USA

The major US equity indices ended the week with sharp declines on Friday, suffering their most significant losses since the 2020 COVID-19 crisis, as a consequence of the new US tariffs announced on Wednesday, which exacerbated investor fears, leading to a worldwide sell-off. The S&P 500 tumbled 6% on Friday, the biggest one-day decline since March 2020, while the Dow Jones Industrial Average dropped 2,231 points, and the Nasdaq dropped 5.8%, down 22.7% from the all-time high set in December last year, thus entering bear territory.

The market turmoil was ignited by President Trump’s announcement of new tariffs this Wednesday, which he called “liberation day”. It included 10% blanket tariffs on nearly all imports, a 25% tax on autos, and reciprocal tariffs on imports from about 90 countries, including a 34% tariff on China, and 20% tariff on EU. If all of these tariffs were enacted, it would raise the effective tariff rate to the highest level in the last century. China responded swiftly, announcing a 34% tariff on US imports, which exacerbated the Friday sell-off, as fears of a global trade war, lower growth, and higher inflation sent the market into a frenzy. Additionally, the EU stated they are preparing their own retaliatory measures, in case negotiations do not yield any results, further feeding into market uncertainty.

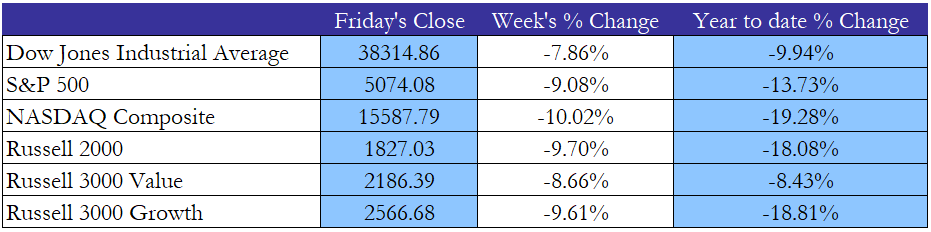

For the week the S&P 500 fell by 9.08%, while the Dow Jones and Nasdaq also declined by 7.86% and 10% respectively, marking the worst week since the start of the 2020 pandemic.

Source: Yahoo Finance, Bocconi Students Investment Club

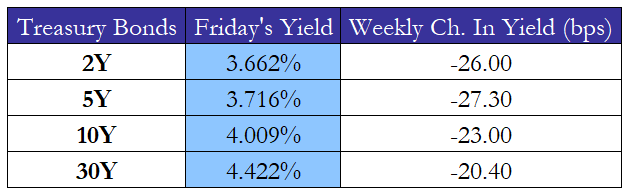

In the rates market, US Treasury yields declined sharply as investors sought refuge in safe-haven assets amid escalating trade tensions. The yield on the 10-year Treasury note fell to 4.01% on Friday, down from 4.27% at the start of the week, marking its largest weekly drop since early 2023 and the lowest yield level in nearly six months. The 2-year Treasury yield, which is particularly sensitive to near-term monetary policy expectations, dropped even more significantly, closing the week at 3.68%, down more than 30 basis points over five days.

Despite a stronger than expected US jobs report that came in on Friday morning, which showed the US added 228K jobs in March, beating expectations of 135K, while unemployment rose to 4.2%, the investor sentiment remained overwhelmingly negative, as fears of a global recession are growing. Federal Reserve Chair Jay Powell also warned on Friday that these new tariffs will cause lower growth and higher inflation, while reaffirming a cautious stance on rate cuts. As of Friday, the market is now pricing at least four quarter point cuts, with a possibility of a fifth by the end of 2025, with the first one being expected in June.

