USA

This past week, the U.S. economy exhibited resilience as key data points underscored a mixed but stable environment. Housing starts fell by 3.1% month-over-month, reflecting continued challenges in the housing market, but initial jobless claims reached a seven-month low at 213,000, signaling strength in the labor market. As Thanksgiving festivities began, consumer behavior took center stage. Despite moderated sales growth projections of 2.5%-3.5% for the holiday season, inflation-adjusted spending is set to exceed last year, supported by positive real wage growth and bolstered consumer confidence. However, retailers remain cautious as elevated prices and diminishing pandemic-era savings constrain some households.

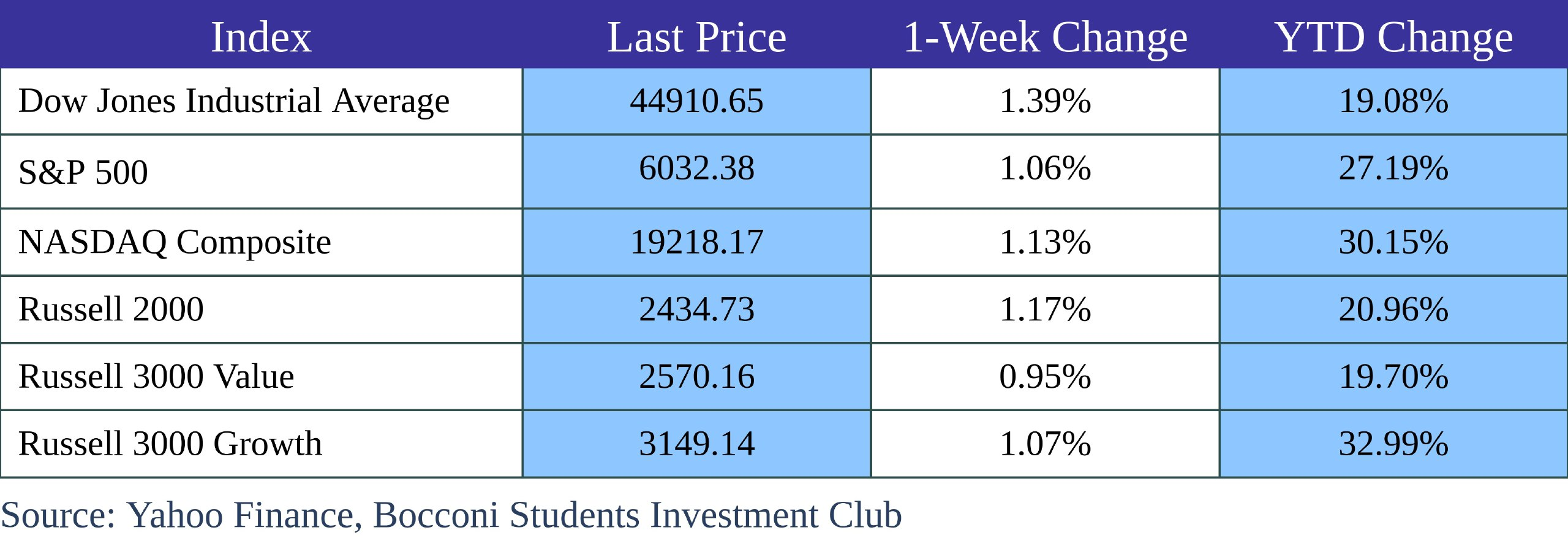

Equity markets displayed robust momentum, with the S&P 500 and NASDAQ indices achieving weekly gains of 1.06% and 1.13%, respectively, while The Dow Jones Industrial Average outperformed both, advancing 1.39% for the week. Small- and mid-cap stocks led performance over the past year, with indices such as the Russell 2000 reaching all-time highs for the first time since 2021.

Equity markets displayed robust momentum, with the S&P 500 and NASDAQ indices achieving weekly gains of 1.06% and 1.13%, respectively, while The Dow Jones Industrial Average outperformed both, advancing 1.39% for the week. Small- and mid-cap stocks led performance over the past year, with indices such as the Russell 2000 reaching all-time highs for the first time since 2021.

