Introduction

Tariffs have recently made headlines, and this time they are the centerpiece of President Trump’s new trade strategy. Simply put, tariffs are taxes imposed on goods imported from other countries, with the goal of protecting local businesses or balancing trade. Though they seem like a simple solution, tariffs often cause trade wars and economic harm. During Trump’s first term, for example, tariffs resulted in retaliation from China, Canada, and the EU, thus affecting American companies’ dependent on exports.

In fact, recently, President Trump has stirred up a major debate by proposing tariffs that would match what other countries charge on American goods—known as reciprocal tariffs. This bold move could reshape the way the U.S. trades with the world. In early February, the Trump administration announced massive tariffs of 25% on all goods from Mexico and Canada (though these were temporarily suspended) and 10% on all goods from China. With more than 40% of US imports coming from these nations, US trade policy has clearly changed.

This strategy comes at a sensitive moment for the world economy given all the geopolitical tension that has recently built up. While the Trump Administration believes that this new policy will protect and even boost the US industries, critics are concerned that it might lead to more trade conflicts, higher prices for consumers, and economic isolation for the United States.

In this article, we will explore the effect of tariffs on different sectors and products, global reactions and potential consequences. We will also provide a trade idea.

Impact on Key Economies

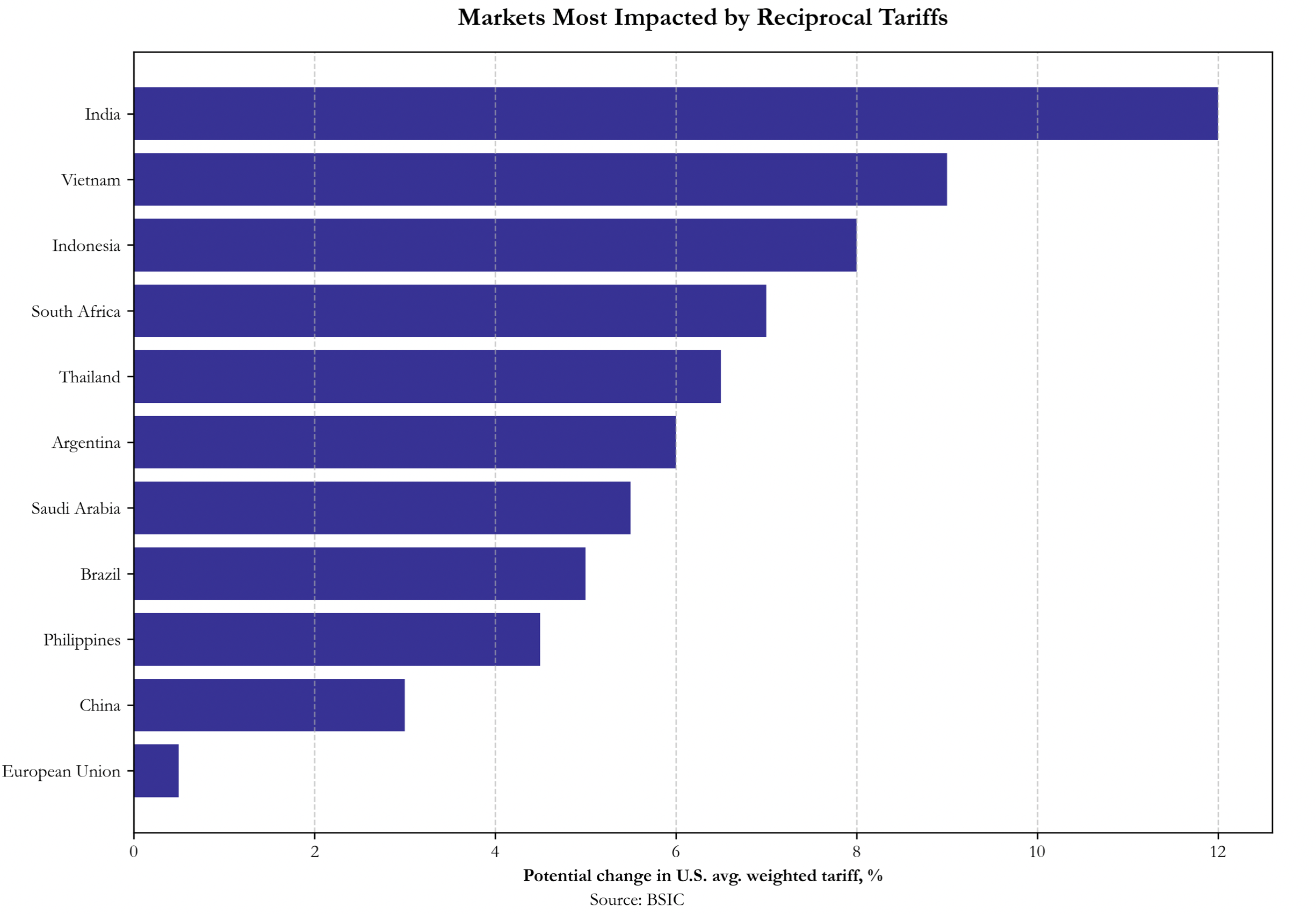

This section aims to dive deeper into the effect of tariffs on some global economies through a sectorial analysis. Some countries such as South Korea, and Singapore are not included, due to their Free Trade agreement with the United States. We will focus on nations with the largest trade differentials relative to the U.S including India, Thailand, Argentina, and Brazil. The chart below highlights these economies, and in our analysis, we will examine the sectors within countries that are most affected by tariffs and what we can expect to happen as a result.

India

One of the countries with the highest tariff differential with the U.S. is India, which has a weighted average tariff differential rate of 6.5% (1). Therefore, on a country-level reciprocity, the U.S. could match this rate and increase tariffs on Indian imports by 6.5%. However, on a product-level reciprocity, the tariffs can be adjusted on a per-product basis, which could raise the differential to around 11.5%.

The sectors within India that would be most affected are chemicals (+9.4%), textiles & clothing (+15.6%), stone & glass (+9.4%), and machinery & electrical (+6.0%). All these sectors have a high tariff differential to the U.S. and a significant trade surplus. If the U.S. were to match these tariffs, Indian exports would lose their price competitiveness, leading to a decline in export volumes. Another sector in India with a high tariff differential is the fuels sector, with (+6.8%). However, the effect will be minimal in this sector, as India imports a large amount of U.S. crude oil and has a trade deficit with the U.S. within this sector due to its limited domestic production of crude oil.

