The Blackstone Group L.P. (NYSE: BX) – market cap as of 24/09/2018: $47.23bn

Introduction

On September 13, 2018, Nordea and DNB announced that they had entered into an agreement to sell 60% of the Baltic bank Luminor to the private equity giant Blackstone in a transaction that is valued at approximately $1bn. Furthermore, Nordea decided to transfer an additional 20% ownership stake over the medium term, as the firm attempts to simplify its business model and exclusively focus on the Nordic markets. According to the press release, the deal still has to be approved by regulatory authorities and is expected to close in the beginning of 2019.

Blackstone

The Blackstone Group is an American Private Equity firm founded in 1985 initially as an M&A boutique by Peter G. Peterson and Stephen A. Schwarzman. Blackstone went public on the New York Stock Exchange in 2007 with a $4bn IPO, one of all-time biggest IPOs for a financial sponsor. The firm is based in New York City.

The company is currently one of the largest Private Equity funds in the world, operating on a global basis. The $439bn of AUM, include investments in private equity, real estate, public debt and equity, non-investment grade credit, real assets and secondary funds. Blackstone deploys capital to make sound investments for its shareholders with the purpose of generating returns through to a combination of cost cutting and management expertise.

With $108bn of capital inflows, FY 2017 was a remarkable year for the firm. Net Income amounted to $3.4bn, a 40% YoY increase, and resulting in an EPS of $2.81. Investments appreciation also demonstrated significant growth. In particular, Corporate Private Equity Businesses went up by 18%; Real Estate Investments showed a 19% improvement; and Strategic Partners Businesses (Secondary PE Investments) appreciated by 23%.

Luminor Group

Luminor Group was established as an independent entity in 2017, through the merger of Nordea’s and DNB’s business operations in Latvia, Lithuania and Estonia. The firm is the third-largest bank in the area with over 3,000 employees, managing assets of €15.0bn and serving roughly 1.3m clients. Until the recent acquisition, Nordea owned 56% and DNB 44% of the holding company, whose primary task is to detain shares in Luminor entities.

Luminor Group offers a broad range of products to small, medium-sized enterprises and private individuals. These include savings accounts, pension plans, loans for home purchase, leasing services and brokerage solutions. In particular, the company provides these services through 45 different branches and manages three subsidiaries named Luminor Bank AS (Estonia), Luminor Bank AS (Latvia) and Luminor Bank AB (Lithuania). Overall, Luminor Group holds a 16% market share in deposits and 23% in lending.

In FY2017, the group announced a net interest income of €67.89m. The company’s operating income amounted to €92.31m in 2017 and cash flow from operating activities was €29.18m during the same time period. Lastly, Luminor Group has a common equity tier 1 capital ratio of 17% (€1.6bn).

