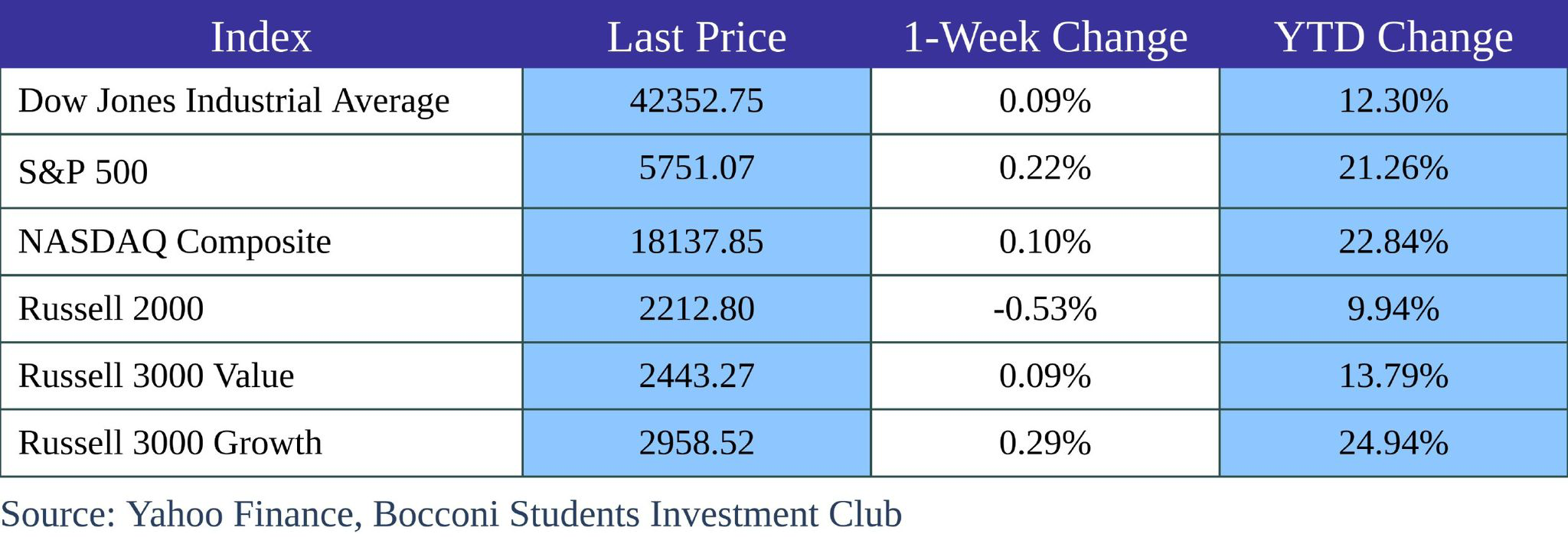

USA

In the midst of Hurricane Helene’s wake, shaky Middle Eastern tensions, and slightly higher than expected job unemployment benefit applications in the report on Thursday, markets responded in a cool manner. In the past 5 days, the S&P 500 was mildly in the red all the way until Friday’s NFP results where it surged and left the weekly change at +0.09%. The DOW moved in a similar fashion and ended 188 points (+0.09%) higher than the prior week.

A catalyst for the lukewarm week prior to NFP results could’ve been the widespread US port strike that lasted a grueling 3 days, in which 36 key US ports’ operations were frozen. As a result, huge backlogs of container vessels stopped US companies from operating properly, potentially spelling catastrophic disruptions in the US supply chain, costing the US economy roughly $5bn per day. Fortunately, this problem resolved itself as the ILA, the union which organized the strike, and the port operators reached a deal in which port workers would receive a 62% wage hike over six years.

High performers in this market include stocks like Palantir (+9.38% 5D) or Lockheed Martin (+3.9% 5D) of the defense industry. This incredible momentum has resulted in new all time highs despite also doing so in the previous week as well. It all goes without saying that the main catalyst of such valuations is strongly related to Iran-Israel tensions.

