What is the Hu-Gang Tong?

On November 17, China took another leap in opening its markets to foreign investors with the establishment of the Hong Kong – Shanghai Stock Connect program. The so-called “Hu-Gang Tong” program will for the first time ever enable mainland residents to trade shares in Hong Kong. The program’s goal is to ease foreigners’ access to Chinese companies that had previously been largely inaccessible. Despite having both daily and aggregate capital flow limits, the prospects of the program have undoubtedly caused a lot of market reaction, especially during the first few days of trading. However, the trading activity soon subdued, raising concerns of whether the entire project will indeed prove to be a success.

The Stock Connect program came about as a result of the central government’s push to link the Chinese securities market with those overseas, as well as its attempt to promote the acceptance of the Renminbi as a global currency. It is an addition to the highly regulated Qualified Foreign Institutional Investor (QFII) program, which, since its inception in 2002, provided foreign investors a direct access to China’s capital market. Aside from further establishing Shanghai and Hong Kong as the leading global financial centres, the program is also widely expected to expand the Renminbi market and thus reduce China’s reliance on dollar-denominated Treasuries.

How has it fared?

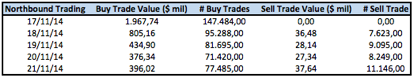

On the very first day of Stock Connect trading, close to $2bn of Chinese shares were bought through almost 150,000 trades; filling the entire daily quota. However, the market did not manage to keep that pace and already by November 21st the amount of trades halved with the counter-value dropping to $400m. This meant that 30% of the quota was met on the second day of trading and 17% on the third.

In contrast, very few “sell” trades happened during these first five days and for an even smaller counter-value in proportion. This was expected, since a greater emphasis on buying Chinese securities than selling them was explicitly expressed by institutional and retail investors.

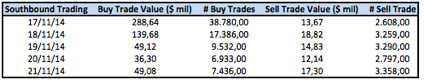

Meanwhile the Southbound link, a channel for Mainland investors’ trading of Hong Kong shares, saw a far lower market activity both on buy and sell trades. This too was expected, since there was a greater interest in entering the Chinese market than the other way around.

As previously mentioned, the Stock Connect is subject to both daily and aggregate capital flow limits. The limit for foreign investors is set at RMB13bn, which means only about $2bn worth of Shanghai stocks can be bought each day. Conversely, mainland investors are allowed to conclude transactions in Hong Kong with a limit of RMB10.5bn (about $1.7bn). The daily quota was only reached on the first day of trading, which posed doubts with respect to the overall success of the program.

What effect has it had on the exchange rate?

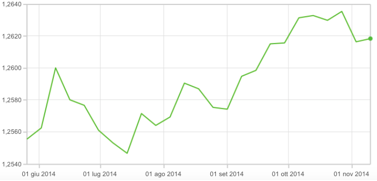

Looking at the exchange rate between Hong Kong Dollars and Chinese Renminbi over the past six months, it is clear that the Yuan appreciated.

This might also reflect the growing demand for the currency as an effect of the Stock Connect opening, in prospective.

Conversely, we notice how in the last month the exchange rate, even though showing some volatility, reverted on its original level. This lack of appreciation is consistent with the fact that there was a slow start and the great volumes in terms of number of trades and counter value that were expected did not take place.

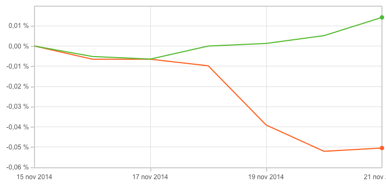

If we look at the percentage changes in exchange rates of HKD and CNY with respect to the US Dollar, it can be seen that starting from November 17 (first day of Stock Connect trading) the two currencies heavily diverged, as the Yuan firmly appreciated and the Hong Kong dollar showed a small depreciation. These movements are consistent with the view stated above and given their timing they constitute a clear effect of the unbalanced demand from the two markets to each other.

What impact has the Hu-Gang Tong had on the market?

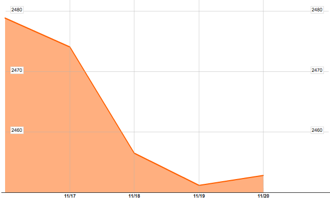

Looking at the Shanghai Stock Exchange Composite Index, we notice how in the five days since the Stock Connect started it lost about 2.15%, going from 2,506.864 to 2,452.66 points.

