Correlation of 10y US Treasuries with Stock Market

On April 25th, the yield on the 10-year US Treasury note broke above the psychologically important 3% threshold for the first time since 2014. The yield’s high for the day was 3.033%, meaning it was just short of 3.05%, which would have put it at the highest level since 2011. Given these developments, it becomes relevant to ask what the effect of these higher yields could have on the stock market.

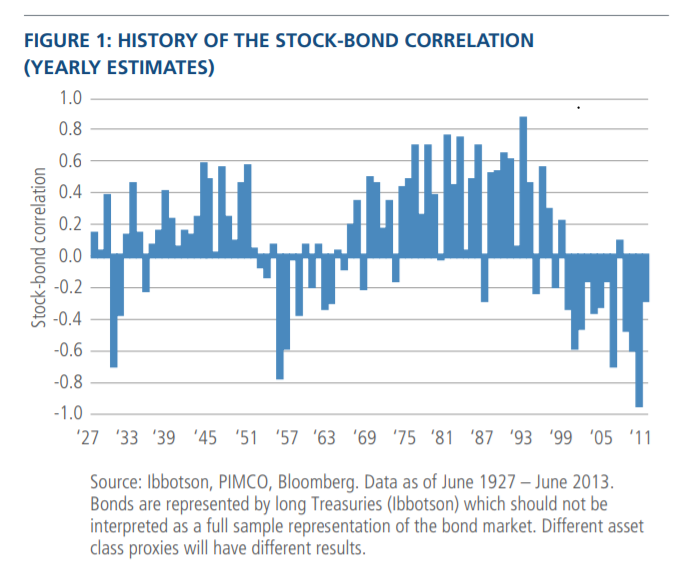

The correlation between stock prices and bond prices has always been a crucial element in any portfolio manager’s investment strategy and risk management, and it is a key statistic for the analysis of financial markets. Notably, this correlation is all but constant. For instance, a PIMCO research report found that, from 1927 to 2012, the correlation between the S&P 500 index and long-term US Treasuries – as calculated by calendar year based on monthly data – changed sign 29 times, ranging from -93% to +86%.

