Introduction

The term “Liability Driven Investment”, also known as LDI, covers investment policies with the goal of covering current and future liabilities of the investor. As such, it is not a benchmark-driven investment strategy since it does not need to outperform any benchmark, but rather only needs to cover all liabilities.

While individuals can also use liability driven investment strategies, for example to achieve a return that is large enough to withdraw a certain amount of capital periodically, pension funds are the most important institutions employing LDI strategies. In fact, over $30tn in capital is tied up in pension funds globally with the most important markets being the US (ca. $20tn) and the UK (ca. $3tn). This makes pension funds an important player in the market but also means the capital of many private clients is tied up in these vehicles, posing potentially a substantial economic risk. In this article, we will dive deeper into what characterizes pension funds, which risks they face, what led to the recent turmoil in pension funds in the UK and how pension funds and LDI move different financial markets.

Pension Funds and LDI

Pension funds generally operate under one of two different mandates: either they are funds for defined benefit (DB) pension plans, or they are funds for defined contribution pension plans (DC). With the former type, the beneficiary of the pension plan (the employee) gets paid out a predefined amount of money which is most often based on the salary and length of employment at a company. DC pension plans however do not have a fixed payout structure, rather only the contribution of the employer and employees are defined, with the amount being paid out depending on the amount contributed and the performance of the fund. While few new DB pension plans are set up, most currently active pension plans (especially those of government employees) in both the UK and US are DB pension plans.

Furthermore, one should make the distinction between funded and unfunded DB pension plans. As the name suggests, unfunded pension plans do not set aside funds for investing but rather pay out the pension liabilities using contributions by employers and employees (and taxes for government sponsored plans). This system is also known as pay-as-you-go or PAYGO financing and is often employed by governments. Conversely, funded plans invest their contributions in the financial markets to cover future payments. Obviously, funded plans are those that directly impact markets; however, both types of funding expose the pension plans to different types of risks which will be covered in the next section.

About 75% of assets controlled by pension funds are allocated to either equities or fixed income, with regional differences in the exact allocation. In 2020, pension funds in the UK allocated roughly 25% of their assets to equities and 40% to fixed income while US funds have about 30% in equities, 20% in fixed income and another 25% of assets in other mutual funds which mainly invest in these two asset classes.

