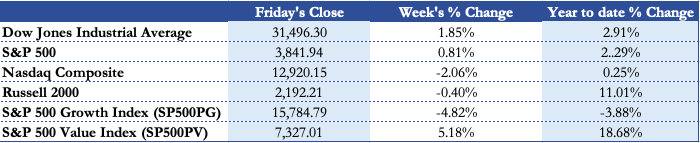

USA

US indexes concluded a highly volatile week with a strong rebound on Friday after the February jobs report came in much better than expected. The economy created 379,000 jobs, more than double the consensus estimate of 175,000. January job growth was revised sharply higher to 166,000 from 49,000.

The S&P 500 gained 0.81% this week, but only after being down more than 2%, while the Nasdaq turned almost negative for the year after its precipitous descent midday Thursday after Powell said last week’s surge in bond yields caught his attention, but Fed remains highly accommodative and didn’t hint at a new change in policy. On Friday, the technology-laden index had been down by as much as 2.6%, as data released by the Labor Department on Friday showed that a solid recovery was underway on the jobs front, pushing bond yields up sharply. But the Nasdaq Composite closed the day higher by 1.6%, near its high of the day, marking the sharpest intraday comeback since Feb. 28.

Oil and gas-related industry groups outperformed again amid another surge in oil prices. The Energy Select Sector SPDR ETF (XLE) jumped nearly 4%.Value stocks kept outperforming growth ones, with the former being up almost 19% YTD, while the latter turned negative with a -3.88% YTD performance. It is worth mentioning Cathie Wood’s Ark Innovation fund drops 10% on week, wiping out all 2021 gains.

The 10-year Treasury yield went over 1.6% early Friday but was trading around 1.577% at the stock market close. Rising interest rates have spooked the stock market lately, including Thursday, when Federal Reserve Chairman Jerome Powell acknowledged the possibility of inflation. But he didn’t give any hints about changes the Fed could make to its monthly bond-buying program, including selling short-term notes and buying long-term debt. This would help hold down long-term yields that are key to mortgage rates and auto loans. The Fed’s next meeting is March 16-17.

As we have seen in the previous week, robust economic signals fed inflation worries, the U.S. created 379,000 new jobs in February, the biggest gain in four months in what’s likely to be a preview of a surge in hiring in the months ahead as most people get vaccinated and the economy fully reopens. The increase in hiring last month was concentrated at businesses such as restaurants, retailers, hotels and entertainment venues as states eased restrictions on customer limits and public gatherings. Most other industries also added workers.

Meanwhile, Senate Democrats reached an agreement Friday night on how to structure unemployment aid in their $1.9 trillion coronavirus relief bill, allowing the plan to move forward after hours of delays. The deal will extend a jobless benefit supplement at the current $300 per week through Sept. 6, according to NBC News. It will make the first $10,200 in unemployment aid non-taxable to prevent surprise bills. The provision will apply to households with incomes under $150,000.

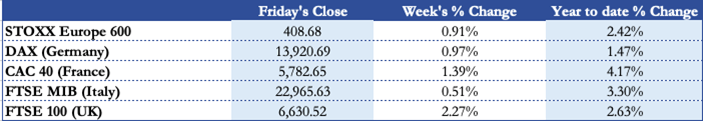

Europe and UK

Shares in Europe ended higher, supported by the prospect that easing restrictions implemented to stop the coronavirus’s spread and supportive monetary and fiscal policies could set the stage for an economic recovery. However, European equities closed lower on Friday as bond yields rose on inflation expectations that were pushed up by strong U.S. payrolls data. The STOXX 600 index marked a weekly gain on strength in growth-sensitive sectors, rising 0.91%. Technology was the weakest-performing European sector for the second week in a row, while utilities and healthcare also lagged. Major stock indexes also advanced, while the UK’s FTSE 100 Index climbed 2.27% on the week, lifted by finance minister Rishi Sunak’s annual budget, which called for more fiscal stimulus and the Office for Budget Responsibility’s projections that the economy would recover to its former size earlier than previously expected.