On the earnings side of things, we meet the biggest upsets of the week. Tesla underperformed the high expectations markets had for its deliveries, sending the stock down roughly 9 points, or (-3.42%), on a 5 day basis. On the other hand, Nike shares have also been tumbling this week as much as 7.3 points (-8.19%) due to revenue declining 10% in their FYQ1 earnings. Elliott Hill, the successor of the infamous John Donahoe, also declined to give an outlook for the rest of the 2025 fiscal year, furthering investors’ bearish sentiment on the sneaker company. Levi’s was another large upset to investors, as the stock plummeted roughly 2 points, or 8.24%. While EPS marginally exceeded expectations, revenue came in flatter than expected which prompted the sell-off. Please keep in mind that these earnings disappointments have been watered down by the NFP results sprinkling optimism across the entire market on Friday.

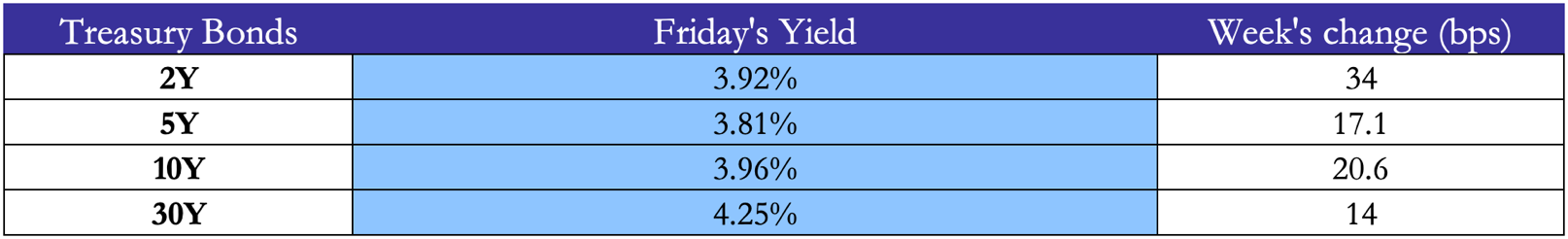

Hence, the thing US investors really paid attention to this week (apart from the Middle East) was the NFP report. Naturally, the contents of this report would determine the state of the US economy, providing a barometer of sorts to investors as to how aggressive the Fed will be in future cuts across their upcoming meetings. Not only did the job figures beat economists’ expectations, but it did so with flying colors: 250,000 actual vs 140,000 expected and a reduction of unemployment to 4.1%. As a result, US 2Y bond yields (the US bond perceived as most susceptible to fluctuations in the target rate) pushed upwards to 3.92%, the S&P climbed 51 points (+0.9%) , and the DOW did 341 points (+0.81%) as well. Ultimately, this report reduced future speculations of an aggressive Fed rate cut (say, 50 bps) by a large order of magnitude. This news completely shocked the finance world, as markets abandoned previous hopes of a 50 bps cut almost immediately as the news came out. As a result, yields shot up across the board as can be seen below:

Source: TradingEconomics, Bocconi Students Investment Club

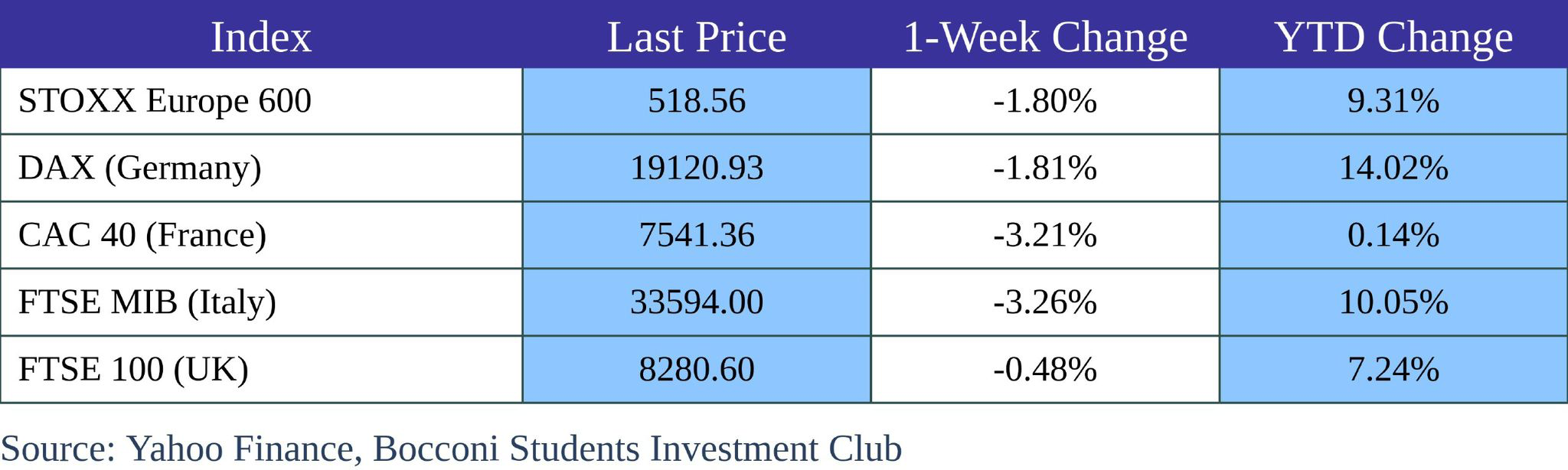

Europe and UK

In the EU and the UK, however, markets experienced similar fluctuations to that of the US. The FTSE 100 and 250 were down 40 points (-0.48%) and 340 points (-1.6%) across the week, respectively. The Stoxx 50 and Stoxx 600 indexes moved in a similar fashion, with a decrease of 105 points (-2.09%) and approx. 9 points (-1.62%) in the past 5 days, respectively. Although the Chinese stimulus initially encouraged a mining sector rally, further concern regarding Middle Eastern tensions shot the sector back down and carried European energy stocks along with their commodity counterparts. And perhaps as more of a surprising development, European automobile manufacturers such as BMW (+1.75% 1D) Stellantis (+1.75% 1D) Volkswagen (+2.85% 1D) and Renault (+2.95% 1D) rallied on Friday despite market-spread concerns about profit prompting week-wide sell-offs prior to Friday. These gains were experienced on the same day that the EU passed an EV tariff on China, which Volkswagen and BMW deemed to be fatal to the industry. This small rally may be attributed to the fact that there’s a huge global tailwind caused by the spectacular NFP results and the fact that this tariff means reduced EV competition and higher pricing power for EU-produced EVs, but given the high quantity of Chinese clientele and production facilities, EU automakers fear that this tariff will cause more harm than good in the long run.

With respect to Stoxx 50, UniCredit (+2.97%) drove growth in the index for Friday amongst US NFP tailwinds along with sustained prospects of the Commerzbank acquisition. Another aggressive bank, BBVA, also experienced positive developments on Friday (+2.34%) as they continued their pursuit of a hostile takeover of Banco de Sabadell. Although BBVA went hostile in May, they’ve recently made revisions to their prior stock-only offer with new cash considerations meant to take recent dividends into account, potentially increasing the likelihood of an eventual merger.

The DAX fell by 291 points (-1.50%) on the week amidst further concerns of automakers despite the small rally experienced on Friday. The CAC 40 followed suit, falling by 206 points (-2.67%) on the week as the Chinese stimulus encourages sustained inflows and the US jobs report signaled equity strength.

On a macro level, the BoE has stated that they’re likely going to remain aggressive on behalf of rate cuts, and this makes sense given the decline in inflation levels across the UK. And on Tuesday, it was announced that Eurozone inflation levels followed suit, reaching a sub-2% level for the first time since mid-2021, but as of Friday, markets are approximately 90% certain of a 25 bps cut. On Friday, an outsized

Following all of this action with respect to yields, bond prices also saw fluctuations. Amidst France’s unveiling of a new budget plan which hopes to contain France’s debt situation, bondholders weren’t impressed, and the result was a strong upturn in yield. That being said, the Eurozone at large experienced yield increases on their 10 year bonds across the board. Switzerland’s yield market was muted, with a 1 bps increase in yield.