As Donald Trump mentions in his agenda, he aims to move towards becoming a net exporter. As a result of the large differential, Prime Minister Modi was the first to meet with Trump to address the reciprocal tariff plan. In the aftermath of the meeting, Trump called Modi ‘a very special man’ and stated that he is concerned about the trade deficit but claimed that “we can make up the difference very easily with the sale of oil and gas.” This highlights the potential common theme we will see in the coming weeks and months as Trump’s administration launches negotiations on a one-by-one basis.

For example, at the moment, India imports significant amounts of oil and gas from Russia at a cheaper cost than U.S. energy. However, this could change, as Trump is keen to increase U.S. energy exports, and the increased costs of importing energy from the U.S. could be offset by avoiding Trump’s reciprocal tariffs. This implies that by increasing purchases of American oil and gas, India may be able to maintain its favorable trade relationship with the U.S. without suffering the full impact of retaliatory tariffs. A study conducted by Goldman Sachs found that both country-level and product-level reciprocity could impact India’s GDP growth by 0.1-0.3%. At the moment, India’s exports to the U.S. make up around 2% of the country’s GDP. Therefore, many argue that a trade agreement between the two nations is possible, but the question arises as to the exact terms Trump will be able to negotiate.

Thailand

Thailand is also highly exposed to the threat of reciprocal tariffs due to its large tariff differential across key industries. Some of the most impacted sectors include plastic and rubber (5.6%) and stone and glass (4.8%). If the U.S. were to reciprocate, Thailand’s exports of these materials would suffer, and they would face price disadvantages. As a country with an export-oriented economy, this would have significant adverse effects on its economic growth by reducing its competitiveness in the U.S. market.

Prime Minister Paetong Shinawatra has already ordered a study on the potential impact of the United States trade policy on Thailand’s exports. The U.S. is the largest export market for Thailand, accounting for 18% of total exports. Furthermore, the trade surplus with the U.S. has steadily increased over the past years, reaching $35.4 billion last year alone, with the country pledging to narrow this gap by, for example, importing 1 million tonnes of ethane in the second quarter of this year.

In a speech last week, Thai Commerce Minister Pichai Naripthaphan, stated that the government will do everything to ensure the Kingdom does not become the target of reciprocal tariffs. He also mentioned that they are ready to accommodate U.S. requests to ensure a good outcome, highlighting their willingness to cut a deal with the Trump administration.

