Introduction

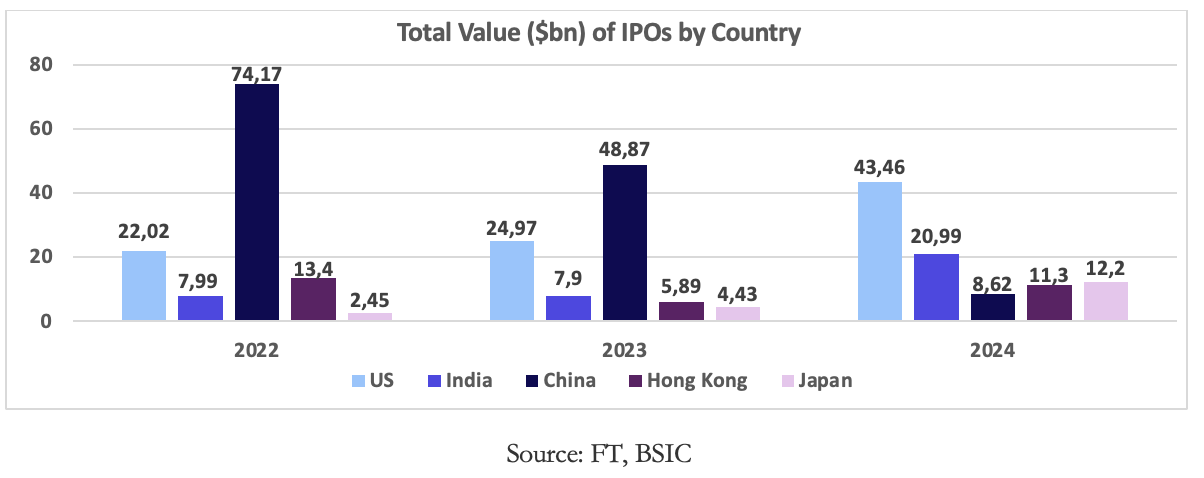

India’s IPO market achieved a historic milestone, with proceeds more than doubling from $7.9bn in 2023 to nearly $21bn in 2024. Fast-growing Indian market has topped the global IPOs rankings with 338 listings, surpassing China by deals value and number, and being outpaced only by the US in total deal value. The IPO boom shows evolution and resilience of the country’s financial ecosystem, making India a global hub for capital fundraising. The government’s emphasis on infrastructure and core sector development, combined with increased private capital expenditure, played a pivotal role in enhancing market dynamism. The country’s biggest IPOs in 2024 included Hyundai Motor’s India [NSE: HYUNDAI] $3.3bn offering, Swiggy’s [NSE: SWIGGY] $1.3bn issue, NTPC Green Energy’s [NSE: NTPCGREEN] $1.2bn IPO, Vishal Mega Mart’s [NSE: VMM] $0.9bn listing, and Bajaj Housing Finance’s [NSE: BAJAJHFL] $0.8bn offering. In 2024, India had a large volume of relatively smaller deas, as companies wanted to raise funds quickly while valuations remain very high, leading to a 75% decrease in an average ticket size per transaction in the last two years.

We saw a radical shift in 2024 Asian capital markets, as tighter regulations and an economic slowdown have led to a listings drought in China, which in 2023 was the world’s largest market. IPO proceeds in the country fell from $48.8bn to just $8.6bn last year, loosing its leading position to India and Hong Kong. However, China’s IPO slowdown was in line with Beijing’s policy, aiming to achieve balance between primary and secondary markets. While Hong Kong, being a listing venue for mainland Chinese companies to raise offshore capital, showed a significant increase in IPO activity from $6bn in 2023 to over $11bn in 2024, including some key transactions such as electronics maker Midea’s over $4bn secondary listing (also listed at the Shenzhen bourse [SZE: 000333]). Hong Kong is likely to continue to benefit as China’s offshore financial hub as the Hong Kong Stock Exchange offers a more streamlined listing process, greater access to global capital, market stability and transparency. Some other Asia-Pacific countries also saw significant growth in IPO activity. For instance, Japan experienced a 175% growth, with 82 IPOs generating $12.2bn. Overall, the APAC IPO market was led by the technology and communications sector, which recorded 120 transactions, followed by the financial services sector with 60 deals. On a broader horizon, standout deals included $5.2bn IPO of Kioxia, the world’s largest manufacturer of NAND Memory, and Tokyo Metro’s $2.3bn listing, both in Japan. Overall, the Asia-Pacific IPO market had a challenging 2024, but momentum picked up in the second half of the year with a rise in mega listings in India and Japan.

