USA

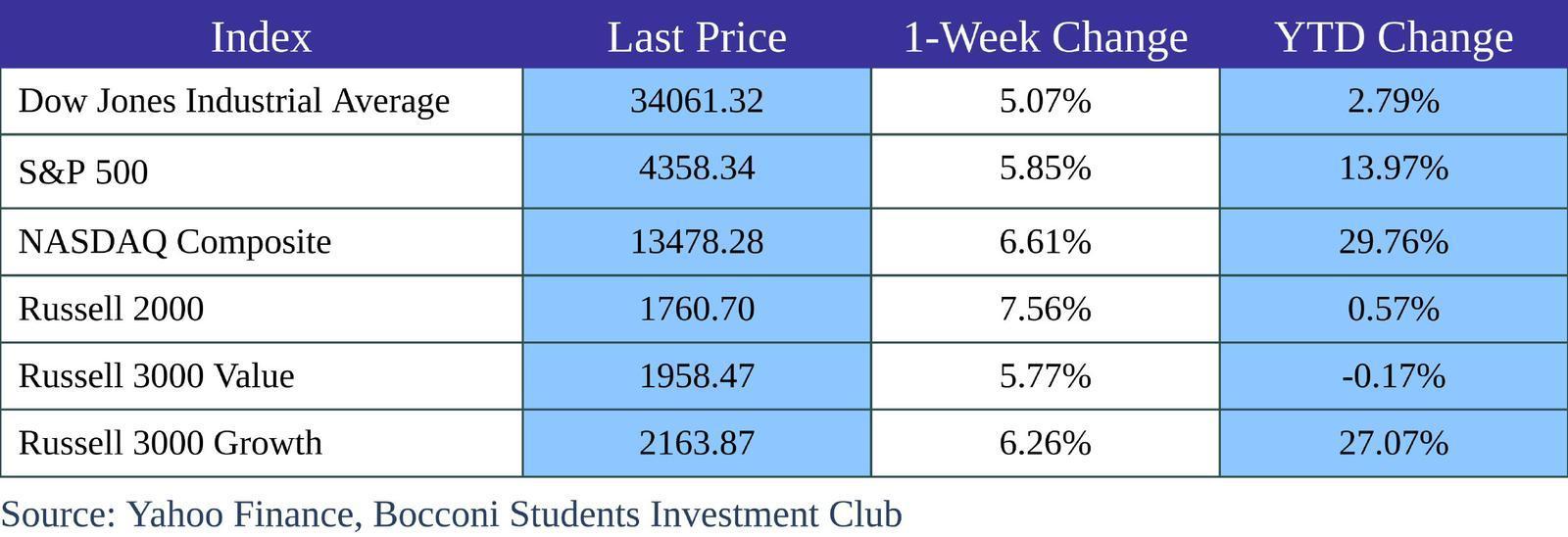

All major stock indexes in the US have witnessed an impressive performance this week, with many analysts attributing this to a seasonal “Santa Rally”. The S&P 500 and the Nasdaq recorded their best week since November 2022, advancing 5.85% and 6.61%. Similarly, the Dow Jones has increased the most since October 2022, by 5.07%. The Russell 2000, Russell 3000 Value and Russell 3000 Growth also rose sharply, with the first one edging up the most out of all indexes by 7.56% and the other two advancing 5.77%, respectively 6.26%.

The week kicked off very optimistically, as investors were bracing for the FOMC decision and key labor market indicators. On Tuesday, Nvidia fell about 1.6% after reports that it may be forced to cancel up to $5 billion worth of advanced chip orders to China. However, the S&P 500 and the Nasdaq still added 0.6% and 0.5% on the day. At the same time, Treasury yields fell to their lowest level in 2 weeks, after the US government announced reduced borrowing requirements. The Treasury Department stated on Monday it expects to borrow $234 billion less in Q4 compared to Q3.

On Wednesday, ADP employment data showed the US private businesses added 113k jobs in October, below market expectations of a 150k increase, but still considered a robust number. More data came throughout the day, with the ISM Manufacturing PMI surprising on the downside to 46.7 from the 10-month high of 49 in the previous month, while the US job openings increased by 56k to 9.55 million and reached the highest level in 4 months.

