USA

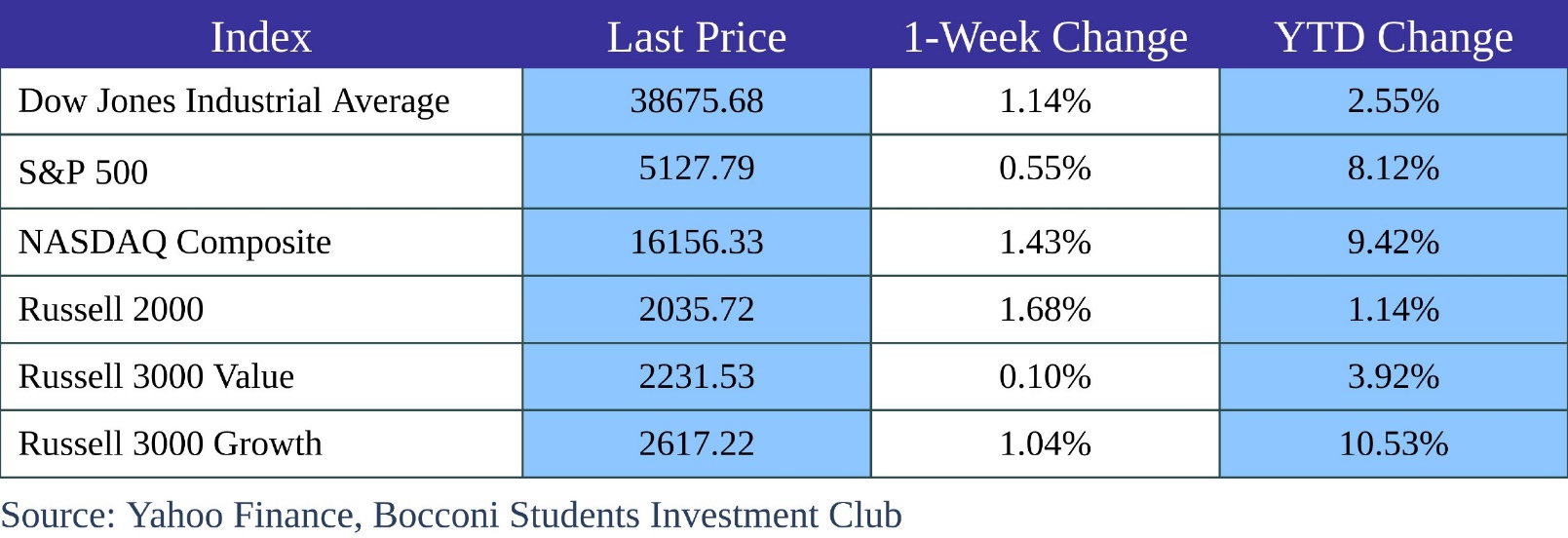

Despite a week marked by volatility in the markets, stocks closed higher, showcasing resilience amidst economic fluctuations. Notably, growth stocks surpassed value shares, contributing to the overall positive sentiment. Small-cap companies outshone their large-cap counterparts, propelling the Russell 2000 Index back into positive territory for the year-to-date period. A surge in market optimism followed Apple’s earnings release, bolstered further by the announcement of its historic USD 110 billion share buyback program, the largest in history. Additionally, Tesla experienced a significant surge, driven by founder Elon Musk’s appearance in China and news of tentative government approval for the company’s self-driving technology. The rally in stocks was partly attributed to indications of easing wage pressures, as revealed by the nonfarm payrolls report, which showed a modest increase in jobs for April, albeit below expectations. Notably, wage growth slowed unexpectedly, suggesting a potential alleviation of inflationary concerns. This news provided a counterbalance to earlier worries over emerging stagflation trends, exacerbated by mixed economic data throughout the week.

