Introduction

The transaction involving the sale of MotoGP to Liberty Media is a significant event in the realm of sports acquisitions, highlighting a meticulous approach to business strategy in the motorsports industry. Our article begins by exploring Bridgepoint’s decision to forego a higher bid in favor of a more compatible partnership with Liberty Media. This decision emphasises the nuanced judgment calls that companies must make, balancing immediate financial gain against long-term strategic alignment. We dissect the mechanisms of such corporate decisions and their implications for a range of stakeholders, from investors to fans who passionately follow the sport.

Further, we turn our attention to Liberty Media’s previous endeavors with Formula One to glean insights into their potential influence on MotoGP’s future. The article aims to offer a detailed examination of Liberty Media’s track record, including how they have expanded their brand presence and engaged with new audiences in the digital sphere. The overarching narrative is set to explore whether the strategies that propelled Formula One’s growth can be effectively applied to MotoGP, considering the current market dynamics and digital engagement trends in sports entertainment.

The Buildup

The sale of MotoGP was a lengthy process with many players involved. In 2018 Bridgepoint [LSE: BPT] was approaching the deadline for the exit from its investment in Dorna. Many renowned names in the financial industry such as CVC, KKR [NYQ: KKR] and Blackstone [NYQ: BX] have placed their bids for the company, showing how attractive the company is. Ultimately, Bridgepoint’s sole purpose was to receive an estimated valuation for Dorna to sell the company to themselves. private equity funds can extend their ownership of a company by creating a continuation fund which is funded by investors. Once a sufficient amount is raised the fund will move the already-owned company into the new fund. This strategy gives many advantages as the fund can hold onto a good asset for longer, it gives the limited partners the option to either exit or stay in the investment and usually the carried interest from the old fund is carried forward to the new one giving lucrative fees to private equity fund managers. Investors face a degree of risk as exiting could result in a loss of potential returns when exiting the investment, but at the same time if the fund underperforms it will result in paying more management fees.

In 2024, Bridgepoint proceeded with the sale of Dorna to Liberty Media [NASDAQ: FWONA, FWONK], but at the same time rejected a bid from TKO worth $200m more than the one offered by Liberty. Bridgepoint justified its decision by claiming that TKO was “culturally not a good fit”, while a person close to TKO claimed that Bridgepoint with its decision “failed in its fiduciary duty not only to its LPs [Limited Partners] but to its shareholders in the public market”. The rejection of TKO’s offer raised a very important question for today’s dealmaking. From one side, by rejecting a higher offer Bridgepoint could have caused a loss of potential profits for its shareholders and limited partners. On the other side, Bridgepoint is trying to align Dorna’s future with a profitable exit from the investment, which will also allow Bridgepoint to profit out of the remaining stake after the sale. The currently leading management theory claims that shareholders’ value should not be the main driver for a company and that in the long term following principles that benefit all stakeholders by implementing standards such as ESG will ultimately give a positive outcome for the company. The question is how much a private equity fund like Bridgepoint can implement such a strategy without acting against the well-being of its shareholders.

About Liberty Media

Liberty Media is a company based in Englewood, Colorado, US. It operates in the Media, Communication and Entertainment industry. Liberty currently has a very interesting corporate structure. It divides its operation into 3 different divisions which are: the Liberty SiriusXM Group [NASDAQ: LSXMA, LSXMB, LSXMK], the Formula One Group [NASDAQ: FWONA, FWONK] and the Liberty Live Group [NASDAQ: LLYVA, LLYVK], each listed with a different tracking stock and each tracking stock is divided into 3 different series (series A, series B and series C). Out of the nine stocks issued, 7 are traded publicly and 2 are traded over-the-counter. Tracking stocks are financial equity instruments which allow the separation of the performances of different divisions of a company. This type of solution is usually used to separate an early-stage, unprofitable segment of a company from the others. Liberty Media acquired Formula One in 2017 from CVC, valuing the sport at $8bn of which $3.6bn was debt. The sale was a two-step process in which, Liberty firstly acquired an 18.7% stake in F1 parent company Delta Topco for $746m in cash from shareholders led by CVC. Afterwards, Liberty took control of F1 by paying $354m in cash and $3.3bn in newly issued shares. Liberty Media implemented drastic strategic changes to the company which was struggling to keep up with the digitalization of the world. F1 was considered a hobby for old people and according to the founder Bernie Ecclestone: “I don’t know why people want to get to the so-called ‘young generation’. Why do they want to do that? Is it to sell them something? Most of these kids haven’t got any money. I’m not interested in tweets, Facebook and whatever this nonsense is. I’d rather get to the 70-year-old guy who’s got plenty of cash”. In the 8 years before the acquisition public dissatisfaction caused a decrease of 40% of its viewership. The idea of Liberty Media to turn around the company was to transform it into an entertainment brand and the first step for that was to create a marketing division. The first three months after the acquisition were spent analysing data and understanding what fans expect from F1. From this analysis, Liberty targeted for its expansion young customers and provided higher engagement with the races. By performing a successful marketing campaign and increasing its social media presence, F1 managed to achieve 1.11m TV viewers per race in 2023. Furthermore, Liberty has also created a streaming platform: F1 TV to further increase the digital presence of the sport and created a Netflix show “Drive to Survive”. By implementing these strategies Liberty managed to decrease the average age of a fan from 36 to 32 years old according to a Nielson survey from 2022. The stock value increased by around 310% and achieved an enterprise value of $49.4bn. Liberty has also fought with Endeavour to acquire WWE and was also in talks to acquire PGE.

