Introduction

On September 28, 2021, Blue Prism, a British enterprise software company that specializes in software robots that automate monotonous jobs, announced that it has reached an agreement with private equity firm Vista Equity Partners to be acquired for £1.1bn ($1.5bn) in cash. Blue Prism, whose clients include Daimler, eBay, and the NHS in the United Kingdom, said it intends to propose that shareholders approve the offer published on Tuesday, calling the terms “fair and reasonable.” The company already announced on August 31, 2021, that it was in discussions with TPG Capital and Vista Equity Partners over a potential takeover.

Vista will pay each shareholder £11.25 per share, a 35% premium over the business’s last closing price before the announcement of £8.32. It’s the latest in a long line of private equity investments in publicly traded software firms. Vista plans to integrate Blue Prism with Tibco, the Silicon Valley-based data analytics business it took private for $4.3bn in 2014. In addition to the Blue Prism acquisition, Vista announced that it “intends to explore the prospective sale of all or a portion of its equity interest” in the combined company, which “may happen within the next 12 months.” It is the most recent overseas acquisition of a London-listed software company this year, following Avast’s $8bn deal with NortonLifeLock. Also, Games developers have been targeted, like the $1.2bn takeover of Codemasters by Electronic Arts and the £919m ongoing acquisition of Sumo Group by Tenant.

About Blue Prism

Blue Prism, founded in 2001, is a multinational enterprise software company based in the UK. It develops Robotic Process Automation (RPA) software to provide businesses with a smart digital workforce. The company was one of the pioneers developing such software. Among the industries in which Blue Prism’s software has been implemented are banking and insurance, consumer packaged goods, legal services, public sector, professional services, healthcare, and utilities. Its RPA software has been purchased by globally leading companies such as Coca-Cola, Pfizer, Prudential, Sony, and Walgreens. Illustrative applications include United Utilities, a UK water provider, that bought Blue Prism’s software in order to improve procedures and increase productivity. The robots monitor water network signals and alarms and automatically notify engineers of any problems. IEG4, a digital transformation company, collaborated with Blue Prism to streamline the processing of benefits claims through more effective data management. Moreover, Fannie Mae, a financial services corporation, employed a Blue Prism RPA platform to automate a review and notification process in its mortgage operations department. Mashreq, another financial institution, collaborated with Blue Prism to automate a variety of processes, including banking, compliance, customer service, and support desk operations. On 18 March 2016, Blue Prism went public by floating on the London Stock Exchange AIM market with a resulting market capitalization of £48.5m.

About Vista Equity Partners

Vista Equity Partners is a private equity and venture capital firm, headquartered in Austin, Texas, specializing in management buyouts, growth and acquisition financings, recapitalizations, restructurings, spinouts, divestitures, unusual situations, and going-private transactions in the middle and large cap market segments. Its key focus sectors include specialty software products, enterprise software, Software-as-a-Service (SaaS), B2B companies, data and technology-enabled business services. It also seeks to invest in technology-enabled businesses with proven and defensible technology that can be used to develop new products, solutions, and services; mature businesses with opportunities to create value by embracing and leveraging technology; and new or existing businesses with proprietary technologies that address specific niche markets. It is looking for opportunities in North America and Europe. Typically, the firm invests between $5m and $1bn in equity into companies with $20m to $500m in sales, and $25m to $5bn in enterprise value.

About Tibco

Tipco is a portfolio company of Vista, headquartered in Palo Alto, California. It offers enterprise data solutions with a focus on real-time communication for business-to-business, business-to-consumer, and business-to-employee data transfers, as well as facilitating communication between otherwise incompatible applications. The company sells middleware, which allows customers to access real-time data from numerous systems while also anticipating their needs. Amazon’s tailored product recommendations and FedEx’s shipment tracking system both use the software. Customers can also receive unique offers based on their surfing patterns according to the software’s feedback. Vista delisted Tibco in September 2014 for $4.3bn. The collaboration was unanimously accepted by TIBCO’s board of directors, who concluded that partnering with Vista would maximize shareholder value, provide flexibility to better serve clients, and assist TIBCO in better executing its strategy and vision.

