Introduction

The aim of this article is to analyse the current price valuation of the biggest players in the gun manufacturing industry, trying to assess if they are correctly priced. We will begin with a brief overview of the recent past in the guns industry, followed by an extensive analysis of our short-term position, and then conclude with a brief long-term view statement.

Not-so-distant past

Few industries are as volatile and unpredictable as the gun manufacturing one, as it is closely tied with fiscal and legislative policy. Demand, and therefore stock prices, seem to be not only erratic, but at times even counter-logical. If we take a look at the evolution of the prices, during the Obama anti-gun administration, they have increased substantially and only recently, since Trump’s election, who is pro-gun, have declined. The intuition and fundamental reason for the stock prices’ evolution is simply the fact that currently gun producers have lower revenues. Opposite to intuition, during Obamas’ anti-gun administration people were “rushing” to buy guns, anticipating stricter gun control, inducing higher revenues. The higher revenues contributed to higher stock price valuation. So it was only logical, upon Trumps’ election, for people to lower their “gun hoarding”, leading to the seemingly irrational fall in prices.

Short-term perspective

As we mentioned previously, gun manufacturers’ stocks have been negatively affected by the forecast of declining sales since Trump election. At this point of our analysis, we want to understand to what extent the market is pricing a fall in the gun demand.

To do so we use data about the number of background checks, conducted whenever someone wishes to purchase a gun at a federally licensed firearms dealer (FFL), by the FBI. Analysts regard these checks as a good proxy of the nationwide demand trend for firearms.

Our original idea was to conduct the analysis by referring to the whole American firearms industry using a pure-play gun ETF, but we discovered that such an index does not exist. Therefore, we focused only on the market leaders “Sturm, Ruger & Co.” (RGR) and “Smith & Wesson” (SWHC). We discarded a big player of the gun industry: “Vista Outdoors Inc.”, the main reason being that Vista is focused on the ammunition business too and it is not a pure gun manufacturer. Even though the demand for ammunition and guns is somewhat correlated, we do not regard background checks as a good proxy for the ammunition market.

