USA

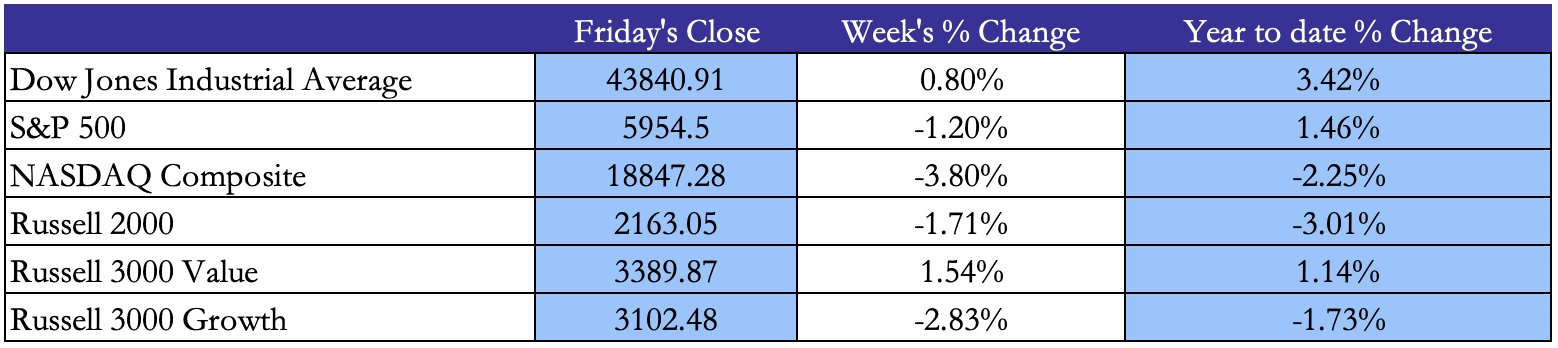

Most stock indexes ended the week on a negative note, although the Russel 3000 Value finished 1.54% higher and the Dow Jones Industrial Average finished 0.80% higher. The NASDAQ and Russel 3000 Growth index significantly underperformed the market, predominantly driven by regulatory uncertainty and concerns of the AI rally slowing down. Tariff fears have also had an effect on US equities and have triggered retaliation warnings from China.

NVIDIA shares, who released their results after the closing bell on Thursday, plunged 8.5%. The company reported jumps in revenue and profit, which exceeded analysts’ estimates, amid booming demand for its AI chips, though market participants appear to have been hoping for more. Other chip stocks fell in tandem with Nvidia. Broadcom (AVGO), Marvell Technology (MRVL), ON Semiconductor (ON) and Micron Technology (MU) all posted steep declines, and the iShares Semiconductor ETF (SOXX) dropped nearly 6%.

Additionally this week, President Donald Trump announced that 25% tariffs on goods imported from Canada and Mexico, which would go into effect on Tuesday, alongside yet another 10% layer of duties on China following one that went into effect this month. Trump also spoke about reciprocal tariffs on major trading partners, which he threatened earlier this month, and are scheduled to take effect 2nd April.

Source: Yahoo Finance, Bocconi Students Investment Club

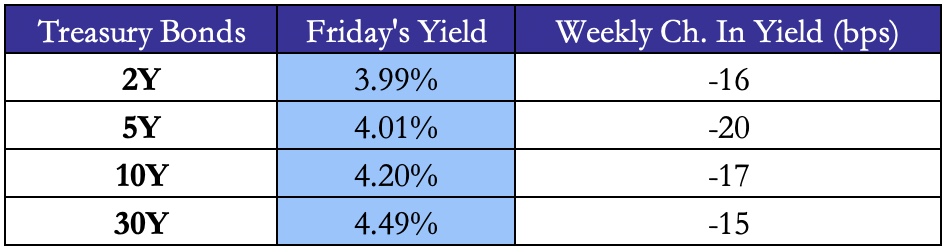

In the rates market, U.S. Treasury bonds produced positive returns as yields declined across all maturities. Intermediate-term yields fell more sharply than short and long-term, with the 5Y yield dropping -20bps throughout the week.

