The risk-free rate is a very wide-spread concept and fundamental for various topics in finance, most notably corporate valuation and derivatives pricing. Often however, not much thought is given to what a risk-free asset is and what rate to use. This article will dive deeper into the theoretical underpinnings of what a risk-free asset is and which rate to use in practice.

Risk-free assets

Let us start with the definition of a risk-free asset. The name suggests that a risk-free asset is an asset that bears no risk – but what does that mean, and are there truly riskless assets? The latter question is highly debated and there is no conclusive answer to it; however, this question should be considered secondary in this article. The more important question is the former: A risk-free asset is generally defined as an asset in which there is no variance around the expected return. In other words, an asset which is sure to meet all payment obligations. This rather vague definition does help us out yet. However, we can infer from it two conditions a risk-free asset has to fulfil: 1. The absence of default risk and 2. The absence of reinvestment risk. In practice, those rates which are used to proxy for risk-free rates often do not meet either condition. Nevertheless, one can draw some conclusions from these conditions: from the first one, we can infer that the party that is giving out a risk-free asset must be in control of the money supply, as otherwise, it would have default risk. In practice, this can only be the case for government-issued securities, even though there is some debate on whether government-issued securities are actually free of any default risk, though for the purpose of this article, the assumption that government issued securities are not associated with default risk will be made. The second condition lets us infer that the riskless asset cannot pay out any returns until it matures, since otherwise these returns would have to be reinvested at future rates that are not predictable.

From these insights, we can now deduce that a risk-free asset could be a zero-coupon government bond since it is not associated with any default or reinvestment risk.

Government Bonds

Government Bonds (aka govies) are the most wide-spread proxies for the risk-free rate in corporate valuation and more often than not, yields on a 10Y or 30Y bond are taken as risk-free. Though this might be a reasonable estimate for most use-cases, taking a closer look at what refinements one could make could prove valuable.

The first and most important thing to keep in mind is the time horizon of the analysis for which risk-free rates are needed and adjust the specific rate accordingly. In a normal environment (with an upward sloping yield curve), this would mean to match the time horizon one has with the maturity of the bond. However, if the yield curve is very flat or inverted, it could make sense to make some adjustments, like using different risk-free rates for different time periods. For example, if each period is one year long, we should match the duration of the zero-coupon bonds used to the period. If there are no zero-coupon bonds, we can use the following procedure to extrapolate the zero-coupon rate for each year: starting from the 1Y bond, we use the relation ![]() (with

(with ![]() being the price of the bond) to extrapolate the risk-free rate

being the price of the bond) to extrapolate the risk-free rate ![]() for year one. For the second year, one uses

for year one. For the second year, one uses ![]() using the already extrapolated

using the already extrapolated ![]() to extrapolate

to extrapolate ![]() and continues to do so for the following years. This procedure is an elementary example of bootstrapping.

and continues to do so for the following years. This procedure is an elementary example of bootstrapping.

Other than that, it is important to keep in mind that one should always be consistent in which currency to use and whether real or nominal rates are appropriate. One last thing to consider is that even though we have assumed the government to be default-risk free, there have been instances in which governments have defaulted (e.g., Argentina in 2001). Therefore, if we want to adjust for the probability of default, we should subtract the default spread associated to the currency rating of that country from the yield on the bonds one uses. A frequently updated list of default spreads for most countries can be found at reference [2].

Interbank Offered Rates

While Government Bonds are often used for corporate valuation and theoretical research, other proxies for the risk-free rate are used in the valuation of derivatives. One of these is offered rates on the interbank lending market. The interbank lending market (not to be confused with the interbank market which is a foreign exchange market for banks), is a market in which banks offer each other loans which are typically of very short maturity (mostly over day) to fulfil liquidity requirements. The most prominent examples are the federal funds rate in the US, the London Interbank Offered Rate (LIBOR) which can be denominated in Dollars, Euros, Pounds Sterling, Japanese Yen and Swiss Francs and the Euro Interbank Offered Rate (EURIBOR). The publishing authority requests quotes each from banks for these rates which are then averaged and released.

The use of these rates as risk-free rates stems from the fact that they are often used as benchmark interest rates on loans with a floating rate such as adjustable-rate mortgages. In fact, about $400tn in derivatives were based on LIBOR rates in mid-2018. These rates are published for different maturities, ranging from overnight to 12 months which make it possible to determine a risk-free rate for longer periods of time. However, there has been a lot of criticism of the usage of interbank rates as risk free rates, due to a variety of factors outlined in the following paragraph.

The most important criticism was the fact that these rates were only quoted rates as opposed to rates used in real transactions. Taken at face value, this should not be a big problem, however during the Great Financial Crisis, it became evident that banks had understated their rates for publication to fake better financial health than they were experiencing. This event, also known as the LIBOR Scandal, led to a series of new reference rates being created such as EONIA (Euro Overnight Index Average) in the Eurozone which were based on actual transactions in the interbank lending market and a better proxy for the risk-free rate.

Still, these rates could be criticized in that they are not collateralized and only consider the interbank market as a reference point even though the transaction volume in this market is very low for longer tenors. Therefore, new proxies for the risk-free rate were developed and the most interbank offered rates will stop being published soon or have already ceased to be published.

New Reference Rates

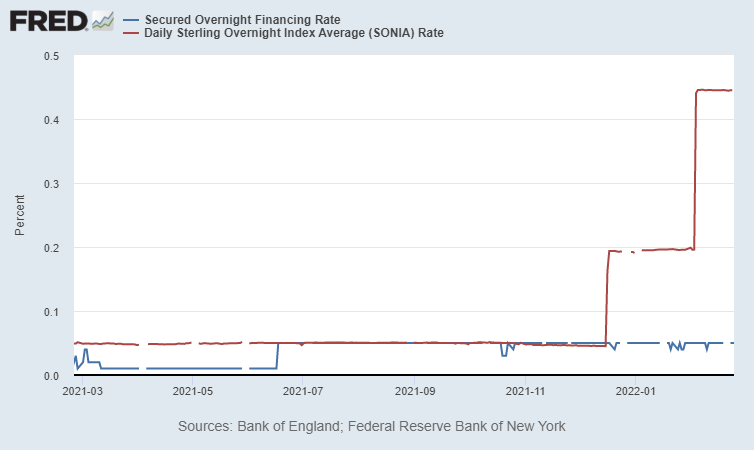

In the UK, Eurozone and US, these new reference rates are the SONIA (Sterling Overnight Index Average), ESTER (Euro Short-Term Rate) and SOFR (Secured Overnight Financing Rate). Importantly, they all consider a broader range of wholesale counterparties such as money market funds, other investment funds or insurance companies. This broader definition means the trading volume in the underlying overnight money markets is much higher than what reference rates were based off before. For example, while EONIA trading volumes were based off about €10-20bn, ESTER volumes eclipse €50bn. As a reference point, you can find the past year of SOFR and SONIA rates below.

Source: Federal Reserve Economic Data

Nevertheless, there are some important differences between these new reference rates: most notably, the SOFR is secured, while SONIA and ESTER are not, meaning the former comes closer to a textbook definition of the risk-free rate. To create a term structure for these rates, one should use the OIS-swap referencing the respective rate.

References

[1] Damodaran, A. (2008). What is the riskfree rate? A Search for the Basic Building Block.

[2] Damodaran, A (2022). Country Default Spreads and Risk Premiums. https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/ctryprem.html

[3] Schrimpf, A., Sushko, V. (2019). Beyond LIBOR: a primer on the new benchmark rates.

0 Comments