Source: Yahoo Finance, Bocconi Students Investment Club

Europe and UK

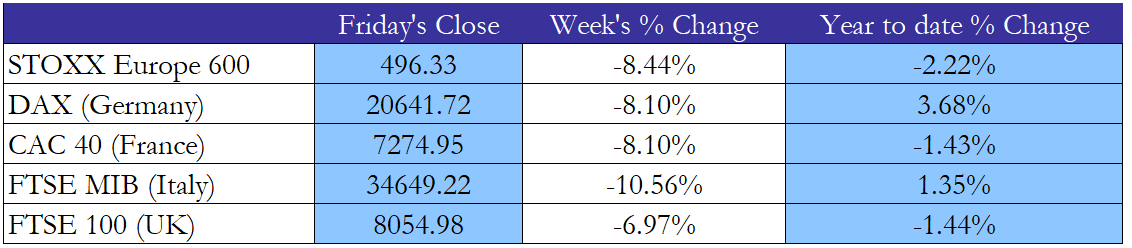

European equities posted their sharpest weekly losses since the COVID-19 crash in 2020, as investor sentiment crumbled in response to the US administration’s sweeping new tariffs and rising fears of a global trade war. The STOXX Europe 600 index dropped by 8.44%, its worst weekly performance in over four years. Germany’s DAX slid by 8.10% to close at 20,641, while France’s CAC 40 index lost 8.08%. Italy’s FTSE MIB posted the biggest decline among major regional indices, falling 10.56% to 34,649, reflecting its high exposure to global manufacturing and financials. In the UK, the FTSE 100 closed at 8,054, down 4.95% on the week, with financials, industrials, and multinational consumer names weighing heavily on the index.

In response to the tariffs, the European Commission confirmed it is preparing retaliatory measures targeting a range of US exports, including agricultural goods, consumer products, and digital services. France’s President Emmanuel Macron urged European firms to reconsider investments in the US, framing the measures as “a serious disruption to global economic order.” In addition to the direct consequences of the taxes, Europe faces the danger of a flood of cheaper Chinese imports, as it will try to seek alternative export markets after the steep tariffs, potentially rising inflation and potentially forcing the European Central Bank to cut rates faster.

Automakers including Volkswagen, Renault, and Stellantis declined sharply, while luxury and industrial exporters such as LVMH, Kering, and Siemens all fell by over 8% on the week. European banking stocks were hit hard, with losses concentrated across Germany, France, and Spain. Deutsche Bank tumbled 10.1%, while Commerzbank slipped 5.1%. In France, Société Générale led declines with an 11% drop, followed by a 7.3% fall in BNP Paribas. Spanish banks were similarly affected, as Santander, Bankinter, CaixaBank, and Sabadell all shed between 9% and 11%.

Source: Yahoo Finance, Bocconi Students Investment Club

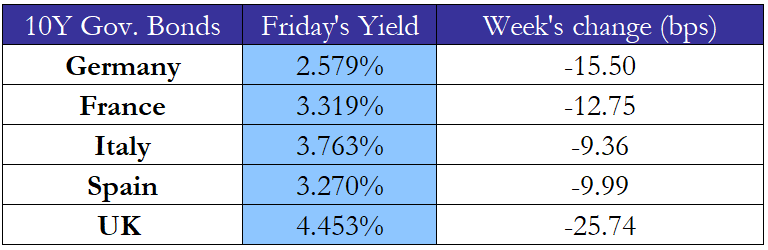

European bond markets rallied this week as investors sought refuge amid escalating trade tensions. The German 10-year Bund yield declined to 2.58%, reflecting the change in risk sentiment. French and Dutch government bonds experienced similar movements, with yields decreasing. Italian bonds also attracted strong interest, leading to a drop in the 10-year BTP yield to 3.76%. Traders now widely expect the European Central Bank to begin cutting interest rates as early as June, with market pricing suggesting at least 75 basis points of easing by year-end. The shift reflects expectations that deteriorating external demand and the threat of imported disinflation from discounted Asian goods could weigh heavily on the eurozone’s already fragile recovery.

In the United Kingdom, government bonds mirrored the trend observed in the eurozone. The 10-year gilt yield fell to 4.45%, influenced by growing recession fears and shifting expectations regarding the Bank of England’s monetary policy stance. Investors are now pricing in the possibility of two to three rate cuts by the BoE before the end of 2025, with the first potentially occurring in May.