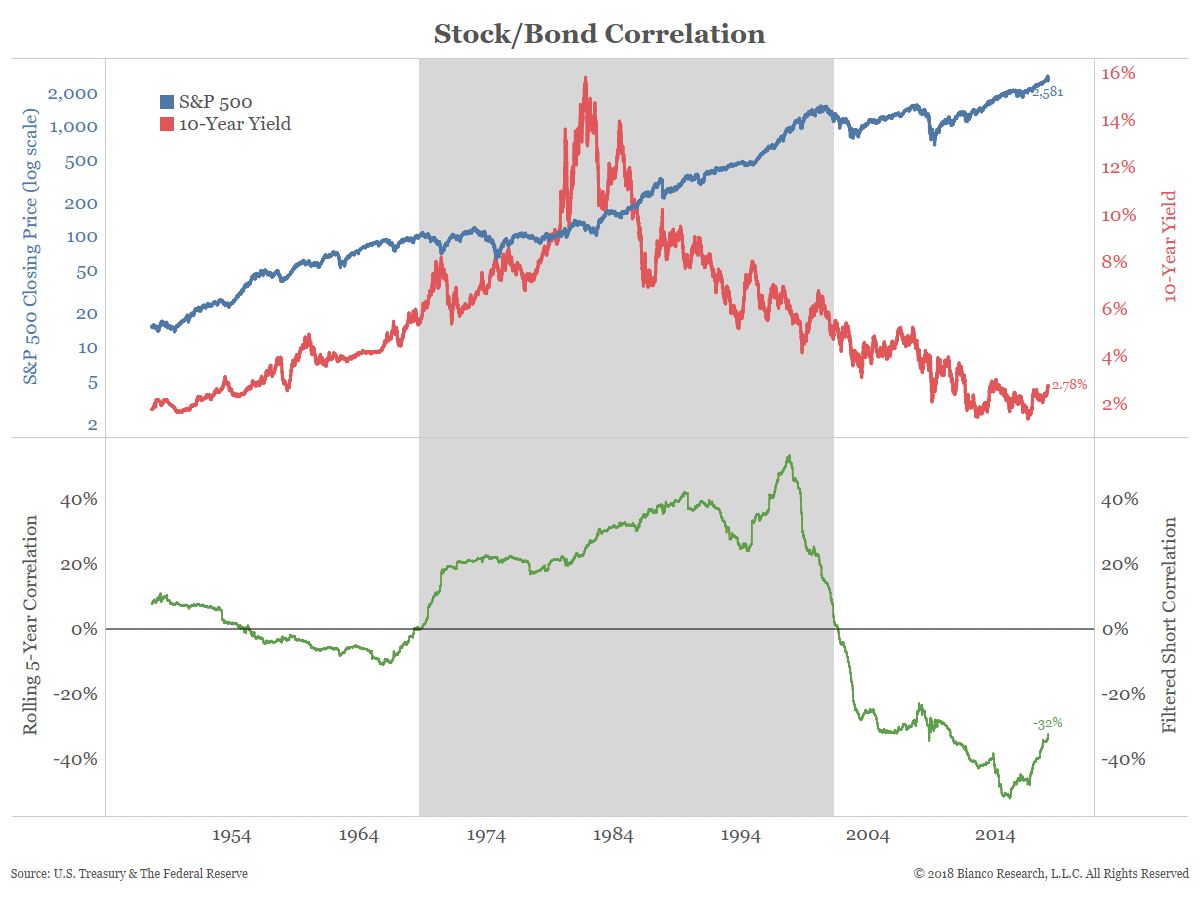

Since 2001, the prices of stocks and bonds have been negatively correlated. This was a drastic change, however, from the previous period between 1966 and 2001 (shaded in the graph below), where the asset classes correlated positively.

Inflationary expectations could be a decisive factor affecting the stock/bond correlation. Since 2001, and especially after the 2008 global financial crisis, a deflationary mindset has permeated the markets. When deflation fears rise, bond yields are depressed, boosting bond prices, and stocks go lower. When deflation fears dissipated, yields rise, lowering bond prices, and stocks rally. The bond/stock correlation is negative. This is referred to as a “risk-on/risk-off” situation.

On the other hand, before 2001 and since 1966, it wasn’t the concern of deflation that permeated the markets, but concern of inflation. As a result, when inflation was deemed too high, bond yields rose while stock prices declined. After all, inflation reduces the present value of companies’ future cash flows because it commands a higher cost of capital. When inflation fears subsided, the opposite is true and bond yields fell while stocks rallied. The bond/stock correlation is positive.

The breaking of the 3% threshold for the 10-year Treasury note yield, combined with very low levels of unemployment and high small business confidence, as well as the end of the era of near-zero (sometimes negative) interest rates and unconventional monetary policy in the form of credit easing and quantitative easing, suggests that we may be pivoting away from the deflationary mindset of the past 15 years and into the inflationary mindset of the previous 50 years. If this is the case, then the bond/stock correlation is likely to become positive once again, having a profound impact on asset allocation and risk management decisions.