Industry overview

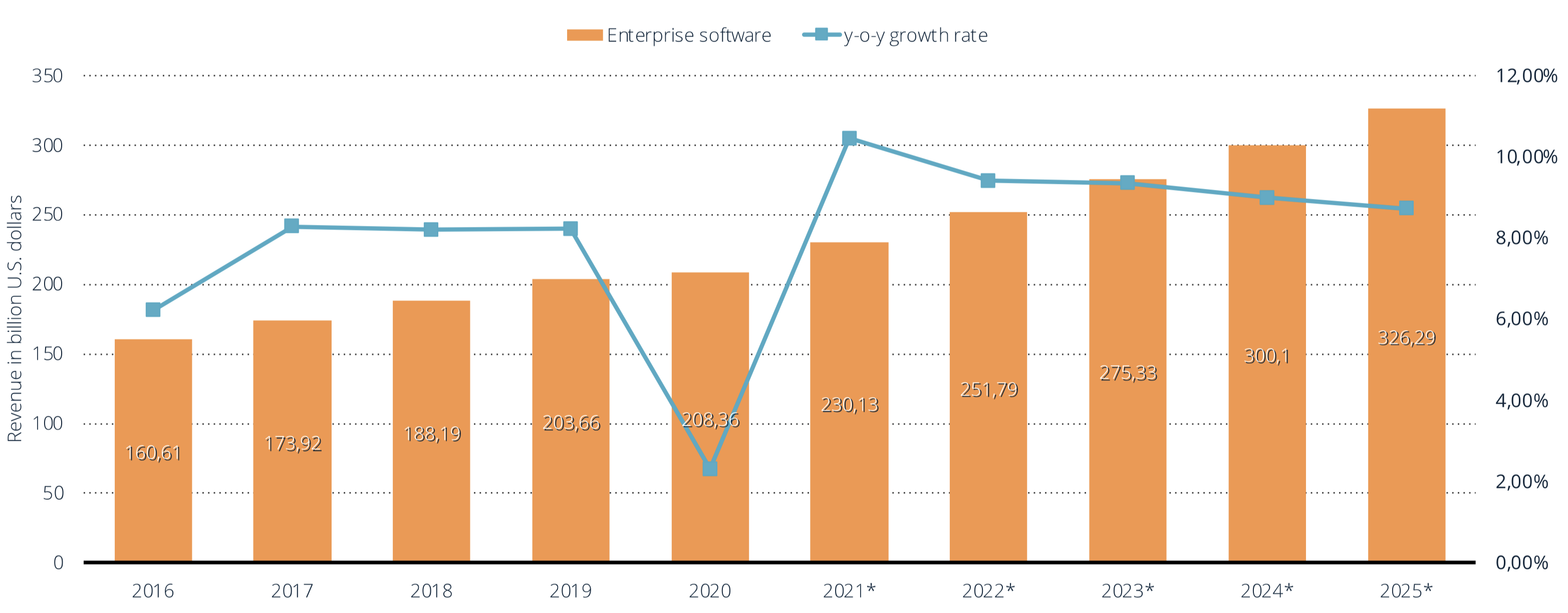

The enterprise software market embraces all revenues generated from sales and subscriptions to several software packages and offerings. Enterprise software aims at fulfilling the necessities of corporations, explicitly addressing the efficiency of their core business processes. The global market has undergone substantial extension over the last decade. This trend is expected to proceed in the upcoming years at a hastened rate. By simply glancing at numbers reported by the sector overall, the global enterprise software market size touched $208.5bn in 2020 in terms of total revenues. Furthermore, estimates for the future exhibit further growth with a CAGR of 11.3% for 2021-2028. With year-on-year expansion constantly near 10%, the enterprise software market is the fastest developing segment in the overarching IT industry.

Source: statista.com

The outbreak of the COVID-19 pandemic had a decisive influence on the business software market. At its eruption, the tech sector as a whole saw general slump due to the uncertainty brought about by the pandemic. Then, the normalization of the work-from-home model due to local and global quarantine regulations has boosted the need for value-added services for diminishing contagion risks. As the pandemic urged institutions to go into home offices speedily, companies relied massively on software solutions to guarantee stable daily services. In turn, the remote-working setup makes companies more exposed to cyber exploitations, which also grants growth to increased spending on security software.