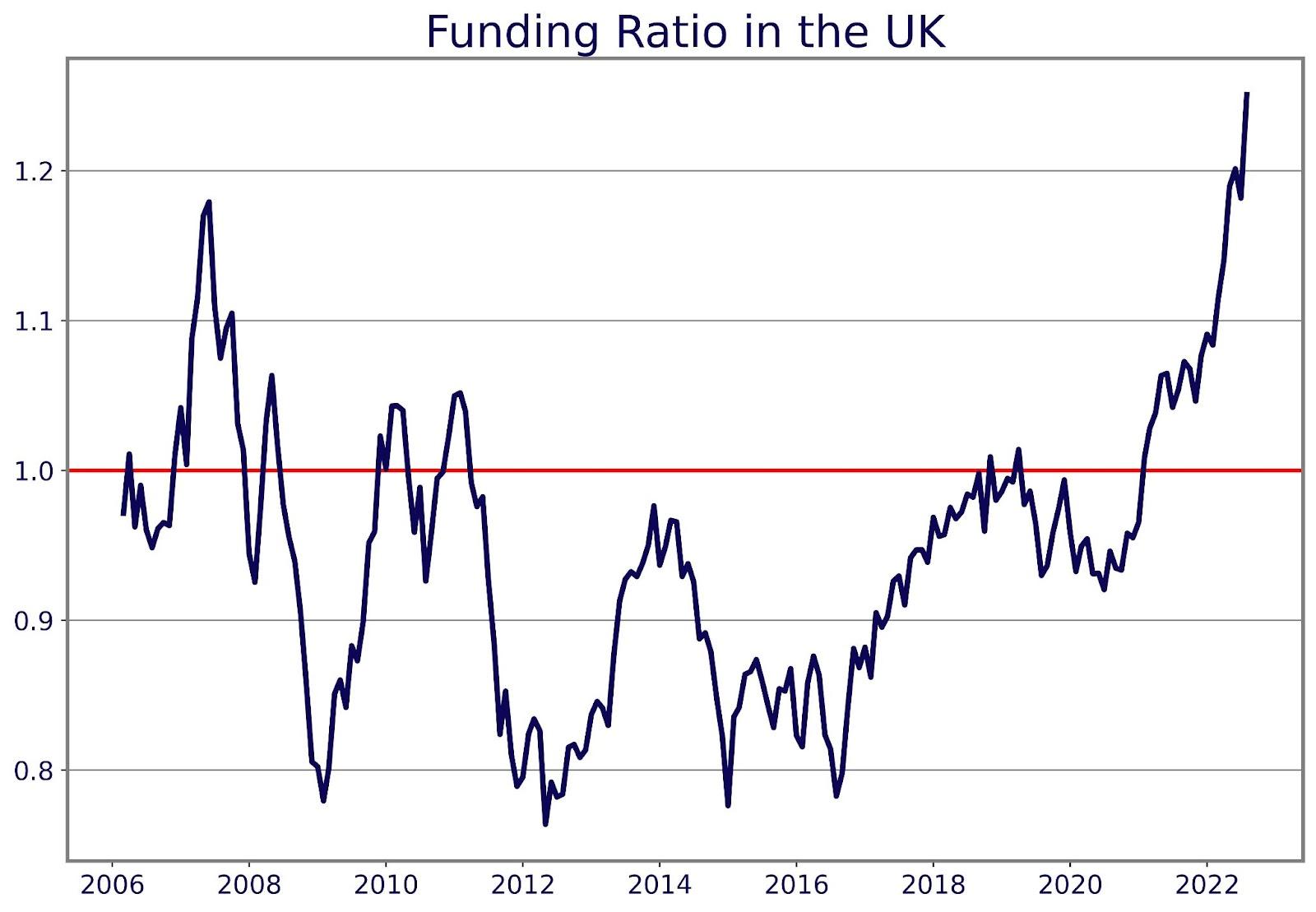

Another important aspect of pension funds is their funding ratio, defined as ![]()

In general, this ratio should not drop below 1, which would mean that the assets currently held by the pension fund are not enough to cover all future liabilities at current market rates. Below, you can see the evolution of the estimated funding ratio for UK pension funds.

Source: Pension Protection Fund (202)

As previously alluded to, DB pension funds are a prime example of LDI. While in the past most pension funds have primarily focused on generating adequate returns on their assets, they have now shifted mostly towards an LDI approach. This approach seeks to match the value of its futures liabilities with the expected returns of their assets by increasing the certainty with which the investment goals of the pension scheme will be met, thereby focusing more on the changes in value of liabilities and their implications. This reduction of uncertainty is mostly accomplished by increasing the funding level and reducing the risk exposure of funds. Therefore, we will now look at the typical risks a pension fund faces.

Risks to Pension Funds

As with other funds, there are a multitude of risks associated with investments of pension funds. Since the 2000s, the risk exposure of pension funds has changed significantly by an increased focus on LDI but also because of stricter regulation.

The most obvious risk for pension funds is of course market risk, i.e. the risk that the investments do not perform as anticipated. Some practitioners and scholars have argued that pension funds do not face this type of risk since their investment-horizon is long enough that short-term fluctuations in the market do not impact the ability to cover all liabilities at any given point in time. Consequently, many pension funds had a high equity exposure due to higher expected returns.

However, this view was challenged at the start of the millennium when drawdowns in the stock market had created funding deficits for some pension funds, i.e. a funding ratio of less than 1. Fund managers acknowledged this risk and consequently changed their asset allocation to investment vehicles with more predictable cash flows. Meanwhile, legislators also reacted with an increase in regulation of pension funds. Many governments required the sponsoring companies of pension funds to use mark-to-market accounting for the pension plans on their balance sheet and increased minimum funding requirements of pension funds. Both qualitative and quantitative studies ([1] and [2]) have attributed a decrease in the risk-profile of pension funds to these changes in regulation. In particular, the exposure to high-yield bonds, mortgages and equities was reduced following the introduction of these regulations while exposure to investment grade and government bonds as well as other investment vehicles with fixed pay outs has increased.