Industry Overview

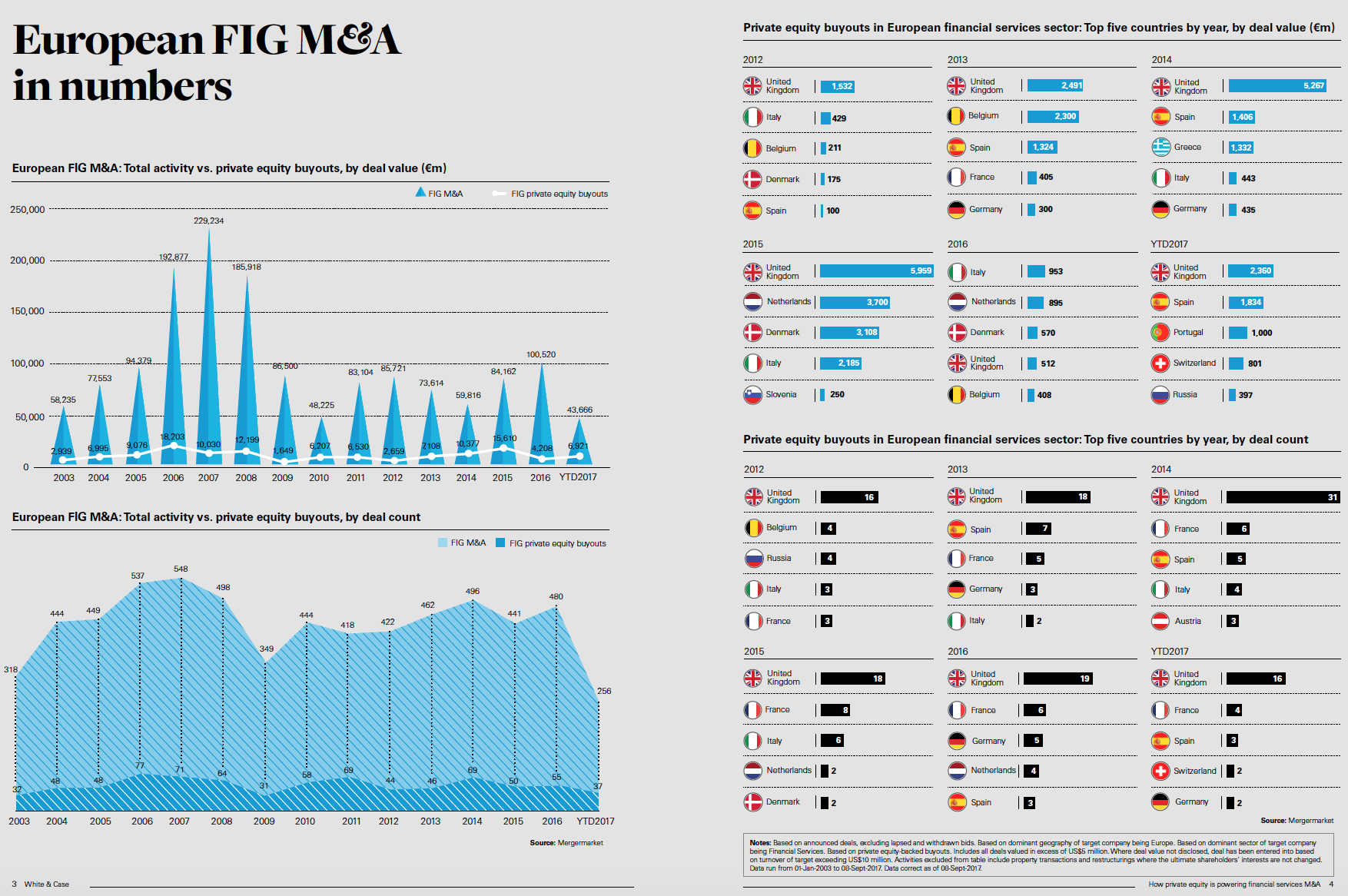

The 2008 subprime mortgage crisis forced numerous financial institutions across the globe to sell secondary business divisions in order to strengthen their balance sheets and to fulfill the newly devised capital requirements. This unique opportunity allowed private equity funds to enter the financial services industry and to effectively compete against other interested parties. According to White & Case, private equity players managed to complete 37 transactions with a total value of roughly €6.9bn in the time period between January and September of 2017. Furthermore, the study highlights that private equity funds view “valuation dislocation”, “the disruptive power of technology” an “changes in legislation and regulation” as the main prospects for high investment returns within the industry. The illustration below provides a comprehensive overview of the private equity buyout landscape and shows that the majority of deals were always completed in the United Kingdom:

Given the large expertise and willingness to engage in distressed investments, governments have also gradually realized the importance of private equity funds in the recovery of the banking sector. In 2015, Hypo Group Alpe Adria AG and its south-east European banking network was completely carved out legally and operationally by Advent International and the European Bank for Reconstruction and Development. Furthermore, HSC Norbank was acquired by Cerberus and JC Flowers in February 2018 for approximately €1.0bn and Lone Star bought a 75% stake in the Portuguese bank Novo Banco in October 2017.

The high profitability of financial services investments, derived from large-scale turnaround and restructuring opportunities, has encouraged private equity players to acquire personal expertise in the field and to focus their efforts on innovative payment solutions and on non-performing loans. In 2015, Bain Capital and Advent International completed a £4.8bn listing of the firm Worldpay on the London Stock Exchange, initially buying the company for around £2.0bn in 2010. According to a study by Deloitte, research also shows that private equity funds have raised at least $300bn for investments in troubled loans.

Deal structure

The Nordic banks Nordea and DNB are selling their 60% stake in Luminor for a total of $1bn. The transaction will be financed using Blackstone’s newest private capital fund that has a size of about $18bn.

As a result of the transaction, Nordea and DNB will each hold approximately 20% of Luminor and maintain ongoing representation on Luminor’ s board of directors. The agreed purchase price in the upfront sale of the 36% stake divested by Nordea is €600 million, valuing Luminor at approximately €1.7bn, approximately in line with the financial group’s price-to-book value (P/BV).

