LVMH Moet Hennessy Louis Vuitton SE(MC:FP) – market cap: 202.855B EUR

Tiffany & Co. (NYSE) – market cap: 16.018 B USD

Intro

The 25th of November LVMH announced an all-cash deal to acquire Tiffany & Co for $16.6bn, including $400m of net debt. Hence, the control of the upmarket American jewellery shifts to Bernard Arnault, CEO of LVMH, and his company. The final price of the acquisition is $135 per share and will be paid in cash. The price indicates an equity value of $16.2bn, showing a premium of more than 37% paid with respect to the market capitalization of Tiffany on the day before this move became public. This final value of $16.2bn was reached after months of negotiation, in which Tiffany rejected a precedent offer of $14.9bn, which implied a price of $120 per share.

Tiffany would sit in a portfolio which contains Bulgari, acquired in 2011, while the stable brands of LVMH are Louis Vuitton, Dior and Sephora. The acquisition of LVMH strengthens the position of the group in the United States and more specifically in the segment of jewellery. The deal will be completed in mid-2020 (probably in June) while the boards of both companies already approved the acquisition.

This huge deal represents the largest deal ever in the luxury sector.

About LVMH

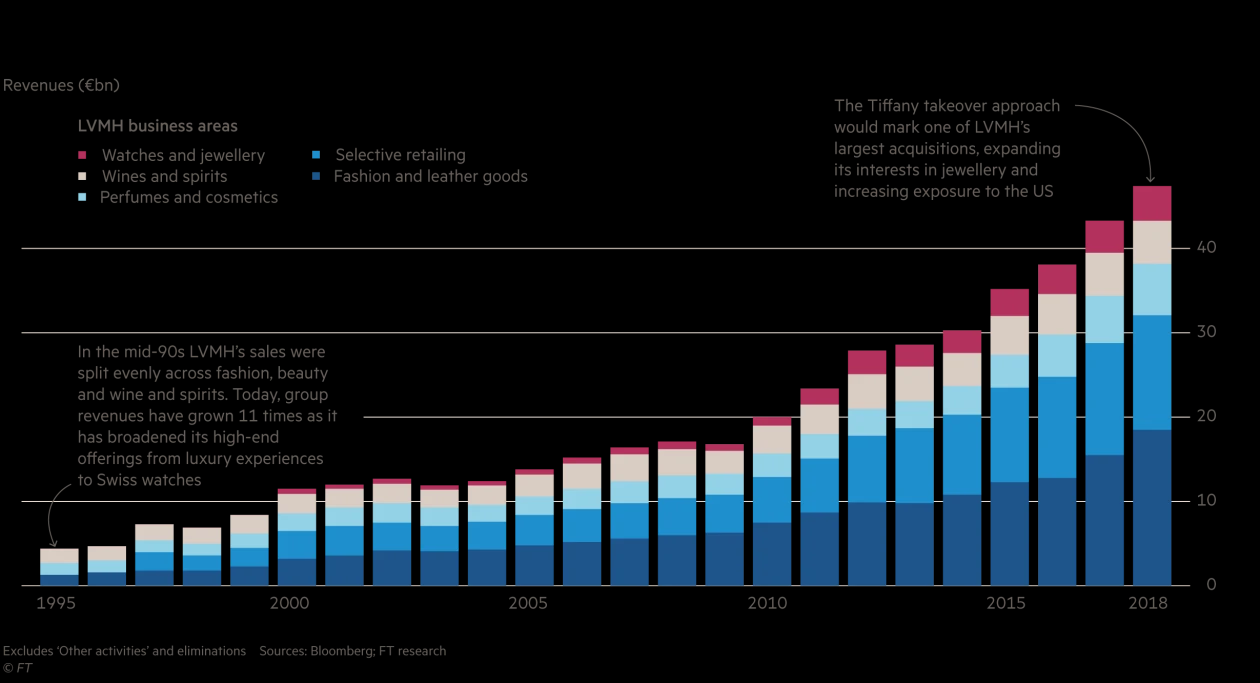

LVMH, the acronym for Louis Vuitton Moet Hennessey, is a French multinational luxury-goods conglomerated, headquartered in Paris. Some of the most prominent brands of the group are Moët & Chandon, Hennessy, Château d’Yquem, Christian Dior, Louis Vuitton, Fendi, Marc Jacobs, Bvlgari and Sephora. The successful integration of various famous brands into a single group, realized by Arnault, the CEO of LVMH, is inspiring for the entire luxury sector and was followed in the following years by some of LVMH’s competitors, such as Kering and Richemont. In fact, after his election as a CEO of the group, Arnault has led the company through an ambitious path. His main idea has always been that of having independent brands, with their own history, which share the advantages of being part of a solid group, in which they help each other to achieve strong growth. With this purpose in mind, LVMH realized in the years a huge number of successful acquisitions, which proved to be essential to avoid the bankruptcy, such as Céline in 1988, Berluti and Kenzo in 1993, Marc Jacobs and Sephora in 1997, Emilio Pucci in 2000, Fendi in 2001.

