Introduction

By typing “hybrid” in the Google search bar, the first results that come out are hybrid cars and their cutting-edge technology that is revolutionizing the automotive sector. If, on the other hand, the same question is made to a bond trader, the first thought that springs to his mind will be corporate hybrids, a rapidly expanding market niche that concerns bonds with hybrid characteristics between equity and debt.

In this article, we will dive into this market segment by analyzing the characteristics, risks and potential benefits of corporate hybrids, while concluding with the valuation and pricing of this asset.

The hybrid market

Corporate hybrids are subordinated bonds which mix together some equity features and some of debt. Although similar to CoCo bonds at a first glance, of which we talked about here, they are issued by corporate companies. Most importantly, our analysis will not encompass financial institutions, which might issue similar products for regulatory purposes and not credit rating ones.

Their first issuance of corporate hybrids dates back to 2003, when the German industrial gases and engineering company Linde placed the first hybrid bonds in the market. Once upon a time, those were just considered debt securities with little recognition for their equity features. Two years later, the French retail group Casino issued hybrids securities that were treated by the rating agency Standard and Poor’s (S&P) as partial equity due to perpetual maturity and deferral coupons.

These bonds are simple debt instruments that pay a fixed coupon, usually annual, but in addition they have very long maturity – sometimes perpetual – while giving the issuer the possibility to defer the coupon payment. For the latter two reasons, rating agencies regard corporate hybrids as half-debt and half-capital, applying the concept of ‘Equity content’, which tends to improve the issuer’s credit ratios. While satisfying credit investors – who recognize that the “debt” characteristic provides funding and supports the issuer’s credit ratings – they also offer opportunities to equity investors since the “equity” characteristics are an effective way to raise capital without diluting existing shareholder ownership. Therefore, these features make them desirable to both issuers and investors.

With more than €50bn new issuances, 2020 marked the best year so far for the hybrid market which reached €200bn of asset class net size. Half of it derives from issuers that entered or returned to the asset class, while existing issuers have been very active in refinancing their corporate hybrids. Even though the market is gradually expanding to new sectors, most of the market is concentrated in Europe, thus in euro, and has been issued by Utilities and Telecoms companies. It is considered a fairly liquid market where new issues are often of €500 million benchmark size and prices quoted within a tight bid/ask spread.

The post Covid-19 outbreak offered a great growth opportunity for the hybrid market. On one hand, companies were in need of inflows, yet did not want to issue new debt and lower their rating score. On the other, investors were willing to find an extra yield in the IG bonds without having to look for HY ones.

Asset Class Net Size (€bn) and Outstanding hybrids by currency

Source: Credit Suisse

Hybrid issuers often have a high-quality financial profile as they are globally IG rated. This marks a considerable difference from the HY European market, where most of the issuers have a significantly less robust financial profile. Hybrids are generally issued by companies that generate solid, consistent operating cash flow. To investors, they offer an attractive yield: these bonds are high-yielding because they are subordinated debt instruments whose rating is on average 2-3 notches lower than the same issuers’ senior debt.

As a bottom line, it is like investing in an IG bond but receiving a HY coupon. However, the hybrid market is also open to non-rated companies such as Air France/KLM, Aryzta, Bourbon, Eurofins, VTG, Finnair, Outotec and Voestalpine, where investors forgot easily about the absence of an official rating and regular information because of the extra yield that they are offered.

Source: Credit Suisse

Their anatomy

A clear understanding of corporate hybrids must start from a simple overview of bond-like security which pays predetermined coupons not tied to operational performance. This is the debt skeleton of our bond and now we will add the equity substrates.

The first one is the coupon deferral option: coupon payments may be deferred by discretion of the issuer, but they are cumulative. This means that even if the issuer, due to operational headwinds, decides to defer coupons, they will accrue over the years and will be paid upon a liquidity event. Therefore, coupons will never disappear, but crucially – as we will see later – the decision to defer coupons will impact heavily and negatively on the company’s reputation. Concerning the coupon analysis, we find the dividend pusher: it means that a dividend payment constitutes a mandatory payment of deferred interest. On the other side, a dividend stopper means that coupon deferral blocks the company from paying a dividend. This way investors are protected on both sides since the company cannot choose to pay dividends without also paying the coupons on these bonds or their deferred blocks.