In the first part of the day, 10Y yields rose to the 4.9% mark in anticipation of the FED’s decision. Later, FED signaled a second consecutive pause in rate hikes, leaving it unchanged at 5.25%-5.50%, as anticipated by the markets. During the press conference, Powell emphasized that the September dot-plot showing the majority of participants forecasting another rate hike this year may not be accurate anymore and also that the recent increase in yields has had a tightening impact on financial conditions, hinting it is done with rate hikes. Following the meeting, the major US stock indexes rallied on late Wednesday and Thursday, while 10Y yields sold off to a two-week low, below the 4.7% mark.

Initial jobless claims surprised on the upside, reaching 217k (expected 210k) on the week ending October 28th and marking the highest amount in 2 months. Alongside declining labor costs and higher labor productivity, this extended gains for the major US indexes in the range of 1.7%-1.9% on Thursday. However, stock futures slipped in extended trading as Apple shares dropped more than 3% following its earnings report, which despite above expected earnings and revenue, was characterized by a weak revenue outlook for the December quarter of about 5% miss relative to Wall Street estimates.

The most awaited labor market data was released on Friday, with the NFP report coming below estimates, as the US economy added 150k jobs in October (expected 180k). Several strikes including those of the UAW members weighted on manufacturing payrolls. Average hourly earnings rose 0.2% MoM (expected 0.3%) and 4.1% YoY, the smallest increase since June 2021, while the US unemployment rate increased to 3.9%, slightly beating market expectations of 3.8%. These all pointed to a cooling labor market and indeed made investors lower their odds of a further rate hike from 20% to 10%. Stocks’ gains were reinforced, while 10Y yields touched the 4.5% mark.

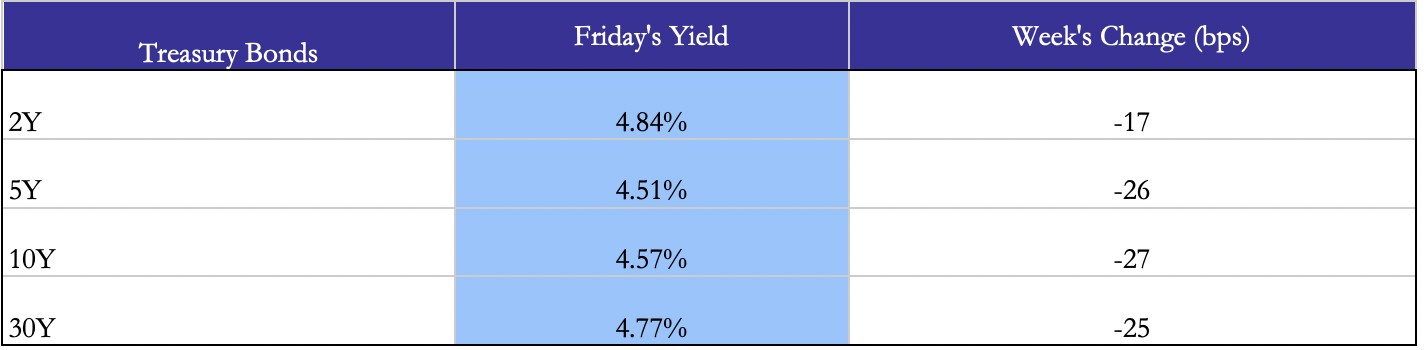

The 10Y yields recouped some of the losses later in the day, but still remained the maturity with the highest bps decrease during the week, followed closely by the 5Y and 30Y bonds. Meanwhile, the 2Y yields sold off for 17bps, widening back the 2s10s spread.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

