USA

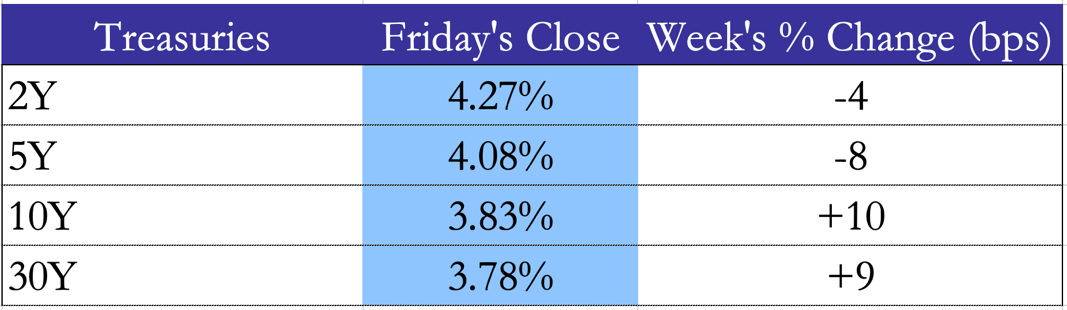

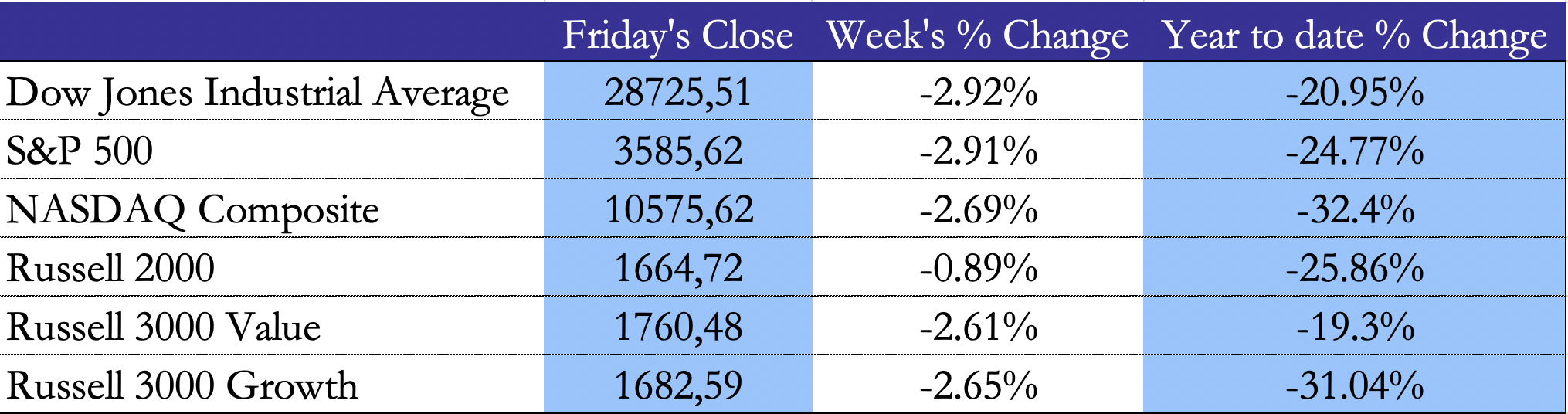

The S&P 500 touched the lowest levels since December 2020 this week, reaching an 8% loss MoM. The 10-year Treasury yield reached a 12-year-high, approaching 4%. On Thursday, the S&P 500 closed at -2.1%, due to the fear of additional rate hikes, driven by higher-than-expected employment data. The airline industry heavily suffered from the cancellation of 2000 flights due to the hurricane Ian, with the most important stocks in the sector losing as much as 5% on Thursday.

Goldman Sachs is shifting to a more bearish attitude towards equities in the short term, due to the current environment of rising real yields. The investment bank, according to which the market-implied probability of recession is 40%, downgraded equities to underweight, while staying overweight on cash. Other companies, such as BlackRock, Morgan Stanley, and JPMorgan Asset Management, are sharing the same view.