Source: Tradingeconomics, Bocconi Students Investment Club

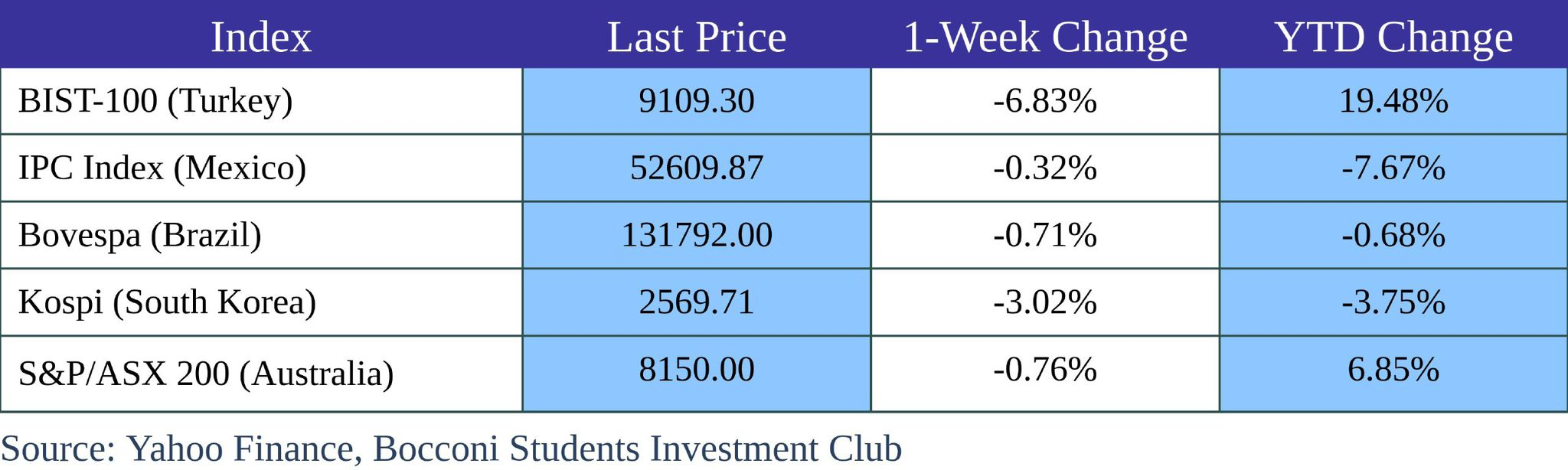

Rest of the World

China is undoubtedly the country to follow right now when it comes to Asian markets. As mentioned previously, the EU recently reached a decision to increase tariffs on Chinese-produced EVs, albeit with strong dissent from Hungary and Germany. Despite these developments, the enormous stimulus package China approved along with decreased RRR and reverse repo rates has resulted in a crazy 773 point (+23%) rally over the past 5 days within the CSI 300. On Friday, all equities which were a member of the index recorded positive developments, with Zhejiang Jingsheng (+20%) and Semiconductor Manufacturing International (+20%) being one of many stocks posting double digit returns on Friday. The question that analysts should be asking themselves is: how effective will these instruments be in turning around the deflationary macroeconomic developments?

On the other hand, Japan had some interesting developments as well. On Monday, Japanese factory output numbers came out, and they disappointed: a decline by 3.3% in the month of August relative to the previous month. Thus, it should be no surprise that over the week, the Nikkei 225 decreased by 482 points (-1.23%) indicating a hangover from the substantial market rally during September. Beyond this, new Japanese PM Ishiba called for ministers to approve an economic relief package which would attempt to aid Japanese citizens through the novel inflationary situation being experienced there now. Beyond this, Ishiba stated that the current economic conditions do not call for further rate hikes as it stands.

Furthermore, Latin America’s S&P LatAm 40 shifted downwards by 10 points (-0.39%) during the week, while Australia’s ASX 200 fell by a modest 62 points (-0.76%) as well. The story in Australia is similar to that of Europe with respect to its mining and energy sectors. For obvious reasons, the Shanghai Composite followed in the footsteps of the CSI, rallying by 249 points (8.06%) on Friday alone.