Their maturity is another equity feature. Because of the IFRS Treatment that requires it to have at least 60 years of maturity to be considered 100% equity (shorter maturities are considered 100% debt), most hybrids are >60 years or perpetual. The first call is usually in 5/10 years since the Standard & Poor’s rating agency requires min 5 years to first call, but early replacement is possible if equity content is preserved, while Moody’s requires min 10 years. The call option makes these instruments more affordable to issuers – the coupon rate can be closer to a 5-year yield than a 50-year yield, for example.

The coupon usually has a step-up feature over time. After the first call date, investors obviously want to receive a premium for the longer time they will hold the bond, thus the coupon resets. Normally, the coupon steps up by 25 basis points on the next reset date, followed by an additional 75 basis points further down the line. In exceptional situations, it can also reach 100 basis points or go further if the hybrid is unrated. This step-up derives from the fact that, as a market convention, corporate hybrids are normally redeemed at the first call date. It is rare for the issuer not to exercise the call and this end up further damaging his reputation.

Source: JP Morgan

Finally, there are clauses which can trigger an early call such as change of control, tax event, accounting event, rating agency event or a substantial repurchase event. But the most important clause is the Replacement Capital Covenants one, which says that the company is obliged to replace the hybrid with a similar or lower ranking instrument if it is called. Most of the issuance – in order to attract investors – place the effective date of the clause one day after the first call date, in fact if the clause comes into effect one day after the first call date, there is a greater incentive for the hybrid to be called than if the clause is effective from issuance.

Navigating the risks

There are six risks that can be distinguished when investing in hybrid bonds. Firstly, there is the credit risk which is relatively small since hybrid issuers are normally rated IG, however as said before non-rated companies are beginning to enter the market and here the credit risk plays a more important role and extra yield for investors are needed.

Interest rate risk regards how much the asset price varies when interest rate changes, usually it is measured with IR01 (how much the asset price changes with respect to 01 basis points change in the interest rate). For fixed income assets, the longer the maturity, the higher this risk and, in this case, hybrids are >60 years or perpetuals making the asset more sensitive to interest rate fluctuations.

The subordinations risk concerns the case in which the issuer default. The rate of recovery for the holders of hybrid securities is usually quite low as senior debt holders take priority who are first in line after payment of salaries, taxes and any secured debt that may exist.

The possibility that the hybrid is not called is the extension risk. These bonds are considered an expensive funding and if they are not called at the first opportunity this is not considered good news for the investors. Even if the coupon step-up, the extension is considered as a red flag of the company facing liquidity issues and the price of the asset can easily fall. Furthermore, S&P usually drops the equity benefit on the first call date since, starting from the first call date, it sees the bonds as less permanent or equity-like. If instead, the senior bonds fall to HY rating the equity content can be extended for 5 more years, making an incentive for the firm not to call.

Deferring the coupon payment is considered, in the corporate hybrid environment, a very low risk since an issuer’s option to defer the coupon is only possible if shareholder remuneration is suspended, and deferred coupons remain due on a cumulative basis. As a result, even if financial caution may lead to dividend cuts or cancellation, suspending hybrid coupons only makes sense in the event of a weak and deteriorating liquidity position.

The last one is the volatility risk. Being considered half equity and half debt, corporate hybrids are somewhat positively correlated to the equity markets. During periods of risk aversion, if the shares of the company fall, its credit spreads on hybrids will widen hugely with yield going up and prices going down.

Coupon Deferral Risk: Lufthansa Case

On 19 May 2021, due to EU State Aid Rules considerations, Lufthansa announced the suspension of its hybrid coupon for the tranche issued back in 2015. The measure lasted until the repayment of the drawn silent participations and the sale of the shareholding in Deutsche Lufthansa AG by the Economic Stabilization Fund (ESF) in Germany. Such coupon was considered a violation of the state aid regulations of the Temporary Framework for state aid to support the economy given the outbreak of Covid-19.

Lufthansa intends to make up for the deferred coupon payments as soon as possible once the stabilization by the ESF has been completed. Since the Covid-19 outbreak, Lufthansa has been under intense financial pressure and had to ask for exceptional state support. In addition, following issuer downgrade to sub-IG, Lufthansa’s hybrid was extended (i.e. not called at 1st call date in February 2021). The hybrid lost about 50% of its value, as seen in the graph below, and then slowly recovered since Lufthansa remained IG graded with solid liquidity.

