Introduction

On November 4th, the 34-year-old democratic socialist Zohran Mamdani became the first Muslim mayor-elect of New York City, comfortably defeating the former governor of New York, Andrew Cuomo. Some of his major policy promises throughout his campaign include freezing the rent for all stabilized tenants, providing free childcare to all children from six weeks to five years old, creating a network of city-owned grocery stores, and permanently eliminating the fare on every city bus, among others. In this article, we will delve deeper into some of the ambitious promises Mamdani has made throughout his campaign and analyze how they will affect New York’s large municipal bond market.

Campaign Promises

Looking at the promises Mamdani made to his voters, it immediately becomes noticeable how ambitious some of the pledges that powered him to a decisive win over Andrew Cuomo sound. Given that New York’s Governor Kathy Hochul is already contending with a $4.2 bn deficit, almost four times last year’s gap, and that, as of now, New York ranks 50th on the Tax Foundation’s State Tax Competitiveness Index, it is well justified to take a closer look at Mamdani’s plans and to assess whether they are even remotely realistic.

One of Mamdani’s main campaign promises was to make the largest public bus system in the U.S. free, in order to make the most populous and costliest U.S. city more affordable. To fund this, Mamdani announced that he wants to raise taxes on millionaires and businesses to bring in $9 bn of new revenue for free buses, along with free childcare and more affordable housing. However, his plan becomes complicated quite quickly when you consider that Mamdani will need help from state lawmakers in Albany, since the Metropolitan Transportation Authority (MTA), which operates public transportation in the NYC metropolitan area, is a state agency.

Since making all buses free is a large-scale endeavour, Janno Lieber, the MTA’s chief executive officer, has already questioned whether it is even feasible to implement. Furthermore, looking at the revenue of NYC’s bus system, Mamdani’s plan would cut the MTA’s revenue by nearly $1 bn and force lawmakers and the MTA to find alternative funding. Additionally, providing more buses and drivers would add costs requiring funding that currently doesn’t exist. The $17 bn in transportation revenue debt that the MTA has issued comes with the pledge that farebox receipts from subways and buses would pay down the bonds. Free buses would mean finding an alternative source of revenue to service this debt.

Another planned experiment of Mamdani’s, one that has historically seen limited success, is the creation of a network of city-owned grocery stores focused on keeping prices low instead of making a profit. While there is strong support for the idea among NYC voters, the promise is overshadowed by doubts about its implementation. The pilot program, which would launch five stores, one in each borough, is estimated to cost $60 mn and could be funded by adjusting priorities in the $116 bn budget. Furthermore, Mamdani wants to increase the corporate tax rate to 11.5% and institute a flat 2% tax on individuals earning $1 million or more.

