Inspire Brands – privately owned by Roark Capital Group

Dunkin’ Brands Group (DNKN:NASDAQ) – market cap as of 13th November 2020: $8.7bn Introduction

On the 30th of October 2020, Inspire Brands announced its commitment to acquire Dunkin’ Brands Group, one of the few franchising companies focused on coffee and breakfast products which showed resilience in the last turbulent year for the restaurants industry. The deal, which is valued at $11.3bn, on a multiple of 23 times the EBITDA, makes this acquisition the industry’s second-largest transaction ever. The price per share is $106.50, indicating a premium of 20% on the closing price of October 23rd, before the NYT reported the deal talks. The high value of the total control premium incorporates the massive benefits expected by the acquirer from the closing of this deal. In fact, Dunkin’ Brands Group will represent the first company of the Inspire Brands family to operate in the breakfast segment and will not require the usual turnaround that Inspire Brands has been used to carry out in its last acquisitions. The company is already operating efficiently, and the bidder can exploit the consistent synergies expected. In addition, thanks to its large dimensions, Dunkin’ Brand Groups will almost triple the current number of restaurants owned by Inspire Brands and allow the other brands of the portfolio to become familiar with operating in different countries. In fact, after the acquisition, Inspire Brands will totalize 31,600 shops around the world and position itself as the second largest player in the world after Yum! Brands, which counts 50,000 locations.

About Inspire Brands

Created in 2018 with the purpose of building a full-spectrum collection of restaurant businesses, Inspire Brands is an American holding company operating in the restaurant industry. Formerly Arby’s Restaurant Group, it is owned by Roark Capital Group, a private equity fund based in US and focused on middle market franchising companies competing in the food, health, and wellness industries. When Roark Capital Group acquired Arby’s Restaurant Group in 2011, the holding company was controlling only the fast-food chain Arby’s. Then, in 2018, Arby’s Restaurant Group acquired another fast-food chain called Buffalo Wild Wings and its name has been changed in Inspire Brands to better represent the new purpose of the company. At this point, the valuation of the company was already around $5bn and it kept increasing during the last two years because of the acquisition of Jimmy John’s. The vision of its Board, guided by the former CEO of Arby’s Mr. Paul Brown, is to transform Inspire Brands in a “family of restaurant brands”. Here, the sister companies operate independently although sharing best practices and investment strategies to benefit the entire enterprise. The various brands complete each other offering distinct products and positioning themselves as complementary experiences for the customers. Nowadays, Inspire Brands already controls Arby’s, Buffalo Wild Wings, SONIC Drive-in, Rusty Taco and Jimmy John’s, with more than 11,000 restaurants in 14 countries and $14.6bn in revenues.

About Dunkin’ Brands Group

Dunkin’ Brands Group, the target company, controls two different franchising restaurant brands, Dunkin’ and Baskin-Robbins. Both these two brands have been founded in the ’50, during the glorious years of growth for the US economy. The strong economic development of the country led to the creation of new manufacturing facilities and offices, contributing to the expansion of a new variegated middle working class (also because of immigrants coming to the States), busy and richer, interested in having a fast breakfast before to go to work. New fast-food chains focused on breakfast meals like Dunkin’, Mister Donut and Baskin-Robbins exploited the new trend becoming the leaders in the US, until the arrival of new competitors like Starbucks and Costa Coffee forced them to share the market demand and specialize on a more specific segment of the market interested in economic and sweet product.

The current legal structure of the company has been created in 2004, one year before its acquisition by a consortium of private equity firms – Bain Capital, The Carlyle Group and Thomas H. Lee Partners – which performed substantial improvements in the performance of its brands. The company went public on 2011 becoming one of the largest enterprises operating in the fast-food restaurants industry and characterized by more than 70 years of history.