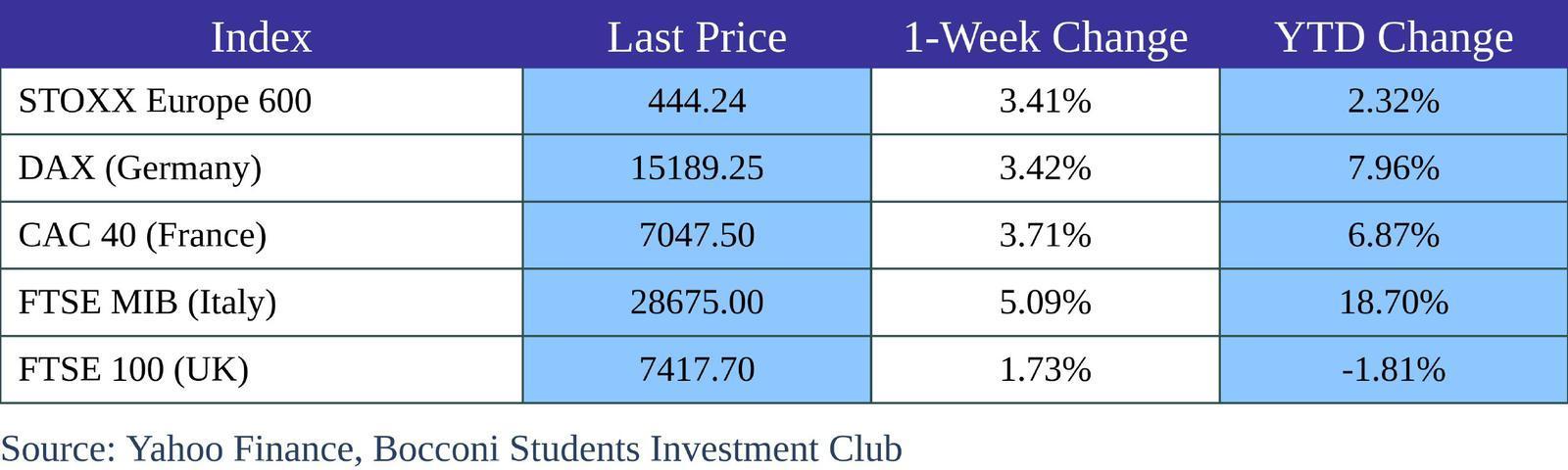

The main European stock indexes followed the trajectory of their US peers, although not as strongly as they performed. The best performer of the week was the Italian’s FTSE MIB, which rose slightly higher than 5%. France’s CAC 40, Germany’s DAX and the main STOXX Europe 600 touched similar increases ranging around 3.4%-3.7%. Lastly, the UK’s FTSE 100 index advanced only 1.73% due to losses in oil companies late in the week.

The week kicked off with Germany GDP QoQ contracting less than expected at 0.1% vs 0.3%. At the same time, Germany’s inflation reached its lowest level since August 2021, falling to 3.8% YoY from September’s 4.5% and prompting a rebound in 10Y Bund yields.

On Tuesday, Eurozone GDP and inflation data were released. The economy shrank 0.1% QoQ, marking the first contraction since 2020 when the pandemic hit, signaling the tightening campaign weighting on the economy. Both headline and core inflation came lower than expected, at 2.9% and 4.2% YoY. European stock indexes rose between 0.6% and 1.5% on the day, recouping some of the monthly losses, while the UK’s FTSE 100 closed marginally lower, due to poor earnings announcements from BP, Shell and Vodafone.

On Wednesday, European stocks maintained their uptick, with rises ranging from 0.6% to the 0.9% achieved by the Italian’s FTSE MIB, ahead of the FOMC meeting. After it, they closely followed their American peers, all opening at least 1.2% higher on Thursday. At the same time, the 10Y yields of the main EU government bonds and of the UK’s gilts retreated, matching the steep decline in long-dated Treasury yields.

On Thursday, the last important CB meeting of the week took place in England, where the BoE maintained its benchmark interest rate at 5.25% for the second time in a row, as policymakers evaluated recent signs of an economic slowdown in the UK. The Committee voted 6-3 in favor of keeping rates unchanged and downgraded its growth outlook, but left the door open for further hikes if necessary. The FTSE 100 index edged up 1.4% on Thursday, also supported by upbeat corporate results, such as the supermarket chain Sainsbury, the gambling firm Entain or Shell. On the other side, the yields on the UK’s 10Y gilt dipped below 4.4%, making its lowest point since the last BoE meeting.