Though these regulations did reduce market risk pension funds were exposed to, there are some adverse effects. Firstly, while mark-to-market accounting has made fund managers more wary of the downside risks of their investments, it has also shortened their investment horizon due to the higher frequency with which financial statements are published. This could have a negative impact on overall performance. Secondly, the shift towards a higher allocation of funds to fixed income instruments has exposed pension funds to much greater interest rate risk which has contributed to the recent turmoil in UK pension funds.

Lastly, pension funds face the risk of being underfunded, i.e. of not having enough funds to pay out all benefits to the beneficiaries. For both funded and unfunded pension funds, this is partly driven by a higher life expectancy, meaning pensions will need to be paid out for more people for a longer time which is also called longevity risk. Furthermore, unfunded pension plans run the risk of not collecting enough contributions to pay all liabilities. Funded DB pension funds face other risks as well: firstly, the shift towards more conservative investment portfolios may mean that pension funds do not make sufficient returns and secondly, many pension schemes are indexed for inflation, so a prolonged period of high inflation necessitates higher overall nominal returns.

As previously stated, pension funds operating under an LDI approach seek to reduce risk by increasing the certainty of the payoff of their investments and by increasing the level of funding. To achieve both goals simultaneously, funds need to increase the value of their assets faster than liabilities rise while also hedging the value of their assets. To do so, pension funds have shifted a considerable amount of capital into different derivatives, most importantly interest rate swaps. In these swap agreements, the pension fund usually receives the fixed rate and pays the floating rate to ensure a bond-like fixed payout, meaning pension funds benefit if interest rates fall. Another benefit of swaps is that they are only partially funded meaning pension funds can also invest their assets elsewhere; however, such swap agreements ultimately lead to the recent disturbances in UK pension funds.

Turmoil in the UK

Over the past years, UK DB pension funds have built up large leveraged positions in interest rate swaps, receiving the fixed rate and paying the floating rate of the swap and as such, had bet on interest rates and bond yields to stay low or decrease. Even though yields have risen substantially over the past year, pension funds have also benefited by higher discounting rates being applied to future liabilities, which explains the sharp rise in the funding ratio.

The real problem for pension funds arose after the sharp rise in gilt yields, which were caused by the announcement of the so-called “mini-budget” by newly appointed Chancellor of the Exchequer Kwasi Kwarteng. This budget called for tax cuts which would require increased government borrowing to finance them, increasing the supply of government bonds, therefore lowering prices, and increasing interest rates. Furthermore, the budget was seen as adding inflationary pressure to an economy which was already experiencing all-time high inflation rates of about 10% which further increased yields.

This rise in yields started triggering margin calls on the swap agreements that pension funds had entered into since their value had dropped significantly in a short span of time. In order to increase the balance of their margin accounts, pension funds started selling liquid assets including mortgages, IG credit, and, most importantly, Gilts which only exacerbated the rise in yields. This meant that 30Y Gilts had reached levels of over 5%.

Two days after the budget was announced, the situation became so dire for pension funds that the Bank of England had to step in and start buying up to £65bn in government bonds over a 13-day period to “restore orderly market conditions”. This calmed markets again, meaning 30Y Gilt yields dropped by about 1pp. Had the BoE not intervened, it reckons pension funds would have had to sell off £50bn in government bonds which could have triggered a financial crisis in the UK.

The Impact of Pension Funds on Financial Markets

In light of the recent events in the Gilts market, we think it is important to analyze the impact of pension funds on financial markets in a broader setting. Theoretical and empirical research in financial economics in the past two decades has highlighted many circumstances in which pension funds can and have become the main driver of prices in segments of financial markets, across different asset classes. In this part, we review 1. the case of the shape of the sovereign yield curve, 2. long-dated swap spreads, 3. equity market volatility, and 4. equity financing.

