Introduction

Lackluster equity capital markets are showing signs of recovery, after almost two years of low activity. The downturn was initially caused by rising uncertainty as high inflation, rising interest rates and a gloomy economic outlook that encouraged investors to ditch growth stocks and turn to safer, more established industry players. As a result of this, many firms decided to delay their IPO plans – for instance private equity group CVC Capital Partners, online bank Chime Financial, and even fintech firm Klarna. SPACS, vehicles used as an alternative mean to gain entry in public markets, weren’t spared: “there are hundreds and hundreds of SPACs that are already public that are looking for a merger partner and any new SPAC IPO is going to be competing against those hundreds of other SPACs,” said University of Florida Professor Jay Ritter in an interview with CNBC. “So it makes no sense for a SPAC to be going public now rather than wait for a year until all this competition goes away.”

Since then, uncertainty – the IPO market’s number one enemy – has started fading, and these same companies are today reviving their IPO plans, signaling that equity capital markets may be at a turning point of their recovery. Instacart for example, a grocery delivery company that benefitted from the pandemic is set to go public by next week. To evaluate equity capital markets’ prospects, this article will first dive into the Arm Holdings’ IPO, which is set to be the largest since Rivian’s IPO [RIVN: NASDAQ] two years ago, and then broaden its analysis to the entire IPO market and how this might affect private equity investors.

Arm Holdings’ IPO

In late August, Chip manufacturer Arm Holdings confirmed rumors that it would list its shares on the 14th of September, on the Nasdaq, in what is expected to be 2023’s biggest IPO. Specialized in chip architecture – meaning both designing and manufacturing – Arm Holdings has been a driving force of the semiconductor industry for the last three decades. According to their website, 70% of the world’s population uses Arm-based technologies (in cars, smartphones, drones, electric passports, etc.), and 99% of premium smartphones rely on an Arm CPU. Created in November 1990 under the name Advanced RISC Machines Ltd, Arm was first structured as a joint venture between Acorn Computers, which provided 12 employees, and Apple, which funded a $3m investment. But today, Arm Holdings has expanded its reach far beyond the UK, and has offices in the US, China, Japan, South Korea, Taiwan, France, and Germany, among many other countries.

In 2016, the Japanese conglomerate SoftBank Group [9984: TYO] acquired Arm Holdings, in a deal that valued it at $32bn. More recently, in 2022, Nvidia [NVDA: NASDAQ] attempted to buy Arm from SoftBank, hoping to secure its supply of chips amid a global ship shortage caused by the Covid-19 pandemic, in a deal that would have valued Arm at $40bn. But the sale was called off because of significant regulatory challenges and antitrust rules. Since then, Arm has kept on growing, and SoftBank Group has decided to float Arm’s shares by issuing 95.5 million American Depositary Shares (ADS) at $51. This would value Arm at $52bn, twice what SoftBank Group paid for it in 2016. One should note that this figure is still lower than the $60bn target SoftBank had set one month ago, after valuing Arm at $64bn following a transaction with the SoftBank Vision Fund in August.

Regardless, the proceeds from the IPO should allow SoftBank Group to build a deep war chest, available to seize opportunities in a market where tech companies have seen their valuations drop as interest rates rise. For instance, in July, the company led a $65 million investment in Tractable, an insurance technology, through its SoftBank Vision Fund 2. SoftBank is planning to use the public shares as collateral for an $8.5bn loan hanging over the Group, for which it will be liable if it doesn’t file Arm’s IPO by the end of September.

Many established tech companies have shown interest in becoming anchor investors in Arm. According to the Financial Times, Nvidia is in talks with Arm to take a stake in the company, at a share price that would value Arm between $35bn and $40bn. Nvidia’s main benefit from this investment would be gaining access to Arm’s large customer base. Other tech giants such as Apple [AAPL: NASDAQ], Amazon [AMZN: NASDAQ] (one of Arm’s largest customers), and Samsung [SSNLF: OTCPK] have also signaled their interest. Accordingly, this strong demand resulted into the IPO being oversubscribed by a factor of ten, and Arm closing its order book a day early.

However, not all economic actors are as enthusiastic as these tech giants. Some fund managers doubt that SoftBank will be able to justify a $52bn valuation – implying a P/E ratio of 99 times its trailing 12-months earnings – and feel anything above $40bn simply doesn’t make sense. Tech investor James Anderson noted that Arm will likely struggle to convince investors of its growth potential, given he doesn’t see Arm as a critical player in cloud computing and artificial intelligence. In fact, since Arm’s 2022 revenues stood at $2.6bn, applying the Philadelphia Stock Exchange Semiconductor Index market cap-to-revenue ratio yields a valuation of only $24bn. This means that Arm’s revenues will have to keep growing at a fast pace. And in that department, the company is already facing a few difficulties: it’s very exposed to China, which brings in a quarter of its total revenues, and the company warned that its IPO plans could “limit opportunities for future growth”. Investors will keep a close eye on revenue growth over the next quarters.