On Friday, the Eurozone unemployment rate increased to 6.5% from last month’s 6.4%, with the lowest rate being recorded in Germany (3%) and the highest ones in Spain (12%), Italy (7.4%) and France (7.3%). The main stock indexes extended Friday’s gains following the US jobs report, except for the UK’s FTSE 100, whose earlier gains were reversed by a major loss in oil companies and a strengthening pound and France’s CAC 40, driven by a decline in heavyweight shares.

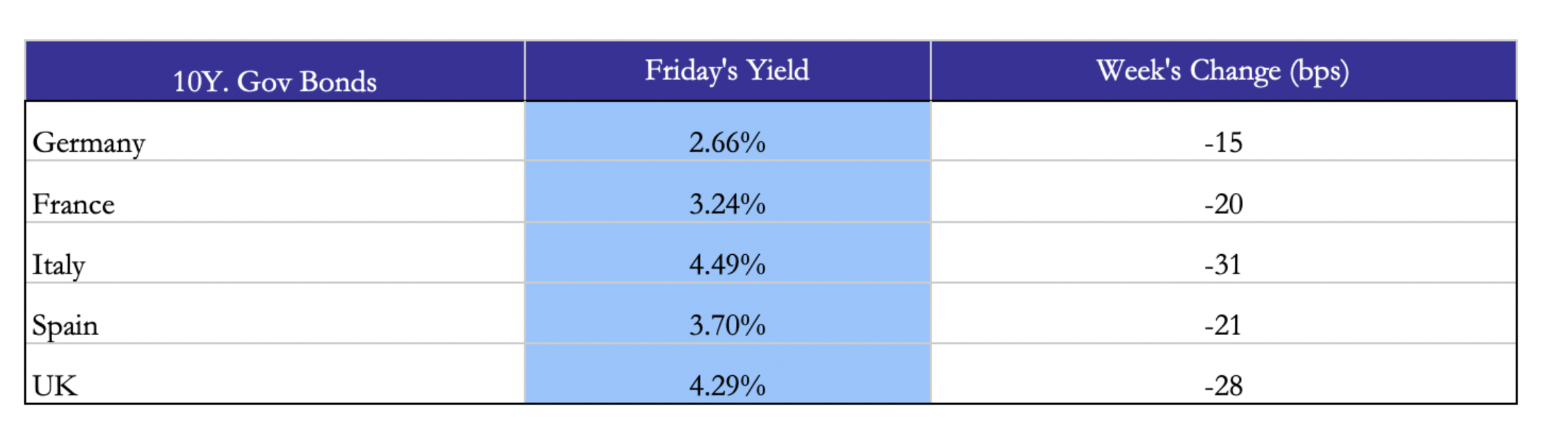

As stocks did, European governments’ yields also followed the US ones throughout the week. The mildest effect was felt by the Bund yields, which lost 15bps on the week, while on the other side the UK’s and Italy’s 10Y yields touched lows reached several weeks ago at 4.29% and 4.49%, selling off for 28, respectively 31bps during this week.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Rest of the World