The PCE price index rose 0.3% in January but dropped to 2.6%, from 2.9%, according to December’s YoY reading. The Conference Board’s Consumer Confidence Index tumbled 7 points in February to 98.3, its steepest monthly drop since August 2021.

Additionally, weekly unemployment claims reached 242,000, the highest since October, although continuing claims edged lower to 1.86 million. Furthermore, the president reiterated the goal to balance the US budget, throughout his term, despite the current national deficits near to the 7% to GDP mark. Collectively, these factors have raised expectations of steep rate cuts throughout the market.

Source: Yahoo Finance, Bocconi Students Investment Club`

Europe and UK

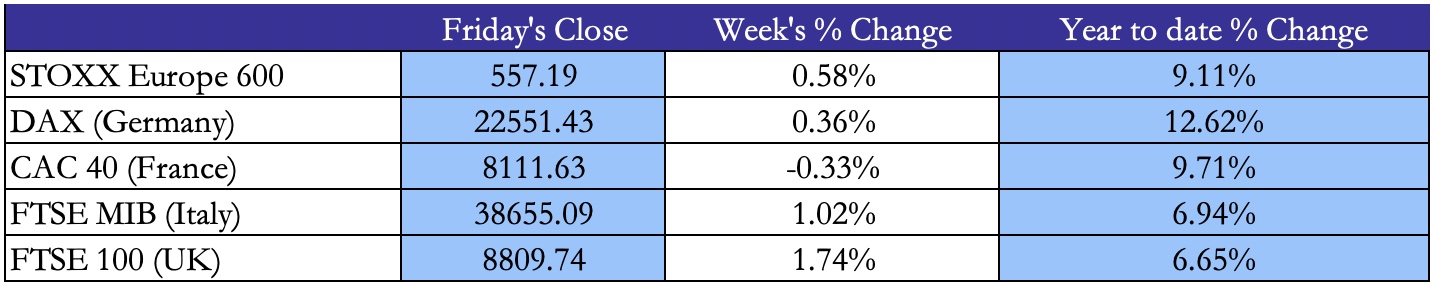

In the Eurozone, we saw a strong performance across almost all major stock indexes, particularly in the UK with the FTSE 100 rallying 1.74%. This was followed by the Italian FTSE MIB rallying 1.02% and the pan-European STOXX Europe 600 Index ending 0.58% higher, posting its longest streak of weekly gains since August 2012. The top performing stocks in Europe were defense stocks, and similar to the US, The Stoxx Technology index was the worst performer, falling 1.5% as it felt the knock-on effects from Thursday’s sell-off of chipmaking giant Nvidia.

Preliminary February data from Germany, France, and Italy presented a mixed picture for inflation. Germany’s inflation rate remained at 2.8%, beating the consensus estimate of 2.7%. In Italy, annual consumer price growth held steady at 1.7%, in line with forecasts. Meanwhile, France’s inflation rate dropped from 1.8% to a four-year low of 0.9%. However, the ECB minutes highlight that inflation concerns still exist.

Minutes from the European Central Bank’s (ECB) January meeting indicated that policymakers remain optimistic about inflation returning to the 2% target but noted “some evidence suggesting a shift in the balance of risks to the upside since December.” Several officials called for “greater caution” regarding the scope and pace of further rate cuts. Nonetheless, a survey showed that consumers’ one-year and three-year inflation expectations eased in January, indicating that inflation expectations are still well-anchored.

Gross domestic product (GDP) estimates confirmed that Germany’s economy shrank 0.2% in last year’s fourth quarter, while France’s shrank 0.1%.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

In the EU rates market, bond yields tightened across all major countries. The UK’s 10-year gilt yield fell below 4.5%, the lowest in two weeks, as traders weighed US trade policies and Bank of England (BoE) signals. German yields dropped to 2.39% as traders weighed escalating trade tensions, key economic data, and the upcoming ECB monetary policy decision. Italian yields dropped below 3.5% amid rising trade tensions and the prospect of increased military spending in Europe.