As of today, LVMH, founded in 1987, has more than $128bn of assets, produces more than $46.5bn of revenues and has more than 145,000 employees across the world (thirty per cent in France). The main products of the group, offered through its 60 and more subsidiaries, are clothing, cosmetics, fashion accessories, jewellery, watches and wines. LVMH operates over 2,400 stores worldwide.

LMHV business model is characterized by the full control of retail through LVMH owned stores and by a no-discount price policy. LVMH geographic strategy focuses on capturing the developing countries, while continuing to invest in the richest ones. The firm’s growth strategy lies in both the organic growth and the acquisitions realized by the group.

Currently, the business of the group is focused on paying particular attention to the different brands it owns to maintain or even strengthen the perception of luxury relating to its products. Indeed, Louis Vuitton products are sold only through Louis Vuitton boutiques, found in wealthy cities, or other luxury goods shop such as Harrods in London.

About Tiffany & Co.

Tiffany, founded in 1837, is an American luxury jewellery maker, which became famous in the early 20th century. Tiffany is well-established all over the world thanks to its luxury goods, like its diamond and sterling silver jewellery. It markets itself as an arbiter of taste and style. These goods are sold at Tiffany stores and through direct-mail and corporate merchandising.

The manufacturing facilities of Tiffany produce, as of today, more than 60% of the merchandise sold. This percentage may increase in the future but is highly unlikely, due to strategic elements such as the cost of investments and the margins the company wants to achieve, that Tiffany will ever decide to manufacture all of its products.

As of 2018, Tiffany operated in 93 stores in the United States and 321 stores worldwide and employs over 14,000 staff. Tiffany’s notoriety, associated all over the world with its trademark duck egg blue boxes, was cemented by the 1961 movie “Breakfast at Tiffany’s”, with the famous Audrey Hepburn. However, in the recent years, the performances of the company have been not as good as they used to be in the past, also due to the lower spending by tourists and a strong US dollar. For this year, to be more specific, Tiffany reported revenues of $4.4bn, down nearly 1 per cent from a year ago, while, just to offer a comparison, between 2007 and 2008 the revenues of Tiffany faced an impressive average quarterly growth of 12.5%.

Industry Overview

Revenue in the luxury goods market amounts to $318,797m in 2019 and it is expected to grow annually by 3.0% (CAGR 2019-2023). The market’s largest segment is luxury fashion with a market volume of $112,890m. In global comparison, most revenue is generated in the United States (US$62,288m in 2019).

Despite the recent slowdown of economic growth in major markets including China, the Eurozone and the US, the luxury goods market is not declining. However, the recent adoption of protectionist policies in the US combined with the implementation of fiscal policies, tighter monetary policy and restrictive trade policy are showing their first results in slower consumer spending, higher consumer prices and disrupted global supply chains. It is also expected that the outcome of Brexit will undoubtedly affect the EU and beyond, but for now, the Eurozone has reached its highest level of employment and wage growth, fueling private consumption. Among other factors impacting the future of the global luxury market the most important include the digital revolution and technological development, growing global middle class and the influence of so-called Millennial HENRYs and Generation Z.

Technology’s greatest impact on the luxury market is the rise of e-commerce and ultimately the need for brands to operate an Omnichannel strategy meaning the brick & mortar and online sales combined. Despite the rise in the number of online purchases, the number of consumers conducting research online, but purchasing in-store is still significant. On top of that, the importance of customer experience, both in-store and online is growing rapidly.

It is also expected that the luxury market will continue to experience growth to accommodate this rising new class – Millennial HENRYs. Along with Gen Z, these two classes dominate the market with their high disposable incomes and are very prominent within the rising economies of the emerging markets. Concerning that, both China and India are attractive markets for luxury brands.

To appeal to the growing global affluent millennial population, companies are abandoning the beliefs that exclusivity and high prices are essential brand characteristics.