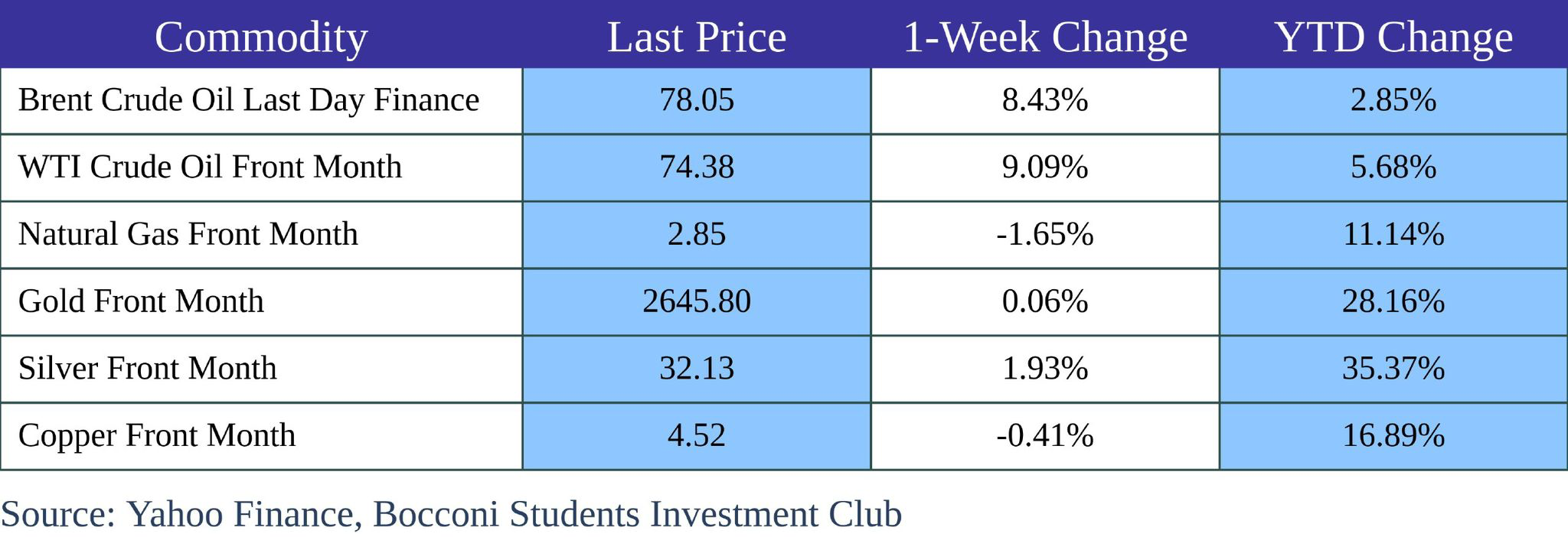

FX and Commodities

To nobody’s surprise, the most interesting development this week in the commodities market was oil prices. On Tuesday, in retaliation for the assassination of the late Hezbollah leader Hassan Nasrallah, Iran launched a large collection of ballistic missiles at Israel. In response, Israel vowed to respond to these attacks with force, and the notion of a strike on Iran’s oil facilities has sent Brent Crude Front Month (+8.5%) and Crude Oil WTI Front Month (+9.2%) prices up 6 points each on the week. Iran is an OPEC+ member and contributes to 3% of the global oil supply, so even the potential of such an attack occurring has caused tectonic shifts in price action. However, following Libya’s reopening of oilfields, a new supply stream helped reduce too much volatility. Despite these oil price developments, US Energy companies like Baker Hughes have cut down the number of active rigs for the 3rd consecutive week. As for Natural Gas, a high total working supply of 3,547 bcf, which is well above average 5-year levels for the winter, has kept supply high. Pair this with lukewarm temperatures across the US, and the result is a 50 bps (-2.45%) reduction in front month Natural Gas future prices.

Gold futures saw a dip of 10 points (-0.38%) on Friday due to the NFP report reducing concerns of an imminent US recession. However, due to geopolitical tensions remaining high in the Middle East, gold’s safe haven characteristic has prevented a larger sell-off which would’ve likely occurred otherwise. Silver continued to rally by 50 bps (+2.13%) likely due to the sustained tailwinds caused by the Chinese stimulus.