Brazil

In the plan that was announced last week, the report from the White House specifically mentioned the import and export of ethanol from Brazil. As of now, the U.S. charges a 2.5% tariff on ethanol, while Brazil applies an 18% tariff. The U.S. is the largest producer of ethanol, with Brazil being the second largest. However, the agricultural sources differ strongly, with the U.S. deriving most of its ethanol from corn, while Brazil uses sugarcane. The disparity in tariff rates has been a long-standing point of contention, with U.S. producers growing increasingly frustrated.

This is because they have become more reliant on export markets, as ethanol’s growth in the U.S. is also affected by rising vehicle fuel efficiency, electric vehicle adoption, and regulatory constraints on higher blends (4). This is further highlighted by Republican Senator Chuck Grassley, who mentioned in a recent Senate hearing that Brazil’s tariff on U.S. ethanol is among his top priorities. However, once again, the threat of tariffs is likely being used as a negotiation strategy rather than a purely retaliatory measure to bring Brazil back to the table and push for lower restrictions on U.S. ethanol. This could help Brazil meet its ambitious national targets for biofuel adoption while also satisfying U.S. producers seeking greater market access.

Long/Short Equities Trade

One can stand to benefit from this anticipated policy through taking a long position in LyondellBasell Industries stock and a short position in PI Industries stock. The anticipated tariffs could stand to benefit US chemical manufacturers, while pressuring Indian chemical exporters. The idea is based on the belief that we will see an increased investor confidence in domestic U.S. chemical producers following the policy shift, and a shift in input costs due to potential forced reliance on U.S. oil and gas over Russian alternatives, favoring domestic companies.

LyondellBasell is a global company with a market cap of around $25 billion specializing in polymers, petrochemicals, and refining. The expected tariffs from the Trump administration will especially affect Indian chemical and agrochemical producers. As Indian producers will face higher costs, U.S. producers such as LYB are well-positioned to gain market share, domestically and globally. Additionally, while Trump’s trade policies are in focus, the potential impact on U.S. natural gas production is uncertain in this time horizon, meaning the primary driver for LYB’s cost advantage remains the current decline in Henry Hub natural gas prices rather than any anticipated supply-side shift. The U.S. Henry Hub benchmark for natural gas has declined around 11% year-over-year, leading to a decrease in the cost of the raw materials for American chemical manufacturers.