For the first time in a decade, US home prices are falling, according to the S&P CoreLogic Case-Shiller index. San Francisco had the biggest MoM decline, of about 3.6%. The decrease in sales is caused by the increase in mortgage rates, which doubled this year, reaching 6.7%, the highest level since 2007.

Europe and UK

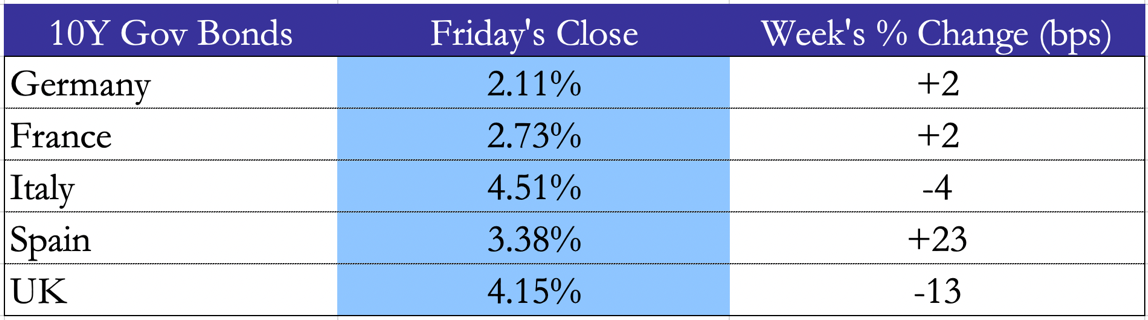

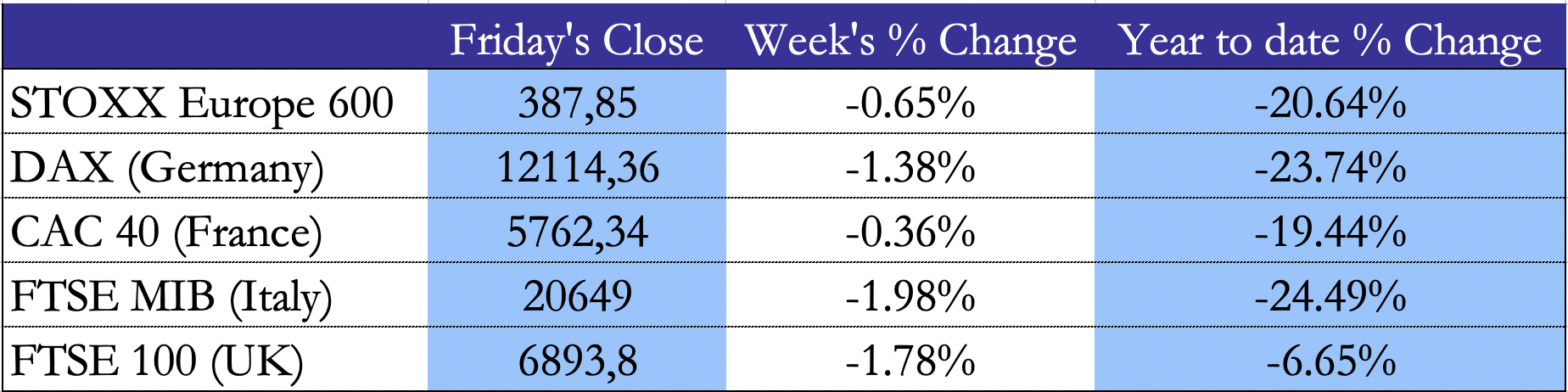

All the spotlight is on the United Kingdom. UK PM Liz Truss has recently announced a £105 billion stimulus package, which consists of tax cuts on income and company taxes (£45 billion), as well as a plan to reduce energy prices (£60 billion). Both measures would be funded by £70 billion of additional debt, which equals between 4% and 7.5% of GDP over the next two years. At the same time, the package is estimated to only lead to a fiscal impulse of 1.6% of GDP. Markets started to panic: the BoE terminal rate for Dec22 rose by 100bps to 4.6%, 10Y Gilts rose by 70bps to 4.2%, and the Sterling touched a 37-years-low against the US Dollar on Tuesday, falling as low as $1.035 on Monday. The BoE reacted by announcing unlimited purchases of long-dated government bonds, temporarily calming Gilt markets. It is still to be seen whether this situation will have an impact on the government’s stability.