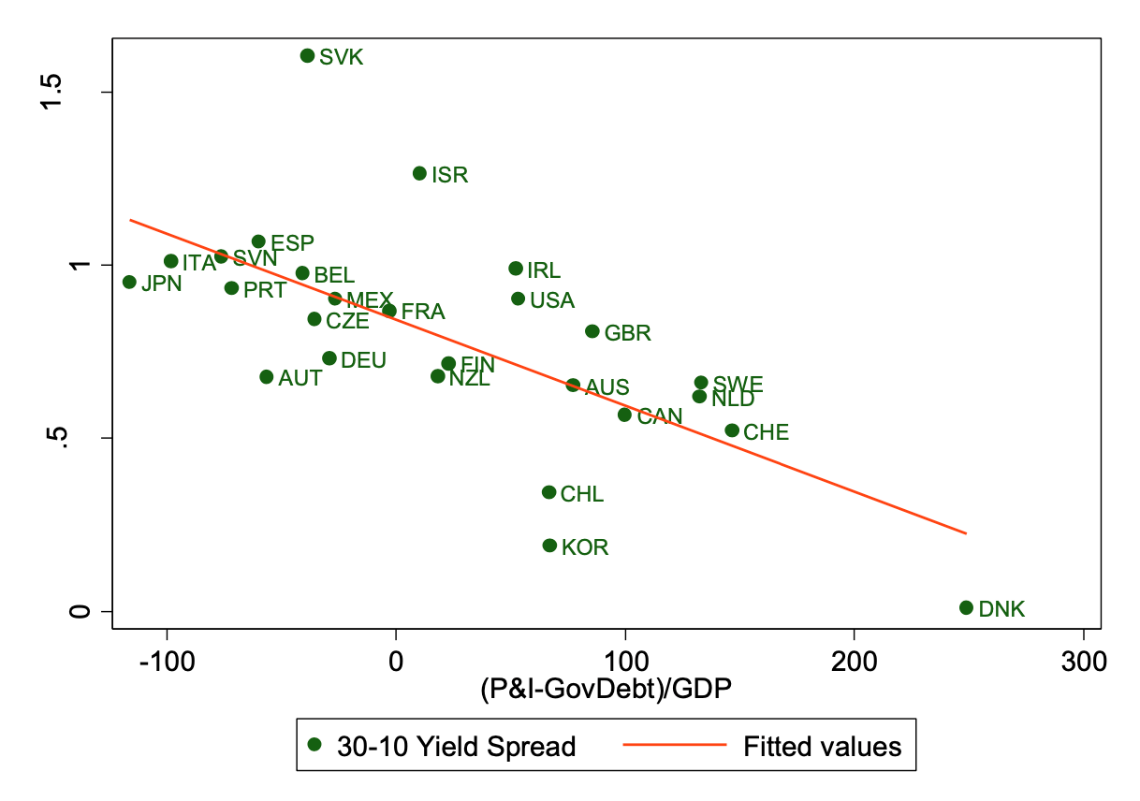

- Reshaping the curve

Greenwood and Vissing-Jorgensen (2018) go as far as to talk about a “global phenomenon of pension and insurance demand driving the long end of the yield curve”. The choice of words hardly overstates their findings. Using data from 26 countries, they find that the 10s30s curve (i.e., the spread between 30-year and 10-year government bond yields) correlates negatively with the ratio of pension funds’ assets to GDP.

Source: Greenwood and Vissing-Jorgensen (2018)

This indicates that LDI has an impact on asset prices. To rule out that 10s30s curve flatness is caused by factors unrelated to pension fund investments, the authors conduct six event studies aimed at identifying causality. These event studies exploit exogenous (i.e., regulatory) changes in the discount rate (imposed by regulators) that pension funds need to use to value their liabilities. The event studies corroborate the hypothesis of a direct channel between pension fund liabilities and the back end of the sovereign curve of the same country. The authors explain this relation as a form of tracking error minimization: since regulation imposes a discount curve based on the country’s yield curve, then holding sovereign bonds of the fund’s country hedges the fund against changes in value of its future liabilities, in an LDI fashion.