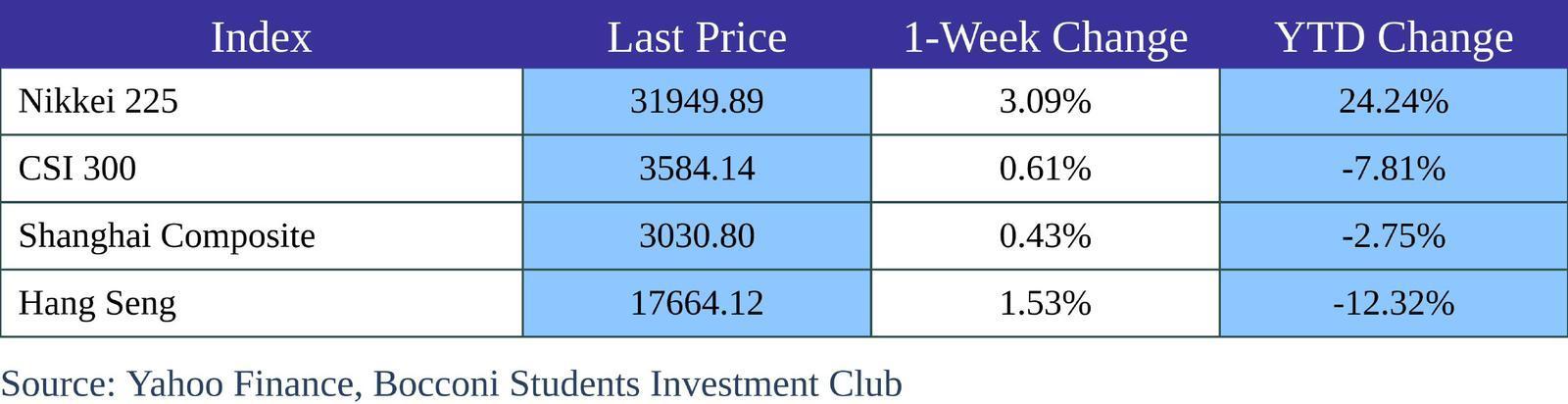

The Asian stock market closed the week in the green as well, with Japan’s Nikkei 225 continuing its impressive rally YTD and rising 3.09% on the week. CSI 300 and Shanghai Composite slightly rose by 0.61% and 0.43%, while the Hang Seng index advanced 1.53%.

The main event of this week in Asian markets was the BoJ’s meeting, where the Bank kept its policy rate steady at -0.1% and decided to allow for more flexibility in their YCC operations, by setting the 1% in 10Y yields as a reference point rather than a rigid limit. This decision came as the Bank raised their inflation forecasts for 2023 to 2.8% (prior 2.5%), 2024 to 2.8% (prior 1.9%) and 2025 to 1.7% (prior 1.6%). Following the announcement, Japan’s 10Y yields rose above 0.9% and the Nikkei 225 index jumped 2.4%.

In China, manufacturing and services PMIs disappointed compared to last month’s readings, resulting in a decline in Chinese stocks on Tuesday. On Wednesday, the Caixin China General Manufacturing PMI entered into the contractionary zone at 49.5, amid slower sales growth, missing market expectations of 50.8 and putting more pressure on stock indexes.

Following the FOMC meeting, shares in Australia, Japan, South Korea and Hong Kong advanced, with the main winner being the Nikkei 225 index, which closed 1.2% higher on Thursday. Chinese stock indexes also followed their peers one day later.