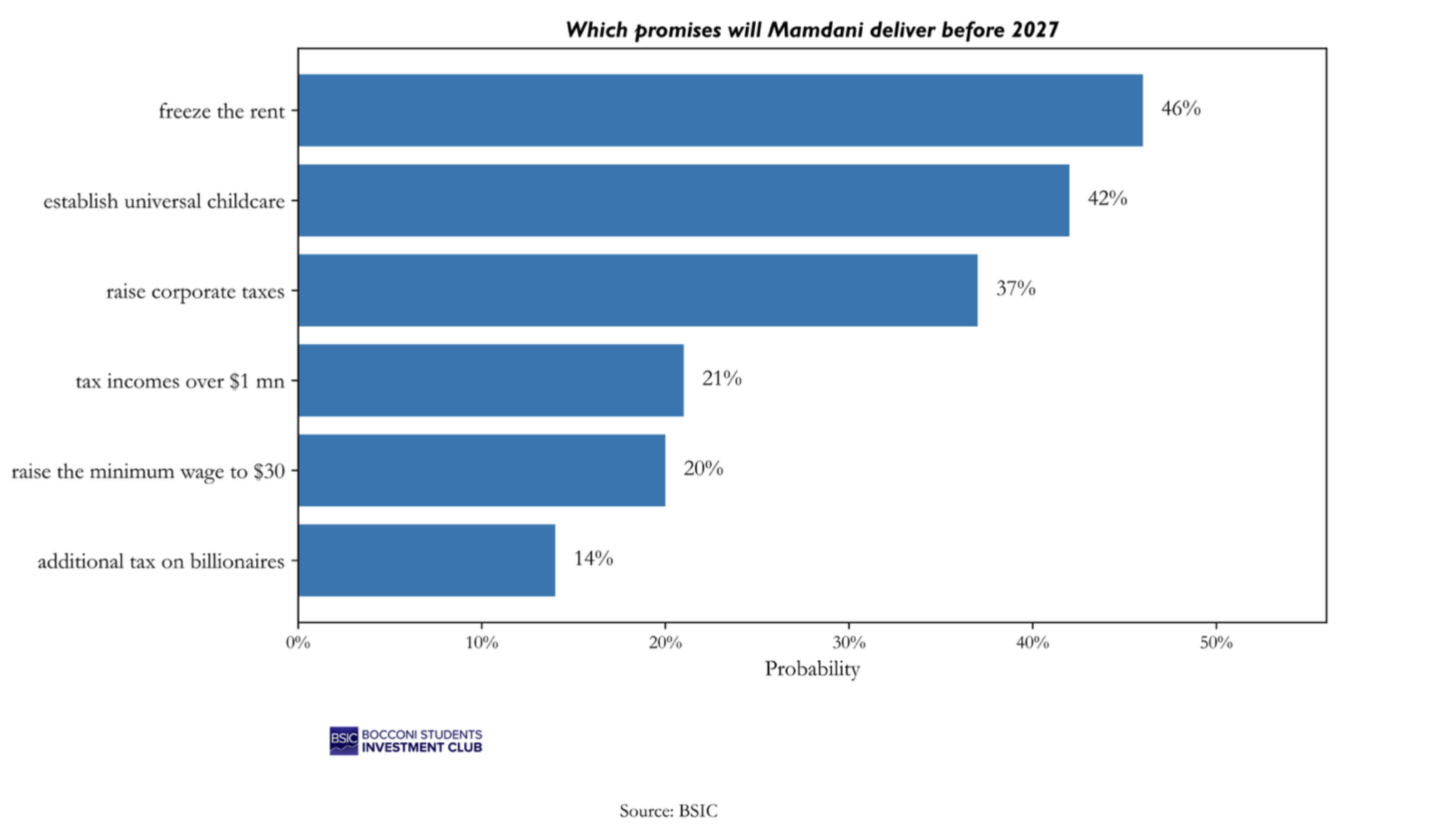

While these plans sound promising on paper, there are major hurdles Mamdani must first overcome, the main one being that Governor Hochul has the authority to raise the state’s taxes but has already said she doesn’t want to do so and has opposed such measures in the past. However, recent reports suggest that Hochul might be more open to raising corporate taxes than she has publicly stated. Prediction markets on Kalshi jumped from only a 21% probability that Mamdani will successfully raise NYC business or New York State taxes before January 1, 2027, to a 37% chance on Friday after the report came out.

The most popular promise Mamdani made was to provide free childcare for all children from six weeks to five years old. Several people close to Mamdani have suggested that this is the part of his agenda he will prioritize most. Implementation could come through gradual expansions of the universal prekindergarten program, the main achievement of former mayor Bill de Blasio. Even though this endeavour would again be expensive, with the state estimating the promise would cost roughly $14 billion annually, in this case Mamdani and the Democratic Governor Hochul share a largely similar outlook on policy, both supporting this popular measure and standing up to President Trump when necessary.

One of Mamdani’s more realistic promises, and one with a straightforward path to implementation, is his pledge to freeze rent for all stabilized apartments throughout his term. Mamdani strongly criticized the Adams administration for raising rates every year. Unlike the plans outlined earlier, Mayor Mamdani actually has the direct authority to realize this pledge, as he has the sole power to appoint the nine members of the Rent Guidelines Board, which sets annual rent adjustments for rent-stabilized apartments. Since several board members’ terms are expiring, Mamdani has already expressed his intention to replace them with people more closely aligned with his policies.

However, it is important to note that each member of the Rent Guidelines Board must review the law and the current economic conditions faced by landlords, meaning they cannot vote without basing their decisions on supporting studies. Still, the mayor’s ability to directly appoint board members should put Mamdani in a strong position to significantly influence their decisions.

Prediction markets on Kalshi are also quite sceptical about whether Mamdani will be able to implement some of his promises before 2027, but they believe that establishing universal childcare and freezing rents for stabilized apartments are the most likely to be achieved, with probabilities of 42% and 46% respectively.