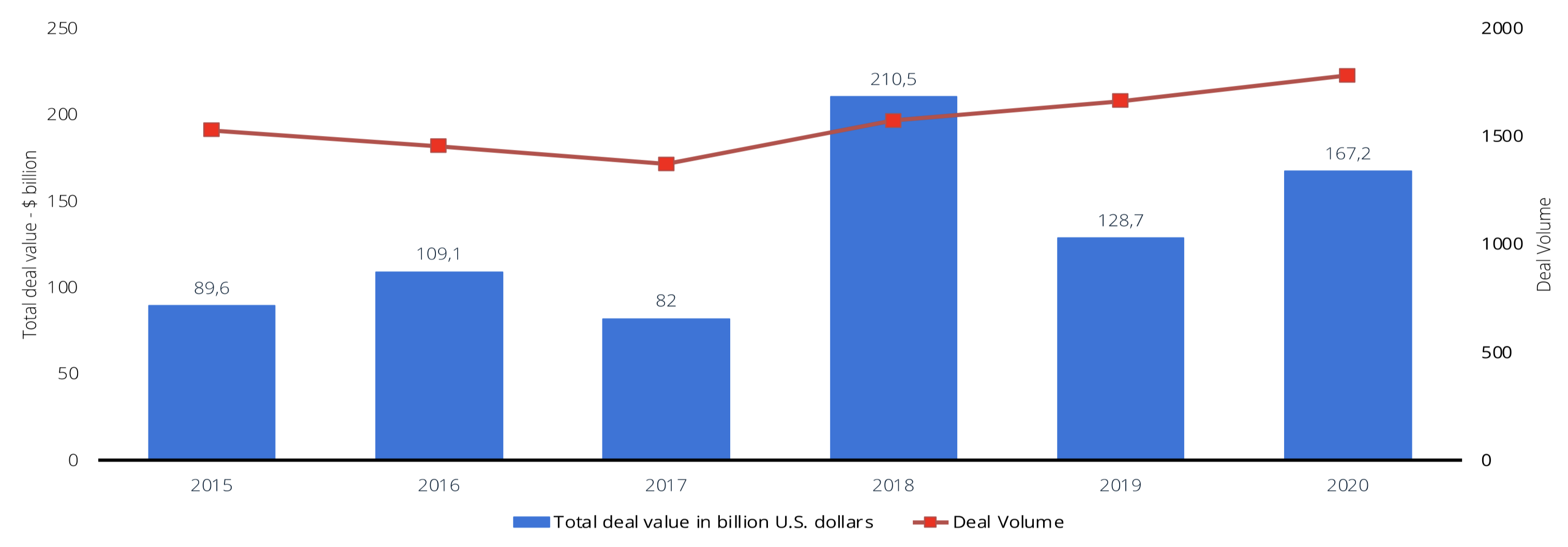

However, it is unexceptionable that M&As are a quintessential fount of growth in the realm of the business software industry. While 2020 was an unusual and unsettling year in several respects, the technology sector and, notably the global software market, remained resilient. At the actual commencement of the COVID-19 pandemic, the global software market observed a decade-low performance. As a result, the pandemic significantly altered the large-cap deal activity in the second quarter of 2020. However, a surge in trust and buyer confidence saw M&A activity pick up, making deal making record highs by the fourth quarter 2020. This restored faith came from accelerating digital transformation trends encouraging a broad-based resurgence in technology spend. The activity was further supported by a peak in the number of special-purpose acquisition companies (SPACs), combined with the continuously sound private capital appetite for software assets. The exceptional return to activity was most evident at the high end of the market. Application software targets worth > $1bn represented 76% of disclosed deal value. They traded at an all-time high median of 8.6x revenue. Notwithstanding these record levels of activity in the fourth quarter of 2020, this activity continued at pace into 2021. Therefore, it is fair to declare that the pandemic accelerated changes that companies envisioned, pulling forward years of development into months.

Source: Global Software Sector Update by Pagemill Partners

Finally, it is also worth analyzing the robotic process automation (RPA) market. It can be described as the business for authorized software platforms to build scripts required to automate repetitive, rule-based, predictable jobs traditionally carried out by humans. In other words, it maps a human task in RPA software language for a software script to follow, with runtime allocated to execute the script by a control dashboard or orchestrator. The RPA market is proliferating, and through 2025, this market will mature and consolidate. However, it is still profoundly fragmented at present, as vendors in adjacent markets are beginning to offer RPA capabilities. UiPath is the global market leader, followed by Automation Anywhere and Blue Prism.