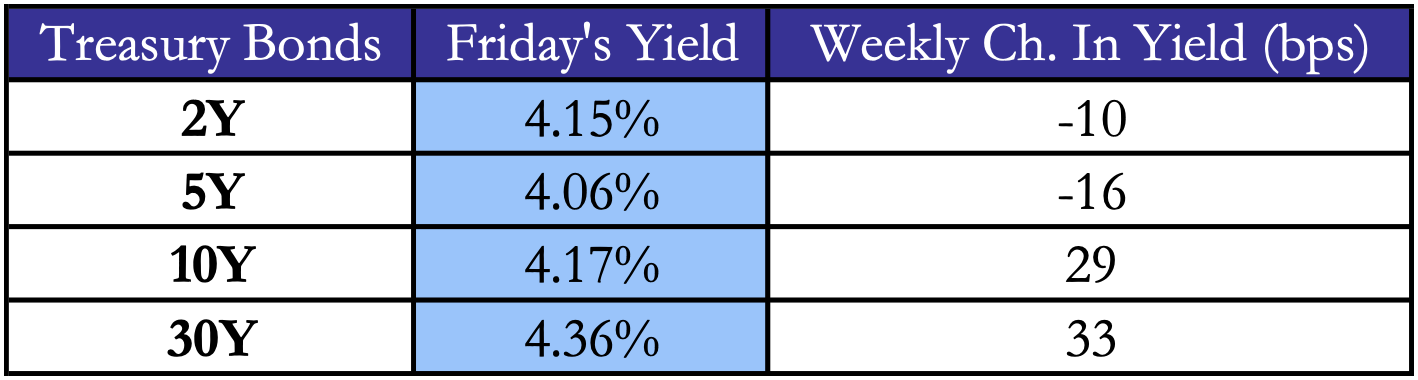

The bond market is navigating a dynamic landscape as central banks ease monetary policies to support growth. The 10-year U.S. Treasury yield closed at 4.15%, slightly lower for the week. Emerging-market debt has gained appeal over U.S. high-yield bonds due to its higher interest rate sensitivity and favorable valuations. Lower-quality bonds led gains in the fixed-income sector, highlighting the value of diversification in navigating volatile conditions.

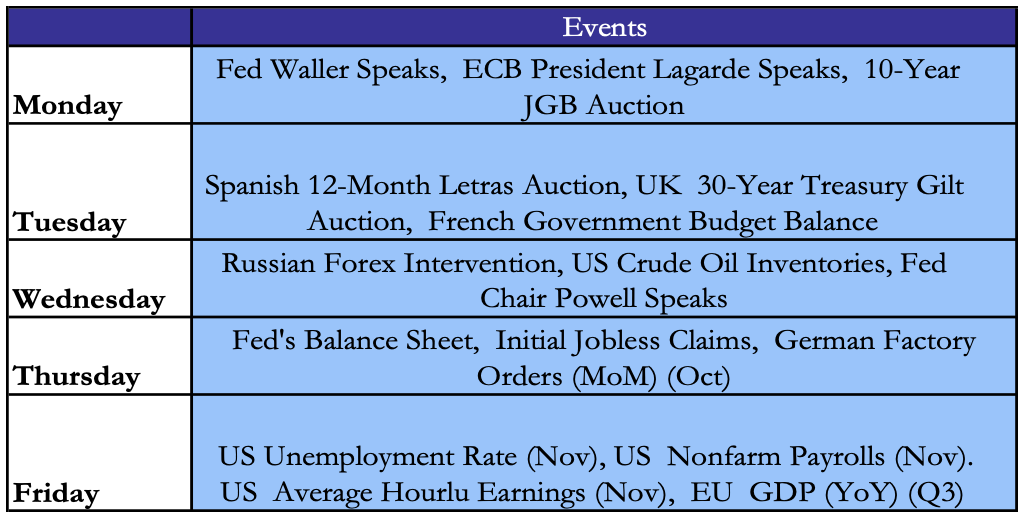

Looking ahead, the upcoming week features critical economic releases, including nonfarm payrolls and ISM PMI data, which could provide further clarity on labor market trends and manufacturing activity. Investors are encouraged to stay disciplined, utilizing rebalancing strategies to align portfolios with risk-return objectives. As the year winds down, maintaining diversified equity allocations and exploring opportunities in fixed-income investments, particularly in intermediate- and long-term bonds, will be key to capturing value in a complex economic environment.