Source: FactSet Fundamentals

About MotoGP

Grand Prix Motorcycle Racing (MotoGP) is the most prestigious motorcycle road racing event. The first season was held in 1949. Currently, Dorna Sports is the only holder of commercial and television rights and is a leader in sports management, marketing and media. MotoGP hosts races with 22 of the fastest riders who compete on specifically designed prototypes. The championship is broadcast to hundreds of millions around the world registering a 36% increase in revenues between 2021 and 2023 from $358m to $486m. According to data from 2022 the audience of MotoGP is composed of approximately 80% men and 20% women, while 60% of fans of MotoGP are under the age of 35. In 2022 MotoGP has commissioned Nielson Sports to perform a survey regarding MotoGP’s audience. The survey was taken of a very big sample of around 110k fans. The results of the survey further prove the effectiveness of Dorna’s management team. 65% of the audience comes from Europe, 19% from Asia and 13% from the Americas. MotoGP has also a very loyal fan base with 82% of respondents declaring that they have followed the sport for over 6 years. The reason behind MotoGP’s performance is its commitment towards advertisement and social media, further proving that incorporating digitalization in the sports industry is a leading driver of growth in the sector.

Deal Recap

On 01/04/2024, Liberty Media Corporation declared its intention to acquire an 86% stake in Dorna Sports, the sole holder of all commercial and television rights to MotoGP. Dorna’s management will retain 14% ownership and continue to handle daily operations. This deal values the enterprise at €4.2bn and the equity at €3.5bn, with Dorna’s existing debt expected to remain post-transaction.

The current majority stakeholders, Bridgepoint, who owns 40%, and the Canada Pension Plan Investment Board, who owns 38%, will receive equity compensation consisting of approximately 65% cash and 21% in Liberty Formula One Series C common stock (NASDAQ: FWONK), with 14% retained in MotoGP management equity. The financial terms include a mixture of cash and debt financing, dependent on prevailing market conditions. The acquisition is projected to finalize by the end of 2024, pending regulatory approvals from competition and foreign investment authorities however, Liberty’s management are confident that the deal will be successful. In 2006, Private equity firm CVC wanted control of both F1 and MotoGP, but the European antitrust authorities forced the fund to get rid of its interests in MotoGP in order to finalise its purchase of F1, as the European body felt one company owning both series would not be good for competition within the European Union. CVC sold F1 to Liberty in 2017 in a deal worth $8bn.