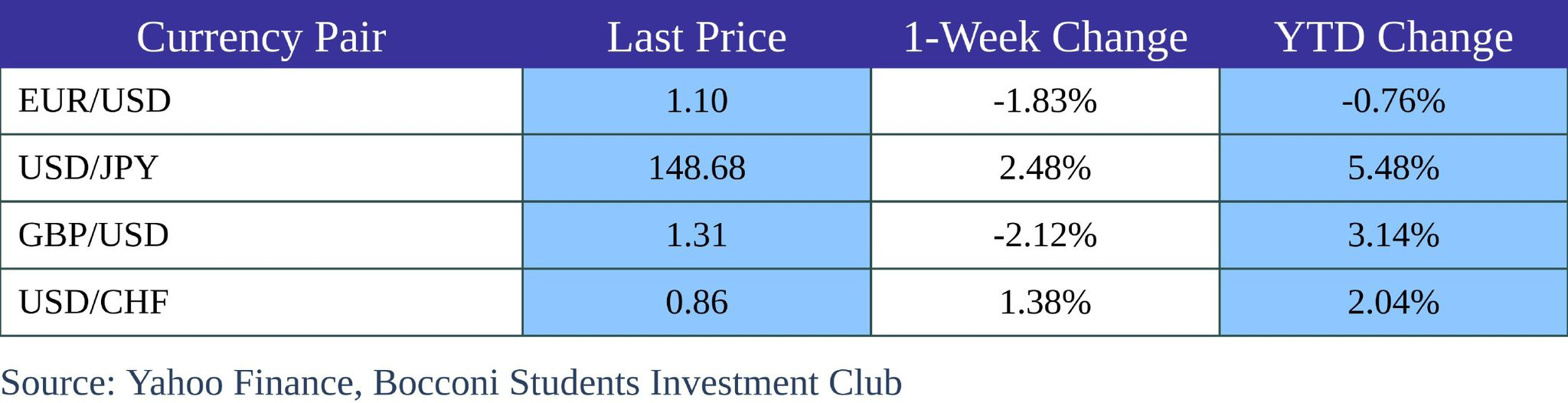

Due to the strong NFP report on Friday, the greenback strengthened as the risk of aggressive rate cuts was reduced by a significant margin. On the other hand, the Euro and Pound have become weaker due to sub-2% inflation reports and aggressive rate cut signalling. Lastly, the Yen also depreciated due to Ishiba’s comments regarding inaction on behalf of future cuts for now.

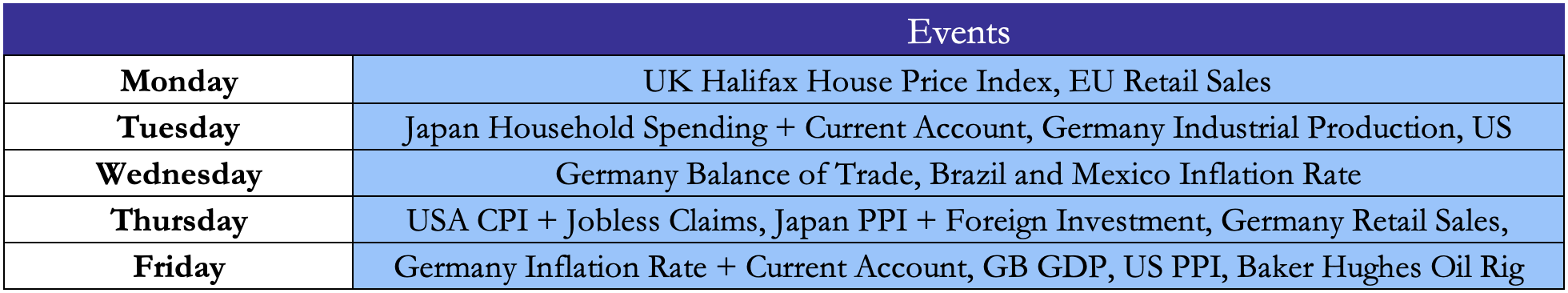

Next Week Main Events

Brain Teaser #20

You need to communicate with your colleague in Greenwich via a messenger service. Your documents are sent in a padlock box. Unfortunately, the messenger service is not secure, so anything inside an unlocked box will be lost (including any locks you place inside the box) during the delivery. The high-security padlocks you and your colleague each use have only one key which the person placing the lock owns. How can you securely send a document to your colleague?

SOLUTION

If you have a document to deliver, clearly you cannot deliver it in an unlocked box. So the first step is to deliver it to Greenwich in a locked box. Since you are the person who has the key to that lock, your colleague cannot open the box to get the document. Somehow you need to remove the lock before he can get the document, which means the box should be sent back to you before your colleague can get the document.

So what can he do before he sends back the box? He can place a second lock on the box, which he has the key to! Once the box is back to you, you remove your own lock and send the box back to your colleague. He opens his own lock and gets the document

Brain Teaser #21

There is a light bulb inside a room and four switches outside. All switches are currently at off state and only one switch controls the light bulb. You may tum any number of switches on or off any number of times you want. How many times do you need to go into the room to figure out which switch controls the light bulb?

0 Comments