This example is symbolic to understand how at first the decision to defer coupons is met with fear by investors and triggers a rapid sell-off. However, the fact that it was due to a special situation and that the coupons were cumulative helped the market price to recover almost completely.

Source: Finanzen.net

Pricing and Valuation

Given the recent attractiveness in the European bond market, it is no wonder that a greater attention spanned from the popular equity or bond-like instruments to the unusual corporate hybrids framework. Their tax-efficiency nature as well as the benefits of reducing the Weighted Average Cost of Capital (WACC) to a company in needs of funding urged the need for a pricing mechanism suitable to create a liquid market.

However, as explained above, a number of hindrances come in the way of this task. First of all, the flexible attributes of the security, especially in the form of the deferral triggers, can be complex to untangle from an investor’s perspective: some are mandatory – ie. when some credit agencies data is breached – while others are discretional deferral mechanism, up to senior management. Most importantly, the short history to date of corporate hybrids does not let us infer a clear relationship between the credit rating of the company and the consequent discretionary trigger which stems from the executives.

Secondly, the early call possibility is a feature to consider thoroughly. So-called “gentlemen’s agreements” may give the idea that most bonds are callable after 5-to-10 years, but in truth we are dealing with sheer economic decision-making benefits. Namely, pricing this possibility goes back to giving a probability tag to the question: at the end of the non-call period, is it cheaper to replace the outstanding hybrid by a pari passu security with the same key terms, or remain financed according to the terms of the outstanding issue?

Last but not least, corporate hybrids do differ markedly from normal bonds in the features of the recovery rate. Being ranked below Senior Unsecured Debt and above Common Equity, some academia results have gone as far as arguing to price a 0% recovery rate for Corporate Hybrids, or at least peg that rate to the one of preferred shares. To this day, to no wonder of the reader, most price models are tweaked to actual secondary market activity available, despite a critical dry-up of that same market in the past crises.

Spread over 10y German Bund of AA, A and BBB Corporate Hybrids

Source: Ryll (2010b)

Without further ado, we can now move onto the methodology pricing for these instruments. Despite no clear framework, we will tackle the pricing issue with a “rock bottom spread” approach first developed by JP Morgan in 2005, and then notorious after its publication in the paper “A Framework for Pricing Corporate Hybrids”.