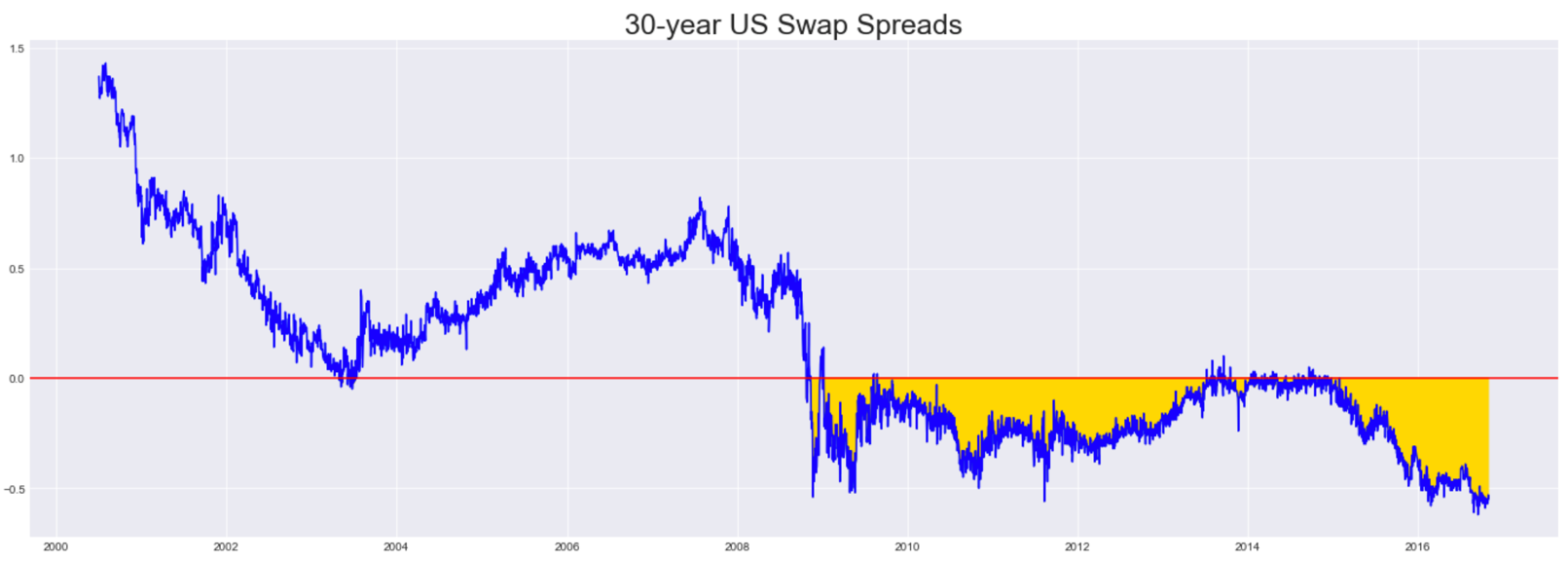

- Negative Swap Spreads

Probably the most puzzling impact of pension funds on asset prices is the case of negative swap spreads. Klingler and Sundaresan (2018) show that demand for long-dated swaps by underfunded US pension fund can explain negative swap spreads in the US. Swap spreads are the difference between a swap rate and a US Treasury of the same tenor. For precision, analysis on these spreads is done on matched-maturity swaps and Treasuries (the two instruments mature together).

Source: Bocconi Students Investment Club

Negative swap spreads were long thought to represent an arbitrage opportunity and an asset pricing anomaly. In fact, an investor able to keep up with margin on the swap position and to stay in the trade until maturity could theoretically earn pure carry yield by paying the fixed rate on the swap (hence, receiving the floating rate) and being long a matched-maturity Treasury. If interest rate risk were the only risk factor to which the traded is exposed, this would indeed represent an arbitrage.

Not so fast! The implementation of such an arbitrage strategy for a capital-constrained investor (i.e., for any intents and purposes, any investor) would require the ability to roll over repo agreements for a very long time to finance the long position in the Treasury security (which is otherwise too expensive to obtain outright). That is obviously impractical, not to mention, it adds multiple risk exposures. Hence the limits to arbitrage.