Overall, the U.S. market continues to reflect a narrative of slowing yet resilient growth, supported by a well-positioned consumer base and adaptable corporate performance. These dynamics set a cautiously optimistic tone as markets transition into 2025.

Source: Yahoo Finance, Bocconi Students Investment Club

Europe and UK

In the UK, private renter households experienced the highest inflation rate among all household groups, with costs rising 3% year-on-year as of September, surpassing the 2.6% rate for mortgage holders. This marked the first instance since 2022 where renters faced the steepest increases, driven by surging rental prices, which rose at a record pace of 8.7% in the year to October. In contrast, outright homeowners saw inflation rates as low as 1%. These disparities underscore the varied impacts of inflation across demographic groups, reflecting broader structural issues in housing and rental markets.

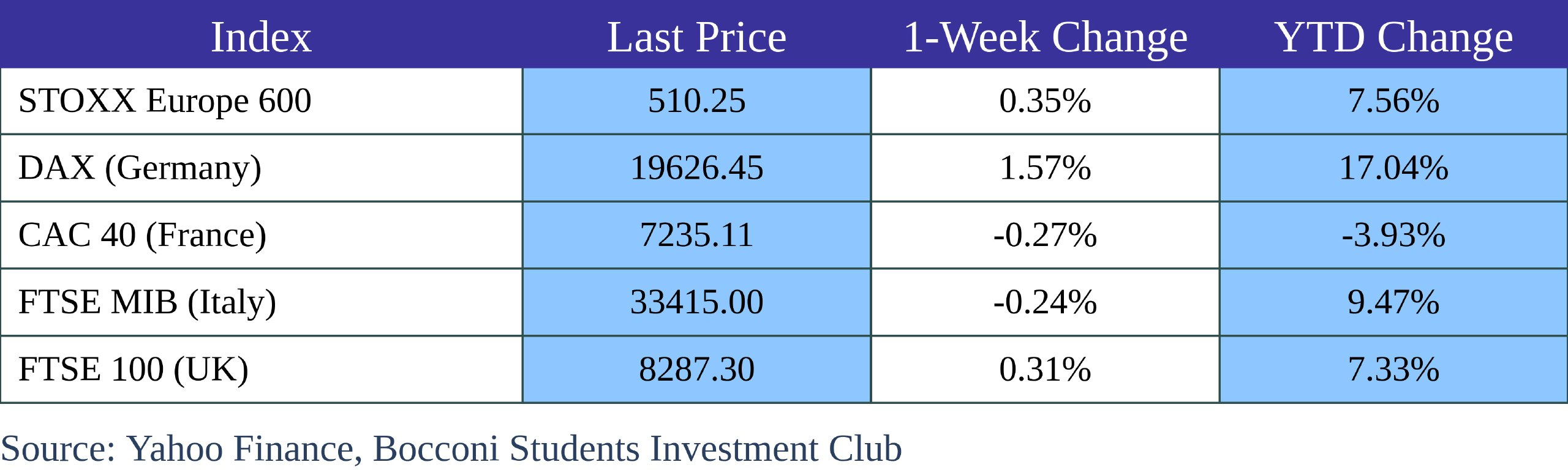

In the Eurozone, inflation rose to 2.3% in November, exceeding the European Central Bank’s (ECB) target for the first time in three months. However, economists attribute the rise to base effects rather than sustained underlying pressures. Core inflation, which excludes energy and food costs, held steady at 2.7%, signaling persistent stickiness in price levels despite recent reductions in energy prices.