Source: Yahoo Finance, Bocconi Students Investment Club

Rest of the World

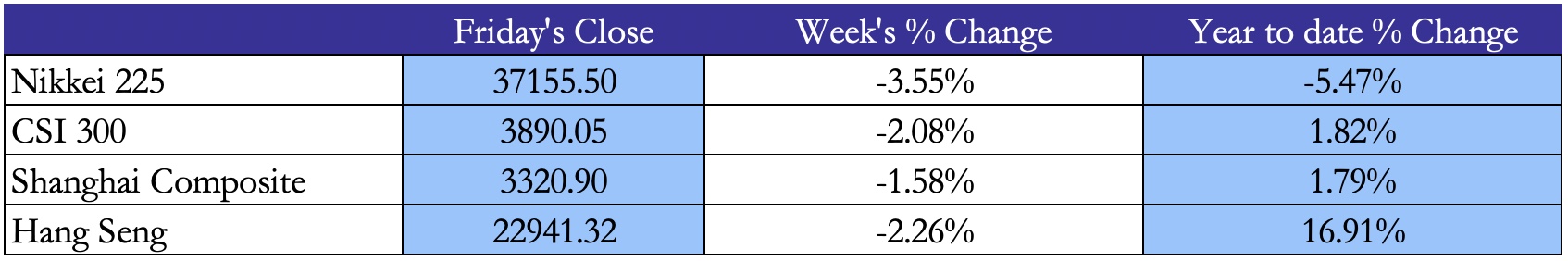

Japan’s stock market declined over the week, with the Nikkei 225 down -3.55%. Domestic chip and AI stocks led the losses, mirroring the sell off in US tech. Furthermore, Concerns grew over additional U.S. tariffs on Chinese imports and how they might affect Japan’s economic outlook and the Bank of Japan’s (BoJ) monetary policy path. BoJ Governor Kazuo Ueda highlighted uncertainties around the global impact of these U.S. measures, noting the central bank would factor such risks into its policy decisions. He also reiterated the BoJ’s willingness to increase JGB purchases if yields rose abnormally.

On Friday, the Shanghai Composite dropped 1.58% to 3,320. The index ended the week with a notable loss after U.S. President Donald Trump imposed an additional 10% tariff on Chinese imports, set to begin on March 4. The rising tariffs are expected to weigh heavily on China’s export-driven economy. Meanwhile, investor sentiment was further dampened ahead of next week’s “Two Sessions,” where the Chinese government will detail its policy plans for the coming year. A major point of interest will be the specifics of any fiscal stimulus aimed at bolstering economic growth.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

Turkey’s BIST 100 index fell to 9659 this week and has experienced a -2% decline since the start of year as concerns of lower growth and higher inflation weighed against expectations of lower monetary policy by the central bank. Inflation slowed less than expected in January, threatening the view that the central bank was due to deliver sharp interest rate cuts in most, if not all, of the meetings in the rest of the year. The TCMB cut its interest rates by 250bps in its January meeting, as largely expected by markets, and noted that monetary policy will remain tight to aid the disinflation process and prevent inflation expectations from rising toward an unsustainable path.

The Bovespa index dropped -3.41% this week as escalating trade tensions fueled risk-off sentiment toward Brazilian equities ahead of Carnival. Most stocks traded lower, with major banks, including Banco do Brasil, Santander, Itaúsa, and Bradesco, falling between 2.1% and 3.7%.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

FX and Commodities

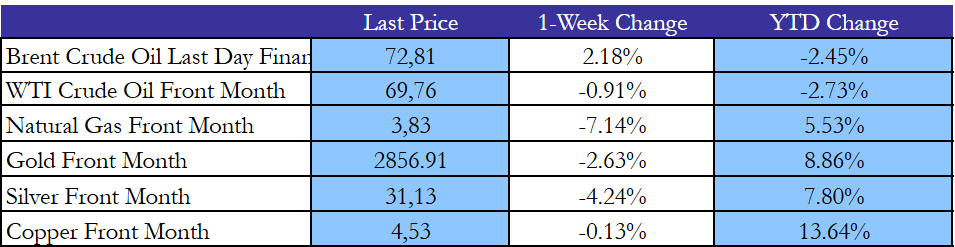

WTI crude oil futures lost 0.8% to settle at $69.76 per barrel on Friday, marking their first monthly decline since November due to geopolitical tensions and economic uncertainty. The drop followed a heated argument between U.S. President Donald Trump and Ukrainian President Zelenskiy, which added concerns about the Russia-Ukraine conflict. Traders were also unsettled by Trump’s announcement of new tariffs on Mexican, Canadian, and Chinese goods, raising fears of weaker global demand. Uncertainty grew as investors tried to interpret the impact of the U.S. administration’s energy policies. At the same time, Iraq planned to restart oil exports from Kurdistan, but international firms hesitated due to unresolved payment agreements.