Hurdles and potential Opportunities for Mamdani

So far throughout this article, it quickly becomes evident that much of the final decision-making surrounding Mamdani’s plans will take place at the state level and does not lie entirely in his own hands. In New York, the State Legislature retains primary authority to enact tax laws that apply statewide or regionally and to authorize or limit local taxing powers. For NYC specifically, the city must seek permission from the New York State Legislature to impose new taxes or change the structure of existing ones. Therefore, it’s quite clear that Mamdani does not have fully autonomous power to raise or alter taxes.

As a result, it is essential for Mamdani to convince Governor Hochul if he wants to fund his plans by raising both corporate taxes to 11.5% and the income tax on earnings above $1 million a year by 2%, quadruple what former Mayor Bill de Blasio proposed for earnings above $500,000. Raising the state corporate tax to 11.5% would lift New York to the highest level in the U.S., tying New Jersey for first place. Although Hochul endorsed Mamdani throughout his campaign, she has repeatedly stated that she does not want to further raise corporate taxes and has blocked similar attempts by NYC mayors in the past. However, there are certainly legit reasons to believe she might take a different path this time.

Another threat to Mamdani’s campaign comes straight out of Washington: President Donald Trump, who has strongly expressed his opposition to NYC’s new mayor. In the days following Zohran Mamdani’s election victory, aides to President Trump reportedly began reviewing the cancellation of federal funds benefiting the city. NYC received almost $10 billion in federal funds in 2025, accounting for roughly 8.3% of total spending in its operating budget, according to the city comptroller’s office. That funding supported education, housing, social services, and other programs for low-income households.

Going back to Governor Hochul, we believe that there is a subtle detail that markets, so far convinced that state approval for most of Mamdani’s costly campaign promises is too high a hurdle, might overlook: Governor Hochul faces a gubernatorial election scheduled for the end of next year. Hochul, who will likely face Republican candidate Elise Stefanik, cannot afford to completely alienate Mamdani’s support from her left flank ahead of a potential primary challenge from her own lieutenant governor, Antonio Delgado. At the same time, Mamdani will need Hochul to succeed politically next year, as an unfriendly Republican governor would almost certainly derail his administration’s goals.

While we strongly believe that Mamdani will not be able to deliver on his promises to their full extent, we also believe that Governor Hochul’s political situation could lead to a team-up between the two Democrats, a scenario that markets are currently not pricing in and which could represent some interesting opportunities.

As touched upon earlier, recent reports suggest that New York Governor Hochul is considering raising corporate taxes in an effort to help fund some of Mamdani’s agenda and to close a potential budget shortfall for the state. While Hochul endorsed Mamdani during his campaign, the prevailing narrative has been that Hochul and the state would block any increases in income or corporate taxes. However, we believe that the combination of pressure on Hochul, who faces an election next year, and on Mamdani, who must find a way to deliver at least part of his agenda, makes state support for Mamdani’s policies more likely.

Furthermore, the state will need to offset funding cuts stemming from Trump’s new budget law, which makes tax hikes almost inevitable for Hochul. Mamdani is advocating to raise the top state corporate tax rate to 11.5% from 7.5%, which would result in a combined effective tax rate of nearly 19%, the highest in the country. We still believe that significant increases in income taxes are unlikely, but given recent reports and the mounting pressures Hochul faces, the likelihood of higher income taxes has increased meaningfully.

To gain the necessary support from Governor Hochul, it is likely that Mamdani will have to first focus on implementing universal childcare, a policy that is very popular among voters and a cornerstone of his agenda, which Hochul has also explicitly supported despite funding and logistical hurdles. While it remains unlikely that universal childcare will be implemented statewide, its roughly $15 billion price tag would consume “the entire amount of my reserves,” according to Hochul, corporate tax increases may still materialize, even if they are intended not to fund Mamdani’s programs directly but to cover cuts from the Trump administration. These cuts could create a $3 billion deficit for Medicaid and may worsen if Mamdani continues to clash with Trump.

How will this affect New York’s Municipal Bond Market?