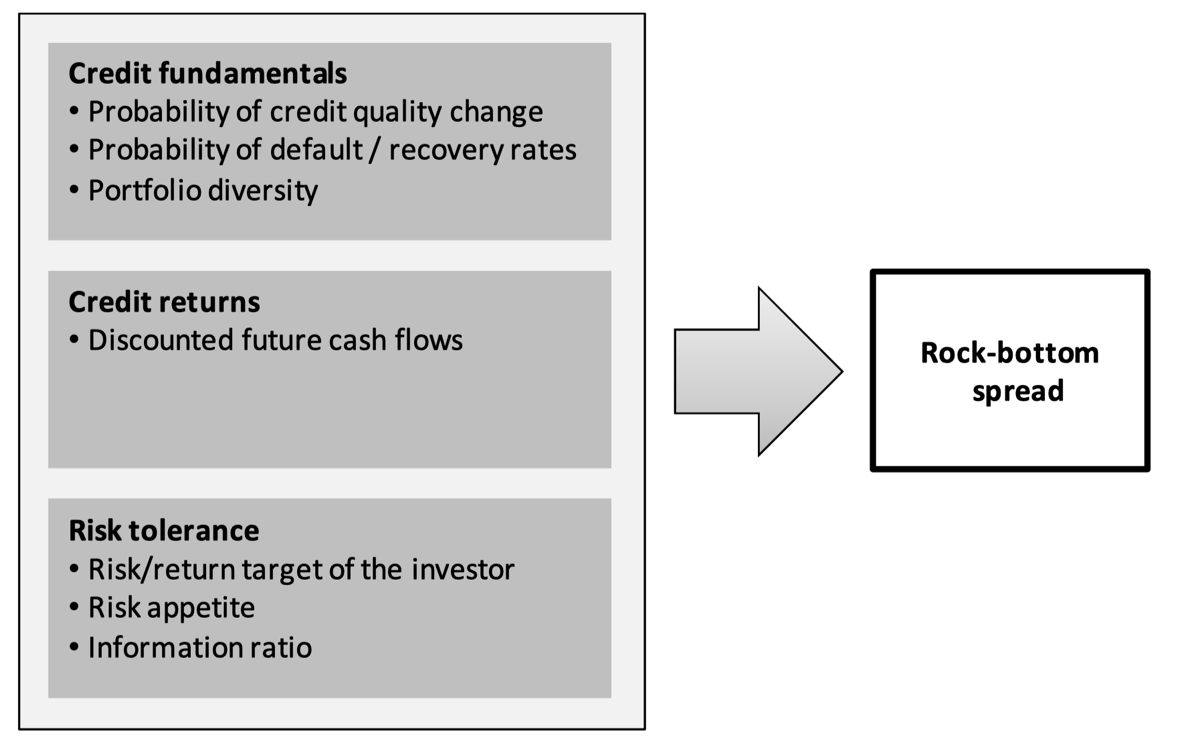

The rock-bottom spread represents the lowest spread at which an investor should be willing to bear the fundamental credit risk associated with holding credit instruments. The methodology is built around the reasonable assumption that investors require a risk premium, which compensates them for the risk of default. While not a particularly groundbreaking definition, it is worth noticing that, however, the difference between the market spread and the rock-bottom spread of a bond is the maximum being offered for the credit instrument’s lower liquidity compared to government bonds. More than that, we will account in our framework the credit fundamentals of the company, the credit returns of the corporate hybrid itself and the risk tolerance of the investor.

Things to consider when assessing the rock-bottom spread

Source: Rappoport (2001)

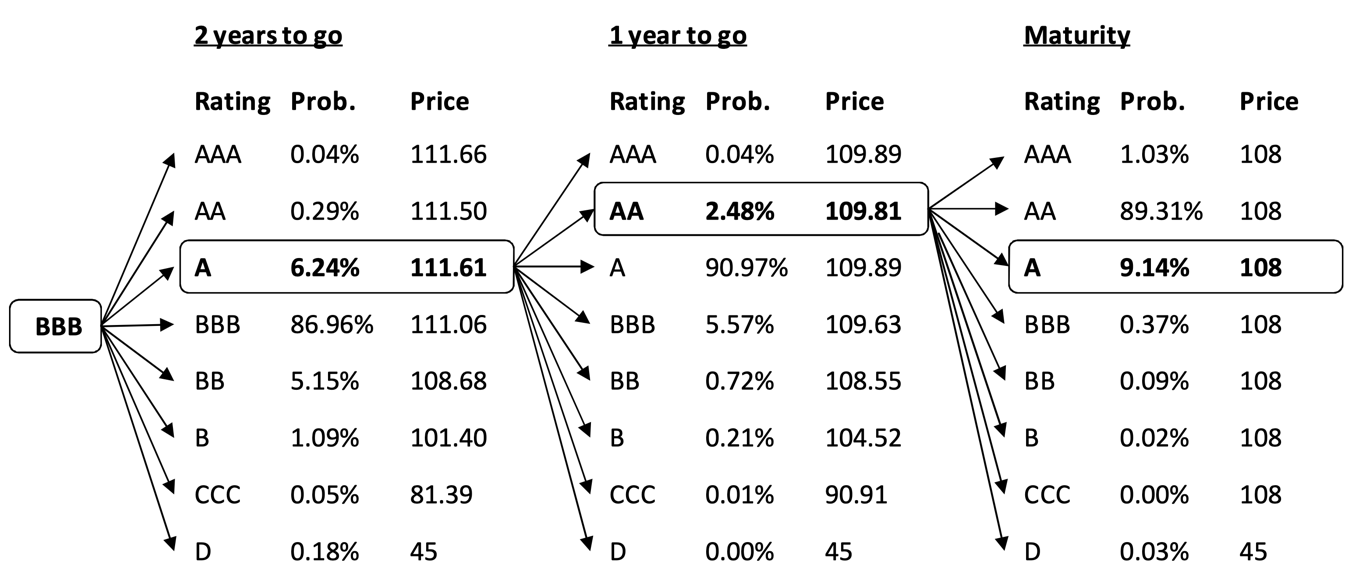

The approach might not be overly complex, but it lies on the very solid fundamentals of the discounted cash flow method. Most importantly, somewhat originally, it employs the so-called “rating migration matrices” offered by credit agencies to infer a reasonable future probability distribution of bond values. For each year, at least before the callable date, we will therefore build a series of scenarios where, for instance, an AAA-rated bond can end up being rated AA with X% probability and vice-versa, according to all the possible combinations. In the picture below, a BBB-rated corporate hybrid has a 5.15% of being downgraded to BB.