Rationale behind the boom on India’s IPO market

Firstly, the shift of domestic savings away from deposits and real assets to capital markets has been the most consistent and dominant reason for the growth in India’s primary markets over the last few years. The popularity of mutual funds among local investors has been increasing as the Securities and Exchange Board of India (SEBI) continues the regulatory developments and Indians seek higher returns than traditional savings options can give them. For instance, SEBI constituted a working group to review the regulatory framework under 1996 Mutual Funds Regulation, and recommended measures to promote ease of doing business for mutual funds. This led to the exclusion of fund manager’s fee from the expense ratio of the fund, thus, bringing it down. Subsequently, these funds became more attractive and competitive compared to actively managed funds. Furthermore, SEBI made amendments to the Basic Services Demat Account (BSDA) facility which further increased accessibility of investment products to investors with relatively smaller ticket sizes. Consequently, the number of Indians with accounts allowing them to invest in mutual funds has increased from around 40m in 2020 to over 180m last year. This surge in domestic investor interest came after foreign investors have withdrawn more than $30bn since October 2024, making local capital the foundation for Indian markets.

Secondly, companies are eager to take advantage of India’s heightened equity valuations driven by domestic fund flows. Currently, P/E multiples are around 20x in India, compared to averages of no more than 14x in most other markets around the world. These inflated equity valuations make Indian market very attractive to companies looking to raise funds in the short run, including by spinning off Indian units of multinational companies such as Hyundai. Despite the latter deal showed not the best results, with stock being down 7% on the opening day, overall Indian IPOs strong performance can be another potential driver of market growth. Corporations and investors have been encouraged by largely strong debuts, making them more likely to follow the listed companies and pursue an IPO this year. Among the 78 mainboard India’s IPOs in 2024, 54 are trading at a premium to their offer prices, with 4 trading over 100% above their issue prices. Moreover, SME IPOs outshone mainboard IPOs, with 28 SME listings trading at over 100% premiums.

