Introduction

On November 1 Johnson & Johnson, an American multinational which develops medical devices and is ranked 36 in the fortune 500 companies with yearly sales of $98.3bn, announced its proposal to acquire AbioMmed [ABMD: NASDAQ], a cardiovascular technology group. The acquisition, worth $16.6bn, will make Johnson & Johnson (J&J) [JNJ: NYSE] owner of the firm’s heart pumping technology. Johnson & Johnson’s acquisition of AbioMed, further places the firm within the Medical Technology industry, which has been growing at 4.8% average in revenue over the last 10 years. This deal will help the firm grow its market share, currently at around 5%, within a growing industry, due to continuous developments within the technological field, bringing lowering data exchange and analysis costs, stronger innovation and huge investments in R&D.

About Johnson & Johnson

Founded in 1886, Johnson & Johnson is one of the biggest pharmaceutical companies as well as being one of the most valuable companies in the world. The firm has an annual revenue of $93.7bn, with net income of around $20.9bn. Its divisions within are the consumer business, pharmaceutical and MedTech, the main generators of Net Income are represented the last two segments.

The firm went public in 1944 and the following 50 years the firm undertook numerous acquisitions of different medical firms to grow its markup within the medical sector. In 1959, J&J acquired McNeil Laboratories, a firm specializing in selling over the counter drugs falling within the consumer sector of J&J today generating $82bn in revenue. A very important acquisition made by J&J in 1998 was the DePuy Synthes, one of the firm’s first acquisitions focused on the development of their MedTech sector. In 1965, J&J developed a crucially important vaccine for infants, the RhoGAM Vaccine, preventing Rh hemolytic disease in newborns. The firm also launched their Hapindex Diagnostics test, a rapid test for blood donors checking for Hepatitis B a few years later in 1971.

More recently, J&J has undertaken one of the biggest changes in its firm structure since its establishment. Historically, the firm was made up of three business segments: Consumer Health, Medical Devices and Pharmaceuticals with the last two segments working together in developing new drugs and vaccines such as the single-shot Johnson & Johnson vaccine. In November 2021, the firm announced that it would split into two publicly traded companies: one focusing on consumer health, and the other housing its pharmaceuticals and medical-device businesses.

The new consumer products company, which has yet to be named, will own such well-known brands as Band-Aid bandages, Aveeno and Neutrogena skin care products, Tylenol pain relief products, Johnson’s Baby Care products, and Listerine mouthwash, among others, focusing on the over-the-counter goods. Meanwhile, the pharmaceuticals, medical devices, and medical technology company, which will retain the Johnson & Johnson name, will have its one-dose COVID-19 vaccine among its many products, as well as advanced medical technologies such as robotics and artificial intelligence (AI). The split of the firm constitutes a great possibility for the share price of the two different firms to reflect their own individual performance which previously, as a conglomerate, was not possible. This split will undoubtedly highlight the weaker consumer business that was underachieving with respect to medical devices and pharmaceuticals business segment.

In the past 10 years, the consumer business of Johnson & Johnson has been hit with numerous litigations which have caused significant negative financial impact to the firm. J&J’s infamous baby powder has been at the center of many of these litigations: in 2016 the firm was ordered to pay $72mn in damages and again in 2019 was ordered to pay $29mn followed by a a $2.1bn settlement in 2020. The mass-produced talc has faced litigations due to claims regarding its correlation with causing women to develop ovarian cancer. In addition, the firm was also hit with a $5bn lawsuit for its involvement in the opioid epidemic. The firm was found guilty by the US government in creating and supplying, both directly and indirectly over 60% of “all active ingredients for opioid manufacturers.” Furthermore, the settlement’s evidence include details regarding J&J’s active persuasion of consumers, conveying that opioids were actually safe and effective for everyday pain. Despite its legal issues, the firm as a whole has continued to grow, albeit at a subdued pace, with a $14.7bn net earnings in 2020 and $20.9bn in 2021.

About AbioMed

AbioMed is a NASDAQ publicly traded MedTech company specializing in the development of circulatory devices. The firm was founded in 1986 and has grown steadily, the firm currently has $1bn revenue with over 2000 employees and a net income of around $135mn. The firm is one of the leading companies in vascular technology with over 1400 patents.