Are we really at a turning point?

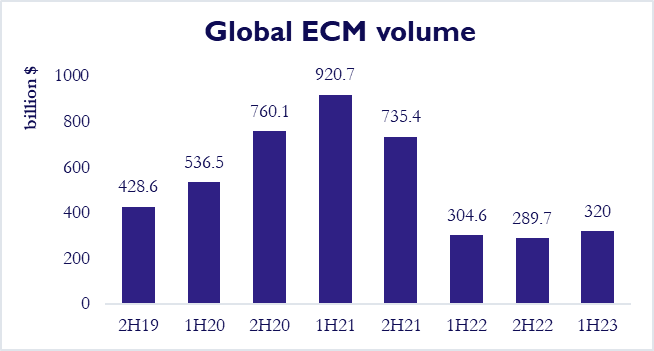

In the past three years, equity capital markets (ECM) issuance has witnessed significant fluctuations. It soared in 2021, following the reopening of global economies after the COVID-19 pandemic, only to nearly grind to a halt in 2022 and the first half of 2023.

Source: iON Analytics

During the first half of 2023, global ECM activity recorded a total deal volume of $320bn, marginally higher than the $305bn achieved in the same period of 2022. Nevertheless, these figures remained considerably lower than the nearly $1 trillion in new public listings witnessed in 2021. Even when compared to the pre-pandemic times, a notable decline can be observed. Despite this challenging environment, certain IPOs have defied the odds and performed successfully. Cava Group [NYSE:CAVA], a Mediterranean restaurant chain, and Oddity Tech [NASDAQ:ODD], a technology-driven beauty products company, are two recent examples.

Cava Group nearly doubled its IPO price of $22 per share when it debuted on the NYSE on June 15. The company successfully raised $318m by selling approximately 14.4m shares. Having previously received investments of $738m over 10 VC funding rounds – reaching a peak valuation of $1.3bn in its series F funding in 2021 – Cava’s IPO constitutes a rare example of a successful listing for a VC-backed company in a period marked by declining start-up valuations. In fact, with only 20 US venture-backed companies completing an IPO in 2022, Cava’s successful one comes at one of the worst times for such operations since the 2008 Global Financial Crisis. The favourable listing of Cava Group may have been bolstered by the strong stock performance of peer companies like Chipotle [NYSE:CMG] and Shake Shack [NYSE:SHAK], both of which saw their share prices increase by more than 48% this year. Chipotle, in particular, being an investor favourite with its current valuation exceeding by 4,500% its initial stock price when it went public in 2006. Oddity Tech, based in Israel, also managed to complete a similar feat. Its shares opened at a 40% premium over the IPO offer price on July 19, propelling the company to a valuation of $2.8bn. Oddity, alongside its selling shareholders, successfully raised $424m by selling 12.1m shares at $35 each, already above the previously considered range of $32-$34.

The success of these recent IPOs has led investors to think about a possible revival of ECM, even for late-stage start-ups, in the latter half of 2023. As a matter of fact, numerous VC-backed firms that initially planned for IPOs last year then indicated their intentions to wait for more favourable market conditions. The most representative examples include Klarna, Stripe, and Reddit.

Klarna is a fintech firm offering a “buy now, pay later” service, established in 2005 in Stockholm. It managed to maintain a history of profitability until 2018, when it embarked on significant investments in the US market, with plans of eventually going public in the United States. According to recent remarks from CEO Sebastian Siemiatkowski, Klarna has fulfilled all its prerequisites for contemplating an initial public offering but is currently waiting for improved market conditions. This decision is understandable when looking at Klarna’s substantial decline in valuation over the past two years. The company, once the most highly valued unlisted start-up in Europe at $46bn, has seen its estimated worth plummet to $6.7bn, even necessitating substantial workforce reductions. This situation serves as a perfect example of the adverse effects that higher interest rates coupled with widespread uncertainty and volatility, have had on start-ups whose value, arguably excessive, referred in its majority on expectations of future profits. Payment processing company Stripe was also rumoured to be exploring an IPO. However, following a substantial $6.5bn Series I fundraising round that halved its previous 2021 valuation of $95bn, the necessity for further fundings at a similar discount is unclear. Reddit, the social media website, had confidentially filed for an IPO in December 2021. However, with no further comments on the matter, it is clear that any plans have been postponed to better times.

