Introduction

The potential $23bn hostile takeover of Teck Resources (NYSE: TECK) by the commodities behemoth, Glencore (LON: GLEN), would mark a significant moment in the industry. The Canadian family-controlled company has long been a prized asset eyed by the biggest industry players; however, its organisational structure was thought to be the biggest obstacle. With Glencore’s possible divestment of its coal assets, Teck represents a credible opportunity for the Swiss-based company. Reports suggest that the $23bn deal would combine Teck’s and Glencore’s metallurgical assets into a single entity, with coal assets merged and listed on the New York Stock Exchange.

Glencore

Glencore’s history dates to 1994 and the management buyout of Marc Rich + Co AG. Marc Rich, the legendary commodity trader who set up his own shop named after him in 1974, had become involved in legal disputes concerning the way the trader had conducted his business activities (bribery allegations). Top traders at March Rich + Co AG initiated a breakaway, thus forming Trafigura and Glencore International. Marc Rich was forced to sell his majority stake following a failed attempt to corner the global zinc market.

Since then, most notably under the CEO of Ivan Glasenberg (2002-2021), Glencore has evolved from being a commodity trader to a commodity trader and producer behemoth. With revenues of $256bn in 2022, the Swiss-based company is the largest of its kind in the world. Glencore proceeded with a public listing on the London Stock Exchange in 2011, a novel move for a commodity company. The successful nature of the IPO preceded grand changes in the company’s structure. It owns its current shape to the 2013 takeover of Xstrata, the Swiss mining company that it had funded and founded, which back then valued the new entity at $66bn. Current market capitalization stands at $68.4bn.

Currently, Glencore is led by Gary Nagle, its former head of coal assets who had joined the company in 2000.

Teck Resources

Teck Resources is a family-controlled Canadian mining company. Its revenue amounted to $13.3bn in 2022, owing to mining commodities such as copper, zinc, and gold, as well as producing refined metals. The company used to be referred to as Teck Cominco, owing to a partnership that started in 1986. Teck is operating under a dual class share structure, with Norman Keevil, a Canadian mining magnate, owning the majority of the class A shares with voting rights. According to the Financial Times, he is not willing to go through with the sale at any cost.

One of its most prominent projects is the Fort Hills oilfield in which it holds a 21.3% in the C$17bn project. Furthermore, Teck is a leading copper and coal producer, expecting to mine 390k to 445k tonnes of the former and 24m to 26m of the latter in 2023. The Canadian company is valued at $22.8bn and since last year it is led by Jonathan Price, a former BHP executive.

Deal rationale

Glencore’s surprise bid to acquire Teck for was announced on April 3rd, just a few days after the Canadian mining company first produced copper concentrate from its Quebrada Blanca 2 (QB2) project in Chile and a few weeks following Teck’s announcement of plans to spin off steelmaking coal business. This is Teck’s largest construction project to date and is expected to double the company’s copper production, producing between 285,000 and 315,000 tonnes of copper annually between 2024 and 2026. Glencore sees Teck as an opportunity to build exposure to the copper market, a commodity which is expected to play a key role in the shift away from fossil fuels.

Copper is essential for most electricity-related transport and infrastructure, including electric vehicles, wind turbines and grid infrastructure. According to estimates from S&P Global, demand for copper is expected to rise to 40m tonnes a year by 2030, up from 25m tonnes in 2021. However, only a small number of high-quality copper resources are still available because most of the world’s most accessible, high-grade copper deposits have already been mined. Competition among miners for these diminishing resources is getting more intense. The wave of M&A activity also includes Rio Tinto’s recent acquisition of Turquoise Hill, BHP’s $6.5bn bid for Oz Minerals, and Newmont’s unsolicited $17bn offer for Newcrest, all of which were driven by an interest in copper.

The combined entity of Glencore and Teck would be the world’s third largest copper miner, producing 1.4m tonnes a year. The two companies also own copper assets located in proximity of each other – Teck’s prized copper mine Quebrada Blanca is located just 40km from the Collahuasi mine, in which Glencore holds a 44 per cent stake. Glencore expects to derive some synergies by sharing processing facilities, although some analysts suggest that this will not be very straight-forward, but Glencore’s marketing business can create value for the entity. Furthermore, both Glencore and Teck have stakes in the Antimina copper mine in Peru, holding 33.7% and 22.5% respectively – this transaction would give the combined entity majority control.