Source: Yahoo Finance, Bocconi Students Investment Club

Rest of the World

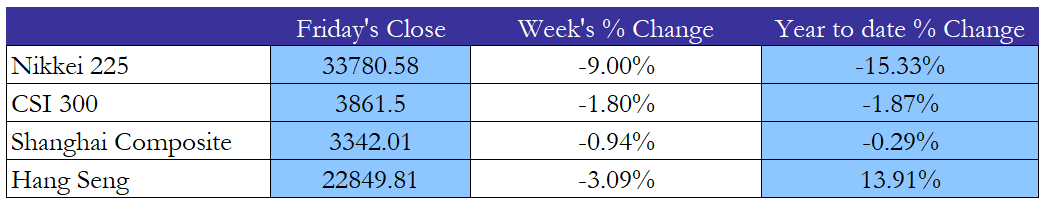

Asian markets followed the worldwide trend, as fears of a global recession intensified. Japan’s Nikkei 225 dropped 2.75% on Friday to close at 33,780, extending a sharp two-day decline and ending the week at its lowest level in eight months. The selloff followed President Trump’s sweeping tariff package, which included a 24% levy on Japanese imports and a 25% duty on auto shipments, a direct hit to Japan’s export-reliant economy. Financial stocks led losses, with Mitsubishi UFJ down 8.5%, Sumitomo Mitsui off 8%, and Mizuho Financial sinking 11.2%.

In China, the Shanghai Composite slipped 0.24% on Thursday to 3,342, as mainland stocks snapped a two-day rally following Trump’s announcement of a 34% reciprocal tariff, raising total duties on Chinese goods to 54%. While markets were closed Friday for a national holiday, Beijing later confirmed its own 34% retaliation, deepening the standoff. Tech and renewable energy names led Thursday’s losses, with Luxshare Precision down 10%, Eoptolink off 6.8%, and Sungrow Power dropping 7.3%.

Source: Yahoo Finance, Bocconi Students Investment Club

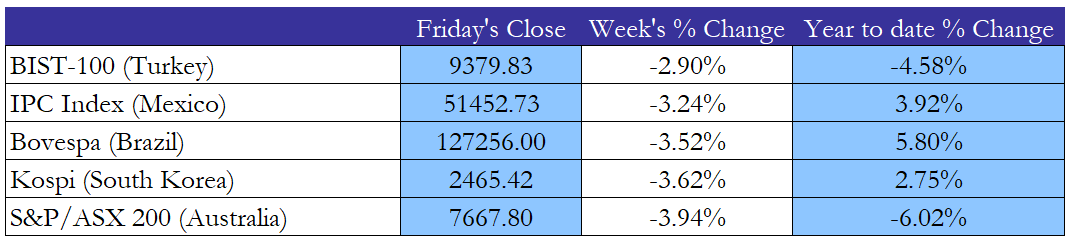

In Turkey, the BIST 100 declined 1.1% on Friday to 9,379, capping a volatile week shaped by political uncertainty and regulatory tightening.

In Brazil, the Ibovespa plunged 3% on Friday to close at 127,256, bringing its weekly loss to 3.5%. US tariffs, compounded by China’s 34% retaliatory levy, have pushed investors firmly into shifting from risky assets. Energy and commodity stocks were hit hardest, with Petrobras down 4.2% and Vale off 4.1%, tracking falling oil prices and weakening global demand for raw materials.

Source: Yahoo Finance, Bocconi Students Investment Club

FX and Commodities

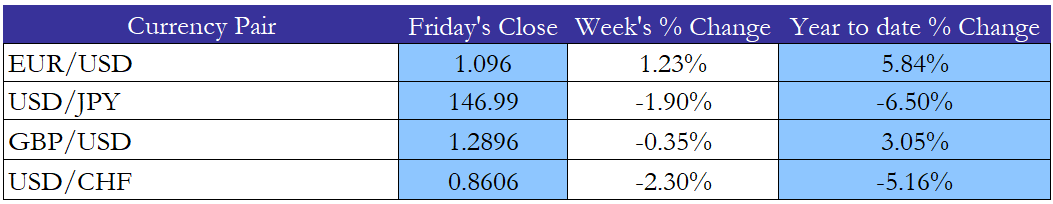

The US dollar suffered the biggest one-day decline since 2022, dropping 1.9% against a basket of currencies on Thursday before pulling back on Friday. This fall is notable considering the fact that usually in risk-off situations the dollar benefits, reflecting the fact that investors have become increasingly worried about the state of the US economy and the unpredictability of its policymaking.