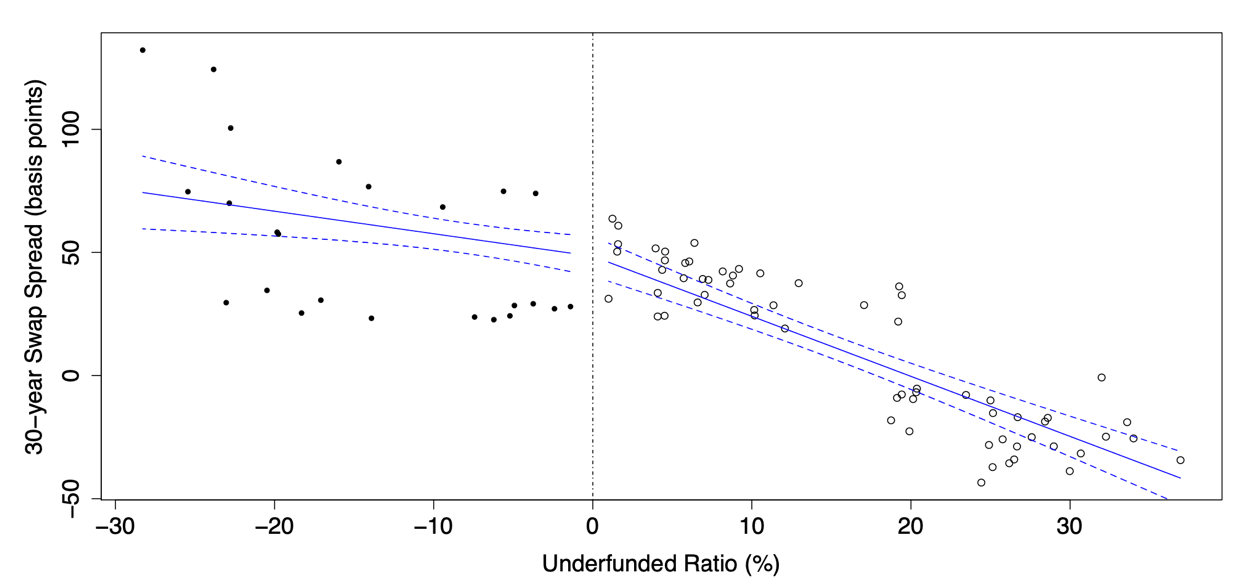

Klingler and Sundaresan (2018) develop a model where underfunded defined-benefit schemes hedge the duration of their liabilities by going fixed receiver on interest rate swaps rather than buying Treasury securities, since the former strategy requires no initial cash outflow and requires only modest investment to cover margins. They define an “underfunded ratio” (UFR) as

where the “DB claims on Sponsor” represent the difference between the fund’s liabilities and its assets.

Source: Klingler and Sundaresan (2018)

Even after controlling for common factors used in the literature to explain/forecast swap spreads (such as Libor-repo spread, Debt-to-GDP ratio, dealer balance sheet constraints, volatility, and level as well as the slope of the yield curve), the authors find that UFR is a significant regressor in explaining 30-year swap spreads.

- Equities and Equity Volatility

The aging population in countries such as Japan and regions such as Europe provide for natural case studies based on the increase of pension fund investments. Using panel data econometrics, Alda (2017) finds that higher pension fund investment in equities positively influences stock market development. With a similar modeling design, using a panel of 34 OECD countries from 2000 to 2010, Thomas (2013) reveals that when pension funds increase their investments in stocks, the volatility of stock prices drops significantly, a result previously found in emerging markets by Walker and Lefort (2002).

- Equity Financing

The instances described above concern the impact of LDI and pension funds in general on financial markets. These institutions also have an important impact on the capital raising of companies, as clearly explained by Scharfstein (2018). The author divides countries into pay-as-you-go systems, where pensions are financed mainly through taxes on current workers, and private saving systems, where individuals use defined-benefit schemes and allocate a percentage of their income to their pension. In countries with pay-as-you-go systems, Scharfstein (2018) finds that “companies are more likely to be funded with bank loans”, and that firms in countries adopting that system are smaller, because “banks are less willing to fund risky growth strategies, and a larger fraction of company shares are held by corporate insiders, consistent with there being less demand for shares from pension funds”.