The European Union is considering to endorse the German proposal to ban European citizens from having high profile positions in Russian state-owned companies. Moreover, shipping restrictions will likely be included in the next package of oil sanctions. Meanwhile, the London Metal Exchange plans to ban trading of Russian metals, including aluminum, nickel, and copper.

Starting from Tuesday, several explosions damaged the two North Stream gas pipelines, causing the leakage of ca. 800 million cubic meters of gas. In order to respond to this event and to the energy crisis in general, the Chancellor of Germany, Olaf Scholz, announced on Thursday a €200 billion relief package to lower gas and energy prices. Consequently, the TTF Gas Futures lost dropped by around 10%. Nevertheless, this initiative raised some concerns by the European partners, with the Italian PM Mario Draghi blaming Germany for its opposition to a European price cap. On Saturday, gas supplies to Italy were halted by Gazprom PJSC, apparently due to regulatory issues.

On Monday evening, the Italian elections results were released. As expected, Giorgia Meloni’s party, Brothers of Italy, won the elections, and the center-right coalition managed to secure a parliamentary majority, by getting 43% of the votes. Meloni is set to become the first female PM, leading the most right-wing government of the Italian Republic. The 10Y BTP-Bund spread hit 258bps on Wednesday, gaining ca. 11.6% with respect to the last trading day before the elections.

