Introduction Download PDF

Repos, or repurchase agreements are the pillars of the financial system, maintaining stability while providing short-term liquidity solutions for the parties involved. As of today, the repo market is estimated to trade more than $3 trillion every day. In a new era of digitalization, many operations across the whole financial market are being automatized, streamlined, and their processes are being simplified. With the use of blockchain technology, and more specifically the Digital Ledger Technology (DLT), repo operations can be more than just automatized. Reducing the time elapsed between contract signing and settlement from 2 days to just one hour is paramount to allow intra-day repo trading. This means that market participants have more flexibility in their liquidity management, but can also benefit from accessing better financing opportunities, rendering higher market efficiency. Higher accessibility to the repo market with the DLT could also entice individuals to turn their backs to bank deposits, preferring repo market’s higher returns. But before diving into the specificities of this ground-breaking technology, lets explain what repo agreements are.

What is a Repo Agreement?

A repurchase agreement is a collateralized loan between two or more parties. The first party will lend a financial asset (collateral) against cash, while the second party will buy the financial asset in exchange of cash. After a specified tenor (the amount of time before a contract expires – usually overnight for repos), the first party will buy back its asset at a repurchase price, reversing the initial agreement. The repurchase price embeds the repo rate, the annualized rate at which the asset is repurchased by the first party, and can be either predetermined (fixed), or floating. This interest rate reflects the repo buyer’s opportunity cost of lending cash for a predetermined time period. Most repo transactions have an overnight tenor, thus qualifying the rate as the “overnight repo rate”, but repos exist for longer time frames and are qualified as term repos. Repo rates are usually fixed, but parties can agree on a floating rate, linked to an interest rate index with a predetermined spread. The most common are ESTR for EUR, SOFR for USD and SONIA in GBP. For better future understanding, the operation from the first parties’ perspective is known a repo, while from the second one is qualified as a reverse repo.

Repos offer great flexibility to the parties involved. Repo buyers can sell the security obtained to clients, use them for margin calls etc. It is important to note that the repo seller (the party lending the financial asset and borrowing cash) retains the economic benefits rising from the asset. If you have a bond engaged in a repo agreement and this bond pays a coupon, this coupon is handed over to the repo seller. Haircuts protect the lender against market fluctuations, while the fact that most jurisdictions grant a favorable treatment to repo buyers under insolvency law mean that essentially, repo agreements provide an extremely reliable and low-risk access to short term liquidity.

The collateral is a security, typically a treasury for liquidity purposes, but can be any security that matches a financing need from one of the parties. However, most of the repo traded on the market have sovereign bonds as collateral due to the concept of haircut, as encapsulated by this quote published by one of BoE’s study groups (2017) “There are currently around $12 trillion of repo and reverse repo transactions outstanding globally, of which nearly $9 trillion are collateralized with government bonds.” Highlighting the default risk of the repo seller (the party lending its financial asset in exchange of cash), a haircut is imposed on the collateral depending on its liquidity and possible market fluctuations. For example, in exchange of a 100 cash, the repo seller might have to provide 102 worth of security (for a 2% haircut). These haircuts can range from 2%-5% for the most liquid collateral (treasuries for ex.), up to 20% for the most illiquid ones (mortgages, corporate debt etc.).

Highly liquid assets with low default risks are favored due to lower haircuts imposed by the repo buyer (the party borrowing the security and lending cash), increasing the parties’ refinancing rate. From this point on, it is important to dissociate each type of collateral. From the highest quality to the lowest, we have sovereign bonds (US treasuries, EU/Japan bonds), Investment Grade (IG) bonds (corporate bonds rated from AAA to BBB), and then High Yield bonds/non-IG (bonds rated under BBB). Another widely used denomination to qualify IG and HY bonds is credit. General Collateral repos (GC) are traded when the lender is indifferent with the collateral they receive among a group of perfectly substitutable liquid securities. Rates repo will generally demand high grade sovereign bonds, while credit repos use corporate bonds as collateral.

The limits of these GC repo arises when repos are used to short a specific security or meet a capital requirement. Here comes Special Collateral repos. These repos have a specific collateral that help institutions meet the regulator’s requirements, such as the Liquid Coverage Ratio established in 2008 after the financial crisis. A market maker may also buy a special repo to sell a security to one of its clients if this security is not available on other markets. Looking beyond banks, of the main player of the repo market will be investment funds (pension and mutual) that are holding long positions on certain securities and wish to get additional returns.