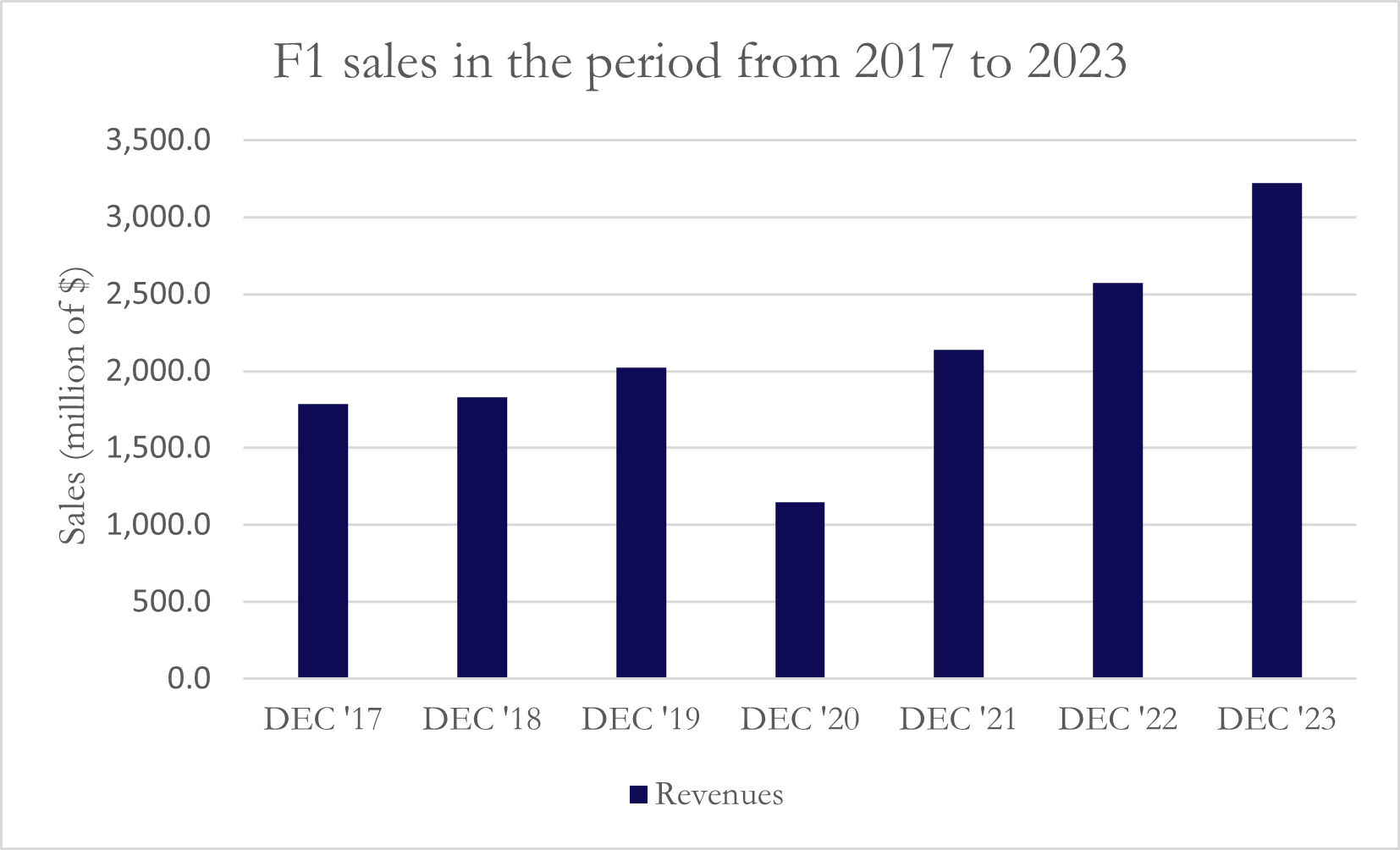

The Formula One Series C stock (NASDAQ: FWONK) is part of Liberty Media Corporation’s tracking stock structure. Liberty Media uses tracking stocks to provide investors with a way to invest in specific parts of their business with the Series C stock tracking the performance of Formula One. Owning (NASDAQ: FWONK) shares allows investors to tap into the growth and profitability of this segment, while Liberty Media retains full control and management. This includes the commercial aspects of the Formula One racing series such as broadcasting rights, advertising, and sponsorships. (NASDAQ: FWONK) listed in 2016 at $18 and has appreciated by 283% to where it is trading on the 12/04/2024 at $69. The fully diluted market capitalisation is $37.4bn with an enterprise value of $50.1bn. In terms of financial performance, sales have grown from $1.8bn in FY18 to $3.2bn in FY23, yielding a 5-year sales CAGR of 12% with an average 5-year EBITDA margin of 16.5%. Revenues are broken down by broadcasting and streaming rights – 36%, ticket sales – 29%, sponsorship fees – 17% and other revenues – 18%. The stock has never paid a cash dividend and does not currently intend to do so going forward. The market is pricing in continued growth for the stock, with an EV/EBITDA multiple of 75x.