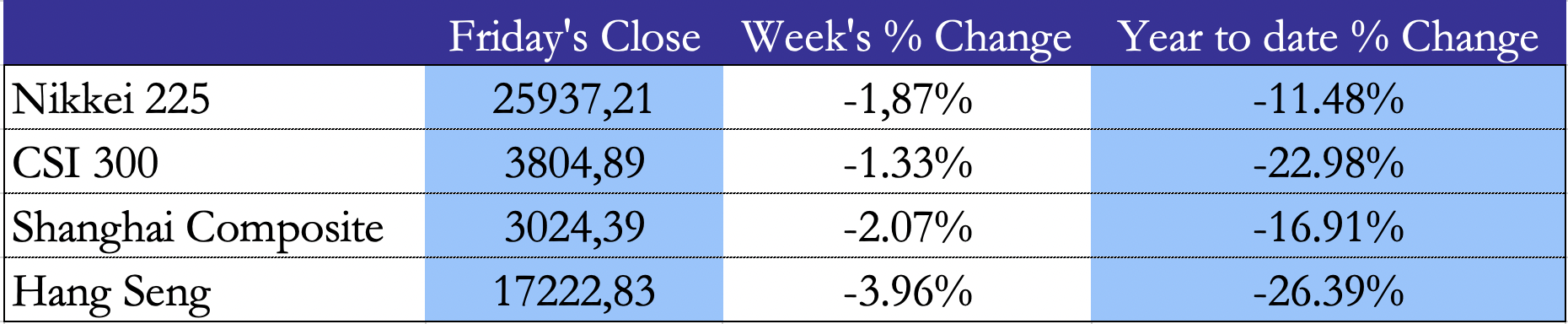

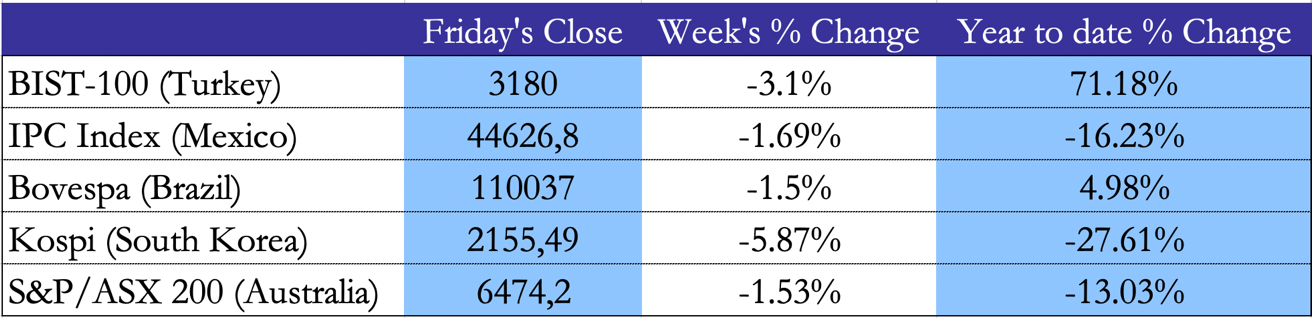

Rest of the world

At the beginning of the week, China released economic data, including car and home sales, that show a recovery after the contraction of the second quarter. Moreover, the manufacturing PMI print came in at 50.1, above expectations. Nevertheless, due to political conflicts with the US government and the drastic effects of zero-COVID policy, Apple decided to shift its iPhone 14 production from China to India, which is currently the world’s second-biggest mobile phone maker, and managed to kick off its 5G network this week.

Japan is set to reopen its borders to overseas visitors starting from October 11. The country, whose tourism sector has strongly suffered due to the pandemic, can now offer many affordable investments opportunities, given the weakness of the currency. However, it will likely take some time to go back to the pre-pandemic levels of visitors, when the spending by inbound traveler was ca. $33 billion.

Tensions over Ukraine have escalated during the week, with the Russian president Vladimir Putin officially announcing the annexation of four occupied regions in Ukraine (ca. 15% of land area) on Friday. The move constitutes the biggest land grab in Europe since World War II. The political implications of the move are still to be seen with the biggest concern being the use of nuclear weapons by the Russian regime to defend the illegally annexed regions. Meanwhile, Ukraine formally applied to become a NATO member on Friday, despite the alliance expected to react cautiously to this move.

FX and Commodities

Asian currencies, such as the Yen and Yuan, are suffering from the strengthening of the dollar, due to the dovish attitude of the Japanese and Chinese central banks with respect to the FED. On Monday, the Yuan reached its 14-years-low, trading at 7.2 per dollar. On the same day, the PBOC imposed a reserve requirement of 20% on banks’ FX sales to clients, while reducing banks’ FX reserve requirements, but these actions were not sufficient to substantially strengthen the currency.

On Monday, the Pound dropped as low as $1.03, and analysts at banks, namely Morgan Stanley and Nomura, are expecting it to reach parity before the end of the year. The market-implied probability of this event is currently about 60%. This drop, which was already underway due to the rise of the dollar, was intensified by the announcement of tax cuts by the UK government.

Commodities prices slumped due to the global economic outlook and the strengthening of the dollar. On Wednesday, most commodities, from copper and gold to aluminum, were red. WTI settled below $80 per barrel on Friday, reaching a 25% decrease from the beginning of the quarter. The OPEC Committee announced its concern about the situation, and it committed to implement an output cut, if it would be necessary to sustain higher oil prices.