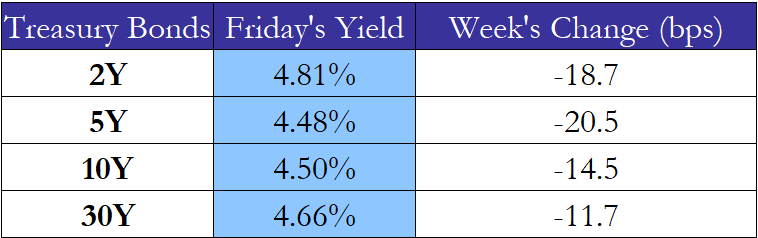

For the sixth consecutive meeting, the Federal Reserve unanimously voted to keep the benchmark interest rate unchanged within the range of 5.25%-5.5%, highlighting that the cost of money will likely remain higher for longer. The Federal Open Market Committee observed no further progress towards the 2% inflation target recently. Expectations for rate cuts in 2024 and 2025 have sharply declined since the last FOMC meeting, and now the market only expects two possible 25 basis point cuts in 2024, which, according to the CME Fedwatch Tool, are projected for the September and December meetings.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

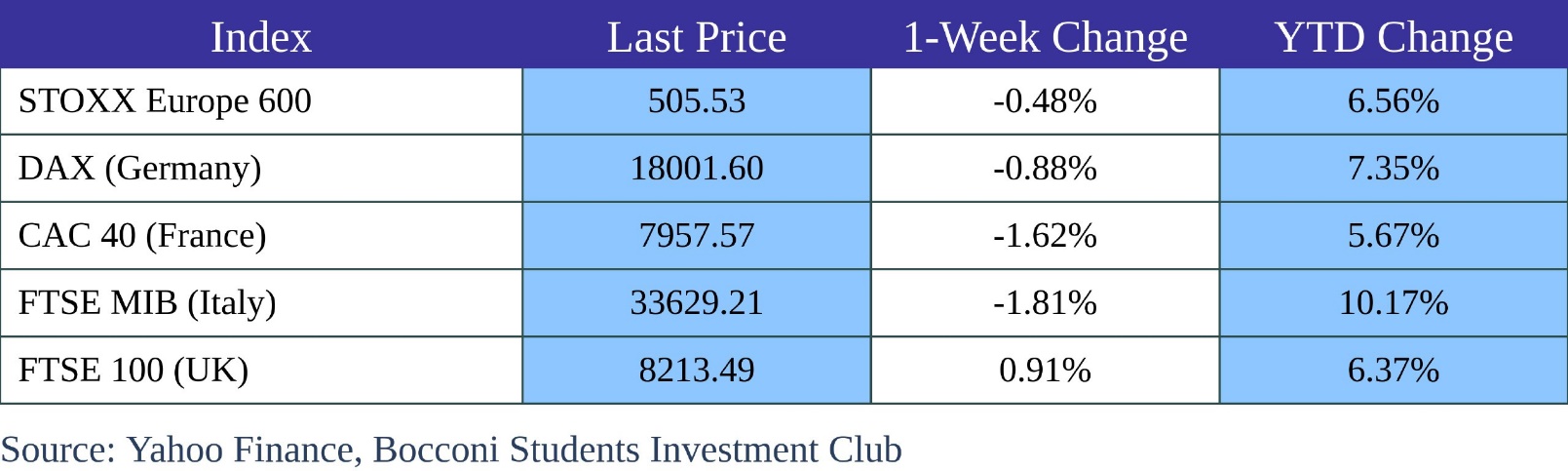

European equity markets showed mixed results, with the UK’s FTSE 100 index emerging as a notable performer, increasing by 0.90% driven by strength in mining and energy sectors, reaching a fresh high. This contrasted with the situation in Germany, France, and Italy, where major stock indexes recorded declines. The German DAX weakened by 0.88%, influenced by cautious investor sentiment amid mixed corporate earnings and uncertainty about future interest rates. Similarly, France’s CAC 40 and Italy’s FTSE MIB experienced losses of 1.62% and 1.81%, respectively, reflecting broader European market apprehensions about the economic outlook.