Last Year’s Performance

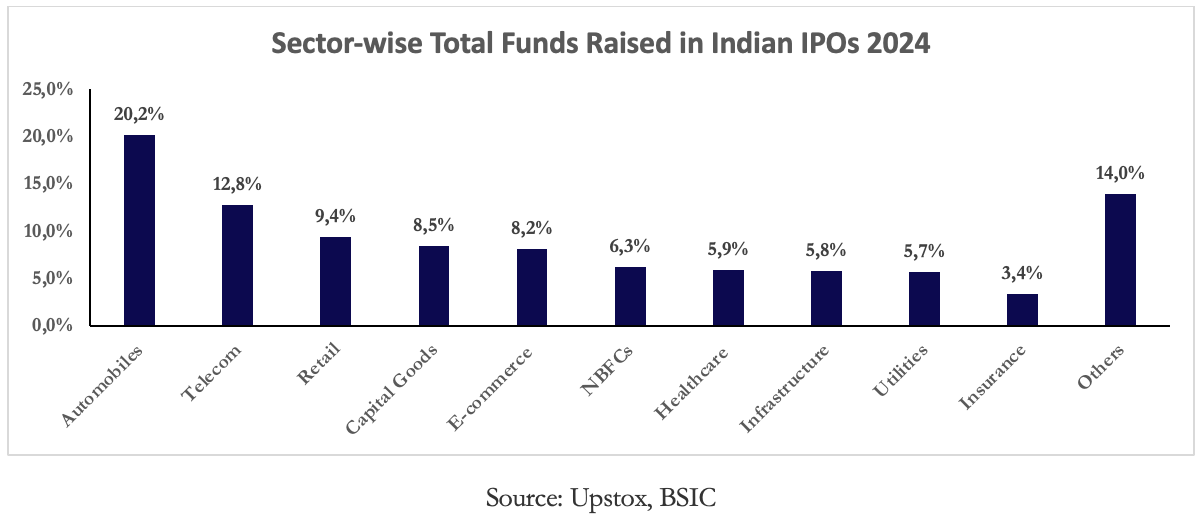

In 2024, the Indian IPO market was characterized by significant activity and milestones, highlighted by major listings such as Hyundai Motor’s India [NSE: HYUNDAI] $3.3bn issue, Swiggy’s [NSE: SWIGGY] $1.3bn offering, NTPC Green Energy’s [NSE: NTPCGREEN] $1.2bn IPO, Vishal Mega Mart’s [NSE: VMM] $0.9bn listing, and Bajaj Housing Finance’s [NSE: BAJAJHFL] $0.8bn issue. The market showed record-breaking numbers, with 338 offerings raising $20.9bn — a 2.6x increase from the previous year. This surge provided substantial exit opportunities for private equity investors, helping them to realize profits. For instance, Accel Partners, Baron Capital, Norwest Venture Partners, and Tencent offloaded their stakes in food and grocery delivery service Swiggy’s IPO. Similarly, MacRitchie Investments Z47 exited Ola Electric Mobility [NSE: OLAELEC], while TPG Growth and Vistra ITCL divested from infant care e-commerce player FirstCry [NSE: FIRSTCRY]. Furthermore, Blackstone sold stakes in Aadhar Housing Finance [NSE: AADHARHFC] and International Gemmological Institute [NSE: IGIL]. The Indian IPO market in 2024, unlike previous years, displayed a diverse sectoral participation, including listings in 23 different industries. Automobiles, Telecom, Retail, Capital Goods, and E-Commerce collectively accounted for 59% of the total issue size, while in 2021 90% of the raised funds were concentrated in just three sectors: BFSI, Healthcare, and Real Estate. 2024 sectoral breakdown is shown below:

This broad-based participation was accompanied by a remarkable performance in the SME segment, which outshined mainboard IPOs in both oversubscription and listing gains. Of the 231 SME IPOs, 28 debuted at premiums exceeding 100%, compared to just 4 among mainboard listings. Oversubscription rates told a similar story — mainboard IPOs averaged 18.9x, while SME IPOs saw an overwhelming 165.3x demand. Overall, 151 IPOs received over 100x oversubscription, with 141 of them from the SME space, underscoring the growing appetite for smaller, high-growth businesses. However, 43% of the funds raised through new offerings were attributed to just five companies – Hyundai Motor, Vodafone Idea, Swiggy, NTPC Green, and Vishal Mega Mart. Notably, the Bajaj Housing Finance IPO was oversubscribed by 67.4x at close and saw the share price more than double on debut. These figures highlight the sustained investor confidence in India’s thriving tech and startup ecosystem and its rising prominence in the global financial markets.

Hyundai Motor’s India IPO

In October 2024, Hyundai Motor India [NSE: HYUNDAI] launched its initial public offering, raising a record $3.3bn, marking it as the third-largest IPO in India’s history and the world’s second largest of the year on that moment. The listing comprised an entire offer for sale of 142,194,700 shares, with a price set between ₹1,865 and ₹1,960 per share. This valuation of $19bn positioned the company at an approximate 26x P/E ratio, a figure that drew mixed reactions from analysts. Some viewed it as high with limited short-term gains, while others considered it fair against competitors like Maruti Suzuki. Hyundai, India’s second-largest carmaker, with a 14.6% market share after Maruti Suzuki’s nearly 40%, plans to spend the IPO proceeds on increasing its local presence. It is expanding production capacity for its sport utility vehicle (SUV) line-up and intends to introduce four EV models.

Upon listing on October 22, 2024, the stock debuted at ₹1,934 on the NSE, slightly below its issue price. The stock faced a consistent decline over the next 10 days due to broader market fluctuations, with the closing price of ₹1,814 as of November 4, 2024. This performance aligns with a broader trend where recent IPOs in India have been experiencing initial price declines due to high valuations, caution among retail investors, and a general market hesitancy in the auto sector. Despite the underwhelming debut, the successful completion of the offering reinforced the strong support from institutional investors, including Singapore’s government, the BlackRock investment company, and Fidelity and Vanguard funds. In the future, experts anticipate healthy double-digit portfolio returns over the medium to long term, primarily due to Hyundai’s plans to gradually become a major player in the EV segment and its access to its South Korean parent’s innovative manufacturing technology.

Swiggy’s Market Debut

Swiggy [NSE: SWIGGY] is a food-delivery app comparable to giants like Uber Eats or Deliveroo. However, it has recently grown to pioneer quick-commerce services in India, delivering groceries and household goods within 20 minutes in the country’s most crowded cities. In November 2024, Swiggy launched its IPO to raise $1.3bn, making it the largest tech IPO of 2024 globally. The issue, priced between ₹371 and ₹390 per share, was oversubscribed by 3.6x, indicating strong investor interest, driven by increasing urban demand for affordable and convenient delivery services. The company’s valuation was set at approximately $11.3bn, a conservative figure compared to its competitor Zomato, which had recently reached a market capitalization of $29bn. With experts saying Swiggy has “lagged” Zomato in both food delivery and quick commerce, the company responded by earmarking about ₹12bn from the IPO proceeds to expand its dark store network, which feeds its rapid commerce arm operating in more than 30 cities.