One-year rating migration matrix

Source: Rappoport (2001b)

Source: Rappoport (2001b)

After the 1-year procedure, we will keep computing the probabilities found on the rating migration matrices, year after year, in a similar fashion of the binomial option pricing model. At the end of year 5, we will have the expected price (and volatilities) of all the possible scenarios, which we will call ![]() . The “D” rating corresponds to the default possibility, and the likely net residual value is approximated by the historical recovery rate.

. The “D” rating corresponds to the default possibility, and the likely net residual value is approximated by the historical recovery rate.

Source: Rappoport (2001b)

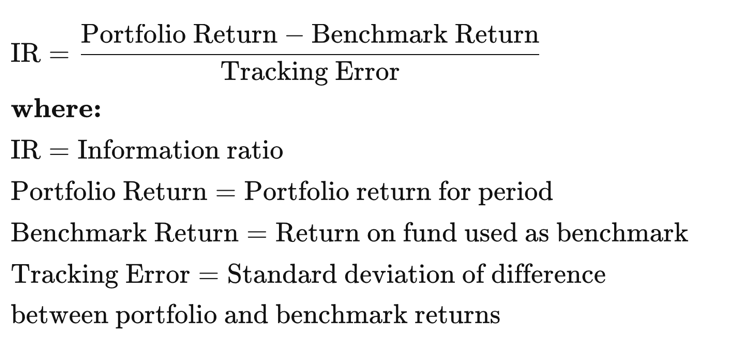

Now, the last step for a “vanilla” valuation of a corporate hybrid is to define the so-called information ratio, given by the excess return of the hybrid that the investor wants to take relative to the risk-free expected return, all adjusted for volatility. In our framework, we suppose that the rock-bottom price (RBP) is equal to the price that yields the investors target information ratio I. Last but not least, we want to adjust everything by a so-called “diversity score”, an approach created by Moody’s to estimate the correlation of movements in the issuer’s credit quality (from 0 to 100).

Source: Rappoport (2001b)

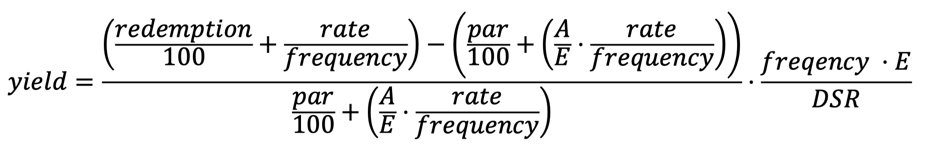

Please beware that the model can only account for one year of rock-bottom spread calculation. To extend the computation beyond this time period, we might use the rock-bottom price at time t as the input for the following year’s calculation (same goes for volatility). Note that above was showed a rock-bottom price calculation, while our goal is to find a rock-bottom spread. This can be done with a price-to-yield (PTY) calculation:

Please beware that the model can only account for one year of rock-bottom spread calculation. To extend the computation beyond this time period, we might use the rock-bottom price at time t as the input for the following year’s calculation (same goes for volatility). Note that above was showed a rock-bottom price calculation, while our goal is to find a rock-bottom spread. This can be done with a price-to-yield (PTY) calculation:

A is the accrued days, E the number of days in the coupon period and DSR the number of days between the settlement and the redemption day.

Conclusion

By the picture painted above, it emerges quite clearly that modern problems are requiring modern solutions in this market regime. While this may read like a primer of an “exotic” instrument thinly traded in the Old Continent, it actually hogs the limelight among the series of securities that shy away from the rigid stocks/bonds distinction.

Starting from CoCos in banks, followed by the proposal of GDP-linked bonds recently, Corporate Hybrids are just a further step of financial innovation that it is revamping the funding structure of modern companies. Tax benefits on the company side and attractive yields on the investor’s may provide a win-win partnership for the future, although the foggy area around pricing methodologies and historical setbacks is yet to be cleared.

0 Comments