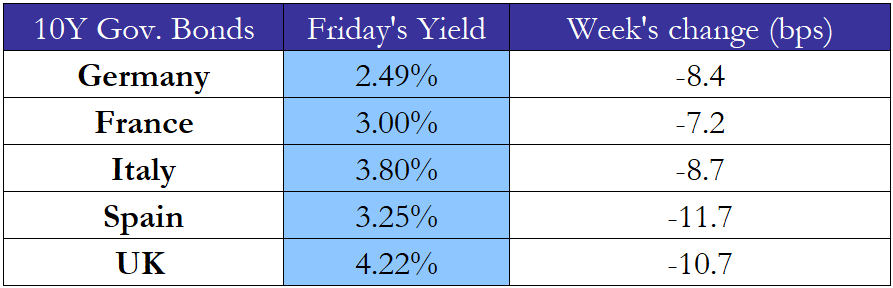

In the bond market, European government bond yields generally declined as concerns over further interest rate hikes by major central banks were downplayed. This was reflected in the yields on German and UK 10-year government bonds, which trended toward lower rates. Meanwhile, the Eurozone’s GDP growth exceeded expectations, potentially supporting the European Central Bank’s (ECB) confidence in starting to lower borrowing costs by June, as inflation is projected to align with targets.

Source: worldgovernmentbonds, Bocconi Students Investment Club

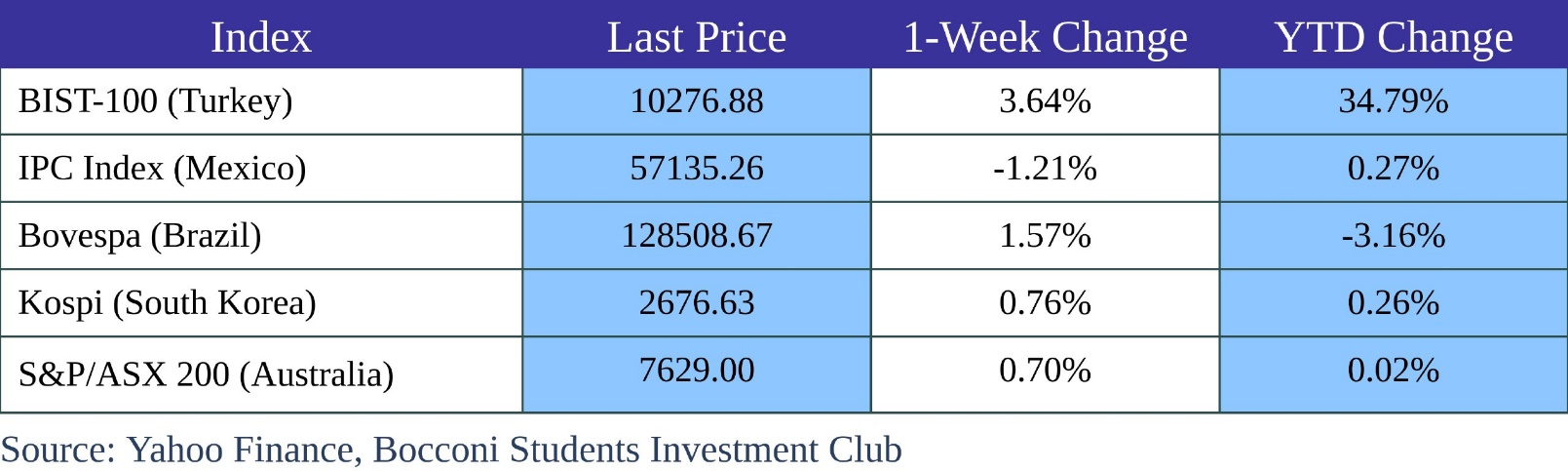

Rest of the World

During a week shortened by holidays, Chinese equity markets showed positive movements. The Shanghai Composite Index increased by 0.52% and the CSI 300 Index rose by 0.56%. The Hang Seng Index in Hong Kong notably advanced by 4.67%. Markets in mainland China and Hong Kong were closed for the Labor Day Holiday and are scheduled to reopen on Monday, May 6. The Politburo of China, in its latest meeting, committed to implementing cautious monetary and fiscal policies to boost demand, indicating potential reductions in interest rates and the reserve requirement ratios for banks. Meanwhile, in Japan, increased speculation about interventions by Japanese authorities in the forex markets to support the yen led to a rise in Japanese stocks. The Nikkei 225 Index saw a 0.8% increase and the TOPIX Index rose by 1.6%. This activity is suggested by changes in the Bank of Japan’s records, though it was not officially confirmed. Despite volatility, the yield on the 10-year Japanese government bond remained stable at 0.9%, a six-month high, amidst concerns that the U.S. Federal Reserve might maintain higher interest rates longer.

