BlackRock, Inc. (NYSE: BLK) – market cap as of 26/02/2019: $69.83 bn

KKR & Co Inc Class A (NYSE: KKR) – market cap as of 26/02/2019: $18.97 bn

Introduction

On February 24th 2019,the Abu Dhabi National Oil Company (ADNOC) announced a landmarked partnership between the national state-owned oil company and two of the world’s leading institutional investors, KKR and BlackRock. The deal, which involve investments in midstream pipeline infrastructure, will see the creation of a newly formed entity called ADNOC Oil Pipelines which will lease 18 pipelines from ADNOC’s offshore and onshore upstream concessions for a 23-year period. Funds managed by BlackRock and KKR will form a consortium to collectively hold a 40% interest in the entity, while ADNOC will hold the remaining 60% majority stake. This deal is of particularly important as it is effectively the first instance of a global institutional investor deploying capital into key midstream infrastructure assets of a national oil company in the Middle East.

About BlackRock

BlackRock is a publicly traded American Global investment management corporation headquartered in New York City. The company was founded in 1988, initially as a risk manager and fixed income asset manager. Yet, it has grown to become the world’s largest asset management group with over $5.98 trillion of assets under management as of December 2018. BlackRock provides its retail and institutional clients with investment management, risk management, and advisory services, with products ranging from single to multi-asset class portfolios investing in equities, fixed income, alternatives, and money market instruments. In recent news, BlackRock has posted a lower than expected revenue of $3.434n for 2018 and yet it provided for a higher than expected adjusted earnings per share ratio of $26.93, 20 percent increase from the previous year, most likely an effect of the recent tax cuts.

About KKR & Co. Inc.

Kohlberg Kravis Roberts is a publicly traded global investment firm which manages multiple alternative asset classes including private equity, energy and infrastructure among others. Founded in 1976 and headquartered in New York City, the firm holds roughly $148.5 bn of assets under management as of 2017. KKR provides a range of investment management services to its fund investors and provides capital markets services to its firm, portfolio companies and third-party clients. The company mainly conducts its business through four segments: private markets, public markets, capital markets and principal activities. KKR posted a total revenue of $2,396 bn in 2018, down by 33% from 2017, along with an earnings per share (excluding extra items) of $2.14, up by 2% from the last year.

About Abu Dhabi National Oil Company

The Abu Dhabi National Oil Company (ADNOC) is the state-owned oil company of the United Arab Emirates, a country with the world’s seventh-largest proven oil reserves, mainly

Industry Overview

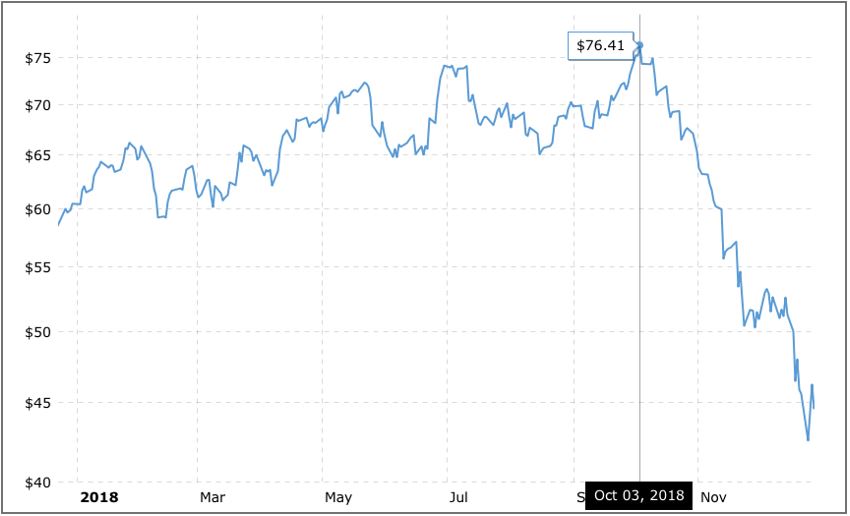

Oil prices are among the most volatile and unpredictable ones within the commodities market. In 2018 only, the price for WTI Crude fluctuated between a low of $42.53/b in December and a high of $76.41/b in October. This sort of volatility makes the asset very difficult to forecast precisely, yet different models suggest prices will rise throughout the first half of this century with the cheaper reserves depleting by 2040. Using 2018 as a base year, it is projected that prices will well surpass $100/b by 2050. Moreover, the market is characterized by the oil price cartel OPEC and the geopolitical instabilities inherent to the region while the discovery and development of shale oil in the U.S. has proven to be turbulent to Middle Eastern production. In the face of such disturbances and the bleak long-term prospects of oil as a basis for economic stability, many oil- and gas-rich countries have decided to diversify their

One such example of diversification comes from one of, if not the most, important of the oil exporting nations in the world. Saudi Arabia’s national oil company, Saudi Aramco, is scheduled to go public by early 2021. 5

An important driving factor for the demand of crude oil is its dependence on aviation and petrochemicals as opposed to automobiles. This is to such an extent that even in the case where one in every two cars were to be electric, demand for crude would keep on growing in the following decades. Escalating prices play on the increase in demand to appetize foreign investment in the region, as suggest KPMG’s recent oil and gas CEO outlook, where 85 percent of industry bosses are confident of industry growth. Among the Gulf Cooperation Council (GCC) the UAE has been perceived as the preferred destination for foreign investment as it leads the GCC countries in term of foreign direct investment (FDI) where policies such as free trade-zones, unrestricted cash transferred and a comparatively diversified economy. The Middle East will be subject to a high level of population growth in the years to come and, considering the sizeable amount of oil revenues which goes to subsidies and benefits towards nationals, a strained budget will struggle to exploit the region’s wealth of energy and fund divestment from fossil fuels and the development of less oil-dependent economies. These factors will be significant drivers for future foreign direct investment in the regions energy assets for the decades to come.