An analysis of these cases raises some important considerations. Start-ups typically do not generate significant cash flows until later stages, making raising additional capital a necessity. Within the current market environment, this leaves many of them facing a choice between raising money at a reduced valuation, taking on debt, or implementing cost-cutting measures while waiting for more favourable conditions. However, they also demonstrate that a successful IPO is still viewed as a favourite exit opportunity for VC investors, founders and employees, as well as a means of raising additional funds for the company. The decrease in ECM activity can thus be interpreted as a result of reduced valuations due to external macroeconomic factors, rather than a change in its perception and desirability. That is, once market conditions and valuations improve, a return to previous volume of deals can be reasonably expected.

Crucially, the recent success of some IPOs by VC-backed start-ups, coupled with the substantial listing by Arm, may have a positive signalling effect for firms currently waiting for better market conditions to pursue their listing plans, having thus the potential of jump-starting ECM activity. Venture capitalists, recognizing the difficulties of finding exit opportunities in the current IPO and M&A slump, have been cutting back on start-up investments. However, a sudden revitalization of the IPO market could potentially reverse this trend, especially considering that, according to a recent study by Crunchbase, VCs have accumulated substantial reserves of “dry powder” – capital that has been raised but not yet deployed. This could, in turn, enable growing companies to achieve higher valuations once more, with the present ones drastically lower than those prior to 2022. In fact, during that period start-ups valuations were motivated by either extreme growth expectations or irrational motives that created a financial quasi-bubble situation. Because of these optimistic assumptions made when determining their value, the effects of a diffused pessimism and the general market downturn were amplified for such companies. However, for the same reasons, a successful series of IPOs and higher VC fundings may rekindle investor sentiment, pushing valuations higher and even mitigating losses on VC balance sheets.

The recent increase in actual and rumoured ECM activities may leave investors to question the reasons behind such trend, and particularly what factors have changed compared to 2022 or the first months of the current year. Something that almost certainly influenced the current wave of IPOs is a notable decrease in perceived stock volatility. The CBOE Volatility Index (VIX), commonly known as the fear gauge of the stock market, has in fact shown a consistent decline. Moreover, there have been far fewer days with the VIX index exceeding the threshold value of 25 – only 3 concentrated in March 2023, following the collapse of SVB and the fear of a banking crisis. Playing in favour of a public listing from late-stage start-ups is also the positive and improved performance of growth stocks, contrary to last year. Even with regards to the macroeconomic landscape, the situation has improved in some way: while inflation remains elevated, it has considerably decreased and stabilized, whereas the Fed has at least slowed the rate of increase of interest rates.

Before concluding that the ECM poor performance of recent times has come to an end, though, it is essential to make some considerations on the profile of the companies that had or are currently pursuing an IPO. In fact, it can be argued that all examples presented above had some distinctive features that separated them from the “typical” VC-backed company, building an argument that suggests caution. While most tech-based start-ups focus on software applications, Arm specializes in the production of hardware components. This means that it faces different industry dynamics, specifically in terms of a reduced threat from new entrants given higher initial costs and a primarily B2B customer relationship. Additionally, Arm finds itself in the position of capitalizing from the growing artificial intelligence sector and it is already a profitable company with significant cornerstone investors. The Cava Group, instead, operates in a not so common industry for the start-up landscape, being a restaurant chain offering a compromise between quality and fast-food – a model whose success had been previously proved by notorious players. The IPO price was also arguably cheap, looking at the rise in the first day of trading, and the clear plan for utilizing additional funds, namely the opening of new restaurants, added to its appeal. Lastly, Oddity Tech was already quite profitable and presented a record of growing revenue.

An additional obstacle to the revamping of IPOs is the possibility of a further interest rates increase coming in November. Rate hikes lower companies’ value both due to an increase in the cost of debt and liquidity risks for the firms as well as making other safer investments more attractive in terms of returns. In fact, they raise the interest rate that can be earned by investing in risk-free instruments such as US Treasury Notes, a baseline component in the determination of the cost of equity with the Capital Asset Pricing Model (CAPM). The combination of higher cost of equity and cost of debt thus determines a significant increase in the Weighted Average Cost of Capital (WACC) of the firm, usually used as the rate at which future predicted cash flows are discounted in a DCF valuation process. Therefore, even if the company’s operations are unaffected by the rate hikes, its stocks will theoretically be worth less. Crucially, US inflation saw an upward adjustment in the month of August; although primarily driven by energy prices, it may still give motives to the Federal Reserve for further rate hikes. It is also important to consider the fact that the market has not fully priced in the potential rate increase of November – bond markets currently estimate a nearly 40% chance of this occurrence. This differs from the situation in July, when an anticipated rate hike had a limited impact on day trading, with the main indexes that either closed slightly higher or remained relatively stable. Therefore, in the event of an interest rate hike a negative signal may be sent to the equity market, potentially offsetting the positive momentum that could have been generated by the previously discussed IPOs.