For a more thorough description of the mechanics of repos, I recommend having a look at two of our previously written articles, “The Invisible Gears: Repo Agreement and the Credit Repo Market – Part 1” and “Part 2”, which jointly feature a tremendous amount of details on the product itself, the market as a whole and several pricing factors.

What are the functions of the repo market?

One of the first economic function of the repo market is to grant money market funds, asset managers or any other institutional investor an effective low risk solution for cash investment. Indeed, reverse repos are massively used by these parties when they temporarily have cash on hand, to maximize their returns. Both the presence of high-quality collateral – sovereign bonds in most cases – and haircuts on the asset (which alleviates most of the market risk) reduces any associated risk to this investment. Repo’s ultra-short tenor (most repos are structure overnight) and their ability to roll over means added flexibility to the parties involved. Any market participant who has long position on a certain asset could also benefit from the repo market, increasing their overall return by lending their assets. Pension funds and asset managers traditionally are some of the biggest players in this field.

As mentioned earlier, repos also provide a mean to market participants to hold a specific security or cash which can facilitate regulatory proceedings (notably to satisfy the liquidity coverage ratio). Regulators now insist that each bank must group its assets together by risk category so that the amount of required capital is matched with the risk level of each asset type. Under Basel III, regulators now use credit ratings of certain assets to establish their risk coefficients. The goal is to prevent banks from losing large amounts of capital when a particular asset class declines sharply in value. This is done to reduce the risk of insolvency and protect depositors.

Securities borrowed through repos can also facilitate the structuration of derivative products. Repos are often used by markets to hedge a specific position, via the use of Special Collateral repos. These securities can be used to diversify the risk profile of a portfolio, as underwriters can finance the underlying hedging operation of the security.

Finally, since 2003, the FED and other central banks used the repo market as a way to “fine tune” monetary policy. Indeed, by controlling the short-term interest rate (overnight rate), the FED can easily adjust the money supply and make sure that the target fund rate stays in the set range. In this last decade, we witnessed an acceleration of the usage of reverse repos as a mean to accelerate quantitative easing. With the use of its overnight repo and reverse repo facility (ON RP/RRP), the FED sold reverse repos (borrowing treasury while lending cash to the second party) to keep injecting money into the economy, as interest rates had already floored. As of today, the FED is now trying to shrink down its balance sheet, and alongside letting bonds expires without any buyback program, the FED now plans to sell repos.