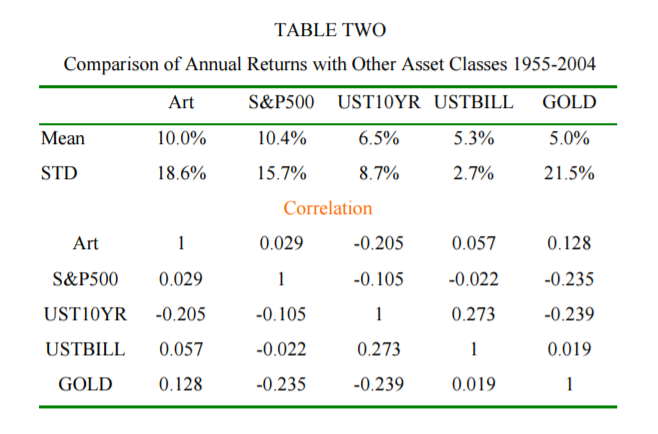

Other Low Correlated Assets

As a general rule, having uncorrelated assets in a portfolio reduces overall portfolio risk. Thus, if bonds start correlating more and more with stocks, a portfolio manager should, for instance, consider allocating more capital in alternative asset classes in order to “hedge” the overall increase of correlation in the market. One of the least known alternative asset class is Art, and in the table below we can observe that, after Gold. (considered by all as a hedging asset in a negative market situation), Art is the asset with the lowest correlation across S&P500, UST10YR and USDTBILL making it an efficient tool to contrast the increasing correlation and improving the efficient frontier of a portfolio in a Markovitz sense. It is as well uncorrelated with Gold so they should be used together and considering that the art’s Sharpe ratio is pretty higher than the Gold’s one the capital invested in Art should be higher.

Source: Mai and Moses, Art as an investment (2004)

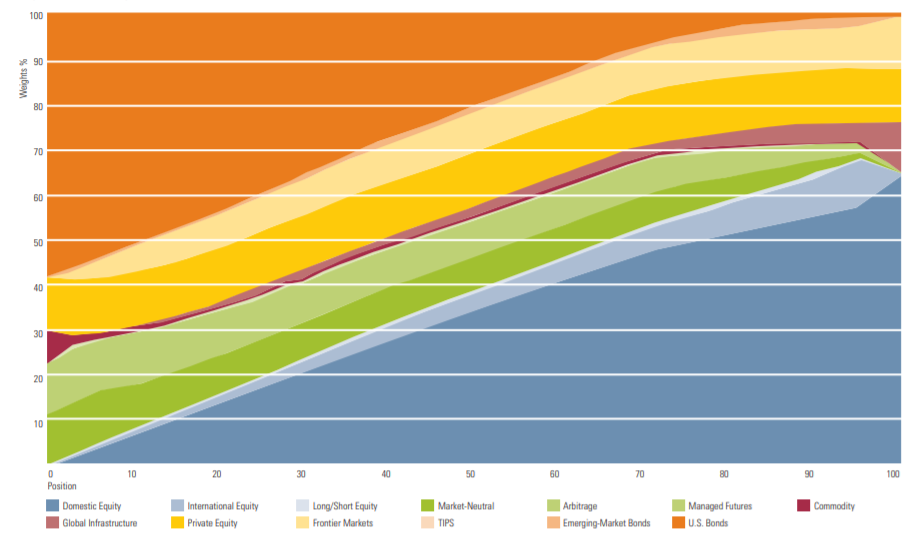

Going beyond Art and Commodities in general, alternative sources of low correlation can be find in Infrastructure, Real Estate and Fund of hedge funds investments. In the graph below, it is analysed the composition of an efficient portfolio for different level of desired returns and standard deviations. It is clear as a really big portion of an efficient portfolio should include Infrastructure, Private equity funds and different strategies Hedge funds which improve the overall portfolio Sharpe ratio. Finally, considering the particular regime switching change towards an inflationary scenario, which should be considered an event moving a portion of the current allocation in fixed income towards TIPS in order to have an hedge against inflation, being market neutral and lowering consistently the duration of the bond allocation.

Source: Morning Star, Alternative investment observer (2010)

Finally, a more direct hedging strategy, but at the same time more complex since it requires multiple rebalancing sensitivities, is being exposed to derivatives products affected by correlation as Basket option or structured products as combination of Basket and Barrier options, trying to match the correlation risk of the overall portfolio with the correlation delta of the options portfolio paying attention to the cross gamma of this kind of products.

0 Comments