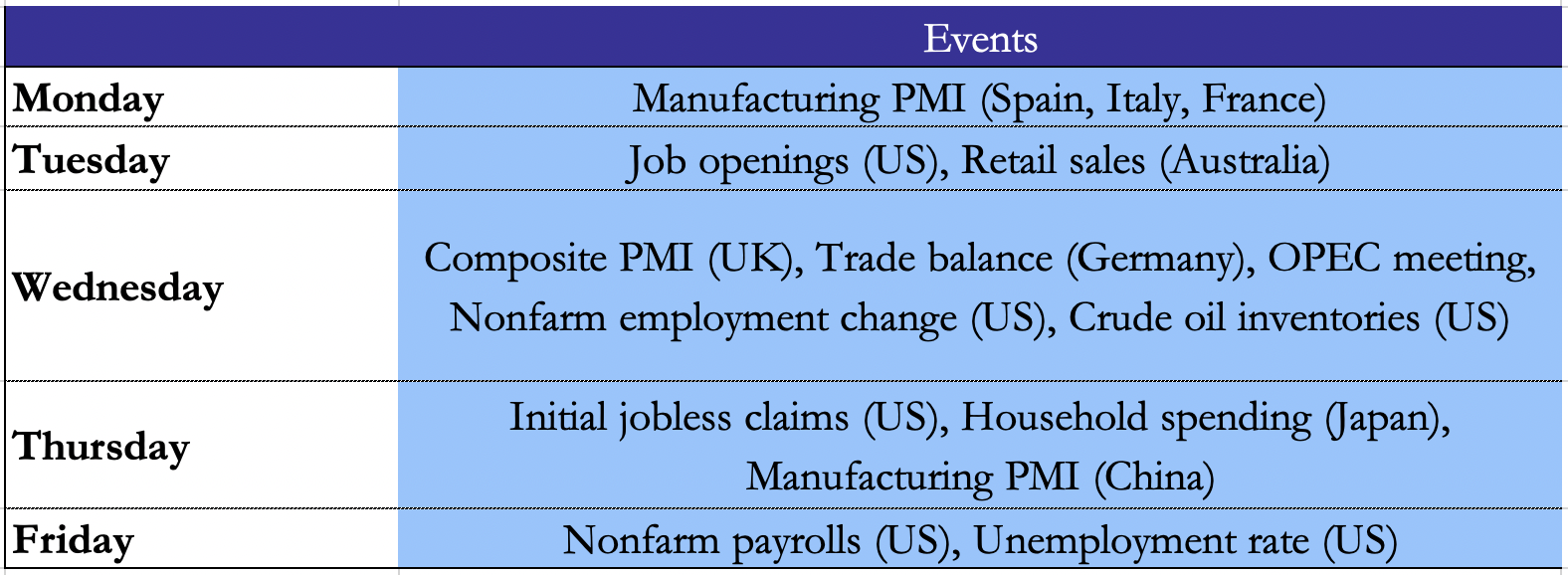

Next week main events

The most important prints of next week are the US Nonfarm Payrolls, Initial Jobless Claims, and Unemployment Rate, which are respectively forecasted at 250k, 200k and 3.7%. The Manufacturing PMI of Italy, France, Germany and Spain will be released on Monday, followed by the Chinese one on Thursday. Regarding commodities market, the US Crude Inventories will be released on Wednesday, and an OPEC meeting will be held on the same day. The latter will be fundamental to understand how the OPEC organization will act to control oil prices.

Brain Teaser #26

Two people play the following game: there are 40 cards numbered from 1 to 10 with 4 different signs. At the beginning, they are given 20 cards each. Each turn one player either puts a card on the table or removes some cards from the table, whose sum is 15. At the end of the game, one player has a 5 and a 3 in his hand, on the table there’s a 9, and the other player has a card in his hand. What is its value?

Problem source: ITAMO 2006 Q1

Solution: To solve the problem we can use the following equation:

![]()

where is the card the other player has in his hand.

![]()

Therefore, we can easily deduce that ![]()

Brain Teaser #27

Two squares of a ![]() checkerboard are painted yellow, and the rest are painted green. Two color schemes are equivalent if one can be obtained from the other by applying a rotation in the plane board. How many inequivalent color schemes are possible?

checkerboard are painted yellow, and the rest are painted green. Two color schemes are equivalent if one can be obtained from the other by applying a rotation in the plane board. How many inequivalent color schemes are possible?

Problem source: AIME 1996

0 Comments