Given the shift in the demographics of consumers across the globe, it becomes evident that the new luxury consumers care only about the brands that created value for them in the last 24 hours. The Luxury Institute’s report on the Millennials, Gen X and even some Baby Boomers, recognizes history and heritage as much less important attributes of luxury brands when making purchasing decisions, ranking them sixth after quality, customer service, design, craftsmanship, and product exclusivity. Therefore, to attract new consumers and remain relevant, some brands are replacing reliance on heritage with radical redesigns, including brand contamination with streetwear firms. To secure greater modernity, while enabling stronger competitiveness with those fashion houses most popular among the millennials, collaborations such as Louis Vuitton x Supreme, Manolo Blahnik x Vetements, and Jimmy Choo x Off-White are happening more and more often every year.

Last year, the luxury industry noted a record number of mergers and acquisitions equal to 265, meaning 47 more than in 2017 and giving a 22% increase. Particularly in fashion, 2018 was marked by the resounding €1.83bn acquisition of Versace by US group Michael Kors, now known as Capri Holdings.

Deal Structure

According to the company’s official statement, LVMH will acquire Tiffany for $135 per share in cash, in a transaction with an equity value of approximately €14.7 billion or $16.2 billion. This can be translated to a 37% premium to where the Tiffany share price stood before Bloomberg News reported the approach in late October, a multiple of 16 times Tiffany’s expected EBITDA in 2019, and a purchasing equity value that is 23 times greater than the one LVMH used to purchase Italian jeweller Bulgari in 2011.

LVMH will raise new debt facilities to finance the acquisition, but specifics on interest rate and other loan terms have not been provided by LVMH. The pack includes three sets of debts, including an $8.5 billion bridge loan, a $5.75 billion commercial paper back-up line, and a €2.5 billion revolving credit facility. These debt facilities will be refinanced through a bond issue by LVMH later. This borrowing activity is necessary because, as of the end of its latest reporting period, LVMH had cash and cash equivalents of only €4.61 billion. At today’s exchange rate, this translates to about $5.08 billion. In addition, the company needs to keep cash on hand as part of its typical day-to-day operations.

The impact on the overall debt leverage of LVMH will remain limited, raising the company’s net Debt/EBITDA ratio close to only 0.9x by the end of 2020.

Deal Rationale

As it can be seen from the recent movements in the luxury world such as Stuart Weitzman and Kate Spade becoming part of Tapestry and Jimmy Choo and Versace becoming part of Capri Holdings, industry consolidation is a key trend, through which lone luxury brands join luxury brand groups with more financial muscle to achieve long-term sustainable growth and luxury conglomerates maintain their leading positions via expanding their enterprise kingdom. LVMH’s acquisition over Tiffany is another example of this.

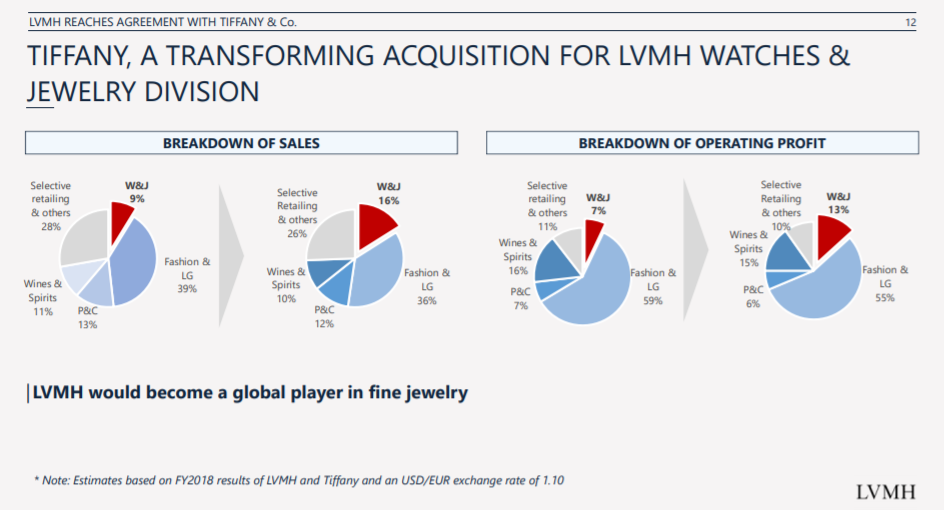

LVMH’s Watches & Jewelry division is its smallest business segment in terms of profits and sales. The company has been actively and progressively expanding its Watches & Jewelry business since 2010, such as via its acquisition over Bulgari in 2011. The fact that the jewelry industry is still primarily local, in which the ten biggest jewelry groups capture a mere 12 percent of the worldwide market, and only two—Cartier and Tiffany & Co.—are in Interbrand’s ranking of the top 100 global brands, left few options for LVMH to choose from when considering another round of inorganic growth. Comparing to Cartier owned by close competitor Richemont or Rolex that is officially not for sale, Tiffany became the only option with the substantial scale that can help increase LVMH’s presence in the hard luxury category and feasibility to acquire. LVMH earned about 8.5% of its 2018 revenue from this business sector. It is expected to achieve more than doubled market share to 18.6% via its acquisition over Tiffany, and be the top of the rankings for market share in branded jewelry, one of the best-performing luxury categories in 2018, which Bain consultants predict will grow a further 7% this year.