Deal Structure

The partnership between the two global investment managers BlackRock and KKR and UAE’s national oil company ADNOC, struck on February 24th 2019, entails an upfront investment of $4 bn from the American counterparts in return for securing over two decades of guaranteed returns o the investment. Under the term of the agreement, KKR and BlackRock will become partners in a newly formed entity, ADNOC Oil Pipelines, which will lease 18 pipelines from ADNOC, while will remain committed to the output and management of these pipelines. ADNOC will retain a 60% ownership of the joint venture while the remaining 40% will be held by BlackRock and KKR.

Deal Rationale

With this $4bn transaction, ADNOC’s CEO Sultan Al Jaber has just made a further step towards the completion of his privatization strategy. As a matter of fact, ever since he was appointed CEO, in 2016, he has been trying to attract funds from investors all throughout the world, in the form of Foreign Direct Investments. For instance, he sold a 5% stake of the company’s drilling business to the US energy corporation Baker Hughes for $11bn (October 2018), later selling a 35% stake of the company’s refining unit to the Italian energy company Eni S.p.A. and the Australian oil and gas producer OMV AG for $5.8bn (January 2019). The recent sale of the pipeline constitutes, therefore, only a further step in the same direction.

The Sultan is paving the way for the development of post-oil industries in the United Arab Emirates. He declared that he is trying to raise around $45bn from international partners in an effort to develop the refining and petrochemicals industries, and thus build the world’s largest integrated production facility in the town of Ruwais. According to him, the UAE should commit to diversifying its own economy, which otherwise would remain bound to oil only, to the detriment of the overall country’s stability in the decades to come.

From BlackRock’s standpoint, instead, the deal at issue is aimed at securing at least two decades of guaranteed returns, on the grounds of the relative stability of pipelines’ cashflows from OPEC’s third major player, which controls about 6% of the worldwide crude reserves. Moreover, stepping into Middle East oil facilities, BlackRock’s CEO Larry Fink is once again committing to focusing on investments in infrastructures, which has been a major trend in Wall Street ever since 2016. At that time, investors started systematically targeting public works such as highways, bridges, tunnels, and airports, thus achieving acceptable returns in a low interest era. Following the trend depicted above, for instance, BlackRock had already bought 50% stake in Glass Mountain Pipeline from NGL Energy Partners LP for $300m (December 31st, 2017), and entered transactions with First Reserve for stakes in its energy assets (February 2017, July 2018).

KKR shares BlackRock’s objectives, with the company’s CEO and co-founder Henry Kravis also pointing at the extant need for massive investments in infrastructures all throughout the world, and especially within Asian countries. According to him, this need will pave the way for attractive investment opportunities in the years to come, promoting private-public partnerships mirroring the one that the article is targeting.

Exactly as BlackRock, KKR has already entered transactions in the infrastructure sector on global basis, now boasting $12.6bn AUM in the field, which include investments in the US DJ Basin and Gulf of Mexico, Canada’s British Colombia, Alberta Montney regions and Mexico’s Bay of Campeche.

As a final remark, it is worth stressing that the transaction constituted a true landmark partnership, being the first time an institutional investor has partnered with a Middle Eastern national oil company. Moreover, someone argued that this deal, with the UAE benefiting from capitals coming from Western Countries, has somehow reverted the usual money flow, which was characterized by the opposite direction. As a matter of fact, major investment companies used to systematically drain resources from the UAE, for financing US projects. The deal at issue, therefore, seems to revert the mechanism.

Market Reaction

In the aftermath of the deal announcement, BlackRock’s shares experienced minor gains, opening at $431.07 on February 21st, and closing at $436.72 the following day. KKR’s share prices, instead, experienced a slight drop, opening at $23.65 on February 21st and closing at $23.35 the following day.

ADNOC, the last party of the transaction, still does not have its shares traded on the marketplace, so no reactions were observed.

However, it would be somehow short-sighted to straightforwardly infer that BlackRock and KKR’s shares performed respectively well and poorly on those two targeted trading days only because of the deal. Indeed, the shares prices of the two companies at issue cannot be so closely linked to this minor purchase, on the grounds of their extremely diversified portfolio of activities and businesses. Instead, what it is still reasonable to infer from those stock prices behavior is that investors, acknowledging the potential growth and guaranteed proceeds linked to this transaction, do not negatively adjust their positive attitude towards the two companies’ performances in the years to come. After all, the cashflows from pipelines are considered to be stable and certain, and participants expect to benefit from them for at least the next twenty years.

Everything considered, anyhow, investors confirm their positive attitude and appetite for investments in infrastructures, and the move from the two aforementioned companies is definitely matching their needs. This last statement being confirmed by both S&P and DJ Global Infrastructure Indexes, which have showedg a positive evolution also during the week when the transaction has been announced.

Advisors

Bank of America Merrill Lynch and J.P. Morgan Chase & Co. acted as financial advisers to ADNOC, which could also count on its own independent financial advisers, i.e. Moelis & Co.

0 Comments