In this article we are going to discuss the increasing importance of logistics real estate and the trends that affected the sector in Europe. We will then explain the main drivers of demand and supply for logistic properties and how these are likely to change in the future years. Finally, after having analyzed the pros and cons of a generic investment in logistics, we will suggest a trade that could be feasible for a retail investor.

Definition of Logistics

Industrial and logistics real estate is one of the main asset classes of commercial property. Logistic properties are distribution and storage purpose-built buildings. Indeed, they are a key component of the supply chain of goods for global trade and they are directly connected to production and consumption. For this reason, manufacturing, retail and distribution business activities are the core sectors that demand logistics properties. In particular, logistics are used for business to business distribution, business to retail store distribution, e-commerce fulfilment and manufacturing.

Main drivers of the business – Demand

The main demand drivers of industrial and logistics market are categorized in macroeconomic (cyclical) and in industry-specific (structural) drivers.

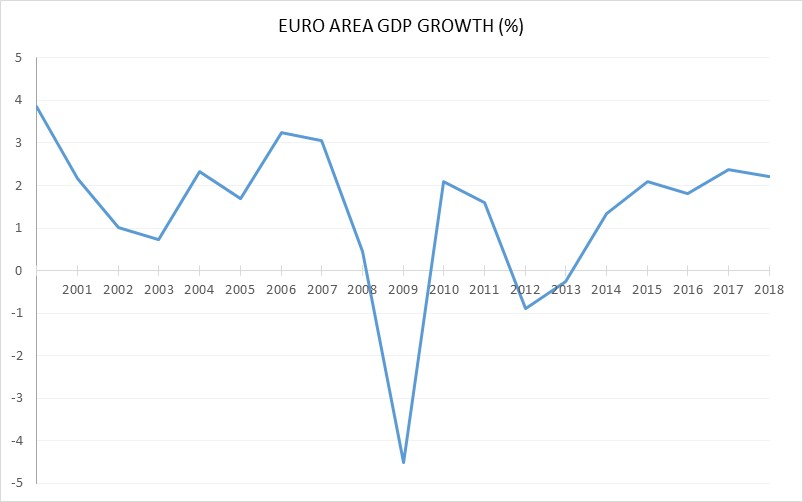

First leading macroeconomic driver is the economic growth measured by GDP, production and manufacturing growth. GDP tends to be highly correlated with demand for industrial real estate, even during non-optimal economic conditions. The Euro Area GDP growth rate in 2017 was 2.37% and it is expected to be 2.2% in 2018.

Source: World Bank

Second indicator is consumption, which is connected to population growth and urbanization, retail sales and emergence of middle class. Consumption accounted for about 57.7% of GDP in the Euro Area in 2017, making it the largest component. The changing nature of consumption is the primary underpinning of positive performance and the most prominent force shaping future demand. Finally, trade is the last leading macroeconomic indicator, which is a traditional demand driver for logistics sector. Eurozone has become over time the main player in terms of world trading volume. Moreover, five countries of European area (Germany, The Netherlands, France, Italy and UK) are among the world largest exporter and importers.

If we look at industrial specific drivers they are: globalization, technological innovations, retail consolidation, infrastructure investments, outsourcing of logistics activities with third parties and evolution of online retail.

Especially the advancements of new technologies have an enormous impact on transforming the logistics industry. It leads to more transparency in the supply chain and acceleration of goods flow. For these reasons, many companies implemented new technologies in their logistics networks. Another driver is the increasing investments in new infrastructure transportation, in order to boost international trade growth and improve supply chain in the country. This eventually is supportive for the demand. In particular, the value of a logistics asset is driven by its geographical location and in particular by its proximity to common trade routes (i.e. highways, railway, ports and airport) and industrial areas. Indeed, new infrastructure investments in a given area would increase the local demand for logistics.

The reconfiguration of supply chains also represents a source of replacement demand and encourages a move from multiple and smaller properties into larger and more efficient warehouses, in order to create efficiency and cut costs. Moreover, also the trend in using third parties’ logistics (outsourcing), which are cheaper solutions and allows for more flexibility, is considered as a driver of logistics demands. Finally, the recent strong driver for logistics demand is the increasing popularity of online shopping in Europe. It especially boosted the demand for efficient logistics services for the shipment of products.

Main drivers of the business – Supply

From the supply point of view, given the logistics market being really heterogeneous, it is more difficult to notify the size of the supply. Traditionally, port-oriented logistics activities and population density are the key factors in shaping logistics clusters.

In Europe the logistics market can be segmented into four different regions based on logistics market size, openness of the economy and forecasted five-year GDP growth:

- Large transportation countries with a domestic focus – where countries have a high population with a domestic based economy. This means the distribution center only serves the local and domestic markets – UK, Spain and France.

- Traditional Gateways with a European Focus – countries which benefit from their geographical position in Europe thanks to the presence of large seaports, have good hinterland links and good proximity to a large consumer base. In other words, they have large presence of European distribution centers – Belgium, Germany and The Netherlands.

- Regional Markets with Open Economies – countries with large export shares, but small market size, with distribution centers serving mainly region and local market – Czech Republic, Slovakia and Sweden.

- New Logistics Market with Strong Prospects – countries with large consumer base and central position between Easter and Western Europe benefits from new infrastructural development, manufacturing and consumer demand – Poland

Market Trends

After having analyzed what are the drivers of supply and demand of the logistic asset class, it is important to understand the trends currently pervading the market and how these will likely impact the desirability of logistics real estate. The three trends that we are going to analyze are the increase in logistics clusters, the exploit in e-commerce and the modernization of the supply chain.