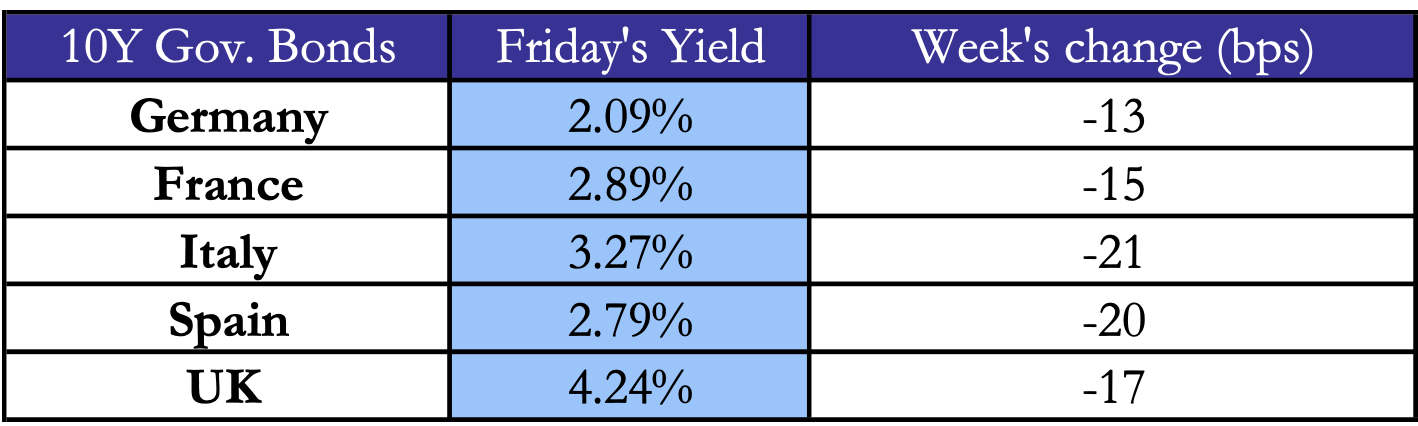

The Bank of England (BoE) has maintained a dovish stance, gradually cutting interest rates following a peak in mid-2023. Declining mortgage rates have offered some respite to homeowners, but renters remain exposed to increasing costs due to constrained housing supply and rising demand. Meanwhile, the ECB is pursuing aggressive rate reductions to combat stagnation, with a quarter-point cut to 3% expected in December. This contrasts with the more cautious Federal Reserve approach in the US, emphasizing the divergence in transatlantic monetary strategies.

Despite easing policy, UK financial markets are grappling with challenges. The London Stock Exchange (LSE) has faced notable delistings, with companies like Just Eat Takeaway opting out of secondary listings. Still, an uptick in initial public offerings (IPOs), including Vivendi’s Canal+ and Chinese fast-fashion group Shein, indicates potential recovery. New LSE rules designed to make listings more attractive could further bolster the domestic market.

Source: Yahoo Finance, Bocconi Students Investment Club

The UK economy shows mixed signals. While declining mortgage rates hint at improved affordability for homeowners, private renters bear the brunt of rising housing costs. Broader inflation trends suggest that wealthier households, who spend more on services, face relatively higher inflation, highlighting uneven economic pressures. Meanwhile, calls for greater domestic investment in UK equities persist, with pension funds seen as a potential source of capital to invigorate the stock market and support fledgling companies.

In the Eurozone, growth forecasts remain muted, with projections revised downward to 0.7% for 2024. Persistent economic weaknesses, including subdued business activity and a weakening euro, weigh heavily on the bloc’s outlook. Policymakers continue to grapple with balancing inflation control and growth stimulation, suggesting further monetary easing into 2025.