Regarding metals, gold fell toward $2,850 per ounce, heading for its biggest weekly drop since November, amid a stronger dollar and as markets have continued to price in only two Fed rate cuts this year as inflation remains above the 2% target. The latest data showed PCE prices rose 0.3% month-over-month in January, in line with expectations, while the annual rate eased to 2.5% from 2.6% in December.

US natural gas futures fell nearly 3% to below $3.85 per MMBtu, hitting a two-week low, driven by record production levels and forecasts for milder weather, which are expected to reduce heating demand. Despite the decline, extreme cold earlier in the year led to significant withdrawals from storage, leaving inventories 12% below the five-year average.

April front-month gas futures on the New York Mercantile Exchange fell 10.0 cents, or 2.5%, settling at $3.834 per million British thermal units (MMBtu), the lowest since February 14. The price drop occurred even as strong liquefied natural gas (LNG) exports continued. For the week, the front-month contract dropped 9%, following a 39% surge in the previous three weeks, but rose about 26% for the month, after a 16% decline in January.

Source: Yahoo Finance, Bocconi Students Investment Club

The euro weakened to $1.04, briefly touching its lowest level since February 12th, as investors assessed economic data ahead of next week’s European Central Bank policy meeting and reacted to US President Donald Trump announcing that a 25% tariff on Mexican and Canadian goods will take effect Tuesday, along with an additional 10% duty on Chinese imports. The ECB is widely expected to cut interest rates for a fifth consecutive time on Thursday and signal further reductions amid slowing inflation and weak economic growth.

The Japanese yen strengthened to around 149.4 per dollar on Friday and was on track to gain nearly 4% for February, supported by strong expectations that the Bank of Japan will continue to raise interest rates this year. Despite some mixed results in the latest economic reports, Japan’s economy and the trends in inflation and wages continued to support the central bank’s policy normalization efforts.

Data released on Friday showed that Tokyo’s core inflation, a leading indicator of nationwide price trends, slowed to 2.2% in February from 2.5% in January. However, it remained above the BOJ’s 2% target for the fourth consecutive month. Meanwhile, US President Trump’s escalating tariffs could pose risks to Japan’s economic outlook, prompting caution about further rate hikes.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

Next Week Main Events

Source: Trading Economics, Bocconi Students Investment Club

Source: Trading Economics, Bocconi Students Investment Club

Brain Teaser #30

Three lightbulbs are installed in a room with no windows. You’re standing outside the room, in front of three switches, each of which controls one of the lightbulbs. So, if you only have one chance to enter the room, how are you supposed to figure out which switch controls which lightbulb?

Solution:

Here’s the approach:

- Turn on switch 1 and leave it on for a little while (long enough for that bulb to heat up).

- Turn off switch 1 and turn on switch 2 just before you enter the room.

- Leave switch 3 off the whole time.

When you enter the room:

- The lit bulb will be controlled by switch 2 (because it’s on).

- Among the unlit bulbs, the one that is still warm to the touch will be controlled by switch 1.

- The cold, unlit bulb corresponds to switch 3.

This way, each bulb can be identified by its state (on, warm, or off and cold).

Brain Teaser #31

You have 9 identical-looking coins, but you know one of them is a counterfeit coin that weighs 1 gram less than the others (for instance, the real coins each weigh 10 grams, and the counterfeit weighs 9 grams). You also have a digital scale that can tell you the exact total weight you put on it, but you are only allowed to use it once. After that single weighing, you must identify which coin is fake. How can you design that one weighing so that the exact total reading tells you which coin is the counterfeit?

0 Comments