The euro rallied sharply this week, rising 1.8%, hovering around 1.10, its strongest level since October, as investors turned away from the dollar amid growing concerns over the US economic outlook and the increasing likelihood of Fed rate cuts later this year, while the Japanese yen climbed to around 145 per dollar on Friday, as investors turn to traditionally safe haven assets.

Source: Yahoo Finance, Bocconi Students Investment Club

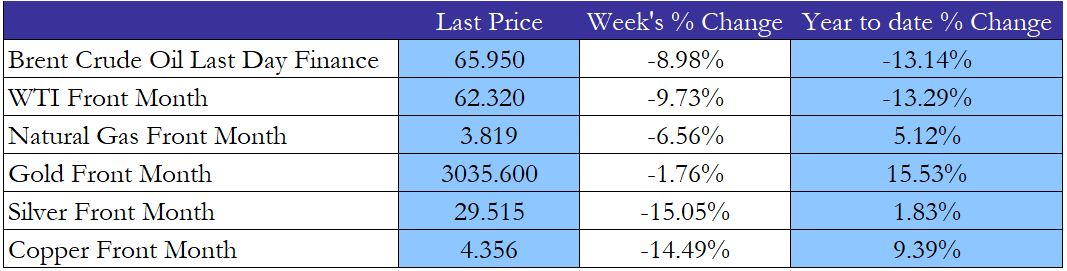

Crude oil markets came under intense pressure this week, with WTI futures plunging 7.4% on Friday to close at $62 per barrel, their lowest level since August 2021. The drop followed a 6.6% decline the previous session, as recession fears, deepening trade conflict, and growing supply concerns combined to drive a sharp risk-off move. Market sentiment was further unsettled by China’s formal retaliation, adding to global growth anxiety. On the supply side, OPEC+ surprised markets by accelerating its output plans, announcing it will increase production by 411,000 barrels per day in May, skewing the market toward oversupply. While US energy exports remain exempt from the new tariff regime, the broader trade disruption continues to cast a long shadow over commodity markets. For the week, WTI fell 10%, its biggest loss in six months.

Gold prices reached all-time highs during the week, rising above $3150 per ounce, before falling about 2.5% on Friday hitting a weekly low. This can be attributed to investors selling in order to cover the losses suffered in other asset classes. Meanwhile, silver dropped below $30 per ounce for the first time since January, with weekly losses of over 12%. Among base metals, copper futures fell over 7.5% to below $4.4 per pound, while aluminium declined below $2470 per tonne, hitting a seven-month low.

Source: Yahoo Finance, Bocconi Students Investment Club

Next Week Main Events

Source: Trading Economics, Bocconi Students Investment Club

Brain Teaser #33

You are invited to a welcome party with 25 fellow team members. Each of the fellow members shakes hands with you to welcome you. Since a number of people in the room haven’t met each other, there’s a lot of random handshaking among others as well. If you don’t know the total number of handshakes, can you say with certainty that there are at least two people present who shook hands with exactly the same number of people?

Solution

In a group of 26 people, each person can shake hands with 0 to 25 others, but it’s impossible for one person to shake hands with 0 people while another shakes hands with all 25, since the latter would have had to shake hands with the former. This means only 25 distinct handshake counts are possible among 26 people. By the pigeonhole principle, at least two people must have shaken hands with the same number of people.

Brain Teaser #34

Your drawer contains 2 red socks, 20 yellow socks and 31 blue socks. Being a busy and absent-minded MIT student, you just randomly grab a number of socks out of the draw and try to find a matching pair. Assume each sock has equal probability of being selected, what is the minimum number of socks you need to grab in order to guarantee a pair of socks of the same color?

0 Comments