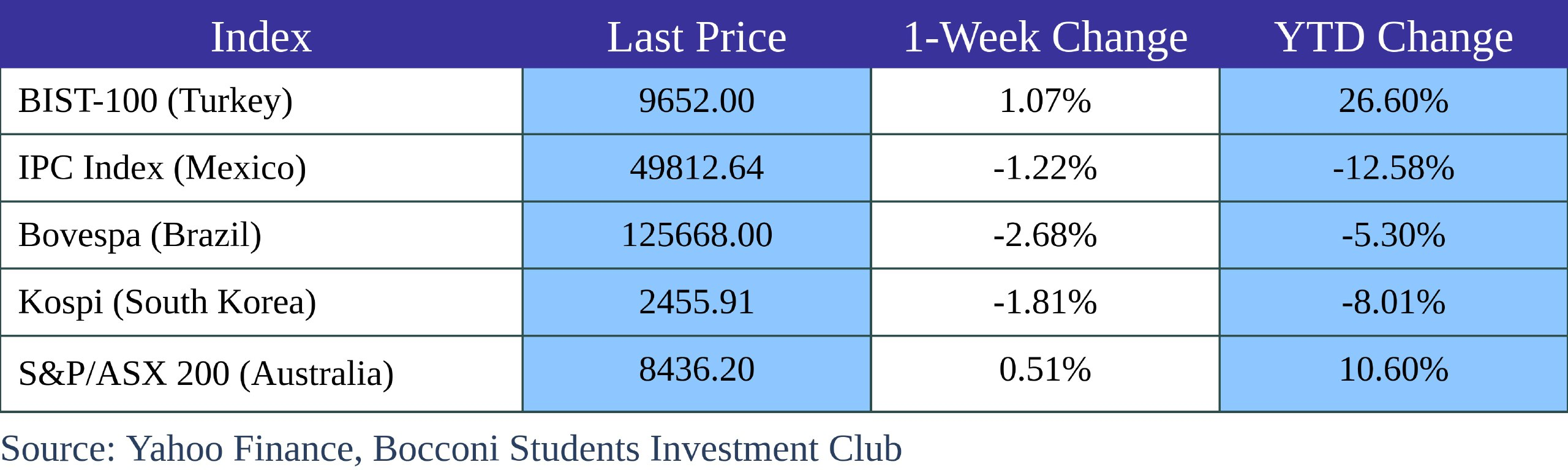

Rest of the World

This week, economic developments in South Korea and China underscored mounting challenges for major Asian economies grappling with domestic and global pressures. Trade-reliant South Korea faces increasing uncertainty from U.S. protectionist policies, while China’s persistent deflationary risks are reshaping its financial markets.

In South Korea, the Bank of Korea (BoK) took the rare step of cutting its benchmark interest rate for the second time in quick succession, lowering it by 0.25 percentage points to 3 percent. The move reflects growing concern over slowing growth, which the central bank now projects will reach just 2.2 percent this year, down from its earlier estimate of 2.4 percent.

BoK Governor Rhee Chang-yong framed the decision as an accelerated response to rising economic risks, including fallout from Donald Trump’s reelection and his administration’s pledge to impose tariffs on key U.S. trading partners. South Korea, which is projected to record its largest-ever trade surplus with the U.S. this year, finds itself at the center of Trump’s renewed focus on countries with significant trade imbalances. South Korea’s $28.7 billion surplus with the U.S. in the first half of 2024 raises the risk of retaliatory measures that could dampen the country’s export-driven economy.

Meanwhile, corporate sentiment in South Korea remains bleak. Twelve of 17 key industrial sectors reported declining profits in the third quarter, as businesses grapple with competitive pressures from Chinese exports and weak global demand. Currency dynamics are compounding these issues, with a strengthening U.S. dollar pushing up the cost of imports, particularly oil, and exerting inflationary pressure on the economy. Economists warn that prolonged inflation and the weakening of the South Korean won could constrain the central bank’s ability to implement further rate cuts, potentially stifling growth even further.

China, Asia’s largest economy, is also facing significant headwinds. For the first time, yields on 30-year Chinese government bonds have fallen below those of Japan, dropping to 2.21 percent compared to Japan’s 2.27 percent. This decline signals investor pessimism about China’s economic trajectory, with parallels being drawn to Japan’s “lost decades” of stagnation following the collapse of its real estate bubble in the 1990s.

Deflationary pressures in China continue to intensify, with core inflation in October rising by a mere 0.2 percent year-on-year. Despite Beijing’s efforts to stimulate growth through aggressive monetary easing and a ¥10 trillion ($1.4 trillion) fiscal package, bond yields have fallen as investors shift to safer assets amid weakening confidence in equities and real estate. U.S. trade policies are adding to the pressure, with President Trump’s proposed tariffs on Chinese goods expected to weaken China’s export sector further.

Chinese policymakers are taking measures to counter deflationary trends, intervening in bond markets to stabilize long-term yields and warning against a liquidity crisis. Authorities are also emphasizing structural investments in high-tech and green industries, aiming to bolster long-term economic resilience. However, analysts suggest that these efforts will require significant boosts to domestic consumption to escape the cycle of low demand and deflationary stagnation. For now, many investors remain skeptical that these measures will reverse the prevailing economic pessimism.