Lastly, it’s essential to recognize that 2021 marked a record year for ECM issuance and replicating such volumes in the near future seems unlikely. The favourable conditions in 2021 were largely attributed to increased stock market activity, fuelled by government capital injections aimed at mitigating the pandemic’s economic impacts. This influx of capital into the financial system created high market liquidity, providing investors with the resources to support newer companies and start-ups. On top of that, many of the IPOs during that period ultimately proved unsuccessful, as companies may have been lured in by the favourable listing environment. Nearly half of the billion-dollar-plus valuation companies that went public in 2021 are now worth less than $500m, with only 40% maintaining valuations above $1bn. The performance of three of the most valuable companies that went public in 2021 – Rivian [NASDAQ:RIVN], Coinbase [NASDAQ:COIN], and Roblox [NYSE:RBLX] – well illustrates this point. Each of these companies has seen a substantial decline in market capitalization since their respective IPOs – with Roblox losing 60%, while Rivian and Coinbase both losing around 80%.

Headwinds for Private Equity Investors

Listing shares on a public exchange is often considered a less popular exit for private equity backed companies than mergers or strategic sales. This is mainly because it is hard to achieve a total exit via an IPO, where only a portion of the equity is sold rather than all the equity in a buyout. Furthermore, as private equity funds often hold controlling stakes, they are subject to various lock-up periods following an IPO, typically of six months, which can delay the realisation of the actual investment. Despite this as well as weak activity in the equity capital markets, the last few months have seen an increasing number of private equity backed companies going public. Apollo-backed Lottomatica [BIT:LTMC], Ares-backed Savers Value Village [NYSE:SVV] and EQT-backed Kodiak Gas Services[NYSE:KGS] all went public in the last four months, raising €690m, $400m and $256m respectively. Interestingly, both Lottomatica and Kodiak Gas Services used proceeds from their IPO to pay down debt on their balance sheet and reduce financial leverage. Considering the high interest rate environment discouraging firms from refinancing, highly leveraged companies may continue to raise equity by going public in order to pay down debt. Portfolio companies of private equity funds typically fit the bill of being highly leveraged and having loans coming due, and so it is reasonable to expect these firms to continue opting for equity injections via an IPO rather than refinancing with higher rates. Meanwhile, KKR recently announced their intentions to take Hitachi Kokusai Electric, a Japanese chip equipment manufacturer, public on the Tokyo Stock Exchange by year-end. Rumours of a $2.7bn valuation would make it the biggest IPO in Japan since 2018. This comes after the excitement surrounding both the Arm IPO and the wider chip industry in the wake of the AI revolution. Of particular significance is the timing of this decision, given the current vibrant Japanese IPO landscape. With ten IPOs set for this month and an additional nine in the pipeline for the next, this resurgence of interest in Japanese stocks is remarkable. It comes at a crucial juncture, following a period marked by cautious investment sentiment, which was largely influenced by geopolitical uncertainties and trade tensions between the United States and China.

One of the other advantages of taking a portfolio company public is the funds’ ability to continue charging management fees and carried interest on holdings that are marked to market at a typically higher valuation than before. Despite most lock-ups expiring six months after IPO, the average duration of post-IPO investment is 3 years. During this additional period, the funds will continue to charge management fees and carried interest on these holdings. It is evident why this is advantageous to the GPs, but recent studies show that these ‘long goodbyes’ cost LPs an extra 20% in management fees and carried interest for holding publicly-listed equities that perform broadly in line with the market and could be directly held by LPs for a fraction of the cost. With buyout funds sitting on a record level of $2.8 trillion of unexited assets, more than four times higher than during the 2008 Global Financial Crisis, there is increasing pressure on LPs to realise their investments in a market environment where higher rates are suppressing valuations. The resurgence of the IPO market gives private equity investors an alternative solution to exit their investments when strategic buyers and financial sponsors are not as active in the M&A market.

Conclusion

Despite weak ECM activity over the last 18 months, there is clearly much optimism amongst investors and companies for the IPO market’s prospects for the foreseeable future. The success of both the Cava and Oddity Tech IPOs seem to have laid the ground for the return of blockbuster IPOs in the following months. With many companies waiting in the sidelines, this may be the moment that onlookers such as Reddit and Klarna have been waiting for. With the last quarter of the year typically the most active for IPOs, we could see a wave of profitable companies successfully floating their shares between now and the end of the year. This will come as good news to many private market investors, who are looking for liquidity events in the near future. While the recent revival of IPO activity is positive sign for ECM, caution is warranted, as the market remains sensitive to a vast range of external factors. The future trajectory of the ECM will depend on the ability of companies to navigate these challenges and sustain growth, ultimately determining whether the market has truly turned a corner or is merely experiencing a brief resurgence in a volatile landscape.

Tags: IPO, Arm Holdings, Venture Capital, Private Equity, SoftBank, Valuation

0 Comments