Perhaps the most interesting dynamic of this deal is both firms’ moves to demerge the coal business and the energy business into two standalone companies. Teck had already announced a proposal in February to separate into two independent, publicly listed companies: Teck Metals and Elk Valley Resources (“EVR”). The two companies were supposed to offer investors with two different value propositions for investment. Teck Metals would be a growth-oriented metal mining company, whilst EVR would be a cash generating, steelmaking coal producer. It is important to note however that Teck Metal would still retain some of the cash flow from EVR for at least three years following the separation. This keeps the coal and metals businesses seemingly intertwined and essentially goes against the proposal’s main selling point: to divest the clean metals business from the ‘dirty’ coal business for investors. The proposal for the spin-off was subject to a shareholder’s vote which was expected on April 26th, before it was withdrawn on the same day.

Glencore had their own separation plan in mind regarding the combined entity following the potential acquisition of Teck. They proposed creating two standalone companies, MetalsCo and CoalCo, which would operate the metals business and the coal business respectively, as the names suggest. They expected to generate between $4.25bn and 5.25bn of estimated post-tax synergies based on their previous acquisition of Xstrata and Gavilon. Perhaps the major difference between the two separation plans is that Glencore’s plan truly separates CoalCo from the Metals business with cash flows from each not being retained by each other, providing investors with a true ESG investment option. Glencore claim that MetalsCo would have generated approximately $16bn of proforma EBITDA in 2022 with CoalCo generating approximately $26bn. They expect the former to be the third-largest copper producer as well as a leading supplier of cobalt, nickel, and zinc, with the latter being highly cash-generating, ultimately positioning both Teck and Glencore shareholders to participate in a valuation re-rating over time.

Deal dynamic

The negotiation has had a fascinating dynamic thus far, with both firms trading punches over a transformative deal for the industry. Glencore’s first all-stock bid, offering a 20% premium on Teck’s closing price, was rejected by the board for five key reasons. First and foremost, the board was not looking for a sale of Teck and would need to undertake a disciplined procedure to consider it. The board also believed that the bid was ‘opportunistically timed’ following Teck’s proposal to split and as they ramp up their QB2 copper project. They claim that there is value from the spin off that will be transferred from Teck shareholders to Glencore shareholders should the bid be accepted.

Additionally, the board argues that there is a high risk of execution due to the level of complexity from the number of jurisdictions and regulatory bodies that must approve the transaction. Teck’s separation already has all necessary regulatory approvals and is expected to be closed by the end of May, compared to the 24 months the Glencore proposal could take to resolve. Glencore’s proposal also introduces Teck’s existing shareholders to exposure from Glencore’s thermal coal business, which isn’t aligned with the global decarbonization agenda. Forcing Teck shareholders to hold this exposure may drive away current and future investors who cannot hold such assets, resulting in the business trading at a discount and destroying value. Teck’s final qualm was regarding new exposure to Glencore’s oil trading business, consequently undoing the work Teck had done previously to exit the oil business.

Glencore responded a week later with a cash element of up to $8.2bn to buy Teck shareholders out of their coal exposure, should they wish not to own shares in CoalCo. Teck rebuffed the revised offer and recommended that Glencore spin off its thermal coal business first and then come back for further discussions when Teck has done the same. Giuseppe Bivona, Chief Investment Officer at activist investor Bluebell Capital, which owns shares in both Teck and Glencore, said “the way the transaction should be done is completely different”. Bluebell wrote to Glencore calling it to separate its coal and oil business and then merge with Teck, like what Teck themselves suggested. At this point Glencore decided to circumvent the board of directors altogether and address Teck’s class B shareholders directly. Gary Negle, Glencore’s Chief Executive, travelled to Toronto to personally sell the deal and convince investors of the value of Glencore’s bid. Meanwhile, Teck’s CEO, Jonathon Price, had also been lobbying shareholders to vote in favour of Teck’s proposed spin-off to fend off Glencore’s bid.

Amidst all the negotiations between the two firms, another headwind potentially affecting this deal is the threat of regulatory bodies. Many commentators have warned that the sale of Teck to a foreign buyer would be a great loss for Canada. The federal government has been encouraged to conduct a “significant review” of Glencore’s takeover proposal by the Mining Association of British Columbia (MABC), the largest mining association in the province, whose members include both Teck and Glencore. Based on net benefit and national security concerns, the government has the authority to reject such an acquisition or investment from a foreign business, and it has done so in the past. For instance, in response to the rising significance of key minerals, Ottawa forced three Chinese businesses to sell their holdings in three Canadian lithium miners in November. Price will not speculate on whether he thinks the government will take comparable actions or carry out a thorough investigation of Glencore’s acquisition of Teck. He did note that there were considerable risks associated with Glencore’s proposition.