The challenges facing South Korea and China highlight broader vulnerabilities in Asia’s economic landscape. Both countries are highly exposed to global trade dynamics, leaving them susceptible to U.S. protectionism and the ongoing shift toward economic decoupling. South Korea’s reliance on exports and China’s struggle with deflation reflect the increasingly fragmented global economic environment, where countries face divergent pressures from inflation and stagnation.

For investors, the landscape suggests a sustained preference for safe-haven assets as uncertainties continue to cloud prospects for growth in the region. While policymakers in Seoul and Beijing scramble to stabilize their economies, the road ahead appears fraught with challenges, and the ripple effects of these developments are likely to shape global financial markets in the weeks to come.

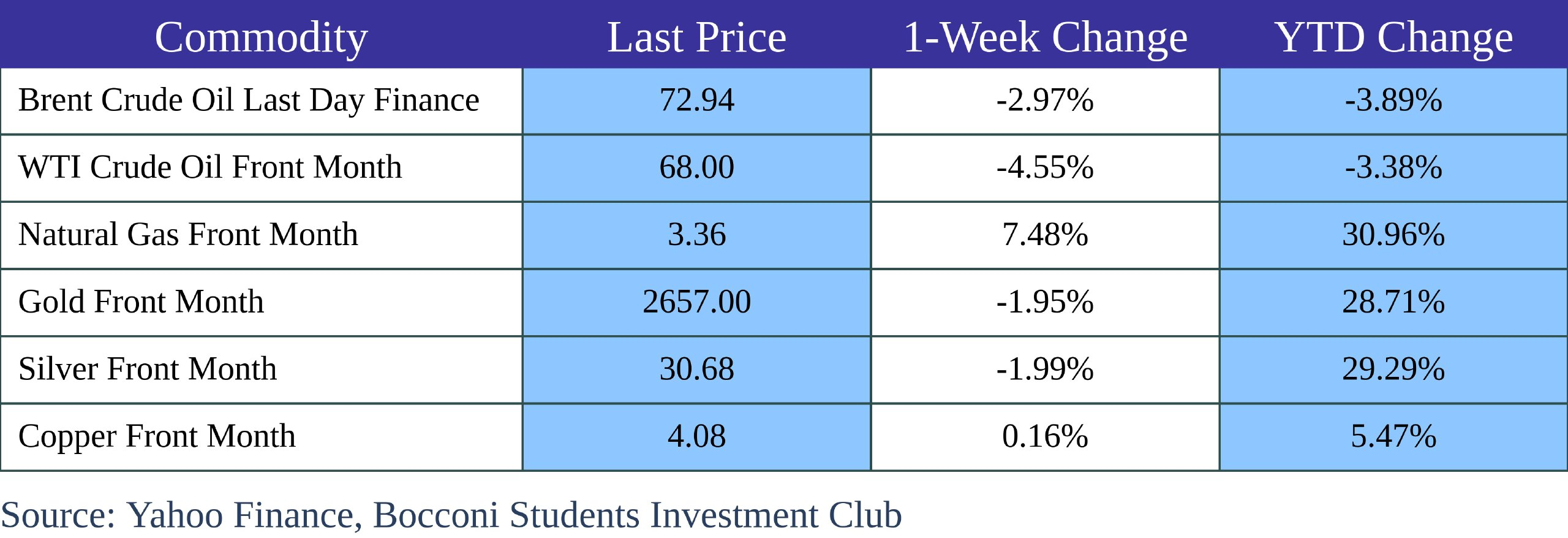

FX and Commodities

The past week in the financial markets underscored the intricate interplay of geopolitics, monetary policy, and trade disputes. Developments involving the yen, rouble, euro, and the broader global energy market highlighted both localized and systemic pressures shaping the global economy.

The yen briefly strengthened past ¥150 against the US dollar, buoyed by robust inflation data from Tokyo and expectations of a Bank of Japan (BoJ) interest rate hike in December. Tokyo’s core consumer price index rose 2.2 percent year-on-year, driven by surging costs of staples like rice. This week’s 3 percent appreciation of the yen, however, raises concerns that an overly rapid ascent might deter the BoJ from raising rates. Analysts caution that further yen strengthening, particularly beyond ¥146, could complicate Japan’s delicate monetary policy balance.