In 2019, Dunkin’ Brands realized $1.37bn revenues, with an interesting growth rate of 4% from the previous year. The trend is valid also for the net income, which reached the value of $242M, with a 5% increase from 2018. It is thanks to its solid structure and organization that Dunkin’ Brands has been able to face the Covid-19 pandemic better than its competitors operating in the coffee and breakfast segment. The change in the workers’ habits during the lockdown period led to a 18.7% decrease in shops’ sales during the second quarter of 2020 for the US market. Anyhow, the direct rival, Starbucks, reported a decline of 40% in the shops’ revenues of the same period, highlighting the superior ability of Dunkin’ Brands to handle the situation thanks to its digital business, already developed before the Covid-19 outbreak. The contact free takeout and the ability to boost premium products along the day instead of focusing on early breakfasts for workers, can be identified as the leading strategies adopted by the company as a response to the crisis. This experience prepared the business for a new chapter of its story, with a strong focus on adaptation to the new consumers’ routine and an additional effort on improving the operations’ efficiency. That is way Dunkin’s CEO, Dave Hoffman, stands his enthusiasm versus the change in control which will bring the desired opportunities of growth, innovation, and internal improvements.

Industry Analysis

Restaurant industry was badly hit earlier in 2020 after governments across the world imposed lockdowns to curb the spread of coronavirus. In some countries restaurants are going to have an even tougher recovery since they have to reclose or reduce dining room capacity for the second time this year.

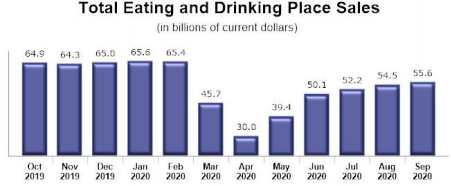

Looking at the US, six months after states introduced “stay at home” orders, over 100.000 bars and restaurants (which means 15% of all eating and drinking places) have permanently closed. Yelp data shows that since the beginning of the pandemic, 53% of restaurants have been listed as permanent closures on the platform, making this business the most affected by COVID-19 across the US. The virus is expected to cause the restaurant industry to lose $240bn in sales this year, based on estimates from the National Restaurant Association. There has been an appearance of growth during the summer. US restaurants sales amounted to $55.6bn in September 2020. This is a massive growth if compared to April levels, but sales in September remained 15% below their pre-coronavirus levels. In total between March and September, eating and drinking place sales were down nearly $162bn from expected levels.

Source: U.S. Census Bureau

Source: U.S. Census Bureau

However, the pandemic’s toll is not uniform across the restaurant industry. In fact, each performance during the crisis depends on different factors such as on-premise versus off-premise sales and digital maturity. Obviously, dine-in sales significantly decreased during the pandemic. Eating places that do not have the ability to shift quickly to takeout or delivery are in a dangerous position. Large chains are outperforming small companies and independents. That is because chains are much better equipped to start mobile ordering and artificial intelligence than mom-and-pops. Nearly 85% of independent restaurants could close by the end of the year if they do not receive state aid, according to the Independent Restaurant Coalition.

On the other hand, giant chains like McDonald’s, Domino’s, and Dunkin’ itself have gone on a massive sales system. Dunkin’ stores in cities have been hit hard as corporate workers continue to work from home and avoid downtown’s breakfasts. To face this problem the chain has decided to invest in digital services and to shut down more than 800 of his franchises. Closings led to a reduction in costs and a noticeable 2% growth in revenues.

Franchising is one of the few sectors that has never ceased to grow even during the lockdown. This business is shaping online ordering and delivery options as “the new normal”. For example, Domino’s US pizza sales jumped 16.1% during the pandemic. We are seeing a new optimism in franchise industry; a lot of business are looking to franchise. The reason is that the core responsibility in franchisors is seen as a strong support and a useful guide in such a difficult period. According to a managing director of Carl Marks Advisor, larger brands and operating groups are looking at the crisis as an opportunity. They are on the way to buy and expand during the slowdown and Dunkin’ acquisition is only one of the many deals through which big chains are taking the lead of the restaurant business.

Some believe that the crisis will leave us with just chain and fast-food restaurants, while others believe that the restaurant industry has been oversaturated for years and this crisis will correct some of that bloat. McKinsey’s analysts drew different recovery scenarios, and the likeliest projection assumes a period of at least three years before demand returns to pre-pandemic levels. A real example could be found in China: even if pandemic seems to be under control, consumer demand has not immediately rebound when restrictions have been removed. While the short-term effects of the pandemic on the restaurant industry are clear, with restaurants being forced to shut down and a subsequent high unemployment , the long-term effects are less so. The incursion of technology is reshaping

the nature of what it means to be a restaurant. The pandemic only accelerated an inevitable process that will be a challenge for every restaurateur.