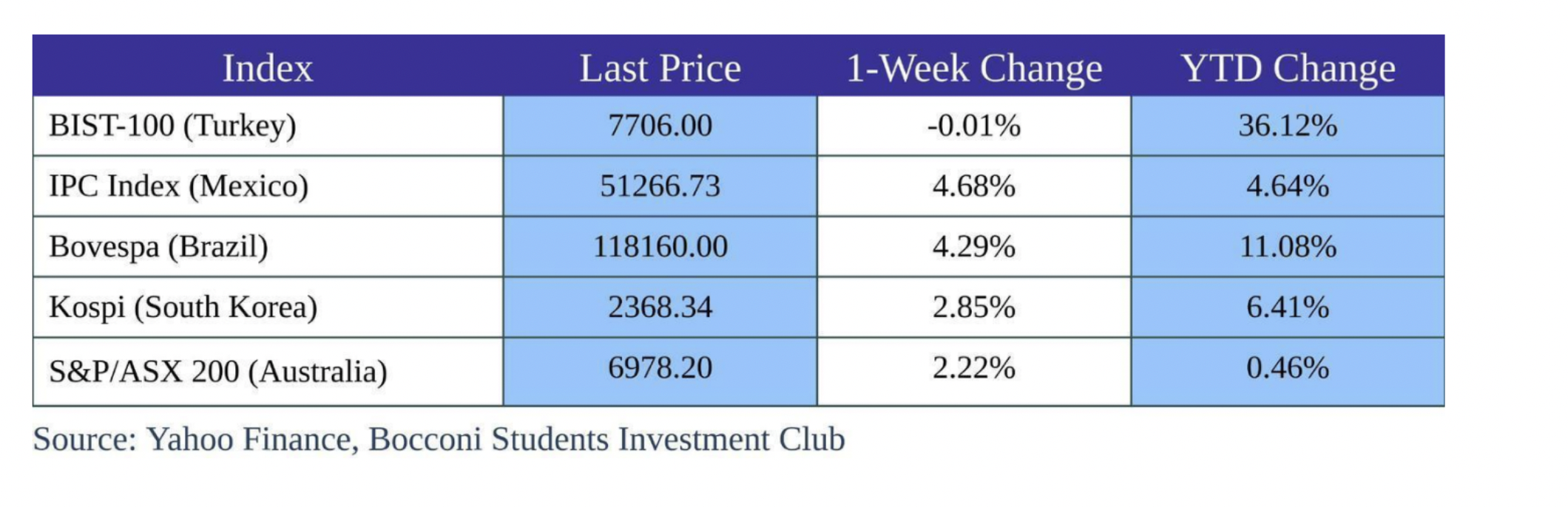

In other parts of the world, positive stock returns were seen as well, with one outlier being Turkey’s BIST-100, which closed the week marginally below the flatline. However, Mexico’s IPC Index and Brazil’s Bovespa saw significant rises of 4.68% and 4.29%, while South Korea’s and Australia’s indexes advanced 2.85% and 2.22%.

FX and Commodities

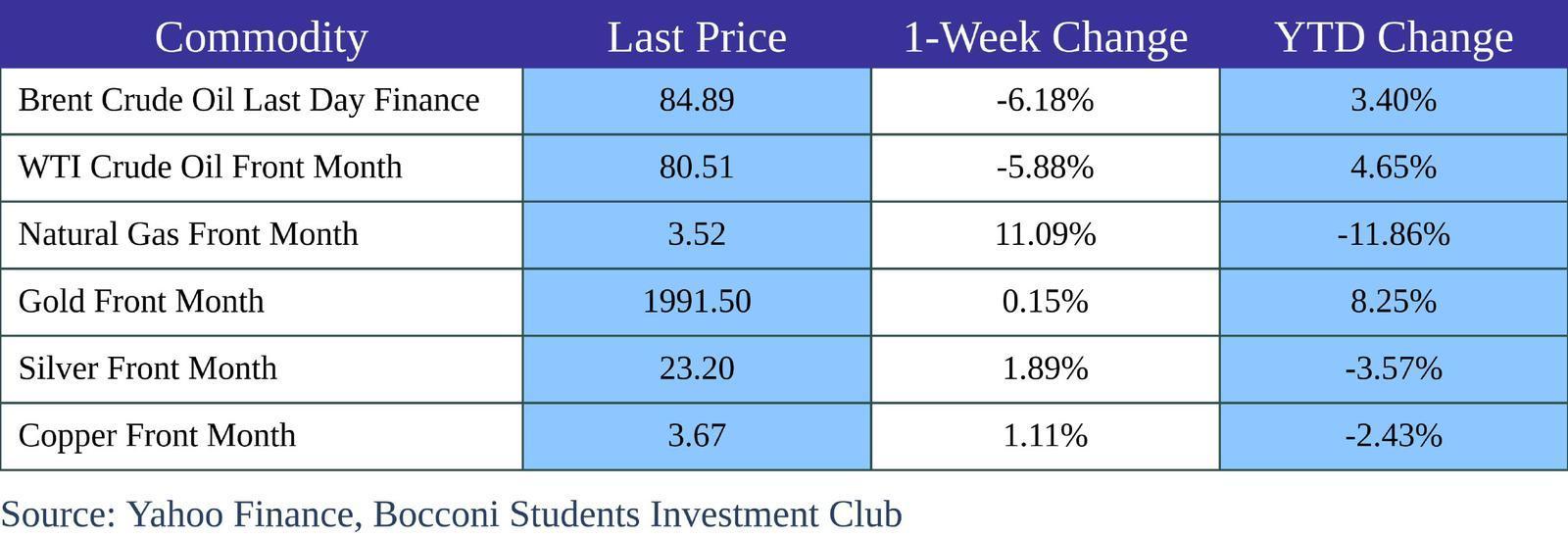

The oil markets had a volatile week. The beginning saw a significant decrease of nearly 4% in oil prices, amid fears that the Israel-Hamas war would disrupt oil supply from the region. The decline continued on Tuesday, when data from the EIA showed that crude oil stocks rose by 1.4 million.