Despite ending lower for the week, Eurozone bond yields rose in the last trading days as long-term inflation expectations strengthened. Uncertainty about whether the European Central Bank would act to suppress the increase in borrowing costs, combined with the Federal Reserve reiterating its dovish stance, gave yields another boost. The UK, which not so long ago was flirting with cutting interest rates below zero, has seen a rapid rise in yields to around 0.8 per cent. On top of this, the Budget revealed government plans to borrow even more than banks had previously expected. On Friday the German 10Y Government closed the week at -0,301%, a weekly decrease of 4.2bps but still YTD surge of 26.8bps. The German 2Y yield closed at -0.688%, a weekly contraction of 3.4bps. The UK 10Y Gilt closed at 0.759%, decreasing from last week’s top of 0.822, but still +56.6bps YTD.

In economic news, data from Destatis showed factory orders in Germany expanded 1.4% month-on-month in January, reversing a revised 2.2% fall in the previous month. Orders were forecast to climb 0.7%.

In his budget speech to Parliament, Sunak pledged GBP 65 billion of additional fiscal spending in the short term and a temporary tax break for business investment. He extended welfare payments and the jobs-support program until September. Most individuals will have to pay more tax over time, and corporate taxes would rise to 25% in 2023 from 19% currently. U.K. house prices dropped for the second straight month in February falling 0.1%, after a 0.4% decline seen in January.

The EU unemployment rate was 7.3% in January 2021, stable compared with December 2020 and up from 6.6% in January 2020. The euro area unemployment rate was 8.1%, also stable compared with December 2020 and up from 7.4% in January 2020.

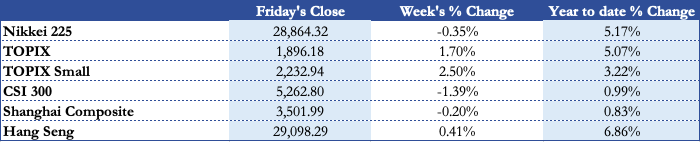

Rest Of The World

Japan’s stock markets generated mixed returns for the week, with the Nikkei 225 Stock Average declining 0.35% and the broader TOPIX Index gaining 1.70%. The yield of the 10-year Japanese government bond finished the week at 0.09%, its lowest level since mid-February, on comments from the Governor of the Bank of Japan, Haruhiko Kuroda, walking off the possibility that the central bank would make its policy on yield curve control more flexible. The Japanese manufacturing sector grew in February for the first time in close to two years, with domestic manufacturers gradually recovering from the impact of the coronavirus pandemic. The au Jibun Bank Japan Manufacturing PMI rose to 51.4 in February from 49.8 in January. Both output and new orders expanded modestly, and businesses remained optimistic that production would rise over the next 12 months.

Chinese shares fell in choppy trade as rising U.S. yields and inflation expectations spilled into the country’s stock market. The large-cap CSI 300 Index fell 1.39%. Technology shares fell along with recent highflying names related to consumers, electric vehicles, and property management. Remarks from China’s banking and insurance regulators urging the need to deleverage and avoid financial bubbles, along with mentions of a possible interest rate cuts, fueled significant volatility in financial and technology stocks. The yield on China’s sovereign 10-year bond rose to end the week at 3.36%, analysts believe that the People’s Bank of China has little reason to tighten monetary policy at this point, given the absence of inflation pressures.

On the economic front, China’s official purchasing managers’ indexes for manufacturing and services in February came in below expectations. However, the below-consensus PMI readings reflected a number of factors, including the disruption of the weeklong Lunar New Year holiday and renewed travel restrictions after a coronavirus outbreak in northern China earlier this year.

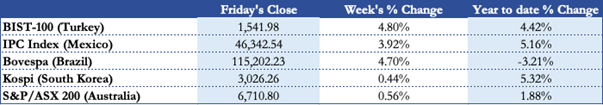

Stocks in Brazil returned about 4.7%. Against the backdrop of a new wave of COVID-19 overwhelming hospitals and leading to new lockdowns, the legislature is working on an emergency constitutional amendment to provide more pandemic assistance without completely abandoning the mandatory spending cap intended to keep government spending in line with inflation. Mexico’s IPC rebounded 0.8% to 46,342.54 on Friday to cap a positive week(+3.92%), as better-than-expected job creation in the US and declining domestic coronavirus cases plus better economic expectations continue to nudge sentiment. Inflation fears in the US forced the Australian share market to close lower, The S&P/ASX200 benchmark index closed lower by 49.9 points, to 6710.8 on Friday. For the week, the ASX200 was higher by 0.56%, after three consecutive weeks trading lower. There were big gains in energy and big falls for miners after base metals prices were lower.