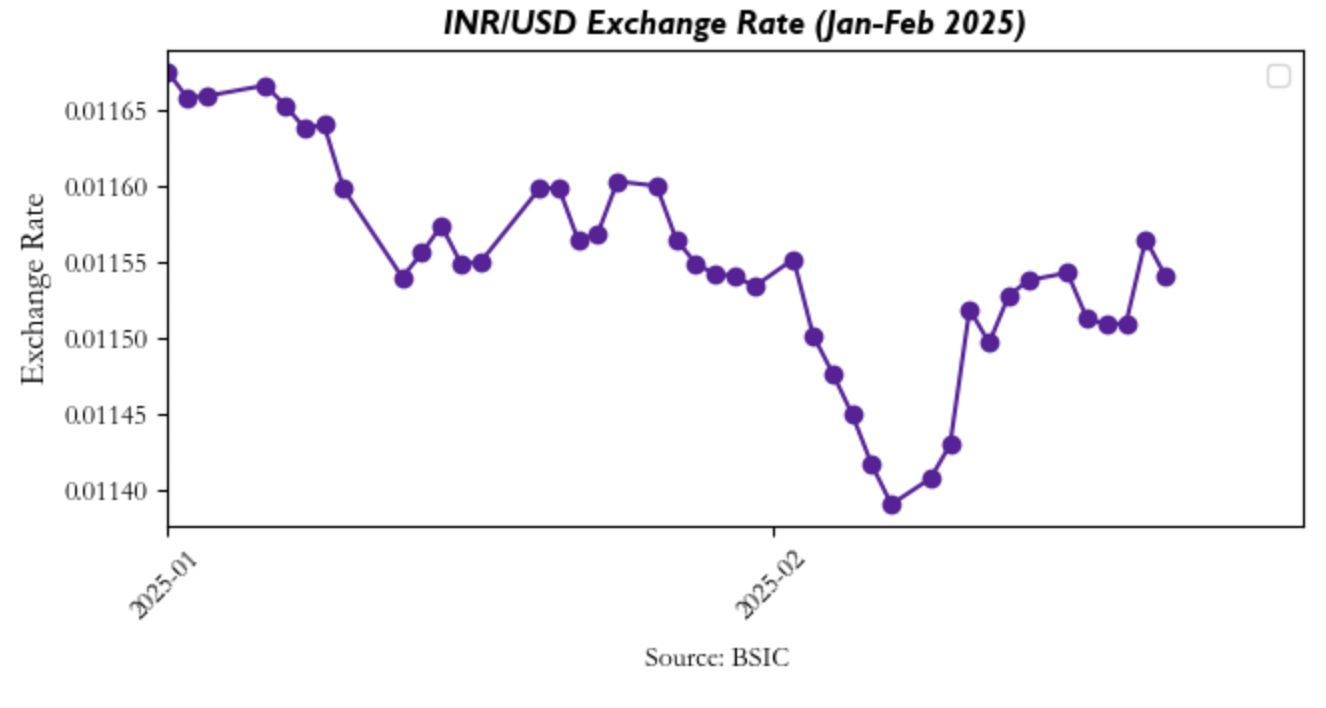

In contrast, Indian firms rely on imported raw materials and also face a currency risk due to the rupee’s depreciation amid global trade concerns. While the rupee has weakened around 3.5% against the U.S. dollar in the last three months, the key driver of this depreciation has been capital outflows, as foreign investors rotate away from Indian equities amid global uncertainty. Again favoring U.S. companies, as the pricing power shifts to their advantage, reinforcing the competitive edge LYB has.

On the other hand, PIIND Industries is one of India’s largest specialty chemical manufacturers, with 60% of its revenue stemming from exports, making it highly exposed to trade tensions. The company has until now benefited from India’s low wages and relatively loose environmental regulation. Trump’s reciprocal tariffs are set to erode some of these competitive edges while potential loosening of environmental regulations and permitting in the U.S. could further strengthen domestic producers relative to Indian competitors. According to a recent report from Reuters, the potential tariff hikes could result in an estimated 8-12% EBITDA margin compression across the sector (2). Additionally, costs for Indian firms that rely on imported raw materials such as PIIND have increased.

The trade should be structured as a beta-neutral pair trade with an equal beta-adjusted amount of long LYB and short PIIND. Even if U.S. equities slow down, LYB’s strong domestic demand and tariff protection should help sustain its valuation. On the other hand, PIIND’s exposure to international headwinds makes it much more vulnerable. Some risks of this trade are a significantly weaker-than-expected enforcement of Trump’s trade policy or a reversal in the recent trend of a weakening U.S. dollar, which could offset some of the cost advantages for U.S. chemical firms. However, given Trump’s focus on correcting trade imbalances, some form of these policies is likely to be implemented.

Therefore, by taking a long position in LyondellBasell and shorting PI Industries, the trade is set to benefit from the asymmetrical impact of reciprocal tariffs favoring U.S. chemical firms and, on the other hand, pressuring Indian exporters. Given the combination of macroeconomic and policy-driven catalysts, this trade represents a compelling opportunity in an evolving global trade environment.

Legal Framework

In the beginning of February, President Donald Trump used the International Emergency Economic Powers Act (IEEPA) of 1977 to impose tariffs on goods coming from China, Canada, and Mexico. As no past president has used IEEPA to impose tariffs, this represented a notable and unheard-of application of this law. As a result, there has been a lot of discussion over the legal basis and consequences of this action.

Typically, the IEEPA is used during national emergencies to give the President the power to control international economic transactions. In particular, it lets the President investigate, end, or reduce trade and financial transactions with foreign companies if he or she thinks it’s necessary to deal with a unique and serious threat to U.S. national security, foreign policy, or the economy. The problem is that IEEPA doesn’t say exactly what a “national emergency” is, so the President is free to decide what one is. In the past, courts have turned to the administration in these kinds of cases. This, however, makes it very hard to challenge the president’s stance on the topic.

Because of this uncommon use of the IEEPA, there are numerous questions about whether it is legal under U.S. law and whether it follows WTO rules. Concerning the United States, critics say that even though the IEEPA gives a lot of power during national emergencies, it was never really intended to be used for imposing tariffs. In the past, tariffs have been allowed by other laws, most often Section 232 of the Trade Expansion Act of 1962 for actions related to national security or Section 301 of the Trade Act of 1974 for actions taken in response to unfair trade practices. Because President Trump’s action is based on IEEPA instead, it creates a new legal debate about whether the president’s emergency economic powers really allow him to impose additional tariffs.