The points made in Scharfstein (2018) indicate that pension systems and pension funds have a much broader impact than just on asset prices. They can have an impact on the capital structure of companies in the country, or at least on the ability of those companies to finance themselves through equity capital.

A Final Note: Preferred Habitat Theory

All the evidence presented above indicates that the impact of pension funds on segments of financial markets is too significant to be ignored. The main implication of the data is that accounting for the type of participants in certain segments of markets leads to superior modeling performance, at least in terms of explanatory power.

Academic research has taken notice of this results with the Preferred Habitat Theory (henceforth PHT) of the yield curve, originally proposed by Culbertson (1957) and Modigliani and Sutch (1966) and most recently formalized by Vayanos and Vila (2021). As the authors put it: “According to that view, there are investor clienteles for specific maturity segments, and the interest rate for a given maturity is mainly driven by shocks affecting the demand of the corresponding clientele. The term structure thus exhibits a degree of segmentation.”

As Greenwood and Vayanos (2014) show, an implication of PHT is a positive relation between yields and the relative supply of longer-term debt. At least from an academic standpoint, this is quite significant, as it represents a robust rebuttal of consumption-based theory of the interest rate determination which assume Ricardian equivalence. According to this theory, “the consumption of the representative agent, and hence interest rates, depends on government spending but not on how spending is financed” (see Greenwood and Vayanos (2014)). The data suggest otherwise, and PHT steps in to provide a more realistic formalization of yield curve dynamics.

PHT has the additional advantage of clarifying misconceptions arising from the expectation hypothesis (EH), a long-rejected theory of the yield curve. According to different versions of the EH, term premia are either nonexistent or constant, implying that long-term yields represent pure expectations of future short-term rates, at most with the addition of a constant term premium. EH then implies that if the term structure of interest rates is upward sloping, investors are expecting rates to go up in the future. PHT rejects that conclusion and argues that, because term premia are not constant, an upward sloping term structure can simply be the result of increasing risk aversion, which makes sense of the fact that investors require higher returns for longer term investments.

References

[1] Lubochinsky, C., “Interest rate risk management by life insurance companies and pension funds”, 2005, Financial Stability Review

[2] Franzen, D., “Managing Investment Risk in Defined Benefit Pension Funds”, 2010, OECD

[3] Greenwood, R. M., Vissing-Jorgensen, A., “The Impact of Pensions and Insurance on Global Yield Curves,”, 2019, Swiss Finance Institute Research Paper Series 19-59, Swiss Finance Institute

[4] Mercedes, A., “The relationship between pension funds and the stock market: Does the aging population of Europe affect it?”, 2017, International Review of Financial Analysis, Elsevier, vol. 49(C)

[5] Scharfstein, D. S., “Presidential Address: Pension Policy and the Financial System”, 2018, Journal of Finance, American Finance Association, vol. 73(4)

[6] Thomas, A., “Pension Funds and Stock Market Volatility: An Empirical Analysis of OECD Countries”, 2013, Discussion Papers del Dipartimento di Economia e Management – Università di Pisa, n. 162

[7] Klingler, S., Sundaresan, S., “An Explanation of Negative Swap Spreads: Demand for Duration from Underfunded Pension Plans”, 2018, BIS Working Paper No. 705

[8] Vayanos, D., Vila, J.-L., “A Preferred-Habitat Model of the Term Structure of Interest Rates”, 2021, Econometrica, n. 89

[9] Greenwood, R., Vayanos, D., “Bond Supply and Excess Bond Returns”, 2014, Review of Financial Studies, vol. 27(3)

[10] Culberston, J., “The Term Structure of Interest Rates”, 1957, The Quarterly Journal of Economics, vol. 71(4)

[11] Modigliani, F., Sutch, R., “Innovations in Interest Rate Policy”, 1966, The American Economic review, vol. 56(1/2)

0 Comments