The market is anticipated to develop with the combination of cognitive technologies and changing business processes across industries. Moreover, the expanding demand for automating repetitive tasks is expected to push the market over the projection space. Furthermore, the global pandemic obstructed both internal and external business processes. It affected back- and front-end office operations leading to long response time, employee burnout, documentation backlog, and supply chain disturbances. Therefore, executing a mechanization solution was crucial in optimizing costs and offering more express services. That is why the pandemic has accelerated the need for a digital workforce across enterprises. It has opened up new avenues for RPA providers to catch the market: automation will redefine the post-pandemic idea of work.

Deal structure

Vista Equity Partners will pay a total consideration of £1.1bn ($1.5bn) in cash, resulting in a price per share of £11.25 per share. As a result, Vista will pay a 35% premium compared to the company’s last closing price of £8.32, as of Aug. 27, the last complete trading day before takeover interest was announced. The deal barely claws back the value lost this year as Blue Prism’s shares dropped by around a third, dragged lower by concerns over the cost of developing products needed to be competitive.

However, Blue Prism requires the backing of 75% of investors voting on the deal to be successful. Blue Prism’s board, which plans to approve the transaction unanimously, defined it as “fair and reasonable.” Indeed, Blue Prism has already announced it has obtained backing for the deal from shareholders owning 23% of the company’s stock so far. Pending permission by shareholders, the deal is awaited to close at most in the first quarter of 2022.

Upon completion, Vista plans to combine Blue Prism with Tibco. Furthermore, the merged companies will be prepared for sale, which might take place withing the next year.

Deal Rationale

The acquisition of Blue Prism by Vista underlies various strategic considerations. By combining the acquired company with its portfolio company Tibco, Vista will be able to build a broad player in the field of enterprise software. The firm believes that this merger “will yield significant synergies and market differentiation, combining the product and R&D investment of the two businesses. Combining Vista and Tibco will ensure to remain at the forefront of the next generation of intelligent automation.” Additionally, significant cost reductions can be achieved to improve profitability. Therefore, the firm plans to reduce the headcount significantly by 8-10% of the 4,750 employees of the combined company.

Moreover, the deal is an opportunity to generate a quick and rather low risk return. The delisting of the company will be possible at comparatively low cost, as Blue Prism is traded at a lower multiple compared to its peers. One reason for that might be the listing on the LSE, where software companies mostly trade at lower multiples compared to technology focused exchanges as the NASDAQ. After the combination with the US-based company Tibco, Vista will immediately start to prepare the combined entity for sale. By selling the company or listing it on a more suitable exchange, a higher multiple can be expected which will increase the value of the equity immediately.

For the Blue Prism management, the transaction presents a favorable opportunity. After falling short of market growth expectations and an increasing competition in the sector, the company’s share price decreased even though it was already traded at a lower multiple compared to peers. Therefore, the management was considering several options such as a secondary listing in the US or an external investor who can support the company with capital to speed up product development and boost sales. Besides voting on the deal, a new management will be appointed at the shareholders meeting.

Market Reaction

After the takeover discussions were announced on August 31, Blue Prisms share priced increased by 32% from £8.32 to £11.00, valuing the company at £1.1bn. In the days, the share price was even in excess of £12, but converged back to the offer price. At the announcement of the agreement on September 28, shareholder representing 23% of the voting rights, including the largest investor Jupiter Investment Management, had already declared their support. Consequently, the share price decreased to £11.42, a level near the offer price.

Nonetheless, opposing voices are getting louder. Activist investor Coast Capital, owning approximately 3% of the outstanding shares, wrote to Blue Prism’s management that they will vote against the offer and that they encourage other shareholders to follow their example. Furthermore, Hawk Ridge Capital, a top 10 shareholder in the company, said that they weren’t happy with the offered price.

Moreover, in the days after the announcement, hedge funds as Sand Grove Capital Management, Melqart Asset Management and Polygon Global Partners have built up significant stakes in the company, betting on a raise of the offer price. Consequently, the success of the acquisition at the agreed terms is not certain yet.

Financial Advisors

Qatalyst Partners acted as lead financial advisor for Blue Prism, whereas BofA Securities and Investec Bank acted as further joint financial advisors. Vista Equity Partners and Tibco were advised by Goldman Sachs as sole financial advisor.

0 Comments