On its listing day, Swiggy’s shares opened at a premium of 8% over the issue price. While this was a modest gain compared to some other recent IPOs, it still marked a positive debut for the company. The stock continued to climb to a high of ₹597.45 in December 2024, gaining 53% over the issue price. Although the stock price currently sits at ₹360, down 40% from its high and 7.7% from the issue price, investors are optimistic due to the recent success of China’s biggest delivery platform, Meituan, and India being a mass market where smartphone penetration is expanding and infrastructure for food delivery is improving.

Outlook: What’s Next for Indian IPO Market?

There is an expectation that Indian IPO market will continue forward the momentum from 2024 and perform extremely well, even potentially eclipsing the $20.9bn raised in 338 IPOs last year. India continues to develop at a rapid pace, with government iniatives like Make-in-India, infrastructure development, and renewable energy advancements all spurring the country’s economy. Moreover, strong debutes last year, India’s heightened equity valuations, surge in Indian domestic retail investor interest, and tighter restrictions in mainland China are likely to continue contributing to the rapid growth of Indian IPOs market in 2025.

This year to date, Indian IPOs total value is $888m coming from 26 deals, 4% higher than the same period in 2024, although the number of deals is lower than the 32 priced at this point last year. So far, Healthcare sector is leading 2025 activity, with Dr Agarwal’s Health Care [NSE: AGARWALEYE] and Laxmi Dental [NSE: LAXMIDENTL] together raising almost 50% of the total value. While Dr Agarwal’s stock is flat compared to its offer price, Laxmi Dental has risen by over 15%. Healthcare IPOs are likely to continue robust performance as there is a strong pipeline of potential listings across various niches in the broader pharmaceutical and life sciences sector. For instance, contract research firm Anthem Biosciences has already filed its draft prospectus for a $397m IPO.

We also expect to see many technology, AI-driven, and consumer facing businesses IPOs as the country’s 31 January budget unveiled a series of tax cuts that would provoke India’s discretionary spending. On 6 February, IT consulting and services firm Hexaware Technologies launched a $1bn IPO, for which the books closed on 14 February, establishing a price band of ₹674-708 per share for its IPO. Moreover, financial services and renewables are expected to continue to experience a positive sentiment. This year to date, 11 startups have already filed their draft red herring prospectuses (DRHPs) with SEBI, including Ather Energy, Ecom Express, ArisInfra, Avanse Financial Services, BlueStone and others, 5 of which have already recieved the regulatory approval. We will also probably see companies coming back to India’s capital markets which became more rewarding in recent years. For instance, firms like ReNew Energy Global [NASDAQ: RNW] and online retailer Meesho are considering relisting in India.

Up until this point, 34 companies have been approved to raise $4.8bn this year, and another 55 are waiting to raise up to $11.4bn. In 2025, there are likely to be several significantly larger deals in comparison to last year, as already at least 7 companies are looking to raise over $1bn each this year. These include online brokerage Groww, fintech company Pine Labs, SoftBank-backed eyewear brand Lenskart, and Indian arm of South Korea’s LG. Other interesting potential IPOs include quick commerce startup Zepto, e-commerce brand Flipkart, Carlyle-backed Hexaware Technologies, EV-focused Ather Energy, and HDB Financial Services. One extremely exciting deal that we are potentially going to see is Reliance Jio’s IPO, India’s number one telecom player with 479m subscribers, owned by Asia’s richest man, Mukesh Ambani. While the company has not yet signaled a timeline for Jio’s public offering, many investment bankers believe it could happen in the second half of 2025. In this case, it might become India’s largest IPO ever with an expected raise of between $4bn and $4.5bn.

Major Companies Looking to List

On the other hand, potential reasons why 2025 might not become a record year, include the uncertainty caused by the reelection of Donald Trump which has resulted in the rupee coming under pressure against a strong dollar and the very disappointing IPO of Hyundai Motors India, the largest Indian IPO ever, which is currently down by 8.7% since its IPO in October. The latter is likely to have instilled some doubt and caution in the minds of eager investors. Moreover, with corporates reporting weak earnings, India’s GDP growth fell to 5.4% in Q3 2024 — the lowest rate in almost two years. Additionally, concerns are being raised about the use of markets by huge foreign companies to take money out of India rather than reinvest it in the country.

Overall, Indian IPO market is primed for another strong year despite the uncertainty surrounding Trump’s election and Hyundai Motors’ disappointing IPO. Strong domestic retail investor interest and generally strong debuts last year are likely to be the key drivers in the continued success of the country’s public markets. Despite short term shocks in foreign institutional investors flows, majority of investors remain optimistic about Indian equity. Given that, 2025 can surpass last year’s $21bn of Indian IPO proceeds, given the country’s great market depth since the global financial crisis, making it one of the most vibrant primary and secondary markets globally.

0 Comments