Another challenge Glencore faces in their takeover attempt, is that of Teck’s dual share class structure. Teck has both class A and B shareholders, with class A shares holding 100 times the voting rights of the widely traded class B shares. Teck’s formal chair, Norman Keevil, controls 55% of Teck’s class A shares, making his vote key to the company’s future. He immediately rejected Glencore’s initial bid on the ground that “it’s not a matter of price” and that “we are not about to be swallowed up by them”. He then made a statement following the second bid on April 17th saying that whilst he was open to mergers, acquisition or even a possible sale of Teck after the separation, he didn’t support Glencore’s bid. His softened tone was brought about by several Teck shareholders and proxy advisors expressing their support for the takeover. The challenges of the dual share structure and the voting power of Keevil must be overcome by Glencore should they wish a successful takeover.

The most recent development in the saga was the last-minute withdrawal of the shareholder’s vote on the restructuring proposed by Teck’s board. They abandoned the vote just hours before it was scheduled, suggesting the board was not confident that it would receive the two-thirds support from shareholders necessary for the restructuring to go through in its current form. They plan to revise their approach and propose a new restructuring without a convoluted royalties payment scheme linking the two new companies. Glencore have stated that they will no longer pursue a deal if Teck proceeds with its own split, meaning the outcome of the shareholders’ vote would have been pivotal for the deal had it gone through. The fact that it got cancelled makes this deal seem more likely. As it stands, Glencore’s proposal still stands and are willing to engage with Teck’s board address issues that have been raised. The question of when Teck’s new proposal will be announced or if there will be any progress made on Glencore’s bid, remains unclear.

Coal Industry

The shift to renewables and the worldwide focus on clean energy has caused radical shifts in the coal industry as the major players in the mining sector have slowly but surely tried to liquidate their coal assets and diversify across other industries. Coal is highly polluting which has caused large mining companies to try and position themselves to monopolize the metal market. Rio Tinto [ASX: RIO] was the first big player to exit the market, and BHP [NYSE: BHP] has slowly cleared out their reserves of coal utilized for power generation and steel making – known as metallurgical coal.

From a financial point of view several companies have undergone important restructurings and spin offs including the South African company Anglo American [LON: AAL] which focuses on the thermal coal market. They were able to spin off their coal division into a new entity known as Thungela [JSE: TGA] in 2021. Glencore’s perspective differs from the rest of the industry as it has tried to consolidate its extremely large thermal coal market share. The chairman of Glencore’s board believes that by being a large player with diversified assets, they will have to abide by higher ethical standards which will in turn benefit all stakeholders of the company. Gary Nagle argues that by not liquidating its coal reserves Glencore will be able to act more responsibly from an ESG perspective, and hopefully align the companies plan with the Paris climate goals. The coal industry benefited greatly from Russia’s invasion of Ukraine as the price of Coal skyrocketed, particularly within the thermal coal sphere. Prices rose from approximately $186 per metric ton to $462 in a three-week period. This helped Glencore triple its coal related EBITDA with reference to the previous year which made up the bulk of their earnings.

However, following an impressive year Glencore abandoned its rationale and showcased interest in spinning off its coal division through its bid for Teck Resources. This idea has been deemed a drastic strategic change that contradicts their previous statements and plans; however, Glencore belittles comments regarding their shift in ideology. The company believes that both Teck and Glencore could benefit from the deal due to an agreement which would see most of the cash from the metallurgical coal business being directed towards the metals company.

The chairman of Teck issued a statement following the rejection of Glencore’s takeover approach which included “as you have now publicly stated you are prepared to spin out your thermal coal business, we suggest you proceed with that”. Several Coal companies have utilized vaguely worded agreements and statements referring to the will of their shareholders with regards to the future. This has helped companies like Glencore remain unbounded by the Paris climate goals. From a business standpoint a potential listing in the United States provides investors that are less bothered by the climate implications and that prioritize cash flow over climate initiatives, which aligns with Glencore’s new agenda.