Transaction and operational costs of the repo market

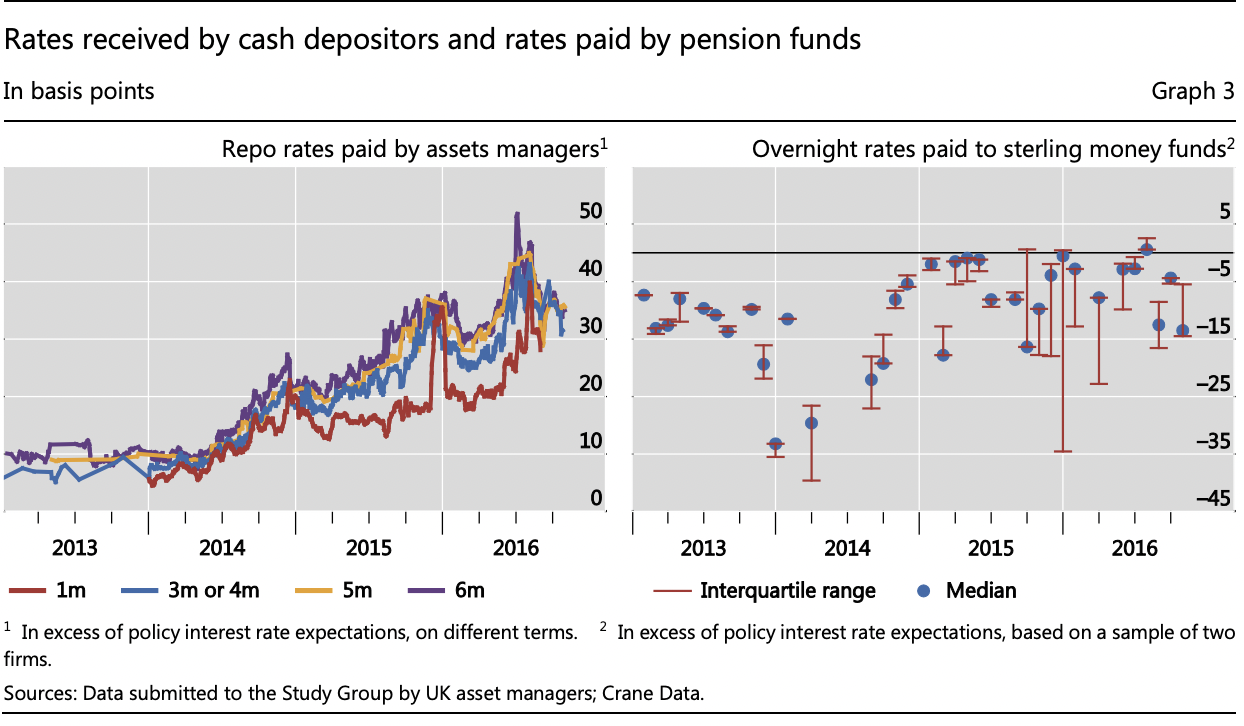

Repo are traded directly on the OTC market, or using an electronic platform which automatically matches buyers and sellers once they’ve inputted a limit on the rate and specified the type of collateral required (general or special). In the past few years, there has been an increase in the cost of repo intermediation. There are many signs that indicate that the costs faced by the users has increased in many jurisdictions. Taking the example of the UK repo market, repo rates paid by pension funds and asset managers to borrow cash in the UK gilt repo market increased by fourfold between 2014 and 2016 (left graph). This number comes in as a surprise when for the same period, rate received by a sample of cash depositors remained constant, and on occasion, spiked downwards (right graph).

Source: Repo market functioning, Committee on the Global Financial System (BoE)

For a traditional repo transaction to be verified and then settled, the front office makes the order and then sends it to the back office that will book the transaction into the system. Once the repo has entered the system, there still is some time before the order goes ahead as both parties need time to exchange the collateral and the cash. Even today, traditional repo settlements take up to two days to settle: these settlement frictions create market inefficiencies and the delayed delivery times mean that these assets are “frozen” for a period of time. Parties trust can also be a limiting factor of the repo market, and although clearing houses have been set up to mitigate this risk, this does come up as an additional cost for the parties involved.

Digital Ledger Technology in the repo market

Technology has often been a solution to reduce settlement and operation constraints and the repo market makes no exception. The revolution with the Digital Ledger Technology (DLT) holds in its ability to streamline repo settlements and allow almost instant transfer of both the collateral and cash. As well as significantly reducing mark-to-market risks, DLT allows for important cost savings. Indeed, with this new decentralized platform where market participants can agree, execute, and settle a repo transaction, there isn’t any more needs for back-office bookings, third party clearing houses, or latent balance sheet data service providers. This technology, alongside the platform provided, facilitates financing and capital requirement management, granting its users an interface where they can enjoy a synchronized workflow environment.

Looking at the different providers of Digital Ledger Technology, we have Onyx, “the world’s first bank-led blockchain platform” which was launched by JP. Morgan in late 2020. They established LiinK, which enables institutions to exchange payment related information in a more efficient manner via the creation of smart contracts. It is however at its early stage, not yet fully operational, and for the moment limits itself to internal transactions. The main actor of this market is Broadridge, a firm that specialize in financial solution solving. It has since created in mid-2021 with the use of the DLT, a Distributed Ledger Repo (DLR). This has attracted major banks such as UBS and Société Générale, dealing more than $50bn worth of repo transaction each day. Although this remains a fraction of the overall repo market, Broadridge has created this platform which facilitates repo transaction and is fully operational, expecting the number of users to triple by the end of the year. A study ran by the International Securities Association on “DLT in the Real World” outlines the core target characteristics of DLT as mentioned by its users. This study reveals how the ability to make real time and automated repo transactions smart contracts (more on this later) is fundamental for banks and other market participants.