Deal Rationale

Although Dorna Sports achieved a record-breaking revenue of €475m in FY22, an increase of 33% from the previous year, the company ended the year with a loss of €8m, due to the prolonged impact of the pandemic. At the beginning of FY22, Dorna refinanced a €975m loan through BNP Paribas, expiring in 2029. The loan, which was priced at 3.8% YTM was used to increase its liquidity and allowed Dorna to distribute a super dividend to shareholders of €390m. Additionally, Dorna established a revolving credit facility agreement of €60m, expiring in 2028.

The process of refinancing loans for the purposes of paying out dividends to shareholders is known as recapitalization. This process grants shareholders an immediate increase in return on investment however, it increases debt on the companies balance sheet and diminishes its overall credit profile, making borrowing in the future more difficult and costly for the company. Carrying out this process is common when debt financing is favourable and interest rates are low.

Dorna was able to raise debt in Q1 of FY22, when the European Central Bank Euribor floor was at its lowest of 0%, indicating a prudent financial decision at the time. The loan was priced at Euribor + 3.75%, indicating a variable interest rate. Currently, Euribor sits at 4% which indicates that Dorna is paying 7.75% annually or around €75.5m. The increasing level of interest expenses due to rising rates could have motivated the firm to sell to a bigger entity such as Liberty that will be able to maintain this level of leverage with ease.

Formula 1 has significantly increased its footprint in the U.S. by adding events like the Las Vegas Grand Prix, which attracted over 315,000 attendees. This reflects a broader strategy of creating spectacle-filled events to draw in large crowds and maximize media coverage, similar to plans for MotoGP. MotoGP has expanded its race calendar in the U.S. by reintroducing multiple Grand Prix events across the country, capitalizing on growing local interest and a historically strong fanbase in regions like Austin and the proposed new venues in the northern United States.

Both MotoGP and Formula 1 have pursued aggressive broadcast strategies. MotoGP’s partnership with TNT Sports to broadcast every race live across the U.S., along with comprehensive coverage on various platforms, aims to deepen viewer engagement. The U.S. represents a significant portion of the global sports marketing spend and offers substantial revenue opportunities through advertising, broadcasting rights, and merchandise sales. Formula 1’s success in harnessing this market—doubling its viewership on ESPN from 2018 to 2023—provides a compelling template for MotoGP. Moreover, introducing more races in the U.S. not only serves to grow the audience but also boosts local economies, similar to the impact seen with Formula 1 races in Miami and Austin.

The Netflix series “Drive to Survive” has significantly enhanced the popularity of Formula 1 in the United States. Since the release of the series, ESPN reported that average viewers per race increased from 547,000 in 2018 to approximately 928,000 in 2021. One of the most notable impacts of “Drive to Survive” is the reduction in the average age of Formula 1 TV viewers from 44 to 32 years old. Drive to Survive” Season 5, which focused on the 2022 Formula 1 season, amassed a significant 90.2 million hours viewed on Netflix from January to June 2023. This ranks it 115th among all shows on Netflix for that period, highlighting its popularity and the broad appeal it has among viewers. The series not only brought in new fans but also re-engaged existing ones, similar to MotoGP’s efforts through various digital platforms.

Regulatory Probe

The primary obstacle that stands in the way of Liberty Media completing its acquisition of MotoGP is represented by the antitrust laws of the EU. As stated by James Killick, a competition lawyer at White & Case, the potential combined entity makes these regulatory probes “quite likely” at an EU-wide level.

There is a possibility the European Commission rules that Liberty’s acquisition of Dorna Sports would give it an excessively dominant position in the motorsport industry, paving the way for higher TV prices and less consumer choice. This is what the European Commission ruled in 2006, when the Luxembourg-based investment fund CVC Capital Partners purchased over 60 percent of Formula One shares from Bernie Ecclestone’s Bambino Holdings and German bank Bayerische Landesbank. As CVC was already a majority owner of Dorna Holdings, it was ruled that they needed to sell their shares in Dorna to complete the acquisition of Formula One. There are concerns that a precedent was set in 2006 and that the European Commission will rule once more that the deal cannot go through.