This week’s most intriguing updates come from Colombia, where the central bank reduced its benchmark interest rate from 12.25% to 11.75%. The decision was influenced by a decrease in annual headline inflation to 7.4% in March, attributed to reductions in the costs of goods and food. Future inflation expectations remain stable at 4.6% and 3.5% for the next one and two years, respectively. Economic growth projections for 2024 and 2025 have been revised to 1.4% and 3.2%, reflecting positive developments in primary and tertiary sectors. This rate cut is aimed at fostering economic growth while steering inflation towards the bank’s mid-2025 target.

FX and Commodities

FX and Commodities

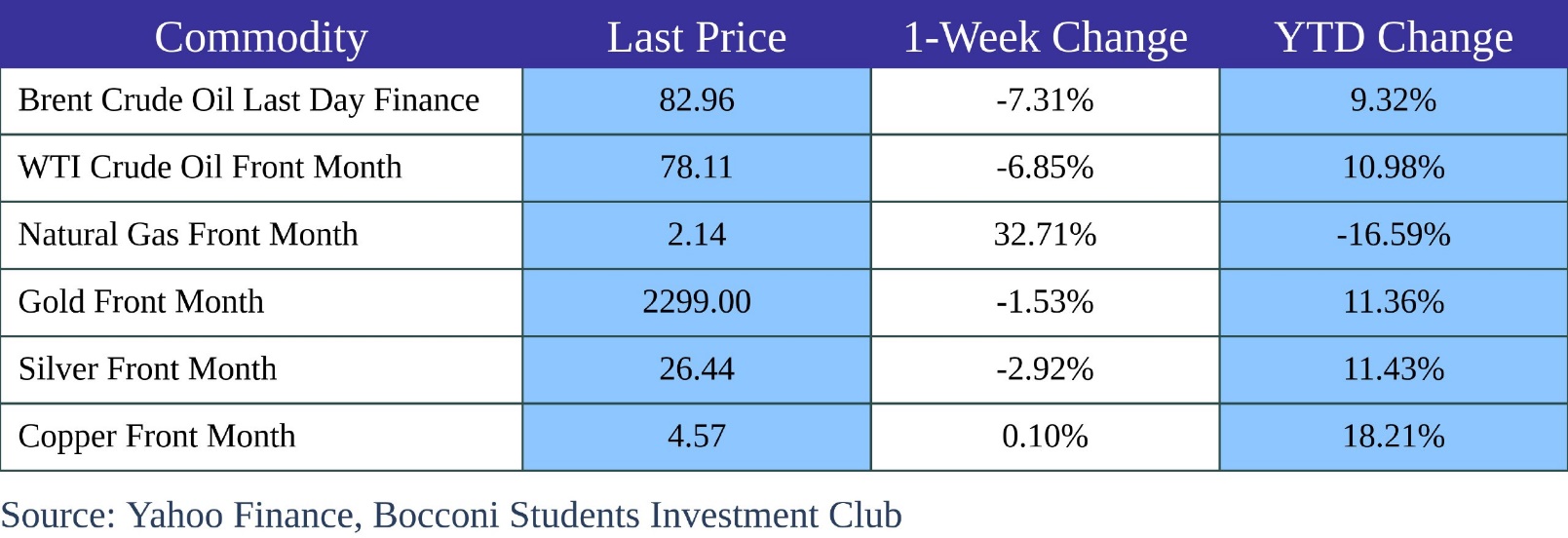

Oil prices have taken a step back, dropping sharply this week. The risk premium related to geopolitical frictions is decreasing with hopes for a ceasefire in Gaza. Moreover, the latest data on weekly stocks in the United States have clearly weighed on the trend: while economists were expecting a contraction of 2.3 million, stocks increased by 7.3 million barrels. North Sea Brent is trading at about $82.96, while U.S. WTI is at $78.11 a barrel. The weakness in prices should encourage OPEC+ to extend production quotas beyond June. Regarding metals, copper is catching its breath after touching the $10,000 per ton threshold in London. Like oil, the price of copper and industrial metals in general continues to depend on the monetary policy of the Federal Reserve. Longer periods of high interest rates could depress global demand. In London, aluminum has dropped to $2,577 (spot price), while zinc has stabilized at $2,880. Gold has fallen for the second consecutive week to $2,302. This short-term price weakness masks the appetite of central banks, which continue to accumulate gold. In its latest report, the World Gold Council reveals that in the first quarter, central banks added 290 tonnes of gold to their reserves.