AbioMed has invested over $850mn in clinical research over the last 5 years, R&D is a key driver in AbioMed’s goals and successes. Their R&D aims at producing effective and safe products, and they have achieved this with their flagship Impella product, obtaining several FDA approvals and using randomized controlled trials (RCT) to analytically and randomly test the safety and reliability of Impella heart pumps.

The “revolutionary Impella heart pump platform”, as described by AbioMed representatives themselves, represents AbioMed’s flagship medical technology, collecting a family of devices which are essential in temporary ventricular support in patients with severe heart functioning problems. The device can, in open heart surgeries simulate and temporarily replace heart movements in pumping blood, providing one of the most innovative and risk-lowering technologies for high risk surgeries. When acquired by AbioMed in 2005, the technology saw a lot of R&D, allowing the introduction of the Impella 2.5, Impella 5.0/LD, Impella CP and Impella RP, all very successful Impella devices. Impella is still being developed to produce even more technologically advanced devices such as Abiomed’s Impella Bridge-to-Recovery, which after testing in 2022 showed incredible results in patient’s cardiovascular activity. The technology is one of the main attraction points for J&J as it adds incredible value to the firm.

The Health Tech industry

Health technology represents an industry focusing on the integration of technology within the healthcare system, in particular, it focuses on developing efficiency, precision and accuracy when replacing less recent medical approaches.

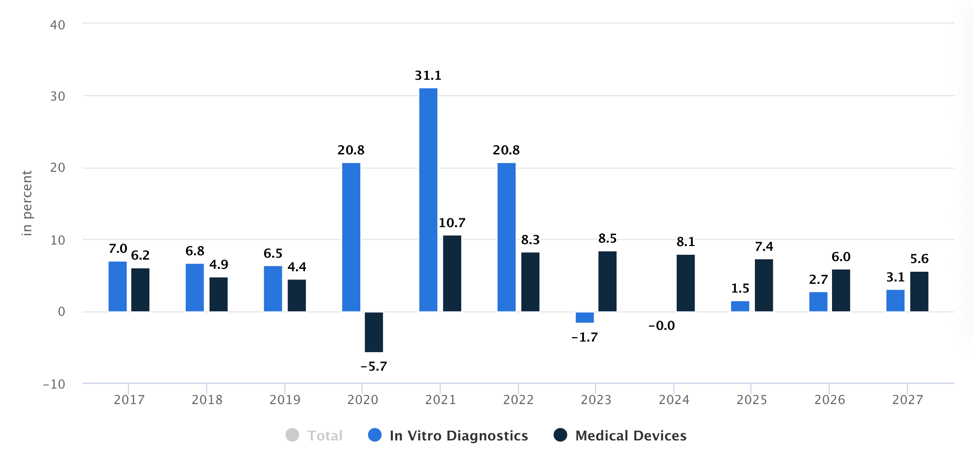

Since the first technological integration within the healthcare industry, represented by Electronic Health Records (EHR), the health-tech industry has grown rapidly to become one of the most competitive industries within the medical field. With the estimated market value of $150bn, holding about 27.3% of the world market the Health Tech Industry is one of the most important industries worldwide. The industry collectively holds 15 different segments with Vitro Diagnostics, represented by tests for diseases and infections, Cardiology, Diagnostic Imaging, Orthopedics and the Medical Device Sector being the key players. The Health tech industry’s projected revenue in 2022 is estimated to be around $575.8bn with the Medical Devices Sector dominating, estimated to be as large as $455.1bn of revenue. The market is also estimated to keep growing by 5.9% over the next 5 years and ultimately achieve revenues of $770bn in 2027. Within the industry J&J represents one of the main competitors holding around 5% of the market. In 2020, the COVID crisis reduced the revenue of the Medical Devices sector by roughly 6% due to the lack of traditional medical procedures carried out given the enormous shift in focus towards COVID-19 medical care. The Covid crisis shifted the focus of the medical world off the development of new, innovative medical devices but rather on Vaccines, Covid Tests and the logistics of delivering existing medical support machines, such as ventilators. During the COVID crisis the attention shifted to the Vitro-Diagnostics sector especially given the increasing demand for COVID tests. Nonetheless, the Medical Devices Sector regained its strength and began steadily growing the following years.

