill & Partners LLP. Among these deals, we find Invesco’s acquisition of OppenheimerFunds in 2018, or even the combination between Crédit Agricole and Société Générale’s money management arms (giving birth to Amundi). Other deals have experienced disappointing results, such as Janus Capital merging with Henderson Global Investors, because the combined entity reported higher net outflows in 2018 ($18.1bn compared to $10.2bn in 2017, the year of the merger); moreover, the company’s clients have yanked $38.5bn since 2017. The deal between Aberdeen Asset Management and Standard Life failed as well and the firms suffered from higher outflows after the arrangement.

What about the years to come? Experts agree that many asset managers will be absorbed by other bigger competitors and some will disappear altogether. However, all of the survivors will need to either cut costs or transform their strategies, so to increase profit and adapt to the new environment.

Deal Structure

Franklin Resources Inc. is set to acquire Legg Mason Inc. for $4.5bn ($6.5bn including debt), paying an implicit 23% premium on Mason’s market value of equity, taking on approximately $2bn of Mason’s outstanding debt. Differently from some recent asset management megadeals, which were funded with stocks (such as those involving Janus Henderson and Standard Life Aberdeen), this acquisition will be an all-cash transaction. The deal is expected to close by the third quarter of 2020. The new entity will operate under the name Franklin Templeton with its global headquarters remaining in San Mateo, California.

In terms of management, Jennifer Johnson and Greg Johnson will keep their roles as, respectively, president/CEO and executive chairman of the Board of Directors at Franklin Resources, Inc. Likewise, Legg Mason’s several fund management affiliates will keep their autonomy unchanged (senior management teams will stay the same) and stick within the newly combined entity. The only exception to this framework is EnTrust Global, which will not be joining the new company; indeed, the alternative investments boutique’s management team will repurchase the business from Mason and become private again, with the agreement to keep an ongoing relationship with Franklin Templeton.

Deal Rationale

The deal comes as a surprise to many industry observers, given the unusual practice of Franklin Templeton to making big acquisitions. It has been unclear whether the company would use its resources to undergo a sizable transaction or stick with the habit of pursuing small acquisitions, which have boosted its alternatives and high-net worth businesses in recent years. As a matter of fact, after the deal will take place, the company will still count on a $3.5bn cash on its balance sheet, for future expansion in the sustainable investing and data science divisions.

Broadly speaking, Franklin Resources expects the acquisition of Legg Mason to produce four main results.

First, the acquisition is supposed to generate greater scale, making Franklin Templeton one of the world’s largest independent global investment managers, with a combined $1.5tn in AUM post-closing.

Second, this acquisition will likely enhance Franklin’s investment capabilities and therefore its product line, maximizing exposure to new asset classes, such as real estate and fixed income.

Third, the transaction will broaden the acquirer’s geographic distribution globally.

And fourth, according to Franklin Resources’s executive chairman Greg Johnson, the transaction will improve the company’s strategic positioning and long-term growth potential, and at the same time, it would work towards its goal of a more balanced and diversified organization, so to serve more clients worldwide. Franklin Templeton’s president and CEO Jennifer Johnson added that a key focus for the newly combined entity will be the expansion of its multi-asset solutions.

Although cost synergies do not explicitly represent a strategic driver of the transaction, some effective results will be in place: cost efficiencies associated to the new entity are expected to bring approximately $200m annual cost savings.

Market reaction

Shares of Legg Mason increased 24% right after the official announcement, trading at $50.45, just above Franklin’s $50-per-share offer price, thus showing investors’ confidence in the deal. The acquisition answers months of speculation over Legg Mason’s future after activist investor Nelson Platz (Trian Fund Management LP’s founder) took a 4.5% stake in the company in May 2019 and secured position on its board.

At the same time, Franklin stock jumped by 12.6%. The company expects the purchase of Legg Mason to show tangible benefits by 2021, generating more than 20% in GAAP EPS accretion by 2021 (excluding one-time charges, non-recurring, and acquisition-related expenses).

“This is a landmark acquisition for our organization, that unlocks substantial value and growth opportunities driven by greater scale, diversity and balance across investment strategies, distribution channels and geographies,” commented Greg Johnson, executive chairman of the Board of Franklin Resources.

However, while Legg Mason’s share price has been stable since the deal announcement, Franklin Templeton’s began to fall. This might be seen as a sign of some concerns rising around the cultural integration of the two firms. Chris Harris, an analyst at Wells Fargo, pointed that “One hurdle would involve combining Legg Mason’s multi-affiliate model with Franklin’s more traditional structure”. Other voices mention the tensions between affiliates’ leadership teams within Legg Mason and their doubt about being taken over by the company that topped the list of world’s worst-selling mutual fund managers in 2017 and 2019, after suffering the biggest fund outflows earlier in 2015. Such issues may adversely affect the integration process and give rise to more complex obstacles. However, on official statements, both sides showed confidence in smooth consolidation.

Advisors

Broadhaven Capital Partners LLC and Morgan Stanley & Co LLC served as financial advisors to Franklin Resources, while Inc. Ardea Partners LP provided additional advice. Willkie Farr & Gallagher LLP acted as external legal counsel.

PJT Partners served as the lead financial advisor to Legg Mason, while J.P. Morgan Securities LLC provided additional service. Weil, Gotshal & Manges LLP was appointed lead counsel to Legg Mason and Skadden, Arps, Slate, Meagher & Flom LLP served as special counsel. Dechert LLP served as legal counsel to EnTrust Global.

0 Comments