Deal structure

Under the deal, which is expected to close by the end of this year, Inspire Brands, owned by private equity firm Roark Capital Group, will buy Dunkin’ Brands Group at an enterprise value of approximately $11.3bn. Inspire Brands will pay $106.50 per share in cash to take ownership of Dunkin’ Donuts and Baskin-Robbins, implying an equity value of $8.76bn. The price represents a 20% premium over Dunkin’s closing stock price on October 23rd, before the New York Times first reported the deal talks. The sale will delist the group from the NASDAQ after being public since 2011. Dunkin’, which has already been private, was sold in 2005 by Pernod Ricard, a French group, to a consortium of private equity firms (including Bain Capital, The Carlyle Group and Thomas H. Lee Partners)

The takeover process is a two-steps merger. First Inspire Brands will acquire the majority of Dunkin Brands, meaning 51% of the outstanding shares. Then, after the anti-trust waiting period has expired and following the successful completion of the tender offer, Inspire will acquire all the remaining shares not tendered in the tender offer through a squeeze-out merger at the same price. Lastly, it is worth noting that as part of the deal Dunkin’ and Baskin-Robbins will operate as distinct brands within Inspire.

Deal Rationale

This deal fits into a recent trend of increasing M&A activity in U.S, where companies across several sectors have bulked up despite the economic uncertainty due to a recent spike in coronavirus cases and the outcome of the US presidential election.

Even if US restaurants have been badly hit after lockdowns were imposed across the country to curb the spread of coronavirus, demand for convenience during the pandemic has seen a rapid increase, helping fast-food chains outperform, especially those with drive-through facilities. As example, Dunkin’ has been able to survive the pandemic thanks to numerous measures, from offering contact-free takeout to boosting premium products like espresso and specialty beverages (Drinks make up more than half of Dunkin’s revenue). This would explain the all-time high 20% premium Inspire Brands is paying on this acquisition; still, Inspire would be paying an enterprise value of over 26 times forward EBITDA, which is much higher in comparison to JAB’s recent $1.35bn acquisition of Krispy Kreme Doughnuts.

It can be argued that a few weeks ago Dunkin’ was the real winner in this transaction, not only because of the high premium, but mainly because of two reasons: first, most of Dunkin’ franchisees run unprofitable businesses that have worse profitability than the industry average and its like-for-like sales at US stores fell 19% during the second quarter; second, Inspire could help Dunkin’ expand in Midwest and the West Coast markets as well as improve its digital marketing and mobile ordering by using its scale to spread better technology across its brands but at the same time it will bear all the execution risk.

This acquisition is only one of the recent ones made by the Roark Capital-backed conglomerate, which aims at improving companies’ digital operations while keeping their brands separate. And given recent news of a possible Covid vaccine by Pfizer, Inspire Brands could be the real winner, thanks to the fact that Dunkin’s pure franchise model generates steady cash flows and that debt is very cheap: Inspire issued $750 m worth of corporate bonds in May, followed by an $825 m offering in July.

Market Reaction

On October 26th, shares of Dunkin’ Brands Group surged 15% closing at $103 after the company confirmed sale talks with Inspire Brands.

Inspire Brands is privately owned so it is not listed, but part of its debt is; and in April, S&P downgraded Inspire’s publicly traded debt for the first time with warnings of “deterioration” of revenue and profits and “very high leverage” and consecutively the price of Inspire’s publicly traded debt dropped by double digits.

Advisors

Barclays served as financial advisor to Inspire Brands, while BofA Securities served as exclusive financial advisor to Dunkin’ Brands Group.

All the views expressed are opinions of Bocconi Students Investment Club members and can in no way be associated with Bocconi University. All the financial recommendations offered are for educational purposes only. Bocconi Students Investment Club declines any responsibility for eventual losses you may incur implementing all or part of the ideas contained in this website. The Bocconi Students Investment Club is not authorized to give investment advice. Information, opinions and estimates contained in this report reflect a judgment at its original date of publication by Bocconi Students Investment Club and are subject to change without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. Bocconi Students Investment Club does not receive compensation and has no business relationship with any mentioned company.

Copyright © Jan-20 BSIC | Bocconi Students Investment Club

0 Comments