Source: Statista

The key driver of Health Tech industry stable growth is the ageing population, enabling stable and continuous flow of capital into R&D, growing the available health services and enabling the development of existing technologies into more efficient ones. One limitation, however, of the development within the industry is the complex regulation imposed on it. As a result, new technologies and products are more difficult to introduce within the market and this hinders technological innovation and growth of the industry.

Health Tech industry trends include increased demand for wearable technologies. For example, both patients and doctors are finding smart wearable technologies to be useful in constant monitoring. Furthermore, the Health Tech industry contains an additional segment which has been grasping a strong amount of attention and R&D: Artificial Intelligence. AI progress has rapidly accelerated following the operational issues endured by the healthcare sector during the Covid crisis. Moreover, regulatory limitations of the introduction of Medical Devices within the Health Tech sector could be overcome by AI, through more efficient data analysis on behavior and patterns of machines to assess their safety and effectiveness.

Overall, the Health Tech industry has had a few slower years with the outbreak of the COVID crisis, in particular within its strongest sector: Medical Devices. However, the industry has grown since 2020, with revenue rising from $456bn to $520bn and $575bn during 2022. The Health Tech industry has an expected average YoY growth of about 6.7% for the next 5 years, reaching $769bn by 2027, especially considering the swift growth of digitalization which is helping to develop quicker and more efficient ways to store and share medical data and so helping to spur innovation in the Health Tech industry.

Deal Structure

On the 1st of November 2022, Johnson & Johnson announced it would acquire Abiomed in what is set to be the largest deal of the year in the pharmaceuticals & medical devices industry. The terms of the definitive merger agreement have already been unanimously approved by the board of directors of both firms.

Johnson & Johnson will acquire, through a tender offer made by one of J&J’s wholly owned subsidiaries Merger Sub, all of Abiomed’s outstanding shares for an amount of $380.00 per share, in cash. This gives Abiomed an enterprise value of $16.6bn, which includes cash acquired. The purchase price upon which both firms have agreed represents a premium of approximately 51% to the closing price of Abiomed’s shares on the 31st of October but is barely above the level these shares were at one year ago. Johnson & Johnson expects to fund the transaction through a combination of cash on hand and short-term financing.

Largest medtech deals, by size, in 2020

Source: Ernst & Young Global Limited

Abiomed shareholders will also receive a non-tradeable contingent value right (CVR) entitling the holders of stocks to receive up to $35.00 per share in cash if certain commercial and clinical milestones are achieved. These milestones, as outlined below, mostly depend on the successful approval and marketing of Abiomed’s new flagship heart pump (the smallest ever conceived), called Impella:

$17.50 per share if net sales for Abiomed products exceeds $3.7 billion during Johnson & Johnson’s fiscal second quarter of 2027 through first fiscal quarter of 2028, or if this threshold is not met during this period and is subsequently met during any rolling four quarter period up to the end of Johnson & Johnson’s fiscal first quarter of 2029, $8.75 per share;

$7.50 per share payable upon FDA premarket application approval of the use of Impella products in STEMI patients without cardiogenic shock by January 1, 2028;

$10.00 per share payable upon the first publication of a Class I recommendation for the use of Impella products in high-risk PCI or STEMI with or without cardiogenic shock within four years from their respective clinical endpoint publication dates, but in all cases no later than December 31, 2029.

The transaction is expected to be completed before the end of the first quarter of 2023 and is conditioned on the tender of a majority of the outstanding shares of Abiomed’s common stock, as well as the green light from regulators and antitrust authorities. Johnson & Johnson is not anticipating any regulatory issues given the limited overlaps with its existing cardiovascular products. It also expects the transaction to be slightly dilutive or neutral to adjusted earnings per share in the first year, considering the impact of financing, and then accretive by approximately $0.05 in 2024, and increasingly accretive thereafter.

Assuming the closing of the tender offer, Johnson & Johnson will acquire any shares of Abiomed not tendered into the tender offer through a merger of Merger Sub (J&J’s wholly owned subsidiary making the offer) with Abiomed for the same per share consideration.

More than 70% of J&J’s shares are in the hands of institutional investors, amongst which the largest are investment funds such as the Vanguard Group (8.88%), State Street Global Advisors (5.40%), and BlackRock (5.01%). These three are also amongst Abiomed’s largest shareholders: the Vanguard Group (10.55%), Baillie Gifford & Co (7.97%), BlackRock (5.81%), and State Street Global Advisors (4.59%).