Source: Bloomberg

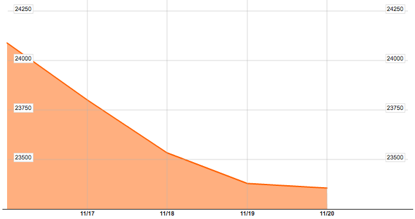

The same trend was followed by the Hong Kong Hang Seng Index, which decreased from 24.313,06 to 23.349,64, or about 3.96%. These drops are undoubtedly caused by a lot of factors, such as the slow-down in the Chinese economic growth and the recent changes in monetary policies by central banks around the globe. However, the poor performance of Stock Connect project in its first days surely had an impact. Share prices in both markets were driven up before the launch of this project by great expectations on its outcome, especially in terms of inflows to Mainland China, but as the value and number of trades suggest, this did not quite happen during the first few days, and the result was a downward pressure on the indices.

Source: Bloomberg

What can explain this lacklustre performance?

This slow start could be attributed to two main factors. First, the operational complexity of the link, particularly the short settlement cycle of “T plus zero”, as people in the industry defines it. It implies that people wanting to sell a security today must have already moved it from the custodial account to the brokerage one yesterday, in order to be allowed to trade.

The other plausible reason is the end-of-the-day window, when there are only 30 to 90 minutes to settle transactions, that is for securities to be delivered and cash received. This tight schedule could have impacted on the investors’ appetite, since most other markets adopt a T+2 settlement system, which allow up to 24 hours in order to finalize the trade.

This strong amount of investments in the initial opening of the connect program can be attributed in a large part to smaller investors such as hedge funds seeking out arbitrage opportunities. Traditionally mainland company shares that traded on both exchanges experienced a significant premium in Shanghai (A-Shares) than over Hong Kong (H-Shares).

The Hang Seng China AH Premium Index, a measure of the gap between the largest dual-listed shares, rose to 100.36, the highest level since the exchange was announced in April. A level of 100 in the index would translate to A-shares and H-shares being priced equally. It appears that despite the exchange connect, high demand for A-shares have kept them at a premium.

In anticipation of the influx on investments into the Shanghai-listed stocks, many popular stock prices were driven up in the shanghai market by investors, setting a “trap” for Inbound investors.

Kweichou Moutai Co Ltd, the top baijiu liquor producer, has raced up more than 50% so far this year, and then fell 10% this week as mainland investors pocketed their profits. Meanwhile, Daqin Railway, a northern China Rail transport operator, has risen more than 50% since March and hit a 4-1/2 year high on Monday, but has since dropped by 10% following recent trading.

These profit-taking selloffs of assets have caused fresh downward pressure on the Chinese economy; the Shanghai Composite Index was down 0.1% at 2,448.6 points, while the CSI300 index of the largest listed companies in Shanghai and Shenzhen also fell 0.1%.

What other explanations are there?

Despite the flurry of initial activity it appears that trading has been below expectations. One large obstacle voiced by potential investors is taxation. Although the government announced no taxes would be levied on profits made in the first day of the exchange connect, many have remained skeptical, and do not want to risk possible claw-backs by the government in the near future. Such uncertainty over tax regulations and laws has been a major factor holding off larger institutional investors.

In addition, regulations forbidding foreign funds from directly owning shares listed in shanghai, instead requiring them to be held by local “clearing houses”, has created added legal complications for large foreign investors.

As previously mentioned, although southbound investment was expected to be lower than that of northbound investment, figures proved weaker than expected, giving evidence of a large capital imbalance. This owes credit to the popular theory that many wealthy Mainland Chinese investors willing to buy Hong Kong stocks had already found many ways of doing so in previous years, while the domestic real-estate market still provides an enticing alternative.

Another reason for the less than overwhelming demand of investment, lies in the fact that only 565 stocks are allowed to be traded through the connect. This has meant that investors’ real hunger, that for China’s “New Economy”, has gone unappeased. These stocks, which remain in sectors such as technology, health care and environment protection, are mostly in Shenzhen and therefore have been excluded. A second future connect to the Shenzhen market has been planned for this reason.

What will the future hold?

Looking ahead, the biggest opportunities for the market lies in SOEs (state-owned enterprises). Long expected reforms of SOEs, which make up 60% of A-listed shares by capitalization, are bound to be a major draw for future investors. According to UBS securities, these firms trade at a 30% discount to price-to-book value in contrast to their private counterparts.

A further opening of the Chinese markets, in accordance with meaningful reforms will go a long way to increasing the inter-exchange trade.

Mr. Li, chief executive of Hong Kong Exchanges & Clearing Ltd. likened the trading link to a new bridge: people wouldn’t cross it just to make its builders feel better. They would cross that bridge when the need arose, to do their own business and make money.

[edmc id=2183]Download as PDF[/edmc]

0 Comments