New York City is home to some of the largest municipal bond issuers in the USA and currently has $46 billion in outstanding general obligation bonds. Due to Mamdani’s ambitious plans, some investors are on edge, expecting him to shake things up when it comes to the city’s credit. At the outset, it’s worth mentioning that promises made by politicians often don’t translate into public policy. NYC also has several fiscal guardrails in place that could protect the city’s credit from the potential effects of Mamdani’s policies.

General obligation bonds are a type of municipal bond backed by the full faith and credit of the issuer, meaning they are repaid through the issuer’s taxing power. These bonds fund public projects that may not generate their own revenue, such as schools and roads, and are secured by the government’s ability to levy taxes, like property taxes, to meet its payment obligations. Because of this strong backing, general obligation bonds are considered among the safest types of municipal bonds.

Revenue municipal bonds, on the other hand, are issued to fund specific, income-producing public projects, such as toll roads or transit fares. They are considered riskier than general obligation bonds and therefore offer higher interest rates as compensation. For New York residents, the interest income from both revenue and general obligation bonds is generally exempt from federal income tax, New York State income tax, and New York City local income tax, making them highly attractive for investors in high tax brackets.

NYC’s debt burden is already above average, with debt service as a percentage of tax revenues projected to climb to 14% by 2033, even without adding any of Mamdani’s policies. Furthermore, there are constraints of which Mamdani is likely well aware, such as the city’s debt cap enshrined in the state constitution. As of this year, NYC had only $41 bn of remaining borrowing capacity and already plans to issue $8 billion more over the next three years. Changing this cap would again require approval from the state legislature to increase or remove it. While Mamdani will almost certainly advocate in Albany and Washington to reform these measures, we believe a significant change to New York’s ability to issue municipal debt to fund public services is not realistic in the near future. Especially Mamdani’s proposal of issuing $70 bn of debt over the next 10 years to fund 200000 units of affordable housing does not seem realistic considering the fiscal guard rails of New York.