If this is the case, things could get interesting for Liberty Media. Reports have emerged that Liberty rejected a $20bn offer from Saudi Arabia’s Public Investment Fund for the purchase of Formula One. With an original purchase price of $4.4bn in 2017, Liberty would be in line to make mouth-watering profit if it decided to sell. Recently, Formula One’s initial popularity explosion has been eclipsed by a lack of on-track competition. Thus, if Formula One’s viewership takes a tumble due to this lack of excitement, it may make commercial sense for Liberty Media to settle for a substantial profit and move towards another series with large growth potential.

However, there is optimism amongst Liberty Media that the deal will be completed on schedule by the end of the year, with CEO Greg Maffei stating that he is “very confident” the takeover will be cleared by EU regulators. In truth, the world of motorsport has transformed over the last 18 years and Liberty’s ownership of both Formula One and MotoGP would not be as market-altering.

Outlook

Whether or not the deal is approved by regulators, we can infer the intermediate and long-term vision of Liberty Media for the MotoGP series from its ownership of F1. Between 2017 and 2022, Formula One’s social media engagement grew by an immense 80% under Liberty ownership and we can expect the same for MotoGP.

In recent years, MotoGP has struggled to expand its viewer base despite offering a competitive and exciting product, an issue that Liberty Media will be sure to address once the deal goes through. The success of the Netflix series Drive to Survive (DTS) was an important driver of Liberty’s mandate to engage a younger audience and to expose Formula One to more mainstream viewership. Under Dorna Sports, MotoGP failed in its attempt to launch its own DTS-style docuseries in 2022 with MotoGP Unlimited on Amazon Prime Video due to a disastrous launch and poor marketing. We can be sure that Liberty Media will aim to rectify the failure of MotoGP Unlimited, and churn out a new, more polished product on Netflix with greater social media engagement.

Moreover, we can expect Liberty Media to focus on MotoGP’s expansion into the American market as it did with Formula One. Pre-Liberty ownership, the F1 calendar included only one event on American soil with the United States Grand Prix at the Circuit of the Americas (COTA) in Austin, Texas. Under Liberty, the number of Grand Prix in the US has expanded to three with the Miami GP (since 2022) and the Las Vegas GP (since 2023). These additional races in the US have especially been coupled with enhanced paddock experiences and an emphasis on celebrity attendance. Although this has angered ‘traditional’ F1 fans, who have argued that there has been too much of an emphasis on the showmanship surrounding the sport, these directives by Liberty Media have increased Formula One’s popularity amongst the casual viewer.

However, the question arises whether Liberty Media will be able to replicate its success in expanding Formula One’s global reach with MotoGP. One issue that could potentially prevent MotoGP from reaching a similar level to Formula One’s popularity is the ‘personality problem’ that can be seen within the series. Ever since Valentino Rossi’s retirement in November 2021, the sport has struggled to find a racer to focalise on and succeed Rossi, undoubtedly MotoGP’s most famous racer. This has not been the case in Formula One, who have not been short of superstar drivers that can transcend the sport: Schumacher, Vettel, Hamilton, and Verstappen to name a few. Part of Formula One’s recent popularity boom has been due to the relevance of its drivers in popular culture and if MotoGP does not rectify this ‘personality problem’, it could become difficult for Liberty Media to scale MotoGP’s exposure.

Furthermore, Liberty Media’s venture in Formula One has succeeded in part due to its ability to exaggerate the drama and tensions occurring between both drivers and teams, both on- and off-track. This can be seen with Drive to Survive, which some have argued has become more of a reality show. The ability to dramatise Formula One has rested on the presence of prominent drivers and prominent team principals with strong characters, an asset that MotoGP lacks.

To conclude, we must ask ourselves: will MotoGP ever be as popular as Formula One? Although both series’ have extremely rich histories dating back to the 1950s, there is an argument to be made that Formula One has become synonymous with high culture thanks to the presence of household racing teams such as Ferrari, McLaren, and recently Mercedes as well as iconic sponsors such as Rolex and Pirelli. Sadly, the same cannot be said of MotoGP. Yet, even if Liberty Media’s venture into the world of motorcycle racing is half as successful as what it has achieved with Formula One, the deal will still be viewed as a success.

For Dorna Sports Chief Commercial Officer, Dan Rossomondo, emulating Formula One’s success is the ultimate goal, however, this needs to be balanced with retaining what makes MotoGP unique. In an interview with BlackBook Motorsport, he stated: “We want to build this very intelligently, very aggressively, but we want to make sure that we keep what makes us special and inherent to who we are.”

0 Comments