On Wednesday, Brent and WTI crude rose above $86 and $82 ahead of the FED’s decision, but the gain was not sustained for the entire day. The prices rose by more than 3% on Thursday, as risk appetite was back to markets following FED’s and BoE’s decisions, which gave the impression they are done with the tightening cycle. Oil prices fell again by more than 2% on Friday, as the low reading of US and China manufacturing and services PMIs added more uncertainty into the demand outlook. Both Brent and WTI crude closed the week around 6% lower.

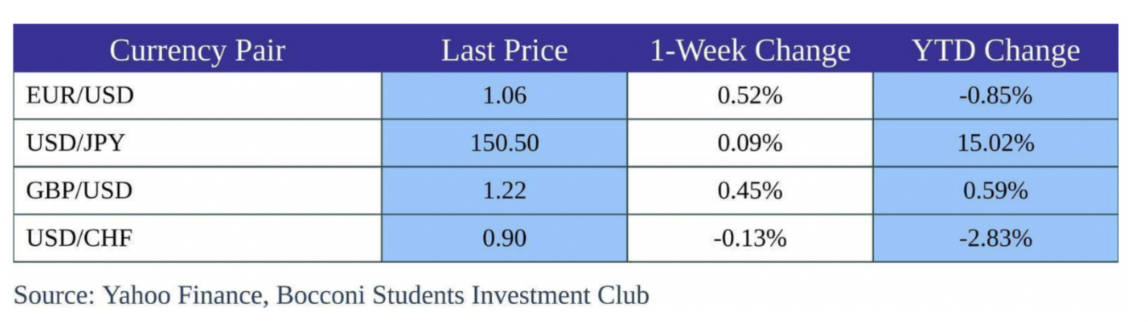

The currency markets also experienced a volatile week. In Japan, yen depreciated 1.6% to 1990-lows of 151.5 per USD, following BoJ’s decision, considered mild by investors. Towards the end of the week, however, yen regained some of its lost territory. In England, sterling appreciated against the USD following the BoE’s meeting, and stabilized around the $1.22 mark in early Friday.

The DXY index, which measures the value of the USD against a basket of foreign currencies was on the rise to the 107 mark up until Thursday, when it started tracking the decline in Treasury yields and retreated to 106.3. The index continued to decline after the jobs report on Friday, reaching 105, whereas euro and sterling touched a 7-week high at $1.07, respectively a 3-week high at $1.23.

Next Week Main Events

Source: TradingEconomics, Bocconi Students Investment Club

Brain Teaser #05

100 prisoners are lined up and assigned a random hat. The hats are available in 10 different unique and distinguishable colors. Each prisoner can see the hats in front of him but not behind. Starting with the prisoner in the back of the line and moving forward, they must each, in turn, say only one word which must be the color like “red” or “blue” or “green” etc. If the word matches their hat color they are released, if not, they are killed on the spot. They can hear each other’s answers, no matter how far they are on the line. What strategy should be used to help release the maximum number of prisoners?

SOLUTION: The 10 colours will be given codes from 0 to 9. The 100th prisoner will sum the numbers associated with the 99 colours he sees and will say the colour corresponding to it, modulo 10. This is enough for 99th person. All he needs to do now is connect the dots, sum the number of hats he can see, calculate modulo 10, and compare it with what the 100th prisoner said. This way all 99 prisoners will be saved, and the 100th prisoner dies with probability 9/10.

Brain Teaser #06

After the revolution, each of the 66 citizens of a certain city, including the king, has a salary of 1. King cannot vote, but has the power to suggest changes – namely, redistribution of salaries. Each person’s salary must be a whole number of dollars, and the salaries must sum to 66. He suggests a new salary plan for every person including himself in front of the city. Citizens are greedy, and vote yes if their salary is raised, no if decreased, and don’t vote otherwise. The suggested plan will be implemented if the number of “yes” votes is more than “no” votes. The king is both selfish and clever. He proposes a series of such plans. What is the maximum salary he can obtain for himself?