In addition, Blackstone has also entered into an agreement with Nordea to purchase their remaining 20% stake over the coming years. The forward sale of Nordea’s remaining 20% stake will be carried out at a fixed valuation of 0.9x P/BV. In addition to the upfront sale and forward sale, Nordea will continue to provide funding to Luminor over the medium term, together with transitional services, until 2020.

The exact payment structure used by Blackstone has not been disclosed. However, it is reasonable to assume that the amount of leverage used would be lower compared to the 60%-70% generally observed in private equity acquisitions. This is due to the fact that the target, being a financial institution, is subject to banking regulations which do not allow a financing structure making substantial use of debt.

Deal Rationale

The deal is not only the first investment of Blackstone in the Baltic region but also one of the largest purchase of a stake in a universal bank a private equity fund has made in the last decade. It is an unprecedented transaction because historically banking sector has not been a typical target of private equity funds. After the financial crisis, there have been a couple of transactions where private equity funds have acquired stakes in commercial banks, nevertheless, they typically concerned small or medium-sized companies which, due to financial struggles, where undergoing a restructuring and were forced by regulators to find new owners.

The Luminor transaction is different because, in this case, the buyout of a bank is treated as a typical investment opportunity that private equity fund is targeting. Such an unprecedented move might be a result of an extraordinary global situation of private equity. Nowadays, funds have an incredible amount of capital at their disposal. There is around $1.7tn of unallocated capital which private equity firms have accumulated over the past five years. For this reason, funds are now more than ever prone to experiment and search for new sectors or markets in order to allocate the capital. Thus, the transaction may even signal a new trend of buyouts in the banking sector, especially considering an increasing interest of private equity companies in lending activities.

The rationale for Blackstone purchasing the Luminor in particular is both due to the characteristics of Baltic market as well as due to the growth potential of the company. Baltic countries are considered very attractive, because they are growing at a higher rate than other European countries. At the same time, there is still room for the loan market to grow significantly. Blackstone senior managing director Nadim El Gabbani, commented to the Financial Times that, since loan growth for Baltic markets only returned to positive growth two years ago, it is a sign that the market is very disciplined and rational. This makes it a particularly attractive market from Blackstone’s perspective.

Luminor has the potential to become a leading bank in Estonia, Latvia and Lithuania as there is no other independent bank in that market with a significant presence in all 3 countries. This makes Luminor well positioned to become market leader and grow further. Moreover, Blackstone’s growth strategy aims to significantly increase the profitability of the bank. Currently, Luminor has a return on equity much below that of its competitors. For instance, SEB (Skandinaviska Enskilda Banken) and Swedbank boasted an ROE of around 20% for 2017. Luminor, on the other side, reached an ROE of 6.3% in the first quarter of 2018. Luminor’s strategy is to invest the capital provided by Blackstone in new technologies, develop its digital offering and, through the launch of innovative products and services, become a leading independent bank in the Baltic region.

For the current owners of Luminor, Nordea and Norways’s DNB, the decision to sell their majority stake is a legitimate result of their strategy to streamline their operations and focus on the core markets i.e. Denmark, Finland, Norway and Sweden. Baltic countries are no longer a priority for Nordea and the sale of Luminor will allow the company to decrease its exposure and redistribute the capital deployed there. Common equity tier one capital ratio should increase by 0.2 percentage points, or by 0.45 percentage points when including the option to sell its remaining stake to Blackstone.

While Nordea entered into contract to sell its minority stake in the future, DNB emphasized that it intends to remain a minority shareholder in Luminor because of the very promising forecast for the future and the potential for value creation. Additionally, DNB disclosed that the sale itself should not have material impact on company’s financial results.

Market reaction

The day after the announcement of the transaction, which took place on September 13, 2018, Nordea’s Stockholm Stock Exchange listed shares were up by 18.5 percent, closing at 97.08 SEK (Swedish Krona) per share, an equivalent of $10,67. On the same day, Blackstone’s New York Stock Exchange listed shares were up 1.5 percent to $36.8 per share. The transaction is still subject to approval by supervisory authorities and closing is expected in the first half of 2019.

Financial Advisors

Blackstone was advised by J.P. Morgan and Allen & Overy. Additionally, Michael Wolf, Senior Advisor to Blackstone, is also providing support to management in the transformation of the bank.

Luminor was instead advised by COBALT, a Baltic boutique investment bank.

0 Comments