The dollar has not yet ceased its dominance over the currency market. Many factors are driving a further strengthening phase of the greenback against other global currencies, especially the euro. Fundamental issues, linked to the Federal Reserve’s continuous postponement of interest rate cuts, and technical factors both contribute to this trend. Meanwhile, the Bank of Japan (BoJ) has steadfastly maintained its interest rates around zero, continuing its path without changes and causing the yen to further weaken. The USD/JPY exchange rate closed the week near 153 yen, the lowest in the last 34 years. The BoJ has reaffirmed its belief that inflation is on track to sustainably reach 2% in the coming years and signaled its readiness to raise financing costs by the end of the year.

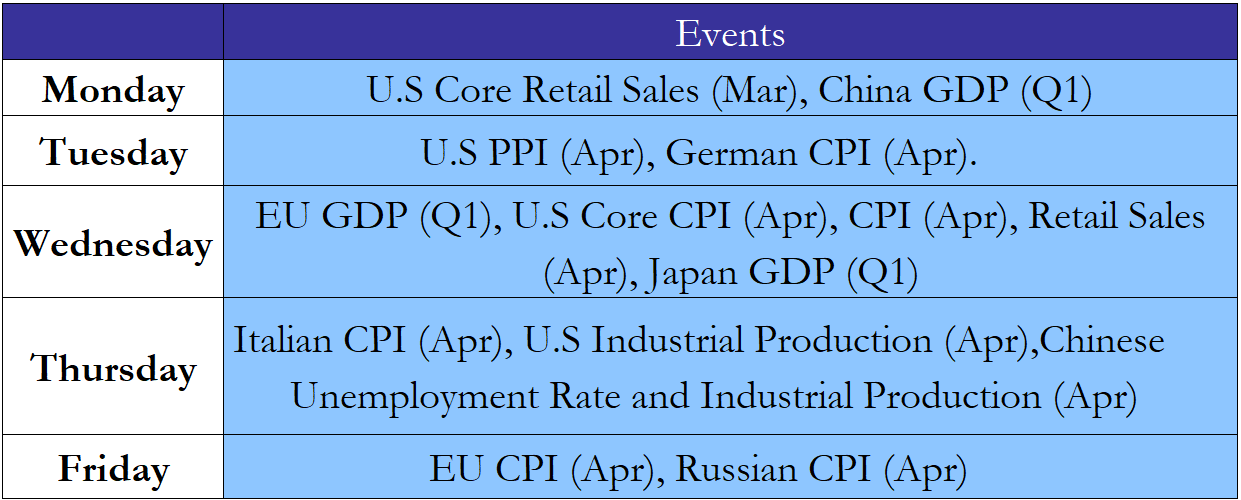

Next Week Main Events

Brain Teaser #17

If x^x^x^x^x···=2 , what is x?

SOURCE: Xinfeng Zhou – Practical Guide To Quantitative Finance Interview

SOLUTION

The solution is quite simple, we present an intuitive but not rigorous answer. Consider y = x^x^x^x^x··· = 2. Given that this exponent tower extends to infinity we can actually say that y = x^x^x^x^x··· = x^(x^x^x^x···) = x^y, but as we saw before y = 2, thus y = x^2 = 2. We conclude that x = sqrt(2).

Brain Teaser #18

You are tossing a fair coin and writing down the outcomes. What is the probability that you will see the sequence HTH before you see the sequence HHT?

SOURCE: Heard on the Street: Quantitative Questions from Wall Street Job Interviews

0 Comments