FX and Commodities

For the week, Brent was up 5.2%, rising for a seventh week in a row for the first time since December, while WTI was up about 7.4% after gaining almost 4% last week. Both contracts surged more than 4% on Thursday after the OPEC+, extended oil output curbs into April, granting small exemptions to Russia and Kazakhstan.

Gold fell to its lowest in nine months on Friday after better-than-expected U.S. employment data bolstered the dollar and U.S, falling nearly 2% this week at 1698$. Silver dropped 0.4% to $25.22 an ounce and was down more than 5% on the week, its biggest weekly percentage fall since late November. Bitcoin is bouncing back this week, currently up 6%, after a 21% drop last week.

On the currency side, the dollar jumped on Friday after data showed jobs growth beat expectations in February, the Bloomberg Dollar Spot Index jumped as high as 92.20, the highest since Nov. 25, before retracing back to 91.90, up 1.12% this week, with the change EUR/USD closed lower this week at 1.1907, down 1.34%. The Swiss franc and Japanese yen continued to weaken against the greenback on Friday on expectations that global growth will lag that of the United States. CHF/USD fell to a seven-month low of 0.9310, before rebounding to 0.9283, while JPY/USD closed at 108.37. AUD/USD was down at $0.7692. It has dropped from a three-year high of $0.8007 last week. GBP/USD briefly fell below 1.38 to a three-week low. The renminbi was steady versus the USD, rising 0.36% in the week to close at 6.496.

3 Biggest Movers

Matador Resources (MTDR), engaged in oil and gas exploration in Texas and Louisiana skyrocketed 27.76% this week riding the decision by OPEC and Russia to extend current cuts in producing oil to April fortified buying in the commodity.

Draftkings Inc (DKNG), which operates an online sports platform that enables users to play fantasy games and win cash prizes, had an extremely volatile week. After gaining more than 16% on the announcement of a partnership with mixed martial arts promoter UFC, the stock sold off almost 25% due to the market pressure on growth stocks. DKNG bounced back Friday afternoon, closing the week -3.27%.

Lyft Inc (LYFT), which operates a peer-to-peer marketplace for on-demand ridesharing in the U.S. and Canada, closed the week up 15.2% despite the tech sell off. Shares of Lyft closed up more than 8% on Wednesday, after the company said it’s seeing rideshare recovery sooner than expected. Lyft is up almost 20% after the company issued its Q4 earnings report on Feb. 9. The company posted a loss of 58 cents a share on revenue of $570 million vs an expected loss of 71 cents a share on revenue of $553.85 million.

Next week’s main events

The main events of next week are the following. On Monday, in addition to BoE Governor Bailey speech, the US Wholesale Inventories MoM with a forecast of 1.3%. On Tuesday, both the Japan GDP Growth Annualized Final (Q4) with a 12.8% forecast and the Euro area GDP Growth Rate QoQ and YoY (4Q) will be released, respectively forecasted at -0.6% and -5%. On the 10th of March, both the US core inflation and inflation rate YoY will be released followed by the ECB interest rate decision on Thursday. The week will close Friday with the release of the German Inflation Rate YoY and the U.K. GDP YoY expected to be -10.9%.

Brain Teaser #1

Starting from this week, we introduce a new section to our market recap, one where we present our favorite brain teasers.

Ten alumni of the BSIC Markets division are getting together for an annual alumni meeting in London. They are curious to find the average bonus of the group. Nonetheless, being cautious and humble individuals, everyone prefers not to disclose their reward to the entire group. Can you help them find a strategy to calculate the average bonus without knowing other members’ figures?

In the next week’s market recap, you will find the solution to this brain teaser and another stimulating riddle.

Source: “A Practical Guide to Quantitative Finance Interviews” by Xinfeng Zhou

0 Comments