Teck Resources operates 4 active steelmaking coal mines which are situated in the Elk Valley part of British Columbia. They have generated more than 4,000 jobs for local communities. They have a strong focus on responsible mining and are motivated to make sure their business practices do not pollute the environment and water quality surrounding Elk Valley. As a business, 60% of their revenue in 2022 came from coal designated for Steelmaking which amounted to 21.5 million tonnes. They also have an extensive exporting practice as they were able to generate sales of 22.2 million tonnes of coal to worldwide clients. Teck holds extensive market share as the second largest exporter of steelmaking/metallurgical coal, which is used in 72% of steel production worldwide. Following on their past emissions standards Teck sees a future for their environmental philosophy and aims to pursue it further through the spinoff into the copper industry.

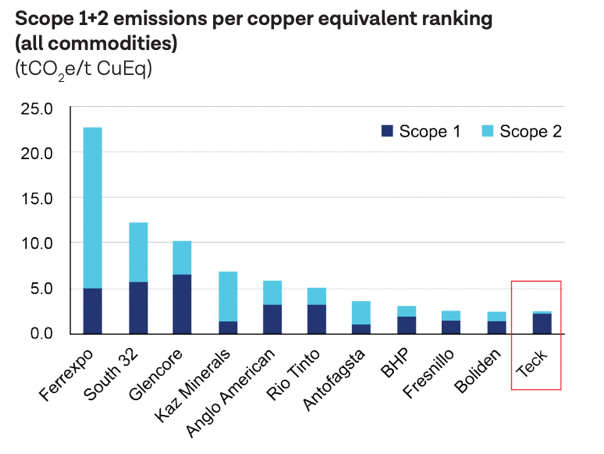

Source: Barclays Research, Teck

M&A analysis of the Coal & Mining Industry

2022 signified an all-time high in terms of global demand for coal as we saw it surpass 8 billion tonnes. When it comes to the overall industry, we saw Russia’s invasion of Ukraine which significantly impacted the internal dynamics of the coal trade, prices and the overall supply and demand on a global level. As demand shifted from natural gas, coal found itself as a natural substitute. However, different sources of energy mainly concerning renewables are threatening the outlook and future for the coal industry.

The overall mining industry is undergoing a period of consolidation which is led by companies that need to increase their scale and reduce their costs through more efficiency. M&A activity steadily increased from 2020 to 2021 as we saw several copper-related transactions take place. The demand for copper has increased significantly and is predicted to keep increasing due to its important role in the shift towards renewable energy, its possibilities with electric vehicles and its role in infrastructure projects. May 2021 saw the price of copper spike at a second all-time high, lagging only the April 2022 price. The total deal value of copper M&A in 2021 was $21bn led by the marquee transaction of the Grasberg mine by the Indonesian government for $5.3bn.

The most important drivers of M&A activity in the copper sector include the companies’ need for high quality copper in several strategic locations, the technological implications of the commodity, and the increased efficiency in the sector correlated with consolidation. The start of 2023 has seen an industry defining deal in the largest merger in the gold industry. The Newcrest – Newmont deal comes at a time when Copper has just recently surpassed gold in total M&A value and is interesting when it comes to its future implications for both commodities.

Outlook

The demand for coal is set to plateau following 2025, however it is extremely dependent on the future of China and its utilization of the resource. The price of coal and its overall consumption is subject to changes in the global economic activity, weather conditions, prices for fuel and overall future government policies. In 2022, China accounted for 53% of global coal demand, meaning that the future of the industry is extremely contingent on China’s policies and outlook for coal. As China increases its plans for renewable power generation by estimating a 1,000 Terawatt/hour increase by 2025, the outlook for coal is stagnant following 2025.

When it comes to an outlook for M&A activity in the copper sector, the high demand for copper could lead to increased M&A activity within the copper sector in the immediate future. As companies become increasingly burdened by ESG considerations, copper will play an important role in positioning firms to take advantage of the shift to renewables.

The shift towards green energy has been an important driver of growth within the metals and mining industry particularly for companies that deal with key metals (copper, nickel, lithium, and cobalt). Mining companies have been conducting several strategic acquisitions in these sectors to grow their exposure to these in-demand commodities. By diversifying their portfolios, they hope to profit over the inflated prices of the metals and consolidate their business to increase supply and be positioned for shortages. Events including Russia’s invasion of Ukraine which demonstrated Russia’s control of Nickel and showed governments that they need to secure their commodities supply chain has led to increased activity. However, due to recent inflationary constraints mining companies might not continue to engage in several mergers & acquisitions. The slowdown in global economic growth coupled with the short-term decrease in the demand for commodities could cause the mining industry’s M&A activity to slowdown in the immediate future.

Source: International Energy Agency

0 Comments