Our Trade Ideas Performance

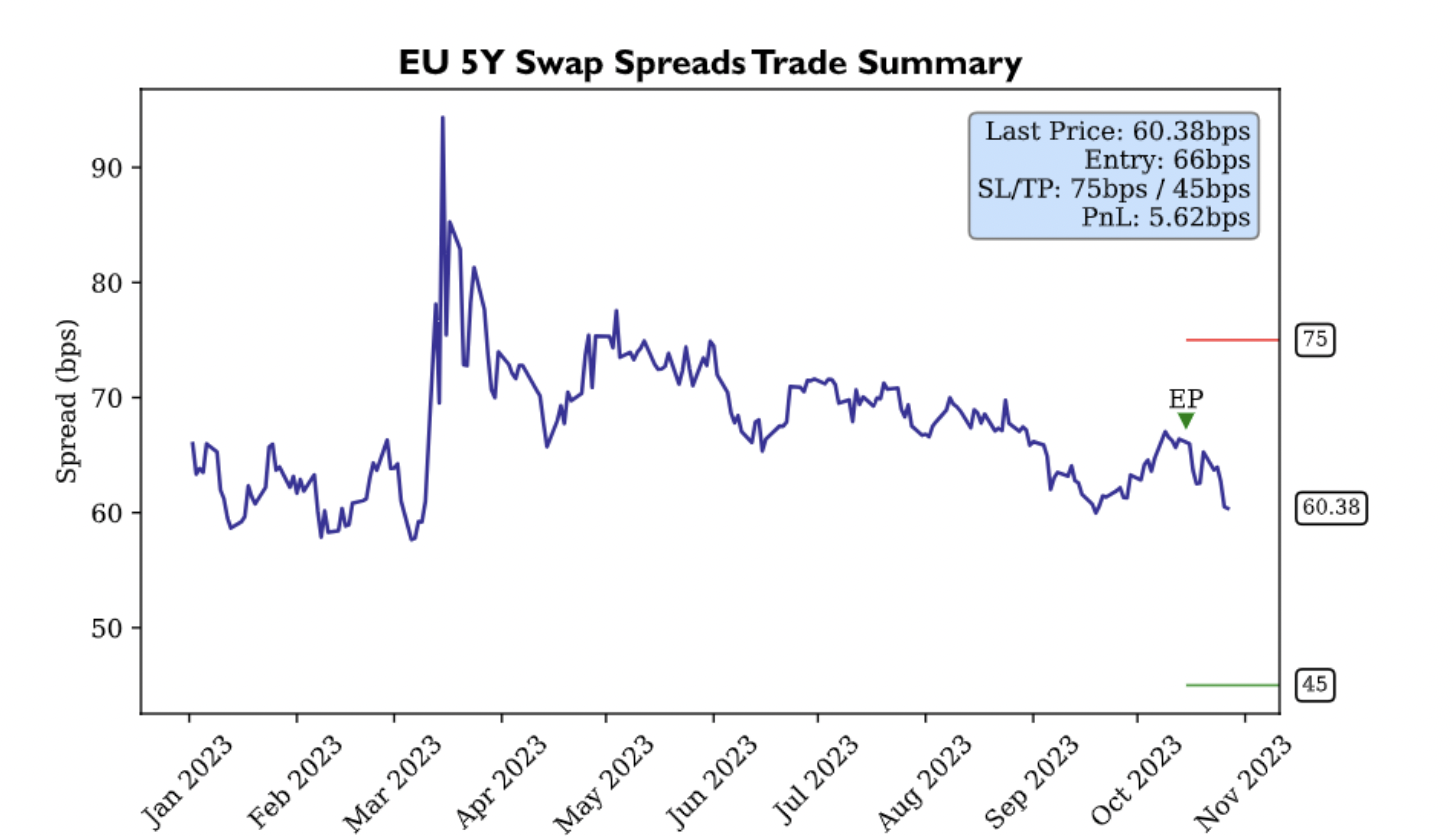

We are happy to introduce a new section of our weekly market recap, in which we aim to present to our readers the current performance of trade ideas implemented in past articles. In this week’s part, we explore how the swap spread trade introduced in the bear steepening article has performed so far.

0 Comments