The Russian rouble tumbled to 107 per dollar, its weakest since the early weeks of Russia’s full-scale invasion of Ukraine. New US sanctions on Gazprombank, a key player in processing international gas payments, exacerbated the decline. The sanctions disrupted foreign trade and reduced foreign currency inflows, straining Russia’s trade balance. While a weaker rouble bolsters oil and gas revenues denominated in foreign currency, it also fuels inflationary pressures, complicating Moscow’s efforts to stabilize the economy. Seasonal import demands and relaxed rules on exporters’ foreign currency sales further weighed on the rouble.

The euro posted its worst monthly performance since May 2023, slipping 3 percent to $1.0575. Investor concerns over weak economic growth, political turmoil in Germany and France, and the prospect of US trade tariffs have dimmed the currency’s appeal. Expectations of aggressive rate cuts by the European Central Bank (ECB) have further widened the policy divergence with the Federal Reserve. While seasonal dollar outflows in December might provide temporary relief, the euro faces structural challenges, with hedge funds increasing their bets on further depreciation.

US President-elect Donald Trump’s proposal to impose a 25 percent tariff on Canadian and Mexican imports has sent ripples through the energy sector, raising alarms over potential disruptions to North American energy markets. Canadian oil producers, responsible for over half of US crude imports, warned that the tariffs would drive up gasoline prices for American consumers while threatening energy security. Analysts noted that US refineries, particularly on the west coast, rely on Canadian heavy sour crude, which cannot easily be replaced by domestic shale oil.

While the proposed tariffs may align with Trump’s broader trade policies, they risk undermining the deeply integrated supply chains established under the USMCA. Canadian and Mexican currencies reacted sharply to the announcement, with the peso shedding 2.3 percent and the Canadian dollar hitting a four-year low. The American Fuel and Petrochemical Manufacturers association cautioned that the tariffs could inflate import costs, reduce accessible oil supplies, and provoke retaliatory measures, ultimately harming US consumers and refiners.

The intersection of forex volatility, trade disputes, and energy dynamics underscores the interconnected nature of global markets. With currencies like the yen, rouble, and euro responding to diverse pressures, and trade policies threatening to disrupt established supply chains, the coming months are likely to remain volatile. Policymakers and market participants must navigate these challenges with a careful balance of strategy and adaptability.

Next Week Main Events

Brain Teaser #27

You are standing at the center of a circular pond with a radius of 100 meters. A crocodile is on the edge of the pond and can run 4 times as fast as you can swim. However, you can run faster than the crocodile on land. The crocodile is hungry and will always move directly toward you in the shortest path possible (straight-line motion). You want to escape to the edge of the pond and then run to safety on land. What is your strategy to ensure you escape, and how far must you swim to guarantee that you reach the edge of the pond safely?

Solution

As we know the crocodile is four times faster than the human. Let the human rotate around the pond in a circle of radius R/4. Since the crocodile is four times faster but travels the full circumference, it matches the human’s angular speed while staying on the pond’s edge. By carefully adjusting the circular swimming, the human creates an angular gap so that the crocodile is more than half the circumference away from the target escape point on the pond’s edge. At this moment, the human swims in a straight line to the edge, as the crocodile cannot intercept in time. Once on land, the human runs faster than the crocodile and escapes safely, with the total swimming distance being slightly more than 100 meters.

Brain Teaser #28

You and your colleagues know that your boss A’s birthday is one of the following 10dates:

- Mar 4, Mar 5, Mar 8

- Jun 4, Jun 7

- Sep 1, Sep 5

- Dec 1, Dec 2, Dec 8

A told you only the month of his birthday, and told your colleague Conly the day. After that, you first said: “I don’t know A’s birthday; C doesn’t know it either.” After hearing what you said, C replied: “I didn’t know A’s birthday, but now I know it.” You smiled and said: “Now I know it, too.” After looking at the 10 dates and hearing your comments, your administrative assistant wrote down A’s birthday without asking any questions. So what did the assistant write?

0 Comments