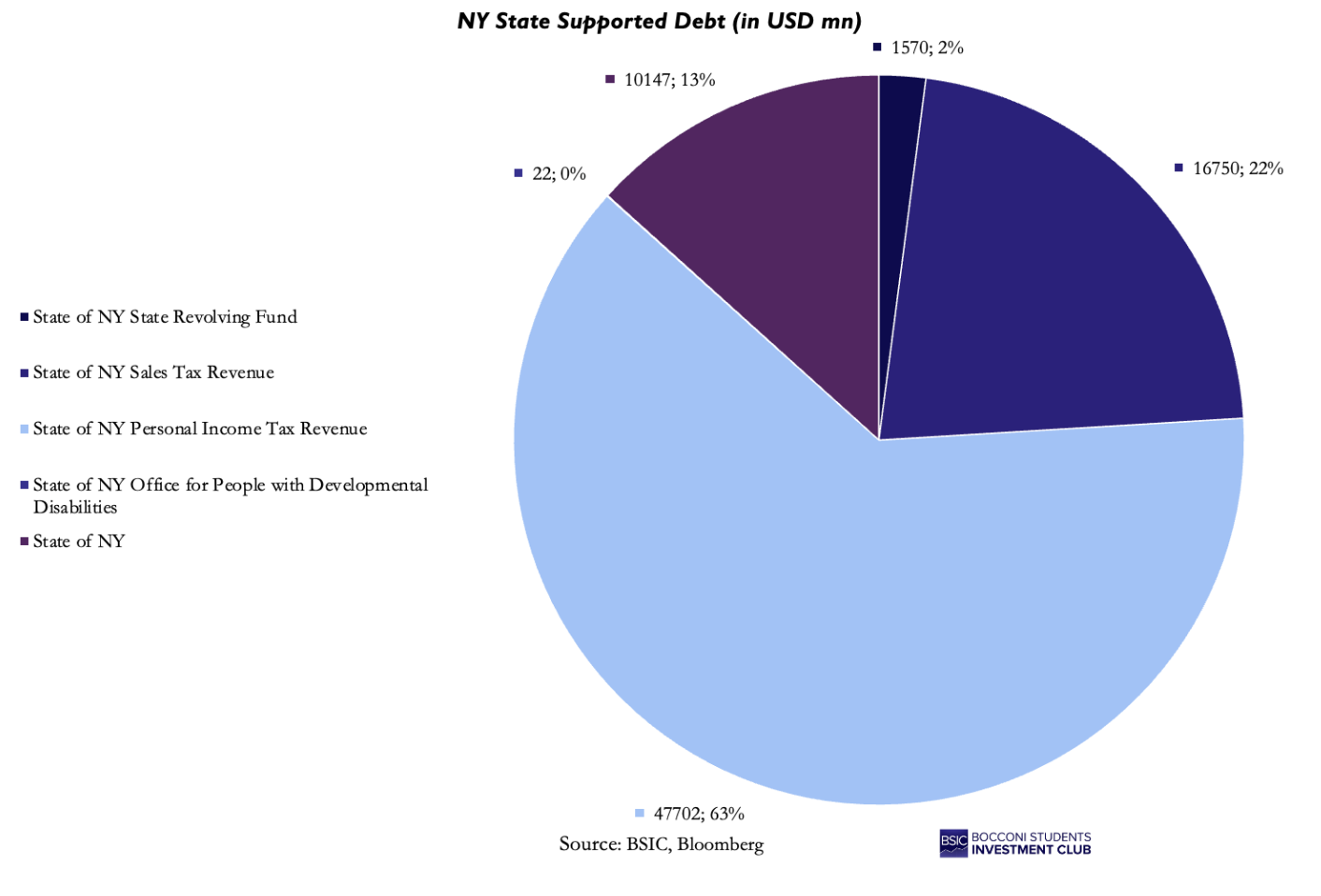

When looking at the debt composition for bonds supported by the state of New York, it stands out that, unlike most other states, New York relies heavily on dedicated tax structures, with the majority funded by personal income tax. While tax increases can often be a supportive factor for bond prices, in this case they are likely to be used either to finance new spending or to address fiscal challenges stemming from the Trump administration. Moreover, increasing income taxes could further concentrate the state’s revenue sources, reducing diversification and leaving bond payments more exposed to volatile financial markets and broader economic conditions, potentially worrying investors.

A decision by Governor Hochul to raise income taxes would therefore further increase the state’s reliance on personal income tax revenue to service its debt burden. Nonetheless, raising income taxes would likely still have a positive effect on New York municipal bonds, since interest earned from munis is exempt from federal, state, and local income taxes, commonly referred to as “triple-tax-exempt.” As a result, munis would become increasingly attractive to high-income New York residents. While we do not think Mamdani’s proposal to raise income taxes on the wealthy alone is likely to persuade the Governor, increasing pressure from Washington could still force her to make difficult fiscal decisions.

Looking ahead, it is difficult to determine precisely what Mamdani will do when he takes office in January next year. However, New York investors will certainly watch closely how the relationship between Mayor Mamdani and Governor Hochul evolves, as well as how attacks from Washington continue to pose challenges for the state of New York. The first milestone investors should keep an eye on will come at the start of Mamdani’s term. In January 2026, Zohran Mamdani will release his first budget proposal, the Preliminary Budget, which will aim to implement at least some of the radical policy pledges that defined his election campaign: free buses, universal childcare, a rent freeze for stabilized tenants, and new affordable housing. In February, he will go to Albany to advocate for these measures during the state legislature’s budget negotiations. To push them through, he will have to overcome the deep-seated anxieties about “overspending” that have long influenced the City’s budget process—anxieties that will be compounded by new risks to federal funding as Donald Trump threatens to wage financial warfare on the incoming administration.

While it remains extremely difficult to predict what the Preliminary Budget will look like and which policies, if any, Mamdani will be able to deliver, we remain very bearish on the promises he made throughout his campaign. The new Mayor will now have to face fiscal reality. While we see the possibility that Mamdani could implement one or two of his promises, given the difficult position of Governor Hochul, who needs Mamdani’s voters to succeed in next year’s election, we still believe that Mamdani will underdeliver on his pledges. Municipal bond investors should remain calm, monitoring whether the market overreacts to headlines. In fact, we believe that any increase in volatility and wider spreads, which have not yet materialized following his election, could represent a good buying opportunity for municipal investors.

References

[1] “Mamdani’s Promises are on a Collision Course with Fiscal Reality”, Bloomberg, 2025

[2] “Hochul Mulls Business Tax Hike to Fund Budget, Mamdani Plans”, Bloomberg, 2025

[3] “How can Zohran Mamdani change New York City?”, Financial Times, 2025

0 Comments