Abiomed’s net profit margin as of September 30 was 24.84%, which stands right in the middle of the net profit margin range (20%-30%) of large medical device companies, and 5 percentage points higher than J&J’s. Noticeably, Abiomed holds no debt and has been profitable for the last 20 years.

Deal rationale

Both firms expect to greatly profit from the new synergies and opportunities that will arise from the acquisition.

On J&J’s side, the main reasons for the deal, other than synergies, seem to be quickly growing sales thanks to exclusive approvals from healthcare regulators, and entering a new segment of the healthcare market ahead of the expected consumer health spin-off expected by November in 2023.

Abiomed will benefit from J&J’s global presence to drive its sales outside of the USA, while J&J will take over the development and market launch of Abiomed’s products. Indeed, cardiovascular diseases are the no. 1 cause of death in the USA, and J&J’s addition of Abiomed’s breakthrough treatments will enable it to meet one of healthcare’s largest unmet needs, and high-growth market. Amongst these products are the Impella heart pumps (on which most of the previously mentioned non-tradeable contingent value right is conditioned), which have received unique FDA approvals for patients with severe coronary artery diseases requiring high risk percutaneous coronary intervention of treatment of acute myocardial infarction.

J&J is focused on its pharmaceuticals and medical devices operations because of the consumer health spinoff expected by November 2023, which has recently been facing headwinds from the pandemic, the stronger dollar and supply chain issues that have kept its growth in the mid-single-digit percent range. This has led Chief Executive Joaquin Duato to try to build up the medical devices unit through acquisitions, such as that of Abiomed, in order to grow sales. By becoming one of the company’s dozen “priority platforms,” Abiomed will be operated as a stand-alone business and should hit annual sales of at least $1 billion.

On Abiomed’s side, shareholders are getting an immediate large payoff (premium of 51%), by passing on the risk of new product launches to J&J shareholders (thanks to the CVR previously detailed, they can only gain if Impella’s launch is successful). J&J’s means and commercial strength will be strongly leveraged to launch the Impella heart pumps and increase the chances of a successful launch. Value will be created for patients, the firm, and its shareholders.

Market Reaction

After Johnson & Johnson [NYSE:JNJ] announced its acquisition of Abiomed [NASDAQ:ABMD] on the 1st of November, its shares closed at $173.09, slipping 0.5% from the previous day. On the other hand, Abiomed’s market capitalization grew by $5bn as investors promptly bought Abiomed stock, which rose by 49.88% and closed at $377.82, just below the $380.00 J&J has agreed to pay. For the past week, Abiomed’s stock has been hovering at this level.

From this, we can infer that Johnson & Johnson shareholders don’t seem convinced yet by the potential benefits of the merger. But over the last few days, the sentiment of analysts has become positive, as they recognized J&J to be the perfect medium to drive sales of Abiomed’s products outside the US market.

On the other hand, the fact that Abiomed shareholders are now willing to pay almost $380.00 for the shares translates their confidence about the deal going through: they’re willing to take the risk until the first quarter of 2023, which is when the deal is expected to close. In fact, Johnson & Johnson executives have said, in a press conference, that they are not anticipating any regulatory issues given the limited overlaps with its existing cardiovascular products.

The announcement of the acquisition came the same day as Abiomed’s quarterly results, so it’s important to look at them too. The Massachusetts-based company posted profits of $106.1 million for the third quarter. Sales of $265.9m missed Wall Street’s expectations by $7.6m, but earnings per share of $1.30 topped expectations by $0.26, and Abiomed hence recorded an 86.4% bottom-line gain on year-over-year sales growth of 7.2%. The company also said it saw impacts on procedural volumes in July due to extended physician vacations. That, paired with ongoing hospital labor shortages, affected sales.

Deal advisors

J.P. Morgan Securities LLC is serving as financial advisor to Johnson & Johnson and Cravath, Swaine & Moore LLP is serving as legal advisor.

Goldman Sachs & Co. LLC is serving as financial advisor to Abiomed, and Sullivan & Cromwell LLP is serving as legal advisor.

0 Comments