Source: Bloomberg, Financial Times

Source: LVMH

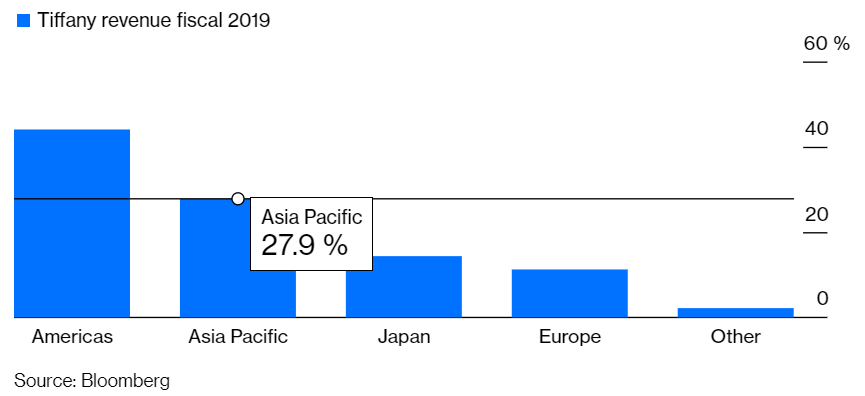

Tiffany’s major markets, US and China’s economic slow-down, and the recent geopolitical issues have resulted in disappointing earnings report of the company. While leveraging the brand’s strong penetration in the U.S. market to increase LVMH’s presence in North America, LVMH can also use its previous M&A experience and track record of rebranding brands, such as how it turned around Bulgari doubling the brand’s sales and increasing its profits fivefold, to boost Tiffany’s marketing budget, launch new products, spiff up its retail stores, and make the brand more appealing to millennials. LVMH views Tiffany’s relatively low priced products as a great way to attract younger shoppers – who presumably could become wealthier as they age and ultimately pay up for LVMH’s pricier brands. Moreover, Tiffany, with 28% of the sales coming from China, is planning to “build more flagship stores in several Chinese cities”, allowing LVMH to ride further on the wave of luxury demand in China. According to analysis by Morgan Stanley, the nation’s share of luxury goods spending is forecast to reach 46% by 2025.

Source: Bloomberg

Last but not least, unlike a private equity house, where objectives are dominated by the need to increase returns year on year, luxury groups like LVMH can take a longer-term view. A well-established and recognizable brand is able to resist short-term actions that would boost sales at the expense of the brand in favor of actions that maintain the long-term success. Tiffany with its 182 years of history and symbolization of “love”, is very well in line with LVMH’s current portfolio of luxury brands with great heritage and long history.

From Tiffany’s perspective, LVMH’s financial and operation capabilities will not only enhance its performance in its major markets, but also allow it to cross-sell in other markets. LVMH has a much larger hold over the European market than Tiffany does with 29% of that divisions’ revenue coming from there (including 6% in France) compared to the 11% that Tiffany boasts. This gives the company the ability to easily expand certain product lines into other regions or to focus on cutting costs in order to generate synergies.

Market reaction

LVMH shares were trading 1.4% higher on Monday morning after announcement of the deal. It is not surprising as analysts at Bernstein wrote in a research note last month that “takeover of Tiffany could make a lot of sense” Although Tiffany is one of the world’s best-known luxury brands, analysts say there is still much room for growth, particularly in jewelry and watches. The deal would also bolster LVMH’s presence in jewelry and watch market, since it’s already the owner of legacy brands such as Hublot and TAG Heuer.

Tiffany’s shares have struggled for better part this year, but increased in October after the news of deal talks. It is believed that LVMH’s deep pockets could help Tiffany improve after a rocky few years and fuel its effort to better connect with millennial consumers. Anusha Couttigane, fashion and luxury goods analyst also said “Should the bid go through, we can expect to see aggressive marketing and collaborations with interesting designers, of which LVMH has many to choose from.” and naturally these would be warmly welcomed by the shareholders.

Financial advisors

Citi and J.P. Morgan are serving as financial advisors and Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal counsel to LVMH. Centerview Partners LLC and Goldman Sachs Co. LLC are serving as financial advisors and Sullivan & Cromwell LLP is serving as legal counsel to Tiffany.

0 Comments