Source: International Securities Services Association

Broadridge platform uses smart contract to “mutualize the workflow”, as the agreement, execution and settling all take place in the same shared ledger. The ground-breaking innovation relies in the way the collateral is treated. With the use of blockchain technology, the collateral will be tokenized. The tokenization of the collateral then allows it to be transferred using smart contracts, allowing for an instantaneous, trustworthy, and reliable transaction. The simultaneous transfer between security and cash enlarges the field of possible market participants as it reduces counterparty risk and facilitates access to the repo market. This replicates the traditional delivery-versus-payment/receipt-versus-payment (DvP/RvP) settlement methodology, typically used for outright purchases of securities. This decentralized platform could potentially allow for smaller net worth individuals to bypass traditional banks to access better financing opportunities (through the repo market), as access barriers to this market would be removed. From a study involving most developed central banks, we can induce from the table below that repo market is still exclusively a tool for developed markets to finance their operations, via banks or other institutional investors. DLT technology could shift this trend, posing a real threat to bank’s profitability model. Individuals would rather place their savings on a decentralized platform and trade on the repo market than deposit it a bank (and earn small interests).

Source: BoE money market survey, ICMA repo survey (euro area), SIFMA (US), BIS debt securities statistics, other national central banks.

The main advantage of collateral tokenization is the ability to automatize contracts. Indeed, with smart contract mechanisms, you can select some conditions for your contract that can be treated with an oracle (an official source of information that confirms whether a company has reached a certain goal). For example, you could set a condition that if a firm reaches its ESG goals, you will lower its bond coupons. The ability to simplify and streamline a process that traditionally required several independent organisms, documentation, and back-office operations into a simple program is game changer. In a study ran by BCG, estimations on cost saving for bond issuance (documentation, paperwork’s etc.) with the blockchain technology (and more specifically the tokenization of assets) could reduce costs up to 50%.

One of the biggest shifts in paradigm with the use of smart contracts is ability to shorten the timeframe for the transaction from 2 days to less than an hour. This is revolutionary as it allows intraday trading on the repo market. Moving from a t+2 setting to being able to settle withing the hour means that banks can better adjust their liquidity positions relative to potential intra-day shocks. This could lead to better market efficacies, as well as allowing banks to better fine tune their financing needs. They can now take advantage of a cheaper financing opportunity that has appeared on the markets, or that corresponds to a specific daily need.

Source: Federal Reserve Board

One of the limits to be found to this DLT technology is with intraday trading, as it can only be effectuated within users of the platform, but not externally. Although this entices new banks to become users of the system, it can prove to be a limit for existing customers. Security and privacy concerns can also be raised due to the use of a public blockchain network to verify transactions. Finally, an important point to mention is the new challenges that arise with intra-day repo trading. Today, risk management teams monitor overnight risk, but with this new technology, banks and institutions would have to monitor real time trade which could pose as a major complication.

Conclusions

The repo market is a pillar of today’s financial system, responding to a need for short-term low risk financing, while ensuring that securities are efficiently allocated to maximize their returns while satisfying regulators. The introduction of DLT technology in the repo market shifts existing paradigms as it introduces intra-day trading, reduces counterparty risk, and cuts down operational costs for its users. Although DLT technology only represents a fraction of the overall repo market, the growth potential is not to be underestimated and could soon become the norm. Alongside the creation of a more efficient market, the use of blockchain technology to tokenize assets is only at its preface. From the introduction of smart contracts that automatize and streamline the whole transaction, to the possibility of fractionalizing underlying assets, processes will surely become more efficient, and more accessible.

Finally, the DLT could prove to be an issue to bank profitability model’s, reducing the overall amounts of deposits as individuals would directly place their saving on the repo market. The impact of DLT on the democratization of repos hasn’t yet been measured, but it could prove to give a new impulse that could translate into increased investments and lower financing costs for individuals.

References

[1] Office of Financial Research, 2016. “Bilateral Repo Data Collection Pilot Project”

[2] Committee on the Global Financial System, 2017. “Repo Market Functioning”

[3] Official Monetary and Financial Institutions Forum, 2022. “How tokenization can boost the repo market”

[4] Infante and Huh, Finance and Economics Discussion Series (Federal Reserve Board), 2016. “Bond Market Intermediation and the Role of Repo”

[5] BCG, 2022. “Relevance of on-chain asset tokenization in ‘crypto winter’”

[6] International Securities and Services Association and Broadridge, 2022, “DLT in the real world”

TAGS: repo market, digital ledger technology, digital ledger repo blockchain technology, tokenization, smart contracts, intra-day trading, DLT, DLR

0 Comments