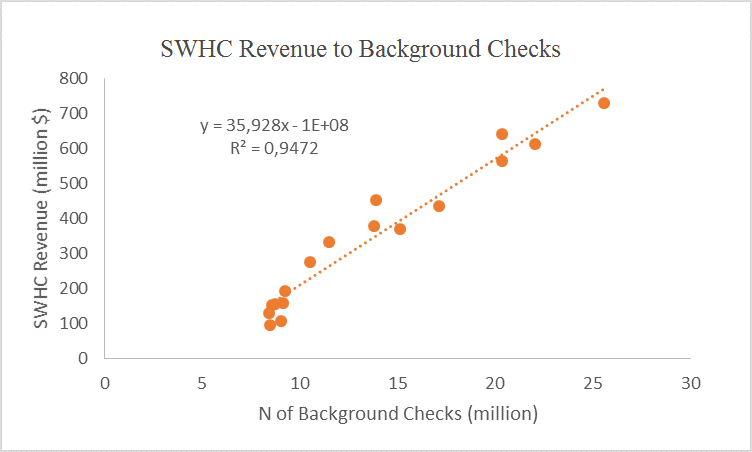

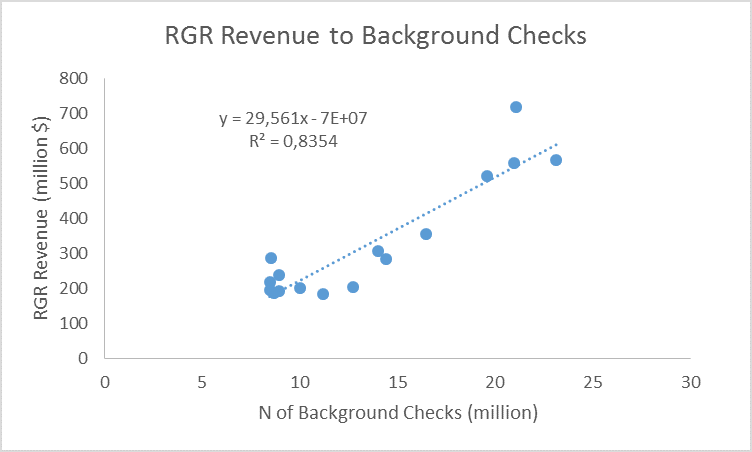

We decided to analyse whether there is a relationship between the number of background checks and gun manufacturers’ yearly sales revenue. We chose to cover the period ranging from 2000 to 2015 as it encompasses both the Bush Republican presidency and the Obama Democratic tenure, showing all the possible trends in gun demand (upward, downward and flat). Adjusting for inflation and different accounting practises, the charts below show the result of the regression.

Chart 1: SWHC Revenue to Background Checks (source of chart data: Bloomberg, FBI)

Chart 2: RGR Revenue to Background Checks (source of chart data: Bloomberg, FBI)

The two regression models seem consistent with high R squared readings. This means background checks are not only a good proxy for the American gun demand, but also a good measure of gun manufacturers’ sales.

Computing expected number of background checks using the current price

The next step is using the regression model to gain a better understanding of investors’ expectations of gun demand trend. In fact, thanks to the regression model and the stock market valuation of gun manufacturers, we can compute the expected background checks (the “size” of gun demand). Focusing our analysis on the background checks allows us to track the stock’s price swings.

In order to find the expected background checks we need to obtain the expected sales revenue from the market valuation of gun makers’ stocks. We did that assuming a constant valuation ratio. We considered two possible ratios: the Price-Sales ratio and the Enterprise Value-Sales ratio. We acknowledge both systems have some weaknesses. On one side, the Price-Sales ratio overlooks the companies’ capital structure. On the flip side, in order to compute the Enterprise Value we need some balance sheet data. The most recent data are available on quarterly reports referred to October 2016.

For the sake of brevity, we will show the results of our analysis employing the Price-Sales ratio even though we reached similar outcomes with the Enterprise Value-Sales ratio too. Moreover, we regard Price-Sales ratio as a good choice as both Sturm Ruger and Smith & Wesson are mainly equity-financed.

We calculated the constant P-S ratio as the average of previous year’s levels for both Sturm Ruger and Smith & Wesson. Our estimate is a Price-Sales ratio ≈ 1.4. We noticed that Sturm Ruger’s valuations are slightly higher than those of Smith & Wesson are. We see the same pattern in the two companies’ PE ratios: 11x for Ruger and 8x for its competitor. A possible explanation is that Sturm Ruger recorded an impressive performance since 2008, with its shares growing nine-fold while Smith & Wesson stocks advanced five-fold during the same period.

Using the estimated Price-Sales ratio and the regression model, we calculated the market forecasted future background checks. According to our estimates, the market is expecting for the month to come ca. 1.7 million checks (1.65 million from Sturm Ruger analysis, 1.77 million from Smith & Wesson’s one). This is a huge 35% drop compared to February 2016 when the FBI conducted 2.6 million checks. For comparison last months background checks were 2 million, a drop of more than 30% over December 2016 levels. In fact the decline in sales should have been a lot higher, hadn’t it been for many retailers clearing their inventories, offering discounts, and even in some cases selling firearms below cost.

We believe the 1.7 million checks estimated by the market is an overestimation of the actual gun demand. Looking backward, this was the same reading of February 2012, still at Obama’s high levels of demand. We think gun demand will further decline in the next months and so will gun manufacturers’ stock prices. The catalyst may be the disappointing background checks figures in the upcoming months. In conclusion our short-term stance toward the gun manufacturers is bearish.

Long-term view

Following the analysis above, we must note our fundamentally different standpoint when it comes to the long term performance of gun manufacturers. Given Trumps’ promises for fiscal stimulus, and looser gun legislative policy, it is easy to see that a bullish medium-to-long term is expected, as both of these actions will boost the demand for guns. Following the above-mentioned reasons, we would like to suggest a short position in the short-term (possibly 1 year horizon), followed by a long position over the medium-to-long term.

0 Comments