As far as the WTO is concerned, these tariffs are only legal if they can be justified through national security or other prominent exceptions. One-sided trade barriers are usually not an acceptable strategy, and, for this reason, member countries have fought against U.S. tariffs in the past. Therefore, If these new tariffs can’t be linked to a real national security crisis, or if officials decide that imposing tariffs under an emergency law like IEEPA goes beyond what the U.S. is allowed by the WTO to do, then the tariffs could be ruled inconsistent with international trade rules.

Currently, there is no clear decision that says these tariffs are illegal, and it is still unclear whether using IEEPA for tariffs is against WTO rules. However, some trading partners, including U.S. companies, might want to take legal action. In fact, earlier this month, China filed a complaint with the WTO, declaring that Trump’s plan to impose tariffs is discriminatory. If these kinds of challenges go forward, courts and WTO panels will have to figure out what the IEEPA can do in an emergency and whether national security exceptions apply.

Global Reactions & Potential Consequences

European Union

As a response to President Trump’s recent public statements on tariffs, the European Union has reacted by defining them as “unjustified” and has threatened to act “firmly and immediately” if they are imposed. With almost 70% of imports entering tariff-free, the European Commission has underlined that the EU keeps some of the lowest tariffs worldwide. Additionally, even though Trump often points them out as unfair, value-added taxes (VAT) apply equally to imported and domestic goods and are not equivalent to tariffs. For this reason, Commission President Ursula von der Leyen among EU officials have promised “proportional and decisive countermeasures,” therefore presenting a united front to retaliate should the tariffs go ahead. However, the European Union has also shown some optimism for a diplomatic solution by expressing willingness for negotiations before tariffs are applied.

China

China strongly disagrees with President Trump’s recent tariffs. They quickly responded by filing a formal complaint with the World Trade Organization (WTO), saying that these actions are “protectionist” and break rules for international trade. Officially meant to stop fentanyl trafficking, the 10% tariff put on Chinese imports is based on “unfounded and false allegations,” according to China’s government. They say that such one-sided actions are unfair because they only target goods made in China. In response, China has put tariffs on important U.S. exports like coal, liquefied natural gas, crude oil, and farm equipment. These sectors were carefully chosen to put pressure on U.S. economic interests. China has also made things worse by starting an anti-monopoly investigation into Alphabet Inc.’s Google, which shows it is ready to use regulations as extra leverage. Even though China has asked the WTO for help, it’s still not clear what will happen because the WTO’s Appellate Body doesn’t function properly. This is partly because the US is blocking the appointment of new judges, which makes any solution more difficult. China is determined to fight what it sees as unfair economic pressure, and this strong response sets the stage for prolonged and intensified trade tensions

Conclusion

With President Trump’s proposal for reciprocal tariffs, U.S. trade policy is about to undergo a radical change that would generate both possible negotiating openings and worldwide reaction. While nations like India, Thailand, and Brazil seem ready to purchase more American goods—especially energy—to avoid higher tariffs, others, including China and the EU, have already threatened or passed retaliatory actions. Legally, taxing using the International Emergency Economic Powers Act (IEEPA) is unheard of. Critics argue that these tariffs are inappropriate for trade restrictions; should national security arguments fail, the World Trade Organization may eventually rule these tariffs incompatible with world standards. The next few months will show whether the United States can effectively negotiate new bilateral trade agreements or will get caught in growing conflicts with important trading partners.

References

- Huang, B., & Xia, L. (2025, February 19). Asia| US reciprocal tariffs offer no help in narrowing trade deficits with Asian economies. BBVA Research. https://www.bbvaresearch.com/en/publicaciones/asia-us-reciprocal-tariffs-offer-no-help-in-narrowing-trade-deficits-with-asian-economies/

- Kumar, M. (2025). Indian exports face uncertainty over Trump’s reciprocal tariffs. Reuters. [online] 18 Feb. Available at: https://www.reuters.com/world/india/indian-exports-face-uncertainty-over-trumps-reciprocal-tariffs-2025-02-18/.

- Morgan, J.P. (2025). Beyond the Fed: Where to Focus Now | J.P. Morgan. [online] Jpmorgan.com. Available at:https://www.jpmorgan.com/insights/markets/top-market-takeaways/tmt-beyond-the-fed-where-to-focus-now?utm_source=chatgpt.com [Accessed 22 Feb. 2025].

- Media, A. (2025). US reciprocal tariffs could hit Brazilian ethanol. [online] Argusmedia.com. Available at: https://www.argusmedia.com/en/news-and-insights/latest-market-news/2657921-us-reciprocal-tariffs-could-hit-brazilian-ethanol [Accessed 22 Feb. 2025].

0 Comments