In the recent years, we have seen the rise of logistic real estate clusters – agglomerations of distribution centers that are concentrated in a particular geographic region – which are driven by two principal factors: the growth of the middle class – driven by population, employment and wage growth – and geographic positioning along global trade routes. For example, regions that contain significant seaports or airports, or that are home to concentrations of particular industries, can require significant real estate clusters. Furthermore, the size of logistics clusters depends on physical infrastructure to properly operate and grow such as adequate roadways and proximity to highway interchanges, access to rail intermodals, seaports and airports.

The exploit in e-commerce (14% increase in Europe in 2017 and expected double-digit growth in 2018) has been the main cause of logistics price increase. Indeed, retailers are progressively losing market share in favor of the big e-commerce players whose main objective is providing the quickest and cheapest delivery. In order to succeed in this goal, the main e-commerce players have started to rethink the circulation of products from the factory to the consumer with new business models which involve a better management of inventory and the acquisition of new deposits in strategic areas. Their efforts are spurring the construction of logistics real estate in key areas, closer to large concentrations of consumers or to vital distribution nodes.

The modernization of the supply chain and in particular the rise of new information and communication technologies, has led to more transparency in the supply chain and an acceleration of goods flow. The increasing efficiency and technology is necessary especially given that the globalization of supply chains has led to longer distances between production and consumption markets. As a result, many companies have implemented extensive technologies to ensure effective supply chain management, greater flexibility and agility into their logistics network which has enabled them to expand sales with a smaller inventory. In this modernization, it is also worth to mention the higher cost efficiency in transportation costs driven by the introduction of hybrid vehicles and other alternative transportation methods. This caused an increase in margins which are likely to be partly transferred through higher rent payments in logistics assets given their key role in this cost optimization process.

Pros and Cons of Investing in Logistics – Pros

Among the many positive aspects of investing in logistics it is necessary to mention:

- High risk-return profile: Investment in logistics offers very stable rents especially due to the usually longer lease terms, lower than average vacancy rate (i.e. JLL’s estimated aggregate European vacancy rate fell back below 5% during Q2 2018). Furthermore, the forecasted positive delta between demand and supply will likely result in a future capital gain upon sale that will furtherly spur returns

- Lower price per square meter per asset: each individual industrial asset is relatively inexpensive – from both a purchase and a development standpoint – investments are well spread, making it an ideal sector for diversification in a portfolio.

- Standard lease terms: such as longer lease periods, fixed rent increases and low maintenance costs. Accordingly, most industrial leases include fixed annual rent increases, linked to the CPI that reduces inflation risk.

- Lower correlation with market: Logistics, and real estate market in general, presents a lower correlation with the stock market, property that is particularly appealing when facing the end of the growing cycle.

Pros and Cons of Investing in Logistics – Cons

- Risk of change of trade routes: A logistic real estate may lose big part of its value following a change in trade routes that may reduce its strategic appeal. This risk may be reduced by diversifying the geographical composition of the portfolio

- High link to GDP: The logistic environment is structurally driven by GDP and economic growth and we are currently at the end of the cycle which may have a negative impact on returns.

Investment Idea

In order to profit from this scenario, we can take exposure to real estate assets using REITs, that have a focus on logistics investments.

Real estate investment trust, or REIT is an investment vehicle that pools money from investors to buy real estate assets and collects rents, which are then distributed to investors in form of dividends. It can specialize in a specific sector or simply invest in a diversified portfolio. Moreover, they are traded as stocks, but they give exposure to different asset class, which is real estate. In addition, REITs tends to have lower beta, since the underlying return are driven by the real estate market cycle and not business cycle; providing some diversification benefit.

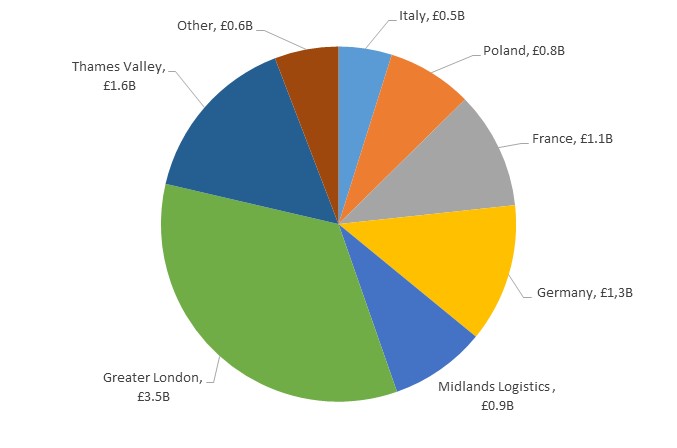

A REIT that fits our purpose is SEGRO plc, which is a UK REIT. It has £10.2B in asset under management invested in the UK and nine Continental Europe Countries. The portfolio is invested in Big Box warehouse (41%), Urban warehouse (55%) and the remaining value (4%) is invested in warehouse or lands which usually becomes a small part of a larger urban warehouse estate. The geographical composition of the investments can be seen in the graph below.

Source: Segro plc Investor Presentation

The selected REIT has strong exposure to logistics and main European geographical areas that are expected to continue to growth.

There is a favorable environment, where there is an increasing change in consumer behavior towards e-commerce and convenience shopping, which force retailer to reshape their supply chain. This can boost demand for urban warehouses. Moreover, it is expected steady economic growth in the major European markets the company is exposed to, which is important since it is one of the main drivers of demand for warehouses.

It must be added that the selected REIT has exposure to the UK market which can represent uncertainty in terms of political risks related to Brexit. However, in terms of real estate demand and supply it is in a favorable condition given the shortage in supply in UK.

0 Comments